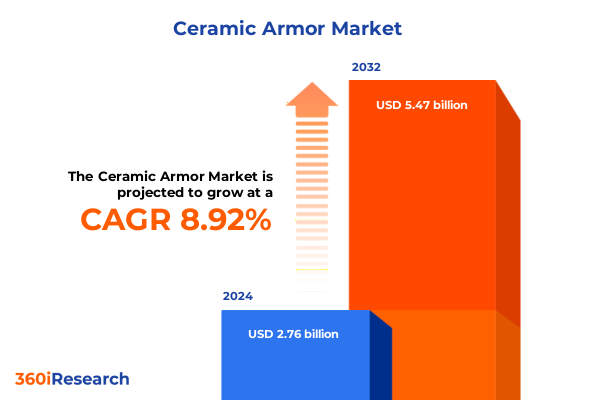

The Ceramic Armor Market size was estimated at USD 2.97 billion in 2025 and expected to reach USD 3.19 billion in 2026, at a CAGR of 9.11% to reach USD 5.47 billion by 2032.

Unveiling the Strategic Significance and Evolutionary Context of Ceramic Armor in Contemporary Defense, Aerospace, and Security Environments

Ceramic armor has emerged as a cornerstone of modern defense and security strategies, redefining protection across personal, structural, and vehicular platforms. Rooted in decades of material science research, these high-performance composites deliver exceptional hardness-to-weight ratios, enabling enhanced survivability without compromising mobility or design flexibility. Today’s applications span combat helmets and ballistic vests, reinforced perimeter barriers, and armored vehicles on the frontlines of conflict. This executive summary distills the pivotal trends, technological breakthroughs, and regulatory drivers that are reshaping the ceramic armor landscape, offering a holistic vantage point for manufacturer, end-user, and investor audiences alike.

As global security architectures evolve, the imperative to stay ahead of emerging threats drives sustained innovation in ceramic matrix compositions, fabrication processes, and integration methodologies. This introductory section sets the stage by outlining the scope of the research, the core thematic pillars under examination, and the key objectives of the analysis. By framing the strategic context-from geopolitical risk drivers to end-user performance requirements-it underscores how ceramic armor will continue to influence defense procurement decisions and security infrastructure planning well into the coming decade.

Exploring Major Technological, Geopolitical, and Material Science Innovations Driving the Ceramic Armor Landscape into a New Era of Future-Proof Application Frontiers

Technological innovation has accelerated the transformation of ceramic armor from basic monolithic plates to multi-layered, hybrid solutions that integrate ceramics with polymers, metals, and nanomaterials. Advances in nanostructuring techniques and cold spray deposition have yielded ultralight composites with superior impact resistance. Simultaneously, geopolitical realignments-marked by escalating tensions across strategic chokepoints and evolving defense budgets-are driving heightened demand for modular armor suites capable of rapid upgrade cycles and field customization. These disruptive shifts have converged to expand the role of ceramic armor beyond traditional military applications into critical infrastructure protection and counterterrorism operations.

Moreover, material science breakthroughs in silicon carbide and boron carbide have unlocked new performance thresholds, empowering designers to optimize ballistic and blast mitigation characteristics under extreme thermal conditions. Concurrently, collaborative R&D initiatives between defense contractors, national laboratories, and academic institutions are fostering cross-disciplinary innovation ecosystems. This section explores how these technological, geopolitical, and collaborative forces are collectively reshaping not only the supply chain dynamics but also the strategic calculus for system integrators and end-users in their pursuit of enhanced mission readiness and lifecycle cost efficiencies.

Analyzing the Far-Reaching Effects of the 2025 United States Tariff Adjustments on Import Dynamics, Supply Chains, and Competitive Positioning in Ceramic Armor

In early 2025, the United States implemented revised tariff structures targeting advanced ceramic components, aiming to safeguard domestic manufacturing and incentivize local sourcing. These measures have had a cumulative impact on global supply chains, leading to cost realignments and strategic shifts among suppliers and end-users. As import duties rose for raw alumina, boron carbide, and silicon carbide feedstocks, manufacturers have accelerated efforts to localize critical processes, from hot pressing to reaction bonding. While this transition enhances supply chain resilience, it also introduces capital investment pressures, influencing procurement cycles and price negotiations.

End-users are responding by diversifying their supplier networks and exploring alternative material compositions that comply with new tariff thresholds. Simultaneously, multinational defense contractors are restructuring production footprints, leveraging tariff exemptions for in-house technology transfers, and pursuing joint ventures with domestic fabricators. Although short-term cost volatility remains a challenge, the long-term effect is a more vertically integrated industry landscape, characterized by closer alignment between material innovators, process engineers, and system integrators. This section examines how these tariff adjustments are reshaping competitive positioning and driving strategic realignment across the ceramic armor ecosystem.

Illuminating Key Insights into Ceramic Armor through In-Depth Application, Material Type, End-User Industry, Manufacturing Process, and Sales Channel Segmentation

A nuanced understanding of the ceramic armor market emerges when considering multiple segmentation frameworks simultaneously. Based on application, the landscape encompasses personal armor such as helmets and vests, structural armor including barriers and building panels, and vehicle armor covering armored personnel carriers, infantry fighting vehicles, and main battle tanks. Material type segmentation reveals distinct performance and cost considerations among alumina, boron carbide, and silicon carbide, each offering unique hardness, density, and thermal stability profiles. In turn, end-user industry differentiation highlights the varying requirements for aerospace, defense, and security sectors, where certification standards, lifecycle durability, and customization demands diverge.

Further granularity is achieved by examining manufacturing processes, with hot pressing delivering high-density microstructures, reaction bonding providing cost-effective scalability, and sintering offering a balance of material homogeneity and production throughput. Finally, sales channel segmentation-spanning direct sales agreements, distributor networks, original equipment manufacturers, and digital commerce platforms-illuminates go-to-market strategies and customer engagement models. Bringing these segmentation lenses together underscores the critical interplay between product design choices, procurement pathways, and end-user performance imperatives in shaping the competitive dynamics of the ceramic armor sphere.

This comprehensive research report categorizes the Ceramic Armor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Manufacturing Process

- Application

- End-User Industry

- Sales Channel

Uncovering Regional Dynamics and Strategic Growth Patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific for Ceramic Armor Solutions

Regional dynamics exert a profound influence on ceramic armor adoption, driven by distinct security priorities, procurement regulations, and industrial capabilities. In the Americas, established defense budgets and advanced manufacturing infrastructures foster rapid integration of cutting-edge ceramic composites into military and law enforcement applications. North American research institutions and defense contractors lead collaborative projects aimed at next-generation material innovations, while Latin American markets display growing interest in cost-optimized structural and personal protection systems tailored to internal security challenges.

Across Europe, the Middle East, and Africa, the convergence of NATO standardization efforts, regional defense modernization programs, and escalating border security requirements propels demand for versatile armor solutions capable of quick deployment. The EMEA landscape is characterized by strategic partnerships between local fabricators and global technology providers, balancing customization needs with stringent regulatory compliance. Meanwhile, Asia-Pacific exhibits explosive growth driven by rising defense expenditures, indigenous manufacturing initiatives, and an increasing focus on maritime and territorial security. Government incentives and public–private collaboration in key regional hubs are catalyzing investments in ceramic armor R&D and capacity expansion to serve both domestic and export-oriented markets.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Armor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of Ceramic Armor Technology and Enterprise Engagement

Leading enterprises and emerging innovators alike are forging the competitive contours of the ceramic armor domain through targeted R&D investments, strategic acquisitions, and co-development partnerships. Major defense contractors are collaborating with specialized materials firms to integrate proprietary ceramic composites with advanced polymeric backplates, creating hybrid armor modules that achieve next-level ballistic performance. Concurrently, niche manufacturers are leveraging additive manufacturing and automated quality control systems to reduce production lead times, enabling more responsive supply chains.

Additionally, cross-sector alliances between automotive OEMs, aerospace integrators, and defense agencies are accelerating the transfer of industrial best practices into ceramic armor fabrication, such as lean manufacturing, digital twin modeling, and real-time nondestructive evaluation. These collaborative frameworks are not only driving technology convergence but also reshaping the competitive landscape by lowering barriers to entry and promoting modular system architectures. As a result, organizations across the value chain are re-evaluating their strategic roadmaps to prioritize agility, customization, and lifecycle cost management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Armor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ArmorWorks Enterprises, LLC

- BAE Systems plc

- CeramTec GmbH

- General Dynamics Land Systems, Inc.

- Hanwha Corporation

- IMI Systems Ltd.

- MKU Limited

- Morgan Advanced Materials plc

- Plasan Sasa Ltd.

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- SAAB AB

Strategic and Actionable Roadmap for Industry Leaders to Optimize Adoption, Overcome Barriers, and Drive Sustainable Growth in Ceramic Armor Solutions

Industry leaders seeking to capitalize on the ceramic armor opportunity must adopt a multifaceted strategy that balances innovation, supply chain resilience, and market responsiveness. First, cultivating deep partnerships with material science research hubs can accelerate the development of next-generation ceramics tailored for specific threat profiles, while pilot manufacturing programs can de-risk scale-up challenges. Simultaneously, diversifying feedstock procurement-by engaging both domestic and international sources-will mitigate tariff-driven cost fluctuations and enhance production continuity.

Moreover, optimizing the integration of advanced manufacturing technologies, such as additive layering and AI-driven process controls, can improve yield rates and reduce time-to-market. From a commercial perspective, aligning sales channel strategies to include direct engagement with end-users alongside digital distribution platforms can strengthen customer relationships and unlock new revenue streams. Finally, embedding continuous performance monitoring and user feedback loops into product development cycles will ensure that solutions evolve in line with shifting battlefield requirements and civilian security demands. This actionable roadmap equips decision-makers to navigate market complexities and drive sustainable growth in ceramic armor solutions.

Outlining a Robust Research Framework Integrating Qualitative and Quantitative Approaches for Comprehensive Ceramic Armor Market Analysis

The foundation of this research rests on a rigorous framework that integrates qualitative insights and quantitative analysis to produce a comprehensive understanding of ceramic armor trends. Primary research was conducted through in-depth interviews with key stakeholders, including materials scientists, defense procurement officers, and manufacturing executives, to capture emerging use cases and technology roadblocks. Simultaneously, secondary data collection leveraged open-source technical papers, regulatory filings, and patent databases to validate performance benchmarks and track innovation trajectories.

Quantitative modeling techniques were applied to analyze cost structures, production capacities, and supply chain vulnerabilities, while scenario analysis explored the potential outcomes of varying tariff regimes and regional security developments. Cross-validation through triangulation ensured the robustness of findings, and peer reviews by domain experts helped refine methodological assumptions. This blended approach provides a transparent, replicable roadmap for assessing the ceramic armor market, enabling stakeholders to make data-driven decisions underpinned by both empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Armor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Armor Market, by Material Type

- Ceramic Armor Market, by Manufacturing Process

- Ceramic Armor Market, by Application

- Ceramic Armor Market, by End-User Industry

- Ceramic Armor Market, by Sales Channel

- Ceramic Armor Market, by Region

- Ceramic Armor Market, by Group

- Ceramic Armor Market, by Country

- United States Ceramic Armor Market

- China Ceramic Armor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings and Strategic Imperatives Highlighting the Future Trajectory and Critical Takeaways of Ceramic Armor Market Evolution

This executive summary has synthesized the pivotal drivers, disruptive innovations, and regional nuances defining the current and future trajectory of ceramic armor solutions. From nanostructured material breakthroughs to the strategic ramifications of 2025 tariff adjustments, the landscape is characterized by rapid evolution and intensifying competition. Segmentation insights reveal how application-specific demands, material selection, end-user requirements, manufacturing pathways, and sales channels converge to shape product development and market positioning.

Looking ahead, industry stakeholders must remain agile, leveraging collaborative ecosystems to accelerate innovation while navigating complex regulatory and geopolitical headwinds. The strategic imperatives outlined herein-spanning supply diversification, technological integration, and market engagement-serve as a blueprint for organizations aiming to secure leadership in the ceramic armor domain. Ultimately, success will depend on the ability to translate these insights into coherent strategies that balance cost, performance, and adaptability in an unpredictable global security environment.

Engaging with Ketan Rohom to Unlock In-Depth Market Insights and Secure Your Comprehensive Ceramic Armor Research Report Purchase Today

The comprehensive ceramic armor research report offers an unparalleled deep dive into the complex interplay of material science breakthroughs, manufacturing innovations, and end-user requirements shaping modern protective systems. It distills extensive primary and secondary research into actionable intelligence, equipping decision-makers with the clarity needed to navigate evolving geopolitical pressures, escalating regional security demands, and dynamic supply chain challenges. Through detailed competitive profiling and rigorous methodological rigor, the report ensures stakeholders can confidently benchmark their strategies against the latest technological advancements and market best practices. As an exclusive opportunity, engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, grants tailored insights and personalized guidance on how the findings apply to your unique objectives.

To secure this in-depth analysis and gain a strategic edge in the ceramic armor domain, reach out to Ketan Rohom. His expertise will facilitate a smooth procurement process and answer any questions regarding report scope, customization options, and licensing. Act now to harness the actionable recommendations and segmentation clarity that can drive your organization’s growth, optimize resource allocation, and strengthen your competitive positioning in an increasingly complex defense and security landscape.

- How big is the Ceramic Armor Market?

- What is the Ceramic Armor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?