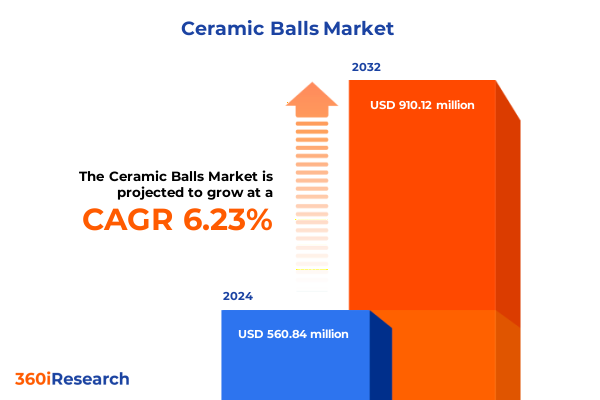

The Ceramic Balls Market size was estimated at USD 594.97 million in 2025 and expected to reach USD 632.04 million in 2026, at a CAGR of 6.38% to reach USD 917.74 million by 2032.

Revealing the Strategic Significance of Ceramic Balls in Modern Manufacturing, High-Performance Engineering, and Emerging Technology Markets Worldwide

Ceramic balls have emerged as a pivotal component across a spectrum of industrial and technological sectors, underpinned by their exceptional combination of hardness, heat resistance, and chemical stability. Initially popularized in high-temperature environments such as kiln rollers and furnace elements, the adoption of ceramic balls has rapidly expanded into precision-driven applications in aerospace, automotive electrification, and medical devices. Furthermore, the broadening of manufacturing techniques, including sol–gel processes and additive manufacturing, has significantly enhanced the microstructural uniformity and functional versatility of these materials. As a result, end users are increasingly prioritizing ceramic balls over conventional steel counterparts, not only for their wear resistance and lower coefficient of friction but also for the enhanced operational lifespans and reduced maintenance requirements they deliver. Consequently, this introduction underscores the strategic significance of ceramic balls as both a performance differentiator and a long-term cost optimization measure for industry leaders seeking to achieve reliability and efficiency gains in demanding operating conditions.

Uncovering the Technological Innovations, Supply Chain Evolution, and Sustainability Imperatives Reshaping the Ceramic Balls Industry

The landscape for ceramic balls is undergoing transformative shifts driven by technological advancements, evolving supply chain paradigms, and sustainability mandates. In material innovation, novel formulations such as nanoengineered zirconia composites and doped silicon nitride are pushing the boundaries of toughness and thermal stability. Simultaneously, the digitalization of production through Industry 4.0 frameworks enables real-time quality control and predictive maintenance, ensuring consistent product performance at scale. In parallel, geopolitical tensions and post-pandemic reconfiguration have accelerated nearshoring and multi-sourcing strategies, reducing lead times and mitigating supply chain disruptions. Finally, the imperative to lower carbon footprints is spurring manufacturers to adopt greener sintering processes and to increase the reuse of scrap ceramics, aligning with broader environmental, social, and governance (ESG) objectives. Collectively, these shifts are redefining competitive advantage by emphasizing agility, resilience, and sustainability across the complete ceramic balls value chain.

Examining the Consequences of Newly Imposed United States Tariffs on Ceramic Ball Imports and Domestic Supply Chain Realignment in 2025

United States trade policy in 2025 has imposed new tariffs on imported ceramic ball products, particularly targeting those sourced from regions with export subsidies. By applying additional duties on several advanced ceramic compositions, policymakers aim to bolster domestic manufacturing investment while addressing perceived trade imbalances. These measures have resulted in immediate cost inflation for assemblies reliant on imported materials and have prompted global suppliers to reevaluate their regional footprint and manufacturing strategies. In response, several key upstream producers have announced capacity expansions within North America, seeking to circumvent tariff barriers and improve delivery times. At the same time, original equipment manufacturers are accelerating qualification of alternative sources from permitted trade zones and investing in collaborative research partnerships to localize critical feedstock production. Over the longer term, this cumulative impact of U.S. tariffs is expected to strengthen the domestic supply base, albeit with upward pressure on end-user pricing and potential shifts in global trade flows.

Illuminating Critical Segmentation Insights Across Material Technologies, Applications, Industries, Sizes, and Product Classifications to Capture Key Opportunities

Insight into market segmentation reveals distinct growth trajectories informed by material selection, functional use cases, industrial end markets, dimensional specifications, and product classifications. For instance, aluminum oxide remains the workhorse material for cost-sensitive, general-purpose grinding media, while silicon nitride and zirconia are gaining traction where superior toughness and reliability under fatigue loading are paramount, such as in high-speed bearing assemblies. When considering functional applications, abrasives and grinding media continue to command broad usage due to their surface finish improvements and particle size control benefits, whereas precision bearings in electric vehicle traction motors increasingly favor self-aligning and angular contact designs enriched by specialty ceramic formulations. The end-use landscape is characterized by diversity: aerospace and automotive sectors are driving demand for high-performance variants, medical applications are leveraging biocompatible grades for surgical instrumentation, and oil and gas industries prioritize corrosion resistance for downhole valve seals. Moreover, engineering parameters like ball diameter range are finely tuned from sub-millimeter sizes for microfluidic valves to above-ten-millimeter diameters for heavy-duty mixers. Added to this, differentiation across precision, specialty, and standard ball types underscores the need for customized tolerance control, surface finish, and mechanical properties that align with specific operational requirements. Together, these segmentation insights illuminate where emerging opportunities exist and inform targeted go-to-market strategies.

This comprehensive research report categorizes the Ceramic Balls market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Ball Type

- Ball Diameter Range

- Application

- End Use Industry

Decoding the Distinct Regional Dynamics Driving Ceramic Ball Demand through Manufacturing Investments, R&D Ecosystems, and Policy Incentives

Regional dynamics in the ceramic balls market reveal a nuanced interplay of industrial development, trade policies, and localized innovation ecosystems. In the Americas, a resurgence in domestic manufacturing investments-propelled by reshoring incentives and infrastructure modernization plans-is driving capacity expansions in high-purity alumina and silicon nitride processing facilities, with several new greenfield sites nearing completion. Europe, the Middle East, and Africa region benefits from established research centers and stringent regulatory frameworks that promote high-end applications, particularly in aerospace and power generation, where ceramic balls deliver long-term reliability under extreme conditions. Meanwhile, Asia-Pacific continues to dominate global production volumes, supported by vertically integrated supply chains, competitive labor costs, and strong government support for advanced ceramic material R&D. However, the region is also witnessing quality-driven consolidation, as leading producers invest in automation and process control to meet increasingly stringent performance standards demanded by global OEMs. Across all regions, collaborative partnerships between material scientists, equipment manufacturers, and end users are accelerating technology transfer and enabling localized solutions tailored to regional requirements.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Balls market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Leading Manufacturers’ Innovations, Collaborations, and Strategic Partnerships Are Shaping the Future of Ceramic Ball Solutions

Leading industry players are differentiating through strategic investments in high-performance material platforms, global footprint expansion, and value-added service models. Several established manufacturers have accelerated the commercialization of proprietary zirconia-toughened ceramics, leveraging decades of sintering expertise to reduce production cycle times and enhance microstructural uniformity. Concurrently, mid-tier companies are forging alliances with specialty chemical suppliers to secure advanced feedstock materials and co-develop next-generation silicon carbide formulations with improved thermal shock resistance. In addition to technological collaborations, mergers and acquisitions are reshaping the competitive landscape, with major conglomerates seeking to integrate complementary capabilities-from precision grinding and polishing services to advanced coating technologies-within their end-to-end portfolio. Furthermore, a handful of agile start-ups are capturing niche segments by introducing digital ordering platforms, customizable tolerances, and on-demand prototyping services that cater to rapid innovation cycles in emerging industries. Collectively, these company-level actions underscore a commitment to refining core competencies while expanding service offerings to meet the evolving demands of sophisticated end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Balls market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Compagnie de Saint-Gobain S.A.

- Toshiba Materials Co., Ltd.

- CoorsTek, Inc.

- CeramTec GmbH

- AB SKF

- 3M Company

- Shandong Sinocera Functional Materials Co., Ltd.

- Sinoma Advanced Nitride Ceramics Co., Ltd.

- Ortech, Incorporated

- Accumet Materials Co.

- Akron Porcelain & Plastics Co.

- Axens by IFP Energies nouvelles

- BASF SE

- Boca Bearing Company

- Fineway Inc.

- FT/F Co.,Ltd.

- Industrie Bitossi S.p.A. by Colorobbia Group

- Kyocera Corporation

- Metalball S.A.S.

- Morgan Advanced Materials Plc. by Vesuvius plc

- RBC Bearings Incorporated

- Shandong Qishuai Wear Resistant Equipment Co., Ltd.

- Tipton Corp.

- Tsubaki Nakashima Co., Ltd.

- Xiamen Innovacera Advanced Materials Co., Ltd.

Empowering Industry Leaders with Strategic Imperatives to Drive Innovation, Resilience, and Sustainability in Advanced Ceramic Ball Markets

To navigate the rapidly evolving ceramic balls landscape, industry leaders should prioritize several strategic imperatives. First, investing in advanced material development-such as hybrid ceramic composites and functionally graded structures-will be essential for achieving performance breakthroughs in high-stakes applications. Second, diversifying supply chains through vertically integrated partnerships and dual-sourcing strategies can mitigate geopolitical and tariff-related disruptions, ensuring continuity of supply. Third, embracing digital manufacturing technologies, including in-line sensor analytics and closed-loop quality systems, will drive operational efficiencies and support premium product positioning. Fourth, aligning sustainability targets with process innovations-by lowering energy consumption in kilns and integrating recycled ceramic feedstocks-will enhance corporate ESG performance and appeal to environmentally conscious customers. Finally, building customer-centric platforms that integrate technical support, rapid prototyping, and predictive maintenance offerings will foster deeper client relationships and unlock recurring revenue streams. By executing on these recommendations, companies can solidify market leadership and sustainably capture value as the ceramic balls sector continues to advance.

Detailing the Robust Multi-Source Research Methodology Underpinning Our In-Depth Analysis of the Ceramic Balls Market

This report leverages a rigorous multi-tiered research methodology combining primary and secondary data collection, expert validation, and analytical frameworks. Initial secondary research involved a comprehensive review of technical journals, patent filings, and industry white papers to establish material properties and processing trends. These findings informed an extensive primary research phase comprising in-depth interviews with decision-makers at leading original equipment manufacturers, ceramic material producers, and research institutions, ensuring firsthand insights into market drivers and adoption barriers. Quantitative data were normalized using standard industry benchmarks and cross-verified against customs databases and trade association publications to ensure accuracy in trade flow analysis and tariff impact assessment. Additionally, qualitative inputs from sustainability experts and supply chain analysts were incorporated to capture emerging best practices and risk mitigation strategies. Finally, a peer review process with senior subject matter experts was conducted to refine the analytical narratives and validate the conclusions drawn. This methodology underpins the reliability and depth of the insights presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Balls market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Balls Market, by Material

- Ceramic Balls Market, by Ball Type

- Ceramic Balls Market, by Ball Diameter Range

- Ceramic Balls Market, by Application

- Ceramic Balls Market, by End Use Industry

- Ceramic Balls Market, by Region

- Ceramic Balls Market, by Group

- Ceramic Balls Market, by Country

- United States Ceramic Balls Market

- China Ceramic Balls Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights on Innovation, Trade Dynamics, and Strategic Roadmaps Guiding the Next Phase of Ceramic Ball Market Evolution

In an era defined by relentless innovation and shifting global trade dynamics, ceramic balls have transcended their traditional roles to become critical enablers of performance and reliability in advanced engineering systems. The convergence of new material formulations, digital manufacturing, and sustainability imperatives is rewriting the rulebook for what these components can achieve. Facing the dual challenges of tariffs and supply chain realignments, stakeholders are compelled to rethink sourcing strategies, accelerate R&D collaborations, and invest in localized production to stay ahead. As diverse end-use industries demand ever-greater precision and durability, the ability to anticipate emerging requirements and deliver tailored ceramic solutions will determine market leadership. Ultimately, the insights and recommendations outlined herein provide a strategic roadmap for navigating complexity and capitalizing on growth opportunities in an increasingly competitive landscape.

Connect with Our Associate Director of Sales & Marketing to Unlock Comprehensive Ceramic Balls Market Intelligence and Drive Strategic Growth

For a deeper exploration of market dynamics and to secure your competitive advantage, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise will guide you through how our in-depth analysis can inform your strategic initiatives and investment decisions. Don’t miss this opportunity to leverage comprehensive insights tailored to your business objectives-contact Ketan today to purchase the complete ceramic balls market research report and position your organization for sustained success.

- How big is the Ceramic Balls Market?

- What is the Ceramic Balls Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?