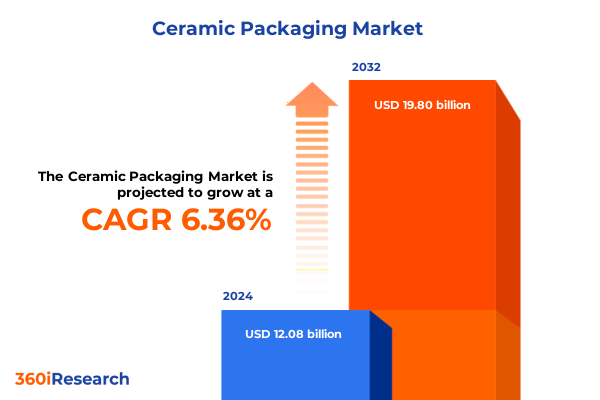

The Ceramic Packaging Market size was estimated at USD 12.82 billion in 2025 and expected to reach USD 13.60 billion in 2026, at a CAGR of 6.41% to reach USD 19.80 billion by 2032.

Establishing the Pivotal Role of Ceramic Packaging in Driving Next-Generation Electronic Performance and Reliability

Ceramic packaging has emerged as a critical enabler for the next wave of electronic components, driving unparalleled gains in thermal management, signal integrity, and durability. In an environment where devices are expected to operate at higher frequencies, greater power densities, and more extreme conditions, the intrinsic properties of ceramic substrates and housing solutions have become indispensable. This introduction delves into why ceramic packaging is not merely a niche material choice but a foundational technology shaping the future of semiconductors, power electronics, and high-reliability applications.

By exploring the convergence of miniaturization pressures, sustainability objectives, and rising performance demands, we set the stage for understanding how ceramic packaging stands at the confluence of innovation and resilience. With global electronics manufacturers and end-user industries seeking materials that simultaneously reduce thermal resistance, enhance mechanical robustness, and support complex multi-layer architectures, ceramic options present a compelling profile. The comprehensive view that follows will map out the technological drivers, emerging use cases, and strategic factors compelling decision-makers to integrate ceramic packaging into their product roadmaps.

Revolutionary Manufacturing and Material Advances Redefining Ceramic Packaging Capabilities for High-Performance Electronics

The landscape of ceramic packaging has undergone transformative shifts as breakthroughs in additive manufacturing, advanced sintering techniques, and hybrid material integration converge. Recent advancements in 3D printing of alumina and zirconia substrates have unlocked intricate geometries with fine feature resolution, enabling designers to embed cooling channels and high-density interconnects directly within the package body. This shift from conventional lamination and co-firing to digital manufacturing accelerates prototyping and customization, allowing faster time-to-market for application-specific designs.

Simultaneously, the integration of nanostructured thermal interface materials and high thermal conductivity fillers into ceramic matrices has elevated heat dissipation capabilities while preserving mechanical strength. These innovations respond directly to the escalating requirements in power electronics, electric vehicles, and advanced computing. As a result, ceramic packaging is no longer a static enclosure but a dynamic platform for co-designing electrical, thermal, and mechanical performance. The industry’s embrace of these transformative trends underscores the rapid evolution of ceramic packaging from a material alternative to a strategic technology lever.

Comprehensive Analysis of 2025 US Tariff Impacts on Ceramic Packaging Supply Chains and Strategic Sourcing Decisions

The introduction of new tariff policies in the United States in early 2025 has reshaped the cost structure and supply chain strategies for ceramic packaging stakeholders. These measures, aimed at balancing domestic production incentives and fair trade practices, have imposed higher duties on imported ceramic substrates and related components, compelling original equipment manufacturers (OEMs) and contract manufacturers to reevaluate their sourcing approaches. The cumulative impact extends beyond immediate cost increases, affecting lead times, supplier negotiations, and inventory planning practices across the value chain.

In response, many domestic and global players have accelerated efforts to localize production of high-value ceramic materials and packaging services. Partnerships between ceramic substrate producers and semiconductor foundries have intensified, with a focus on establishing integrated manufacturing cells within the United States. While these shifts mitigate exposure to tariff fluctuations, they demand capital investment in specialized equipment and skill development. Consequently, the tariff landscape has catalyzed a broader realignment of production footprints, reinforcing the strategic importance of agility and vertical collaboration in ceramic packaging supply chains.

Holistic Segmentation Insights Illuminating Material, Form Factor, and End-Use Industry Performance Drivers in Ceramic Packaging

An in-depth examination of ceramic packaging reveals distinct material-driven performance profiles across alumina, aluminum nitride, silicon nitride, and zirconia. Alumina continues to serve as the workhorse for cost-effective, medium-performance applications, while aluminum nitride’s superior thermal conductivity makes it the preferred choice for high-power modules. Silicon nitride is gaining traction in high-reliability environments due to its fracture toughness, whereas zirconia’s exceptional mechanical stability positions it for advanced aerospace and defense systems. The nuanced understanding of these material characteristics enables designers to optimize for thermal management, mechanical resilience, and signal integrity without compromising reliability.

Form factor segmentation highlights diverse packaging architectures tailored to meet varied performance and assembly requirements. Ceramic ball grid array solutions provide a balance of fine-pitch capability and thermal performance, whereas ceramic column grid arrays deliver enhanced stand-off height for underfill-free applications. Quad flat packages combine a compact footprint with robust mechanical anchoring, and monolithic ceramic designs integrate multiple functional layers into a single substrate, reducing interfacial losses. Multilayer ceramic packaging further extends this concept by embedding passive components directly within the ceramic stack, streamlining assembly processes and improving signal routing for high-frequency designs.

Across end-use industries, the adoption of ceramic packaging diverges based on sector-specific drivers. Aerospace and defense applications prioritize material toughness and radiation resistance, while the automotive sector demands materials capable of surviving thermal cycling and environmental stress. Consumer electronics favor thin, lightweight ceramic quad flat packages for compact devices, whereas energy and power systems leverage high-conductivity aluminum nitride solutions. Healthcare equipment relies on biocompatible ceramics with stable performance over time, and telecommunication infrastructure benefits from multilayer architectures that support ever-increasing data rates. Manufacturing companies engaged in industrial automation integrate these packaging options to ensure uninterrupted operation in harsh factory conditions.

This comprehensive research report categorizes the Ceramic Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Category

- Integration Level

- Hermeticity

- Application

- End-Use Industry

- Sales Channel

Evaluating Regional Strategic Imperatives and Investment Patterns Shaping Ceramic Packaging Adoption Across the Americas, EMEA, and Asia-Pacific

Regional dynamics shape the adoption and evolution of ceramic packaging as each geography pursues distinct strategic priorities and faces unique market forces. In the Americas, a concerted push toward reshoring critical electronic component manufacturing has bolstered investment in domestic ceramic substrate capabilities. Government incentives and public–private partnerships have supported pilot lines for aluminum nitride and advanced multilayer architectures, reinforcing the region’s role as a leader in power electronics and automotive applications.

Europe, Middle East & Africa regions exhibit a differentiated landscape where stringent environmental regulations and sustainability goals drive demand for lower-lifecycle carbon footprints. Ceramic packaging players in this region emphasize energy-efficient sintering processes and recycling of ceramic offcuts. The growing telecommunications infrastructure build-out across the Middle East and North Africa also presents opportunities for multilayer packaging solutions with enhanced electrical performance.

Asia-Pacific remains the largest consumer base, underpinned by high-volume consumer electronics production in East Asia and accelerating adoption of electric vehicles in China, Japan, and South Korea. Ceramic ball grid arrays and multilayer substrates dominate this market due to their cost-effective scalability and integration with existing surface-mount production lines. Furthermore, emerging economies in Southeast Asia are establishing hubs for advanced ceramic processing to serve regional automotive and renewable energy segments.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Competitive Ecosystem of Ceramic Packaging Providers, Material Innovators, and Integrated Supply Chain Collaborators

The competitive landscape in ceramic packaging encompasses a mix of established material producers, specialized substrate fabricators, and integrated packaging solution providers. Leading material suppliers have intensified research and development in engineered ceramics, collaborating with equipment makers to refine tape casting, laser drilling, and direct-write printing capabilities. These partnerships focus on scaling high-performance formulations, such as nanocomposite-enhanced aluminum nitride, and improving yield through advanced defect inspection techniques.

On the packaging front, dedicated contract manufacturers have expanded their service portfolios to include turnkey assembly for power modules, RF front-end components, and microelectromechanical systems. Through strategic acquisitions, many of these firms have bolstered their vertical integration, securing critical upstream inputs and accelerating time to market. Alliances between semiconductor foundries and packaging specialists have also emerged, offering co-optimized ceramic substrate and die attach solutions, thereby enabling seamless qualification processes for mission-critical applications.

Consolidation trends are evident as major electronics conglomerates integrate ceramic packaging capabilities in-house to secure supply chain control and protect intellectual property. Concurrently, innovative startups challenge the status quo by commercializing novel ceramic ink formulations and additive manufacturing processes that promise rapid prototyping and localized production. This dynamic interplay among incumbents, consolidators, and newcomers fuels continuous improvement in cost structures, performance benchmarks, and application breadth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- AMETEK. Inc.

- Aptasic SA

- CeramTec GmbH

- ChaoZhou Three-circle (Group) Co., Ltd.

- Egide S.A.

- Fujitsu Limited

- Hefei Shengda Electronics Technology Industry Co., Ltd

- Infineon Technologies AG

- Jiaxing Glead Electronics Co., Ltd.

- KOA Corporation

- Kyocera Corporation

- LEATEC Fine Ceramics Co., Ltd.

- Mackin Technologies by Hygente Corporation

- Materion Corp.

- Materion Corporation

- Micro-Hybrid Electronic GmbH

- Micross Components, Inc.

- Morgan Advanced Materials plc

- NGK Insulators, Ltd.

- Niterra Co., Ltd.

- Palomar Technologies, Inc.

- Qnnect, LLC

- Remtec Inc.

- Renesas Electronics Corporation

- Schott AG

- Stratedge Corporation

- Texas Instruments Incorporated

- VTT Technical Research Centre of Finland Ltd.

- Yixing City Jitai Electronics Co., Ltd.

Implementing Integrated Roadmaps Combining Advanced Materials, Strategic Alliances, and Agile Manufacturing for Ceramic Packaging Success

To capitalize on the evolving ceramic packaging landscape, industry leaders must adopt a proactive approach that blends technology scouting, strategic partnerships, and operational flexibility. Companies should establish cross-functional teams tasked with monitoring additive manufacturing breakthroughs and engaging with academic research centers to pilot advanced sintering and co-fired architectures. This early engagement will de-risk scale-up challenges and position organizations to integrate novel ceramic formulations into their roadmaps swiftly.

Simultaneously, businesses should pursue joint ventures with regional substrate fabricators to hedge against tariff volatility and localize high-value manufacturing capabilities. These alliances can tap government-backed programs to secure capital incentives and streamline regulatory approvals. On the operational front, firms need to build modular production lines capable of switching between alumina, aluminum nitride, and silicon nitride platforms without extensive retooling, thereby enhancing responsiveness to market shifts.

Finally, product development teams should collaborate closely with end-user collaborators across automotive, telecommunications, and healthcare sectors to co-design packaging solutions optimized for specific application requirements. By embedding customer insights into material selection, form factor design, and testing protocols, companies can reduce qualification cycles and accelerate time to revenue. This integrated, customer-centric strategy will ensure that ceramic packaging offerings not only meet technical demands but also deliver tangible value in competitive markets.

Detailing a Robust Multimodal Research Approach Integrating Primary Interviews, Supply Chain Analysis, and Secondary Data Triangulation

The research methodology underpinning this market analysis combines primary stakeholder interviews, in-depth supply chain mapping, and comprehensive secondary data synthesis from industry journals, patent filings, and regulatory disclosures. Primary interviews were conducted with material scientists, process engineers, and procurement executives across tier-one OEMs and specialized substrate fabricators to uncover real-world challenges and innovation priorities.

Secondary research leveraged peer-reviewed publications on ceramic sintering advancements, global trade databases for tariff and shipment analyses, and technology roadmaps from leading semiconductor equipment associations. Data triangulation ensured consistency between qualitative insights and quantitative indicators, while cross-validation against site visits and pilot production case studies enhanced reliability. The structured approach to segmentation analysis incorporated both top-down and bottom-up techniques to align material properties, form factor variations, and end-use requirements with observed market behaviors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Packaging Market, by Material

- Ceramic Packaging Market, by Category

- Ceramic Packaging Market, by Integration Level

- Ceramic Packaging Market, by Hermeticity

- Ceramic Packaging Market, by Application

- Ceramic Packaging Market, by End-Use Industry

- Ceramic Packaging Market, by Sales Channel

- Ceramic Packaging Market, by Region

- Ceramic Packaging Market, by Group

- Ceramic Packaging Market, by Country

- United States Ceramic Packaging Market

- China Ceramic Packaging Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Ceramic Packaging Market Dynamics, Strategic Imperatives, and Innovation Pathways for Informed Decision-Making

Ceramic packaging stands at the nexus of material science and electronic system innovation, delivering critical performance advantages that are essential for current and future high-reliability applications. The amalgamation of transformative manufacturing methods, regional strategic realignments, and the imperative for agile supply chains underscores the dynamic character of this market. Key segmentation insights reveal differentiated value propositions across materials, package architectures, and end-user industries, while regional analyses highlight varied investment and regulatory landscapes.

As competitive pressures and technological demands intensify, organizations that execute on actionable recommendations-such as forging strategic partnerships, embracing additive manufacturing, and localizing production-will command a significant advantage. The research methodology’s rigorous execution assures the credibility of these insights, offering decision-makers a clear pathway to harness ceramic packaging innovations. Ultimately, this executive summary equips stakeholders with the perspective needed to navigate the complexities of the ceramic packaging ecosystem and unlock sustainable growth.

Unlock Proven Ceramic Packaging Insights and Strategic Advantages by Engaging with Expert Consultancy to Elevate Your Market Position

Ready to gain a competitive edge in ceramic packaging technology and strategic market positioning? Connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure the comprehensive research report that unveils transformative insights, tariff analyses, segmentation breakdowns, regional dynamics, and actionable guidance tailored for industry leaders. Elevate your decision-making with the depth and clarity this report delivers, and ensure your organization is positioned to harness the full potential of ceramic packaging solutions in today’s evolving electronics and semiconductor landscape.

- How big is the Ceramic Packaging Market?

- What is the Ceramic Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?