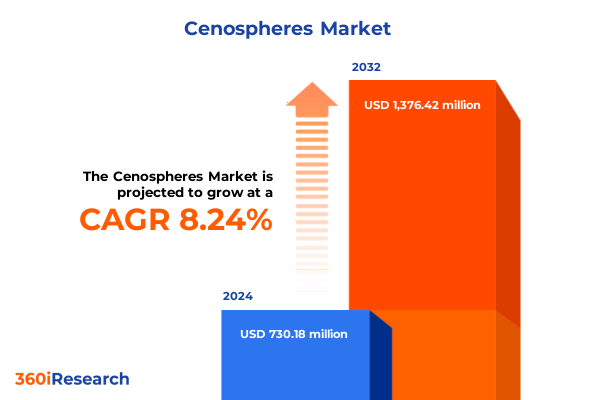

The Cenospheres Market size was estimated at USD 771.93 million in 2025 and expected to reach USD 822.52 million in 2026, at a CAGR of 8.61% to reach USD 1,376.42 million by 2032.

Revealing the Strategic Importance of Cenospheres as High-Performance Microspheres Transforming Multiple Industrial Applications

Cenospheres, the hollow spherical aluminosilicate particles derived from fly ash, stand at the intersection of advanced materials engineering and sustainable industrial practices. With a unique combination of low density, high strength, and thermal stability, these microspheres offer transformative potential across diverse sectors, including oil and gas, automotive, construction, and coatings. In recent years, rising demand for lightweight composites and thermal management solutions has propelled cenospheres into high-value formulations, replacing conventional fillers and reducing overall material weight while enhancing performance. Transitioning from by-product to strategic raw material, cenospheres have attracted attention from leading manufacturers seeking to optimize supply chains and reduce environmental footprints.

Advancements in processing technologies have further diversified the functional properties of cenospheres, enabling surface modifications that improve compatibility with polymer matrices and increase corrosion resistance in marine environments. As global emphasis on carbon reduction intensifies, the ability of cenospheres to lower energy consumption in building insulation systems and facilitate more efficient drilling operations underscores their relevance to sustainability agendas. Moving forward, the increasing convergence of material science innovation and circular economy principles positions cenospheres as a critical enabler of high-performance, eco-efficient industrial solutions.

Exploring Revolutionary Technological and End Market Drivers Reshaping Cenospheres Demand and Advancing Material Science Integration

The landscape for cenospheres has shifted dramatically, driven by breakthroughs in nanocoating techniques and integration with advanced composite manufacturing processes. Innovations in plasma-assisted surface treatments now enable precise control over microsphere wettability, unlocking enhanced dispersion in polymer and ceramic matrices. This shift has not only broadened application potential but also created avenues for next-generation lightweight automotive components and aerospace systems that demand stringent mechanical and thermal requirements.

Simultaneously, evolving end-market demands are reshaping supply dynamics, with oil and gas operators seeking more stable, low-density fillers for cementing fluids to maintain well integrity at extreme depths and temperatures. In the coatings sector, formulators are turning to cenospheres for their ability to reduce volatile organic compound emissions while maintaining scratch resistance and UV stability. These transformative developments, coupled with digital materials characterization and predictive performance modeling, are fostering an era of precision-engineered cenospheres that align with stringent regulatory standards and performance benchmarks.

Analyzing Far-Reaching Impacts of 2025 United States Tariff Measures on Import Dynamics and Domestic Production Strategies in Cenosphere Supply Chains

In 2025, the United States implemented new tariff measures affecting aluminosilicate microsphere imports, intensifying cost pressures on manufacturers that rely on international supply chains. These duties have elevated landed costs for imported cenospheres by an average of 15 to 20 percent, prompting downstream consumers to reevaluate sourcing strategies and accelerate the qualification of domestic alternatives. In response, several midsize refractory and additive producers have ramped up local processing capacities, reducing dependency on long-haul logistics and mitigating geopolitical risk exposure.

While import protectionism has raised short-term material costs, it has concurrently spurred investment in state-of-the-art processing facilities within North America. Industry stakeholders are forging strategic joint ventures and leveraging government-backed incentives to scale cenosphere refinement, thereby securing consistent supply and fostering regional economic development. As a result, domestic producers are positioned to capture incremental volume previously directed to low-cost imports, although competitive dynamics will hinge on the ability to meet strict quality standards at scale.

Deciphering Critical Segmentation Insights Revealing Application, End Use, Particle Size, Wall Thickness, and Form Dynamics within the Cenosphere Market

Detailed analysis of cenosphere applications reveals that the oil well drilling segment is experiencing significant momentum, driven by specialized usage in cementing fluids for deepwater and unconventional wells to achieve enhanced wellbore stability. Within paints and coatings, decorative paint formulators are increasingly incorporating microspheres to achieve gloss control and matte finishes without compromising durability, while industrial and powder coating producers leverage their thermal insulation properties to extend service life in harsh environments. Construction additive innovators exploit microspheres for lightweight concrete, balancing structural strength with reduced dead load in large-span architectural elements. In the domain of plastics and polymers, formulators integrate cenospheres to optimize stiffness-to-weight ratios in automotive interior components, whereas rubber processing engineers utilize them to enhance abrasion resistance and reduce silicon content in tire compounds.

When examining end-use industries, applications in commercial construction have outpaced residential uptake due to stringent green building certifications requiring low-carbon materials, while semiconductor and electrical equipment manufacturers depend on precise microsphere particle size distributions-ranging from sub-20 microns for high-dielectric polymer composites to larger fractions exceeding 100 microns for structural potting compounds. Wall thickness variation, spanning thin (<5 microns) to thick (>15 microns) shells, dictates crush strength parameters, thereby guiding selection for high-pressure environments in upstream oil and gas versus lightweight filler roles in consumer products. Finally, the decision between powder and slurry forms hinges on downstream processing workflows, with slurries preferred in coating lines for viscosity control and powders favored in dry blend compounding for consistent feed rates.

This comprehensive research report categorizes the Cenospheres market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Particle Size

- Wall Thickness

- Form

- Application

- End Use Industry

Unveiling Regional Dynamics Highlighting Strategic Growth Drivers across Americas, Europe Middle East Africa, and Asia-Pacific Cenosphere Markets

Across the Americas, robust shale oil and gas activity and a strong manufacturing base underpin elevated demand for drilling-grade cenospheres and insulation applications. North American producers benefit from localized processing networks that deliver just-in-time supply to major consumption hubs, while Latin American infrastructure projects present emerging opportunities for lightweight concrete formulations.

In Europe, Middle East and Africa, regulatory emphasis on resource efficiency and low-carbon construction materials is creating fertile ground for high-performance microsphere adoption in commercial real estate developments and advanced coatings. European chemical producers are adapting formulations to comply with REACH directives, while Middle Eastern operators invest in deepwater well completion technologies that require thermally stable fluid additives. Africa’s nascent manufacturing sectors signal long-term growth potential, contingent upon strategic partnerships and localized logistics capabilities.

Over in Asia-Pacific, expanding automotive assembly lines and electronics manufacturing hubs are driving unprecedented usage of fine-caliber cenospheres in precision filtration and thermal interface materials. Government initiatives in China and India aim to support domestic cenosphere refiners, improving quality standards and reducing reliance on imported grades. Southeast Asia is poised for rapid uptake, particularly in high-rise construction markets and maritime applications along critical trade routes.

This comprehensive research report examines key regions that drive the evolution of the Cenospheres market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Alliances Driving Innovation Growth and Competitive Differentiation in the Global Cenosphere Sector

Leading manufacturers have distinguished themselves through vertical integration, securing raw fly ash streams and investing in proprietary classification technologies to produce high-purity microspheres tailored for critical end uses. Espin Ceramics maintains a strong foothold in specialty coatings and polymer composites, leveraging advanced sieving protocols to deliver narrow particle size distributions. Shandong Ocean Minerals differentiates via high-throughput hydrocyclone systems that optimize yield across multiple size bands, while NovaSphere Materials has emerged as a disruptor by introducing functionalized surface coatings that enhance interfacial bonding in composite matrices.

Strategic alliances between cenosphere refiners and well service providers underscore the importance of application-specific innovation, with collaborative R&D efforts yielding next-generation formulations for deepwater cementing and energy-efficient building materials. At the same time, a handful of niche players are securing patent positions related to shell thickness control and slurry stabilization, signaling intensifying competition in specialty product segments. The convergence of OEM partnerships and flexible manufacturing footprints will be a critical determinant of market leadership moving forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cenospheres market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ash Resources, LLC

- Cenosphere India Limited

- Imerys S.A.

- LKAB Minerals AB

- Luyang Energy-Saving Materials Co., Ltd.

- Micropowders, Inc.

- Omya AG

- Sekisui Chemical Co., Ltd.

- Tokuyama Corporation

- Wenling Zhanbei Spherical Material Co., Ltd.

- Xinfeng Ruitai Chemical Co., Ltd.

Driving Strategic Action Plans and Operational Recommendations Empowering Industry Leaders to Optimize Cenosphere Value Chains and Fuel Sustainable Growth

Industry leaders should prioritize the diversification of feedstock supply by establishing multi-source agreements with power generation facilities and cement plants, thereby ensuring resilience against regional disruptions. Investment in advanced classification and surface modification equipment will unlock new high-value applications, particularly in thermal management and lightweight structural composites. Additionally, forging strategic partnerships with drilling services and construction firms can accelerate co-development of tailored microsphere grades that meet exacting project specifications.

It is imperative to adopt digital supply chain management platforms to enhance traceability, forecast demand variability, and reduce inventory carrying costs. Companies should also pursue incremental product certification for green building and oil-field approval bodies, expanding market access and reinforcing value propositions. Finally, engaging in continuous R&D to explore hybrid filler systems and bio-resin compatibility will position firms at the vanguard of sustainable material innovation.

Outlining Comprehensive Research Methodology Integrating Primary Interviews Secondary Data Analysis and Rigorous Triangulation Techniques

The research methodology underpinning this analysis integrated comprehensive secondary review of technical journals, patent disclosures, and publicly available corporate collateral. Benchmarking of product specifications was cross-validated against manufacturing process documentation and quality control data sheets. A series of structured interviews with equipment suppliers, end-use formulators, and drilling service managers provided primary insights into current application challenges and performance requirements.

Quantitative data points were triangulated via multiple independent sources to ensure accuracy, while trends were validated through expert panel discussions and scenario modeling. The research team applied rigorous data governance principles, employing statistical tests to confirm the reliability of observed correlations between cenosphere characteristics and end-use performance outcomes. This multi-pronged approach guarantees a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cenospheres market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cenospheres Market, by Particle Size

- Cenospheres Market, by Wall Thickness

- Cenospheres Market, by Form

- Cenospheres Market, by Application

- Cenospheres Market, by End Use Industry

- Cenospheres Market, by Region

- Cenospheres Market, by Group

- Cenospheres Market, by Country

- United States Cenospheres Market

- China Cenospheres Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Key Executive Insights Emphasizing Strategic Opportunities Challenges and the Future Trajectory of the Cenosphere Industry Landscape

In summary, cenospheres have evolved from an industrial by-product to a strategically valuable material underpinning performance gains in energy, construction, and advanced manufacturing sectors. Technological breakthroughs in surface treatment and classification have expanded their utility, while shifting trade policies have galvanized domestic production and supply chain localization. Segment-specific dynamics, ranging from high-performing drilling additives to precision-grade coatings, underscore the multifaceted value proposition of microspheres.

Looking forward, market participants that invest in process innovation, cultivate strategic partnerships, and adhere to emerging regulatory frameworks will be best positioned to capture growth opportunities. As sustainability and lightweighting imperatives intensify, the role of cenospheres in enabling eco-efficient solutions will only become more pronounced, heralding a new era of material performance optimization.

Engaging Directly with Our Sales Leadership to Acquire In-Depth Cenosphere Market Intelligence and Propel Your Strategic Decision-Making

To explore comprehensive insights into cenosphere technologies and gain an actionable roadmap for strategic investment planning, schedule a one-on-one discussion with Ketan Rohom, Associate Director, Sales & Marketing. Ketan Rohom can provide immediate access to extensive data tables, segmented analysis, and strategic consulting services. By partnering directly, you will receive tailored recommendations and customizable research packages that align with your organizational priorities, ensuring you achieve maximum return on research investment. Reach out today to transform your understanding of the cenosphere market and secure a competitive advantage.

- How big is the Cenospheres Market?

- What is the Cenospheres Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?