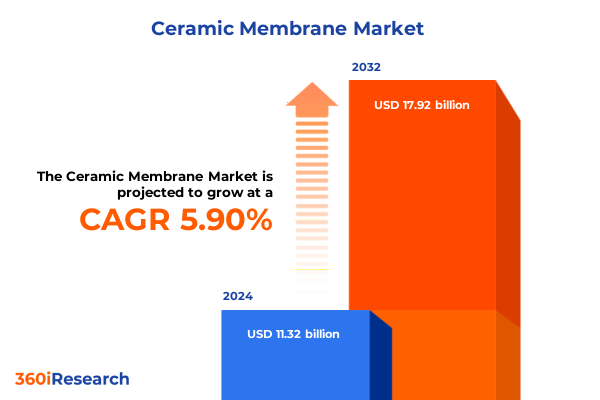

The Ceramic Membrane Market size was estimated at USD 11.93 billion in 2025 and expected to reach USD 12.57 billion in 2026, at a CAGR of 5.98% to reach USD 17.92 billion by 2032.

Unveiling the Versatility and Impact of Ceramic Membranes in Modern Industrial and Environmental Filtration and Separation Applications

Ceramic membranes represent a paradigm shift in filtration technology, emerging as robust alternatives to traditional polymeric systems. Their construction from materials such as aluminum oxide, silicon carbide, titanium dioxide, and zirconium dioxide endows them with exceptional mechanical strength, chemical inertness, and thermal stability, enabling reliable performance under extreme process conditions. As industries prioritize operational resilience and sustainability, the unique attributes of ceramic membranes-including high fouling resistance and regenerability through steam sterilization or aggressive chemical cleaning-position them as indispensable components in modern separation processes.

Across sectors ranging from water and wastewater treatment to pharmaceutical manufacturing, ceramic membranes facilitate precise, energy-efficient separations that reduce chemical usage and minimize downtime. Innovations in pore architecture and module design have expanded their applicability from microfiltration to nanofiltration, reverse osmosis, and ultrafiltration, catering to diverse purity requirements and flux demands. As environmental regulations tighten and end users seek solutions with longer lifespans and lower total cost of ownership, ceramic membranes are poised to redefine industry standards and drive next-generation filtration strategies.

Exploring Revolutionary Technological Advances and Evolving Drivers Reshaping the Ceramic Membrane Market Landscape for Next Generation Solutions

The ceramic membrane landscape is undergoing transformative shifts propelled by breakthroughs in material science, manufacturing technologies, and digital integration. Recent progress in interfacial engineering has enabled ceramic supports with multilevel pore structures that achieve unprecedented water permeability and mechanical strength simultaneously, overcoming the traditional trade-off between flux and durability. Advances in additive manufacturing and automated assembly are also reducing production complexity, enabling bespoke membrane geometries tailored to specific process requirements.

Simultaneously, the convergence of real-time monitoring systems and artificial intelligence is optimizing membrane performance, as sensor-enabled modules adjust backwash cycles and cleaning protocols to extend operational intervals and minimize unplanned maintenance. These developments are accelerating the transition from pilot trials to full-scale deployments in critical industries such as biopharmaceuticals, where ceramic ultrafiltration units now support sterile drug formulations, and oil & gas, where membranes are integrated into Zero Liquid Discharge systems for sustainable water reuse. As these trends continue to evolve, the ceramic membrane market is primed for widespread adoption and innovative applications that will reshape separation process paradigms.

Assessing the Far Reaching Consequences of 2025 United States Trade Policies and Tariff Actions on Ceramic Membrane Supply Chains

In early 2025, the United States enacted a series of tariff measures affecting critical ceramic membrane components and related raw materials. Section 301 reviews led to elevated duties on tungsten products, wafers, and polysilicon-materials sometimes used in advanced ceramic formulations-raising rates to between 25 and 50 percent effective January 1, 2025. These adjustments, coupled with reciprocal tariffs announced under the “Liberation Day” directives, have introduced elevated cost pressures across ceramic membrane supply chains.

Utilities and industrial users are grappling with sudden increases in project budgets for upgrades and new installations, as baseline tariff floors ranging from 15 to 50 percent have driven an estimated 2 percent rise in overall equipment costs. Chemical cleaning agents, specialized catalyst coatings, and multichannel support structures sourced internationally have seen price hikes, prompting some firms to temporarily pause capital plans or seek alternative domestic suppliers. Meanwhile, ongoing debates over the Foreign Pollution Fee Act of 2025 propose eco-tariff structures that could further adjust import levies based on carbon intensity, introducing additional complexity for long-term procurement and cost forecasting. As stakeholders adapt through strategic inventory management and supplier diversification, the cumulative impact of these tariffs continues to reshape investment decisions and operational strategies within the ceramic membrane ecosystem.

Drawing Strategic Insights from Diverse Product Material Technology and End User Segmentation in the Ceramic Membrane Domain

The ceramic membrane market is defined by a complex interplay of product variants, material compositions, technological modes, and end-user applications, each driving unique performance attributes and commercial considerations. Disc holder assemblies crafted to support tubular modules offer ease of backwashing and mechanical stability, while flat-sheet filter elements deliver high surface area and compact footprint benefits for lab-scale test cells. Ceramic membrane filters provide the core separation interface, with configurations tailored for pilot studies or large industrial installations. These product distinctions directly influence installation design, maintenance regimes, and overall process economics.

At the material level, alumina-based membranes continue to serve as cost-effective workhorses in general water treatment, whereas silicon carbide formulations are selected for aggressive chemical or high-temperature operations. Titanium dioxide membranes, prized for their photocatalytic properties, are gaining traction in specialized applications requiring antifouling or antibacterial functionality. Zirconium dioxide variants, with their superior flexural strength, address the demands of high-pressure ultrafiltration processes.

Technological segmentation further refines application fit. Microfiltration modules handle coarse particulate removal, enabling pre-treatment in municipal and industrial wastewater systems. Nanofiltration membranes extend capabilities to softening and selective divalent ion removal, supporting applications from dairy protein concentration to wastewater polishing. Reverse osmosis ceramic platforms are emerging for brackish water desalination, offering resistance to chlorine and fouling. Finally, ultrafiltration ceramics balance retention performance with flux for biotechnology separations. End users across the chemical sector leverage membranes for solvent recovery, the food & beverage industry harnesses them for juice clarification and dairy processing, oil & gas operators deploy ZLD systems, pharmaceutical and biotechnology firms utilize virus-retentive modules, power generation facilities incorporate filtration for boiler feedwater, and water & wastewater treatment entities adopt solutions to meet stringent discharge standards.

This comprehensive research report categorizes the Ceramic Membrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Material Type

- Technology

- End-User

Uncovering Regional Dynamics and Growth Potential across Americas Europe Middle East Africa and Asia Pacific Ceramic Membrane Markets

Regional market dynamics for ceramic membranes are shaped by distinct regulatory frameworks, infrastructure priorities, and industrial concentrations. In the Americas, mature municipal and industrial water treatment sectors drive demand for robust filtration technologies, with end users prioritizing low maintenance costs and regulatory compliance. The United States, as the largest economy in the region, is witnessing accelerated adoption of ZLD systems in oil & gas and power sectors, while Canada and Latin American nations focus on upgrading antiquated municipal plants and addressing water scarcity challenges through membrane-based reuse.

In Europe, the Middle East, and Africa, tightening wastewater discharge limits and the push toward circular water economies are fuelling investments in advanced separation solutions. European nations emphasize sustainable resource management and encourage public-private partnerships for wastewater infrastructure modernization. In the Middle East, arid climates necessitate desalination and brine management, leading to growing interest in ceramic reverse osmosis modules that can withstand high salinity and chlorine dosing. African markets, while nascent, are beginning to explore ceramic membrane pilot projects driven by donor-funded initiatives to improve water security.

Across Asia-Pacific, rapid industrialization and stringent environmental regulations in countries such as China, India, Japan, and South Korea have established the region as the global leader in ceramic membrane installation volumes. Textile clusters in South Asia are implementing membrane systems to comply with effluent quality standards, while East Asian semiconductor and pharmaceutical hubs integrate nanofiltration and ultrafiltration ceramics into high-purity water circuits. Government incentives for advanced water infrastructure and local manufacturing capabilities further reinforce the region’s dominant position in ceramic membrane adoption.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Membrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Ceramic Membrane Manufacturers Innovations Collaborations and Competitive Strategies Driving Industry Leadership

The ceramic membrane landscape is highly competitive, with a mix of established multinational corporations and specialized regional players driving innovation. Legacy filtration providers have leveraged decades of experience to refine ceramic module designs, integrating anti-fouling coatings and modular skid systems for seamless retrofits. Emerging firms focus on disruptive manufacturing techniques, such as 3D printing and sol–gel processes, to accelerate new product prototyping and reduce production lead times.

Strategic collaborations have become a hallmark of market advancement. Joint pilot projects between global environmental services companies and material science innovators are demonstrating the viability of smart ceramic membranes equipped with embedded sensors for real-time performance monitoring. Partnerships between membrane manufacturers and automation technology providers are also enabling predictive maintenance frameworks, reducing unplanned outages.

Competition centers on delivering membranes that exhibit extended service intervals, minimal chemical cleaning requirements, and high selectivity for targeted contaminants. Companies leading in end-to-end solution offerings differentiate themselves through comprehensive service agreements, digital performance analytics, and hybrid system integrations that combine ceramic membranes with complementary filtration or adsorption units. As sustainability commitments deepen across industries, corporate leaders that align product development roadmaps with circular water economy objectives and net-zero targets are strengthening their market positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Membrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alsys Group

- Aquabrane Water Technologies Pvt. Ltd.

- Aquaneel Seperation

- Aquatech International LLC

- ARAN Holding GmbH

- Cembrane A/S

- Ceraflo Pte Ltd.

- GEA Group Aktiengesellschaft

- Guochu Technology (Xiamen) Co., Ltd.

- IPNR Endura

- Jiangsu Jiuwu Hi-Tech Co., Ltd.

- KERAFOL Keramische Folien GmbH & Co. KG

- Kuraray Co., Ltd.

- LiqTech Holding A/S

- Mantec Technical Ceramics Ltd.

- Membratec SA

- Membrion, Inc.

- Metawater Co., Ltd.

- Nanjing Tangent Fluid Technology Co., Ltd.

- Nanostone Water, Inc.

- Pall Corporation

- Paul Rauschert GmbH & Co. KG.

- Qua Group LLC

- Saint-Gobain S.A.

- SIVA Unit

- TAMI Industries

- Toray Industries, Inc.

- Veolia Water Solutions & Technologies

Empowering Industry Stakeholders with Practical Recommendations to Navigate Ceramic Membrane Market Challenges and Accelerate Sustainable Growth

Industry stakeholders can take proactive steps to harness the full potential of ceramic membranes while mitigating external risks. First, developing strategic partnerships with material suppliers and research institutions will accelerate access to next-generation formulations that enhance flux, fouling resistance, and mechanical lifetime. Establishing co-development agreements can secure preferential access to breakthrough photocatalytic or hybrid organic–inorganic membrane technologies, offering differentiation in high-purity applications.

Second, supply chain resilience must be reinforced through diversification and nearshoring. Given the volatility of global tariffs and raw material availability, organizations should evaluate dual-sourcing strategies and local manufacturing partnerships to ensure uninterrupted access to critical ceramic substrates and module components. Implementing advanced inventory analytics will optimize buffer stock levels, aligning on-site holdings with dynamic lead times and tariff risk profiles.

Third, digitalization of membrane operations-leveraging IoT-enabled sensors, AI-driven cleaning optimization, and cloud-based performance dashboards-will unlock efficiency gains and extend asset life. By adopting prescriptive maintenance models, users can reduce chemical consumption and unplanned downtime, achieving measurable sustainability outcomes. Finally, integrating ceramic membranes into circular water reuse frameworks and renewable energy-driven treatment plants will deliver compelling environmental ROI and position organizations at the forefront of regulatory compliance and corporate ESG excellence.

Detailing Rigorous Research Methodology Data Collection Analytical Techniques and Validation Frameworks Underpinning the Ceramic Membrane Study

This study employs a robust multi-tiered research methodology combining primary and secondary data sources to ensure comprehensive, validated insights. Initially, an extensive review of technical journals, patent filings, and industry white papers provided the foundational understanding of material compositions, manufacturing processes, and emerging technologies. Peer-reviewed publications on ceramic membrane fabrication and performance characteristics were analyzed to capture the latest innovations in pore engineering and module design.

Primary research involved in-depth interviews and surveys with key stakeholders, including membrane manufacturers, end-user process engineers, water utilities, and technology integrators. These engagements yielded qualitative observations on real-world performance, maintenance practices, and procurement considerations. Data triangulation techniques were applied to reconcile interview findings with publicly available case studies and regulatory filings, ensuring accuracy and minimizing bias.

A vendor landscape analysis was conducted to map competitive offerings, partnership networks, and geographic footprints. Supply chain dynamics were examined through trade data reports and customs tariff documents to assess cost exposures and sourcing trends. Finally, all inputs were synthesized using a structured framework that aligns segmentation insights with regional, technological, and end-user dimensions. Rigorous validation workshops with industry experts confirmed the relevance and reliability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Membrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Membrane Market, by Product

- Ceramic Membrane Market, by Material Type

- Ceramic Membrane Market, by Technology

- Ceramic Membrane Market, by End-User

- Ceramic Membrane Market, by Region

- Ceramic Membrane Market, by Group

- Ceramic Membrane Market, by Country

- United States Ceramic Membrane Market

- China Ceramic Membrane Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Takeaways Future Outlook and Strategic Imperatives for Stakeholders in the Evolving Ceramic Membrane Ecosystem

The evolution of ceramic membrane technology is redefining separation processes across diverse industries, blending material innovation with digital intelligence to deliver robust and sustainable filtration solutions. As markets embrace next-generation membranes with enhanced fouling resistance and precise pore distribution, opportunities abound for operators to optimize water reuse, reduce chemical footprints, and meet stringent regulatory mandates. The cumulative effect of U.S. tariff adjustments underscores the importance of agile supply chain strategies and localized partnerships to safeguard continuity and cost competitiveness.

Key takeaways highlight the need for holistic approaches that integrate product, material, and technology segments with targeted end-user applications. Regional dynamics reveal a dual landscape of mature demand in the Americas and accelerating adoption in Asia-Pacific, driven by infrastructure investments and environmental policy imperatives. Competitive trajectories will favor companies that combine advanced R&D with service-oriented delivery models, leveraging digital platforms to enhance performance transparency and predictive maintenance capabilities.

Looking ahead, stakeholders must navigate shifting trade policies and tariff frameworks while capitalizing on emerging ceramic membrane innovations to achieve sustainable growth. By aligning strategic initiatives with circular water economy objectives and embedding intelligent operations within membrane systems, organizations can secure long-term value and maintain leadership in a rapidly evolving filtration ecosystem.

Secure Comprehensive Insights and Competitive Advantage with a Dedicated Discussion to Purchase the In Depth Ceramic Membrane Market Research Report Now

To gain a competitive edge and secure critical market insights, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. A personalized consultation will provide in-depth clarity on how ceramic membrane innovations can be leveraged to optimize operations, enhance product performance, and navigate emerging regulatory challenges. Through this discussion, you will uncover tailored strategies that align with your organization’s objectives and identify high-impact opportunities in end-use applications, regional deployments, and technological integrations. Act now to access premium research analyses, detailed segmentation deep dives, and strategic roadmaps that will inform your decision-making and investment planning. By partnering in this dialogue, you will ensure your team is equipped to capitalize on the transformative potential of ceramic membrane solutions and maintain a leadership position in an increasingly competitive landscape

- How big is the Ceramic Membrane Market?

- What is the Ceramic Membrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?