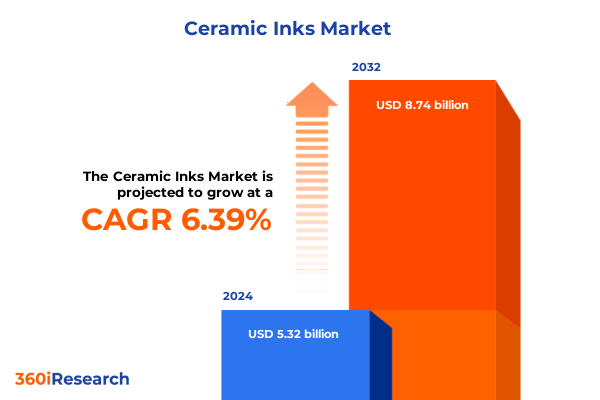

The Ceramic Inks Market size was estimated at USD 5.59 billion in 2025 and expected to reach USD 5.88 billion in 2026, at a CAGR of 6.58% to reach USD 8.74 billion by 2032.

Exploring the technical breakthroughs, production challenges, and shifting customer demands that are redefining the future trajectory of ceramic inks manufacturing and applications

Ceramic inks, a specialized subset of printing formulations, have emerged as a critical enabler in the production of high-quality ceramic tiles, sanitary ware, and decorative elements. Unlike traditional printing inks, ceramic inks must withstand extreme firing temperatures often exceeding 2,200 °F, requiring advanced metal oxide pigments and carefully engineered binders to ensure a durable bond to porcelain and stoneware substrates. The result is a vibrant, long-lasting finish that meets the demanding aesthetic and functional requirements of modern architectural and interior design applications.

As manufacturers embrace digital inkjet printing to achieve finer resolution and greater design flexibility, the ceramic inks sector is experiencing renewed interest. Leading suppliers have invested heavily in research to optimize ink rheology, color stability, and adhesion under diverse firing cycles. This convergence of material science innovation and digital process integration is driving a shift away from conventional screen printing toward inline digital solutions, enabling just-in-time customization and reduced inventory complexity.

By understanding the technical underpinnings and adoption drivers of ceramic inks, industry stakeholders can better align their capabilities with evolving market demands and lay the foundation for sustained competitive advantage.

Examining the disruptive forces, emerging digital printing technologies, and sustainability imperatives that are driving transformative shifts in the ceramic inks landscape worldwide

Over the past two years, the ceramic inks landscape has been reshaped by the rapid adoption of digital inkjet technologies and the intensifying focus on sustainable chemistries. In early 2024, several market leaders introduced high-chroma UV-curable inks tailored for ceramic tile digital printing, offering enhanced color gamut and improved cure speeds compared to traditional ceramic paste systems. These UV-curable formulations eliminate volatile organic compounds and enable lower energy consumption during curing, aligning with broader regulatory trends toward greener manufacturing.

Concurrently, water-based ink platforms have gained traction as processors seek to reduce lifecycle environmental impacts. Notably, Torrecid’s January 2025 launch of ECOINKCID and 2LOWINKCID marks a significant milestone, demonstrating reductions of up to 85% in organic carbon emissions and 75% in odor generation without compromising firing performance or adhesion properties.

The integration of specialty additives-such as rheology modifiers, defoamers, and sintering aids-has further expanded the capabilities of solvent, UV-curable, and water-based ceramic inks, enabling seamless compatibility with a diverse array of printing systems and substrate chemistries. As a result, producers must continuously adapt formulation strategies to balance performance, sustainability, and cost optimization in an increasingly competitive environment.

Analyzing how the latest adjustments to United States tariff policies in 2025 are reshaping import dynamics, supply chain strategies, and global sourcing for ceramic ink producers

The Harmonized Tariff Schedule classifies ceramic ink formulations under HTS 3215.11.30.00, where general duties apply at 1.8% ad valorem under column 1 and an additional 25% duty is imposed on Chinese-origin imports under Section 301 measures. This combination of baseline tariffs and supplemental duties elevates the total landed duty rate for key solvent-based ceramic inks to 26.8%, creating a pronounced cost differential relative to non-Chinese-origin and FTA‐eligible suppliers.

Beyond solvent-based products, water-based acrylic and latex inks also face similar tariff treatments, while water-based decorative and functional inks classified under HTS 3215.19.00 remain free of general duties but may incur up to a 25% Section 301 surcharge on designated subheadings. These cumulative tariffs have driven many downstream ceramic ink consumers to revisit their supply chain strategies, diversifying sourcing toward European and North American specialty pigment manufacturers to mitigate exposure to additive duty burdens.

In light of these 2025 adjustments, organizations are prioritizing local or near-shore procurement, ramping up in-house application labs, and exploring formulation partnerships with regional ink developers. Such realignments aim to optimize landed costs, shorten lead times, and reduce inventory carrying costs in an increasingly complex global trade environment.

Revealing critical segmentation insights that illuminate how diverse ink types, product categories, end uses, applications, and sales channels intersect to influence market strategies

The ceramic inks market is defined by a rich tapestry of formulations, from traditional solvent-based alcohol and mineral spirits systems through UV-curable and advanced water-based platforms such as acrylic and latex blends. Within decorative and functional product segments alike, this variety allows manufacturers to precisely tailor properties like gloss, opacity, and thermal stability to suit both tile decoration and performance-critical applications in electronics or automotive components.

End-use profiles span a spectrum of ceramic tile formats-floor and wall tiles-alongside decorative elements including mosaic and panel solutions. Each application demands specialized pigment formulations capable of surviving high-temperature firing while preserving chromatic integrity, be it in tableware sectors encompassing cookware and dinnerware or sanitary ware segments covering bathtubs, sinks, and toilets.

Distribution channels further shape market dynamics, with direct sales agreements strengthening partnerships between ink developers and large-scale tile producers, while distributors and online retail platforms facilitate access for smaller manufacturers and specialty ateliers. Understanding these intersecting segmentation layers enables stakeholders to identify high-value niches and optimize go-to-market strategies within the ceramic inks ecosystem.

This comprehensive research report categorizes the Ceramic Inks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ink Type

- Product Type

- End Use

- Application

- Sales Channel

Providing a nuanced regional perspective on ceramic inks demand, competitive landscapes, and innovation trajectories across the Americas, EMEA, and Asia-Pacific regions

In the Americas, the United States leads adoption of advanced ceramic inkjet technologies, driven by a mature construction sector increasingly favoring digitally decorated porcelain slabs and designer tile formats. Sun Chemical’s joint venture with Vidres (SUNIC) underscores this trend, as its SUNIC inkjet inks deliver color consistency and stability across red paste, white paste, and porcelain substrates-addressing the North American demand for rapid decor customization and reduced inventory waste.

The Europe, Middle East & Africa region reflects a dual narrative of heritage craftsmanship in Italy and sustainability imperatives in Scandinavia and Germany. In 2024, Italian tile manufacturers recorded a modest 1.9% increase in sales volumes to 376 million square meters, driven by exports to North American and Asian markets even as domestic production contracted by 2.0%. This resilience highlights the critical role of high-performance ceramic inks in maintaining premium pricing and brand differentiation on the global stage.

Asia-Pacific remains the largest ceramic tile manufacturing hub, anchored by China’s 600 million square meter export volume in 2024 despite a 2.5% year-on-year decline. More than 70% of these exports are sold within the Asian region itself, underscoring the domestic integration of ceramic inks into high-speed digital printing lines that favor local pigment and binder supply chains to reduce lead times and tariff exposure.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Inks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting key company profiles, strategic collaborations, and innovation pipelines from leading manufacturers and technology providers in the ceramic inks sector

Among the leading suppliers, Sun Chemical distinguishes itself through SUNIC Inkjet Ceramics S.L., a specialized JV offering customized formulations and rigorous process engineering support. Its ElvaJet Topaz SC range, launched in 2022, expanded ink operating windows for Kyocera printheads and enhanced drop control across multiple nozzle sizes, cementing Sun Chemical’s position in high-performance ceramic inkjet markets.

Torrecid has also emerged as a key innovator, unveiling its ECOINKCID water-based ink series in January 2025 to meet stringent environmental standards. These formulations achieved up to 85% reduction in organic carbon emissions and 75% odour reduction, enabling compliance with emerging global regulations while sustaining the high-temperature firing profiles essential for tile and sanitary ware applications.

Other notable players include Sicer, whose Low Emission ink portfolio underscores a commitment to sustainable manufacturing, and Tecglass, which has leveraged its Jetver line to deliver UV-curable inks for both glass and ceramic surfaces that resist environmental degradation and abrasion. These companies’ strategic investments in R&D and partnerships with printer OEMs continue to expand the boundaries of ceramic ink performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Inks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cerdec GmbH

- Colorobbia Italia S.p.A.

- DIC Screen Europe GmbH

- Ferro Corporation

- INX International Ink Co.

- Marabu GmbH & Co. KG

- Nazdar SourceOne, LLC

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical Corporation

- Zeller+Gmelin GmbH & Co. KG

Offering actionable strategic recommendations designed to empower industry leaders to capitalize on emerging trends, optimize operations, and drive sustainable growth within ceramic inks

To thrive in this complex landscape, industry leaders should proactively diversify raw material sourcing by qualifying multiple pigment and binder suppliers across tariff-neutral regions. Such risk mitigation not only addresses duty escalations but also enhances continuity in product development cycles.

Investing in cross-functional application laboratories can accelerate formulation optimization, enabling rapid iteration of UV-curable and water-based inks tailored to specific substrate chemistries and firing protocols. Collaboration with OEMs of digital printing systems will foster co-innovation and ensure seamless integration of new ink chemistries with printer hardware advancements.

Furthermore, embedding sustainability criteria into product roadmaps-such as reducing VOC content, improving carbon footprint, and achieving circular economy objectives-will not only satisfy regulatory mandates but also resonate with architects and designers who prioritize green building certifications. By aligning strategic investments with these actionable priorities, organizations can position themselves for resilient growth and market leadership.

Outlining the rigorous research methodology employed, including data sources, analytical frameworks, and validation processes underpinning the ceramic inks market analysis

This analysis integrates primary interviews with R&D directors, supply chain executives, and digital printing specialists across Asia, Europe, and North America. Secondary research sources include the U.S. Harmonized Tariff Schedule, Ceramic World Web reports, IndexBox market statistics, and publicly available company press releases.

Quantitative data was validated through cross-referencing HTS duty rates with Section 301 notices published by the Office of the United States Trade Representative. Regional production and export figures were corroborated with proprietary datasets from Mecs Research Centre and Prometeia for Confindustria Ceramica, ensuring accuracy in regional market sizing.

Analytical frameworks applied include Porter’s Five Forces to assess competitive intensity, SWOT analyses for major ink platforms, and scenario modeling to evaluate the impact of tariff adjustments and technology shifts. This robust methodology underpins the credibility and actionable value of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Inks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Inks Market, by Ink Type

- Ceramic Inks Market, by Product Type

- Ceramic Inks Market, by End Use

- Ceramic Inks Market, by Application

- Ceramic Inks Market, by Sales Channel

- Ceramic Inks Market, by Region

- Ceramic Inks Market, by Group

- Ceramic Inks Market, by Country

- United States Ceramic Inks Market

- China Ceramic Inks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing core insights and lessons learned to present a compelling conclusion that underscores the critical success factors for stakeholders in ceramic inks

The ceramic inks sector is at a pivotal juncture, driven by digital printing adoption, regulatory headwinds, and an unwavering focus on performance under extreme firing conditions. Key success factors include the ability to innovate sustainable formulations that meet strict environmental and safety criteria while delivering the chromatic precision demanded by today’s designers and architects.

Supply chain agility, supported by diversified sourcing strategies and near-shore manufacturing partnerships, has emerged as a critical differentiator in navigating tariff complexities. Likewise, strategic collaborations between ink developers and printer OEMs are accelerating the commercialization of next-generation ink technologies.

As market dynamics evolve, stakeholders who engage in continuous co-innovation, invest in advanced application support, and maintain a relentless focus on operational excellence will capture the greatest share of growth. These insights provide a clear roadmap for decision-makers to refine their strategic priorities and secure lasting competitive advantage in the ceramic inks industry.

Engage with Ketan Rohom to secure your comprehensive market research report and gain unparalleled insights into the evolving ceramic inks industry landscape

Ready to gain the in-depth insights and strategic analysis you need to navigate the complex ceramic inks landscape? Contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report. Leverage our expert findings to optimize your product development roadmap, refine supply chain strategies, and capitalize on emerging growth opportunities. Don’t miss the chance to equip your organization with the actionable intelligence required to stay ahead of the competition and drive long-term success.

- How big is the Ceramic Inks Market?

- What is the Ceramic Inks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?