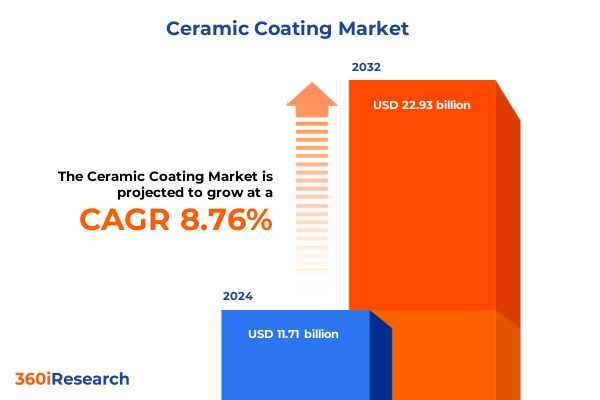

The Ceramic Coating Market size was estimated at USD 12.69 billion in 2025 and expected to reach USD 13.78 billion in 2026, at a CAGR of 8.81% to reach USD 22.93 billion by 2032.

Exploring the Rising Significance and Enduring Value of Ceramic Coatings Across Diverse Industrial Sectors Worldwide and Emerging Opportunities

Ceramic coatings have established themselves as essential solutions for protecting surfaces against wear, corrosion, and extreme thermal conditions, finding critical application across sectors such as automotive, aerospace, industrial machinery, and marine vessels. Their unique formulation delivers high hardness and chemical stability while often eliminating volatile organic compounds, aligning with stricter environmental regulations and sustainability objectives. This convergence of performance and eco-friendliness has positioned ceramic coatings as a preferred choice for manufacturers seeking durable and compliant protective layers.

In recent years, the transition toward electric and hybrid vehicles has intensified demand for coatings that improve thermal management of batteries and electronic powertrains. Specialized ceramic formulations help dissipate heat more efficiently and maintain component integrity under variable load conditions, supporting the broader shift to low-emission transportation solutions. Moreover, digital innovations such as real-time application monitoring and predictive quality control are enhancing production consistency and enabling rapid process adjustments to maintain stringent performance standards.

Unprecedented Transformations Reshaping the Ceramic Coating Landscape from Sustainability Mandates to Digital Innovations and Emerging Vehicle Technologies

The ceramic coating landscape is undergoing a profound transformation driven by intersecting technological, regulatory, and market forces. Sustainability mandates and tighter emissions targets are compelling formulators to refine solvent-free systems and embrace biomass-balanced chemistries, reducing carbon footprints without compromising on protective properties. Concurrently, digitalization initiatives-ranging from data-enabled application robotics to in-line spectroscopic verification-are optimizing throughput and ensuring consistent film thickness in high-volume production environments.

Equally impactful is the automotive sector’s pivot to electrified platforms, where thermal barrier and electromagnetic compatibility requirements are reshaping R&D focus toward multifunctional coatings. In aerospace, lightweight composite substrates subject to extreme thermal cycling are redefining supplier partnerships and driving innovation in erosion-resistant formulations. Marine operators, too, are demanding hybrid antifouling solutions that balance commercial vessel efficiency with advanced anticorrosion treatments for leisure crafts. These convergent shifts are forging a market axis where materials science, digital integration, and sustainable design coalesce to unlock new performance frontiers.

Assessing the Combined Effects of New United States Tariff Policies on Ceramic Coating Supply Chains, Production Costs, and Industry Resilience

On February 1, 2025, the U.S. administration introduced tariffs of 25% on imports from Canada and Mexico and 10% on a broad range of materials from China, including critical inputs such as titanium dioxide, resins, and coating intermediates. These measures aim to address national security concerns but have escalated raw material costs and injected uncertainty into the paint and coatings supply chain.

The American Coatings Association warned that new duties on Canada, Mexico, and China-collectively the industry’s largest trading partners-could disrupt production across automotive, aerospace, and medical device segments, given the reliance on imported specialty intermediates. With Canada and Mexico accounting for $1.26 billion and $815 million in coating-related trade, respectively, the positive trade surplus of $1.7 billion underscores the industry’s dependence on integrated North American supply chains and the challenge of shifting raw material sourcing on short notice.

In response, major suppliers have begun passing through surcharges to offset increased input costs. Sun Chemical, for instance, announced a tariff surcharge on color materials, affecting both imported and domestically produced pigments and additives, while maintaining efforts to identify alternative suppliers and mitigate long-term impact through strategic supply-chain adjustments. These developments underscore the need for agile sourcing strategies and close supplier collaboration to preserve margins and production continuity.

Unveiling Deep Ceramic Coating Market Segmentation Insights to Illuminate Application, Coating Type, and Sales Channel Dynamics for Strategic Prioritization

The ceramic coating market can be dissected across multiple dimensions that reveal differentiated growth and opportunity pools. Application segmentation highlights diverse end-uses, from aerospace components-where formulations must endure high thermal cycling in both commercial and military aircraft-to automotive applications spanning both commercial vehicles and passenger cars. Within industrial settings, coatings find purpose in manufacturing processes that include automotive and electronics production, as well as oil and gas equipment. Marine applications address both large commercial vessels and pleasure boats, where UV exposure and corrosive environments drive specialized protective requirements.

Coating type further refines market understanding by distinguishing silica-based systems, available in colloidal and fumed silica variants, from titanium dioxide polymorphs, including anatase and rutile grades. These chemistries deliver distinct hardness, opacity, and wear characteristics, aligning with end-use specifications from thermal barrier needs to decorative finishes. Sales channels provide additional insight: traditional offline distribution through authorized distributors and technical coating specialists continues to serve industrial clients, while online retail via dedicated company websites and third-party e-commerce platforms is rapidly expanding access to professional and DIY users seeking convenience and direct technical support.

This comprehensive research report categorizes the Ceramic Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material System

- Formulation

- Technology

- Substrate

- Coating Thickness

- Coating Structure

- Application Purpose

- End-User

- Sales Channel

Highlighting Critical Regional Ceramic Coating Market Dynamics and Demand Drivers Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics reveal pronounced variation in demand drivers and competitive intensity. In the Americas, robust investment in advanced manufacturing and major expansions in automotive and aerospace production underpin growth in high-performance ceramic coatings. The North America market alone reached an estimated $11.95 billion in 2025, driven by thermal barrier coatings for turbine engines and hydrophobic finishes in automotive applications, with U.S. aerospace and automotive OEMs spearheading adoption of next-generation formulations.

Europe, Middle East & Africa (EMEA) benefits from a mature industrial base and stringent environmental regulations that drive demand for solvent-free and biomass-balanced solutions. Germany, France, and the UK are leading adopters in aerospace component coatings, while rapid expansion in renewable energy infrastructure across Europe is stimulating demand for durable, high-temperature resistant finishes. In the Middle East, petrochemical and power generation sectors are accelerating uptake of corrosion-resistant ceramic coatings on critical equipment.

In Asia-Pacific, the largest regional share at around 40% of the global market is anchored by expanding automotive production in China and India, coupled with sustained aerospace growth across Japan and Australia. High-volume manufacturing and increasing consumer awareness of vehicle protection solutions have propelled a CAGR of approximately 7.6% through 2027, with premium vehicle markets in South Korea and Taiwan driving demand for decorative, scratch-resistant coatings.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves, Innovations, and Portfolio Developments from Leading Ceramic Coating Suppliers Shaping Market Competitiveness

Key industry participants are deploying diverse strategies to capture emerging growth pools and navigate supply-chain complexities. XPEL Inc. expanded its Fusion Plus product line in late 2023 to include specialized coatings for automotive glass, wheels, and marine applications, underscoring a broadened portfolio aimed at premium aftermarket segments. BASF SE has pursued both divestiture and innovation: in May 2025 it initiated a sale process for its coatings division at an estimated €6.0 billion valuation, while simultaneously forging strategic partnerships in automotive refinish markets and advancing biomass-balanced product lines to reduce carbon intensity by 25% year-over-year.

3M continues to leverage its materials science expertise and global distribution network, showcasing new paint protection films and reinforced ceramic coatings at major industry exhibitions and introducing enhanced pattern-driven application software to support rapid installation. Onyx Coating’s upcoming Graphene Pure Ultra launch exemplifies next-generation innovation, featuring multi-walled carbon nanotubes to achieve 10H hardness and superior slickness for professional detailers.

Meanwhile, Sherwin-Williams and private equity consortia are evaluating joint bids for major coatings assets, reflecting broader consolidation trends as capital seeks exposure to high-margin protective solutions. These strategic maneuvers highlight the convergence of M&A activity, sustainability imperatives, and product innovation shaping the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A&A Coatings, Inc.

- Akzo Nobel N.V.

- Ametek, Inc.

- APS Materials, Inc.

- Artekya LTD

- Axalta Coating Systems Ltd.

- BAF - Industrie- & Oberflächentechnik GmbH

- Bodycote plc

- Compagnie de Saint-Gobain S.A.

- Curtiss-Wright Corporation

- DuPont de Nemours, Inc.

- FEYNLAB INC.

- Graco Inc.

- GYEON

- Henkel AG & Co. KGaA

- INOMETA GmbH by AVANCO Group

- Jotun A/S

- Kyocera Corporation

- Linde plc

- Nano-Care Deutschland AG

- Nanoshine Group Corp.

- Onyx Coating GmbH

- PPG Industries, Inc.

- Resonac Holdings Corporation

- Solvay S.A.

- Sulzer Ltd.

- The Sherwin-Williams Company

- Vibrantz Technologies

- Wacker Chemie AG

Empowering Ceramic Coating Industry Leaders with Actionable Strategies to Navigate Regulatory, Technological, and Market Evolutionary Challenges

To thrive amidst evolving regulatory and market conditions, industry leaders should prioritize accelerated adoption of green chemistries and transparent mass balance protocols, aligning product portfolios with emerging net-zero targets and VOC elimination goals. Investing in digital quality-control platforms-such as in-line spectroscopic monitors and robotic application systems-can enhance process reliability and reduce coating variability while lowering operational costs.

Simultaneously, developing agile sourcing strategies to mitigate tariff exposure is essential. This includes forging local supplier partnerships in North America and diversifying procurement channels beyond traditional trading partners. Companies can also explore cost remission through targeted surcharges while optimizing raw material substitution pathways to maintain margin resilience.

Lastly, leaders must embrace customer-centric segmentation by tailoring formulations and service models to the distinct needs of passenger vehicle, commercial fleet, aerospace, and marine customers. Leveraging e-commerce platforms and direct-to-customer engagement tools will expand reach in aftermarket DIY and professional user segments, unlocking incremental revenue streams.

Describing Comprehensive Research Methodology Employed Including Data Collection, Validation, and Analytical Techniques for Market Intelligence Rigor

Our research integrates rigorous primary and secondary methodologies to ensure comprehensive market intelligence and actionable insights. Secondary research involved systematic review of public filings, government tariff announcements, industry publications, and credible news outlets to map regulatory changes, supplier activities, and macroeconomic drivers. Key secondary sources included Reuters, PCI Magazine, and company press releases, ensuring up-to-date coverage of tariff impacts and corporate strategic moves.

Primary research comprised in-depth interviews with industry experts, coating formulators, OEM procurement leaders, and aftermarket service providers. Insights from these conversations validated segmentation frameworks across application, coating type, and sales channel dimensions. Quantitative data were cross-referenced with third-party datasets, and qualitative findings were triangulated to mitigate bias and enhance reliability.

Analytical rigor was maintained through structured data validation protocols and scenario modeling, which addressed tariff sensitivities and regional demand fluctuations. The combined approach ensures that our findings accurately reflect the dynamic ceramic coating landscape and inform strategic decision-making for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Coating Market, by Material System

- Ceramic Coating Market, by Formulation

- Ceramic Coating Market, by Technology

- Ceramic Coating Market, by Substrate

- Ceramic Coating Market, by Coating Thickness

- Ceramic Coating Market, by Coating Structure

- Ceramic Coating Market, by Application Purpose

- Ceramic Coating Market, by End-User

- Ceramic Coating Market, by Sales Channel

- Ceramic Coating Market, by Region

- Ceramic Coating Market, by Group

- Ceramic Coating Market, by Country

- United States Ceramic Coating Market

- China Ceramic Coating Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 3180 ]

Synthesizing Key Findings and Strategic Imperatives for Stakeholders to Leverage Ceramic Coating Market Opportunities in a Rapidly Evolving Environment

The global ceramic coating market stands at a strategic inflection point, where sustainability imperatives, technological innovation, and geopolitical dynamics are redefining competitive advantage. Companies that invest in eco-efficient chemistries and harness digital process controls will be best positioned to meet evolving end-user expectations and regulatory demands.

Simultaneously, adaptive sourcing strategies and tariff mitigation frameworks are critical for preserving margin integrity in the face of shifting trade policies. A nuanced understanding of regional growth differentials-anchored by North America’s aerospace prowess, EMEA’s environmental regulations, and Asia-Pacific’s manufacturing scale-enables targeted investment and partnership decisions.

Ultimately, the alignment of segmentation-driven product development, agile supply-chain models, and collaborative innovation ecosystems will determine which players capture the most value in this growth market.

Drive Informed Ceramic Coating Decisions with Expert Guidance from Ketan Rohom and Secure Your Customized Market Research Report Access Today

To explore comprehensive insights and strategic intelligence on the global ceramic coating market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage directly to discuss how this tailored research can address your specific business challenges and uncover opportunities across applications, regions, and emerging technologies. Secure access today to elevate your decision-making with data-driven guidance and unmatched industry expertise.

- How big is the Ceramic Coating Market?

- What is the Ceramic Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?