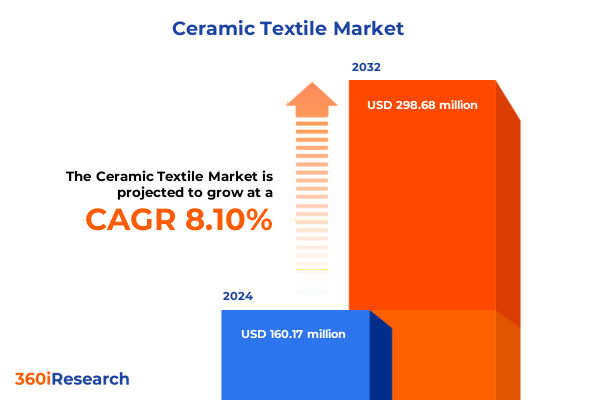

The Ceramic Textile Market size was estimated at USD 171.39 million in 2025 and expected to reach USD 185.46 million in 2026, at a CAGR of 8.25% to reach USD 298.68 million by 2032.

Exploring the Foundation and Significance of Ceramic Textiles in Modern Industry with Contextual Overview and Strategic Importance

Ceramic textiles have emerged as indispensable materials in sectors where extreme temperatures, corrosive environments, and demanding mechanical stresses are the norm. Engineered from high-purity oxide and non-oxide fibers, these textiles deliver superior thermal stability, chemical resistance, and low thermal conductivity, making them critical to industries ranging from defense and aerospace to petrochemicals and power generation. Beyond their core functional benefits, the inherent adaptability of ceramic fibers enables designers to tailor textiles into various formats-braided, woven, or nonwoven-meeting precise performance demands without compromising durability or safety.

In this executive summary, we set the stage by outlining the foundational characteristics and strategic relevance of ceramic textiles within the broader advanced materials landscape. Following this introduction, the document delves into transformative market shifts, analyzes the cumulative impact of U.S. tariff measures implemented in 2025, and distills key segmentation insights across product, fiber, application, and end-user dimensions. We then explore regional nuances influencing demand, profile leading industry players and their strategic initiatives, and offer actionable recommendations for stakeholders seeking competitive advantage. The methodology section transparently details our research approach, while the conclusion ties together critical imperatives shaping the future of ceramic textiles. Collectively, these insights provide decision-makers with a comprehensive understanding of current dynamics and a forward-looking framework to navigate opportunities and challenges in this rapidly evolving field.

Identifying Pivotal Technological and Market Transformations Reshaping Ceramic Textile Production and Application Landscapes Worldwide

Over recent years, the ceramic textile landscape has undergone profound transformations driven by technological innovations, sustainability imperatives, and evolving end-user requirements. First, advancements in fiber synthesis techniques-such as solution precursor plasma spraying and sol–gel electrospinning-have enabled manufacturers to produce ultra-fine alumina, zirconia, and silica fibers with unprecedented phase purity and mechanical resilience. As a result, the next generation of textile formats delivers enhanced thermal shock resistance and structural stability, thereby expanding applications in high-temperature insulation and advanced filtration.

Meanwhile, digitalization has reshaped production and quality management processes, with Industry 4.0–enabled sensor networks and digital twin models facilitating real-time monitoring of fiber diameter, tensile strength, and surface morphology. This integration of smart manufacturing tools not only boosts operational efficiency but also ensures reproducible product quality, accelerating time to market for customized solutions. Furthermore, the growing emphasis on circular economy principles has prompted the adoption of recycling and reclamation workflows, transforming manufacturing scrap into feedstock for new fiber production and reducing the carbon footprint associated with raw material extraction.

Finally, regulatory and customer-driven imperatives for greener and safer materials have elevated demand for non-carbonaceous ceramic textiles that minimize hazardous byproducts in both production and end-of-life disposal. As a consequence, companies are actively investing in low-emission process technologies and exploring bio-derived ceramic precursors. These collective shifts underscore the industry’s commitment to balancing performance with environmental stewardship, setting the stage for sustained innovation and market expansion.

Analyzing the Combined Effects of US Tariff Measures Enacted in 2025 and Their Influence on Ceramic Textile Supply Chains and Pricing Dynamics

The tariff measures introduced by the United States in early 2025 have created significant reverberations throughout the global ceramic textile value chain. Imposed under both Section 301 and Section 232 authorities, these duties target a broad spectrum of imported ceramic fibers, particularly those originating from China and other Asian manufacturers. In response, end users in defense, automotive, and energy sectors have encountered increased raw material costs, prompting procurement teams to reassess sourcing strategies and prioritize cost containment.

Consequently, domestic fiber producers have experienced heightened demand as buyers seek to mitigate exposure to applied import levies. This shift has intensified investments in local manufacturing capacity expansions and spurred collaborations between fiber fabricators and midstream converters. However, despite these efforts, supply constraints persist due to lengthy qualification cycles for new fiber grades and the capital-intensive nature of ceramic fiber production assets. Accordingly, downstream processors have absorbed significant cost pressures, resulting in modest price pass-throughs to end users and occasional renegotiations of long-term supply agreements.

Moreover, the tariff-induced reconfiguration of global supply chains has accelerated nearshoring trends, with several strategic buyers establishing assembly and conversion facilities closer to domestic fiber sources. While this localization enhances supply security and reduces lead times, it also necessitates greater focus on operational excellence to offset scale disadvantages. In parallel, suppliers are diversifying into alternative fiber chemistries-such as zirconia-rich blends-to broaden qualification pathways and lessen reliance on tariff-impacted materials. Ultimately, these adaptive responses reflect an industry navigating complex trade policies while preserving its trajectory of performance-driven innovation.

Diving into In-Depth Segmentation Perspectives Revealing Diverse Ceramic Textile Categories Based on Product Type Fiber Composition and Usage Patterns

The ceramic textile market’s multifaceted growth is best understood by examining its distinct categories, which vary according to manufacturing process, fiber composition, intended function, and end-user demand. From the outset, variations in textile formats-ranging from braided structures offering high mechanical integrity to nonwoven mats engineered for rapid thermal response, and traditional woven constructs balancing durability with flexibility-have shaped material selection across applications. Moreover, fiber chemistries play a pivotal role: alumina fibers maintain exceptional structural stability at extreme temperatures, carbon-based variants deliver superior thermal conductivity, silica compositions ensure optimal acidity resistance, and zirconia fibers confer enhanced fracture toughness.

Building on this, the choice of textile aligns closely with application-specific requirements. In protective armor systems, both personal body armor and vehicle armoring leverage high-strength ceramic matrix composites to maximize energy absorption without excessive weight. Similarly, filtration solutions bifurcate into air and liquid domains, where fine denier braided or woven mats capture particulates at elevated temperatures or corrosive environments. In insulation, acoustic barriers and thermal shields exploit nonwoven or loose-fill ceramic fiber blankets to attenuate sound waves or reflect radiant heat, respectively. Reinforcement applications, spanning ceramic, metal, and polymer matrices, utilize tailored fiber weaves to bolster mechanical performance in structural composites.

Finally, the end-user landscape encompasses key industrial sectors whose distinct demands guide product evolution. In automotive manufacturing, suppliers focus on thermal management and lightweighting for electric and hybrid vehicles, whereas the construction realm-across commercial projects through infrastructure and residential buildings-prioritizes fireproofing and energy efficiency. The industrial segment, including aerospace platforms, oil and gas facilities, and power generation turbines, seeks advanced fiber solutions to extend component life and maintain operational reliability amid increasingly demanding service conditions. Collectively, these segmentation layers reveal the nuanced interplay between material innovation and market requirements driving the ceramic textile industry today.

This comprehensive research report categorizes the Ceramic Textile market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Fiber Type

- Application

- End User

Uncovering Regional Variations in Ceramic Textile Demand and Supply Across the Americas Europe Middle East Africa and Asia-Pacific Zones

Regional demand for ceramic textiles is influenced heavily by the economic maturity, regulatory environment, and industrial focus of each geographic zone. In the Americas, growth is underpinned by strong defense and aerospace sectors in North America, where both public and private investment drives advanced materials adoption. Manufacturers in the United States and Canada benefit from a robust innovation ecosystem and established process industries, although recent tariff measures have catalyzed reshoring initiatives to strengthen domestic supply chains and reduce strategic dependencies.

Across Europe, the Middle East, and Africa, the landscape is characterized by heterogeneous demand drivers. Western European nations lead in developing next-generation filtration and insulation solutions for petrochemical and pharmaceutical applications, supported by stringent environmental regulations. Meanwhile, the Middle East focuses on high-temperature filtration for oil and gas operations, with local fiber conversion facilities emerging to service regionally concentrated refinery hubs. Africa, though nascent, exhibits growing interest in ceramic textiles for infrastructure resilience and energy projects, foreshadowing future expansion as project pipelines mature.

The Asia-Pacific region remains a cornerstone of both production and consumption, led by China, Japan, South Korea, and emerging Southeast Asian economies. Here, vast manufacturing bases and ongoing investments in power generation, automotive electrification, and building modernization sustain robust demand for ceramic textiles. Additionally, domestic players in this region have scaled production capabilities rapidly, leveraging cost advantages to export fiber and converted textiles globally. Nevertheless, policy uncertainties and evolving trade dynamics continue to shape strategic planning for all market participants in the Asia-Pacific, reinforcing the importance of agile supply network design and regulatory monitoring.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Textile market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Highlighting Strategic Moves Innovations Collaborations and Growth Trajectories in Ceramic Textile Manufacturing

The competitive landscape of ceramic textiles features both established conglomerates and specialized materials innovators. Among these, industry pioneers note that strategic partnerships and acquisitions have become central to enhancing technical capabilities and expanding geographic reach. For example, leading oxide fiber producers have integrated vertically with converter firms to offer end-to-end solutions, while non-oxide fiber specialists have deepened collaborations with composite manufacturers to co-develop application-specific weaves.

Research and development activities remain a key differentiator. Market leaders allocate significant resources to pilot lines for next-generation fibers, experimenting with hybrid compositions that blend alumina and zirconia phases or incorporate silicon carbide whiskers for enhanced thermal shock resilience. Concurrently, proprietary surface treatments and sizing chemistries are engineered to optimize fiber-matrix adhesion in demanding composites, granting partners improved mechanical endurance under cyclic loading.

Strategic expansion into high-growth end markets also underpins competitive positioning. Several top-tier players have announced capacity increases in North America and Europe specifically to serve defense and clean energy segments, while others have established joint ventures in Asia to leverage regional cost efficiencies and support rapidly growing electronics and automotive applications. Furthermore, digital customer platforms offering real-time order tracking and technical advisory services are increasingly deployed as value-added differentiators. Collectively, these strategic moves underscore the importance of integrated value chain engagement and continuous innovation for maintaining leadership in the ceramic textile arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Textile market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AGC Inc.

- Compagnie de Saint-Gobain S.A.

- Johns Manville Corporation

- Mersen S.A.

- Morgan Advanced Materials Plc

- NUTEC Incorporated

- Rath AG

- Rauschert Steinbach GmbH

- Resco Products, Inc.

- RHI Magnesita GmbH

- Shin-Etsu Chemical Co., Ltd.

Formulating Strategic and Actionable Recommendations to Empower Industry Stakeholders to Navigate Evolving Ceramic Textile Market Dynamics Successfully

Industry leaders should prioritize investment in advanced manufacturing infrastructures, including continuous fiber drawing systems and automated textile looms, to achieve both scale and consistency. By adopting lean six sigma practices alongside digital quality tools, organizations can reduce production variability and respond rapidly to customer specifications, thereby strengthening market competitiveness.

In parallel, diversifying supply chains across multiple geographies will mitigate risks associated with trade policy fluctuations and raw material shortages. Establishing regional conversion hubs closer to key end users can decrease lead times and transportation costs while enhancing supply chain resilience. Moreover, pursuing partnerships with local engineering and construction firms can accelerate qualification cycles for new textile solutions in emerging markets.

To capitalize on evolving application requirements, companies must deepen engagement with end users through collaborative development programs. Joint research initiatives in areas such as lightweight armor composites or high-efficiency filtration media will generate insights that inform product roadmaps and create differentiated offerings. In addition, proactive regulatory monitoring and advocacy can shape favorable standards for ceramic textiles, particularly in industries where safety and environmental compliance are critical.

Finally, embedding sustainability and circularity considerations into product and process design will unlock competitive advantages. Implementing closed-loop fiber reclamation and exploring renewable ceramic precursors will resonate with environmentally conscious customers and mitigate long-term raw material cost pressures. Taken together, these actions provide a roadmap for stakeholders aiming to lead in the evolving ceramic textile market.

Outlining Rigorous Research Methodology Employed to Aggregate Validate and Synthesize Insights Within the Ceramic Textile Market Study Framework

This study employs a rigorous multi-phase research methodology to ensure that the insights presented reflect both broad market trends and the nuanced dynamics of ceramic textiles. Initially, an extensive secondary research phase aggregated data from peer-reviewed journals, industry white papers, conference proceedings, and patent databases. These sources provided historical context and technological benchmarks while helping to identify leading innovation pathways and regulatory developments.

Building on this foundation, a series of in-depth primary interviews were conducted with senior executives from fiber manufacturers, converter firms, end-user engineers, and procurement specialists. These qualitative discussions offered real-world perspectives on supply chain challenges, material performance expectations, and anticipated market shifts. Insights gleaned from expert feedback were synthesized and validated through follow-up queries, ensuring consistency and accuracy across stakeholder segments.

Quantitative validation was achieved via a structured data triangulation process. Production capacity figures, trade flow statistics, and cost variables were cross-referenced against customs data, financial disclosures, and consultancy reports. This systematic cross-checking allowed for the identification of potential data discrepancies and the refinement of analytical models. The final step involved scenario analysis workshops with technical and commercial teams to test assumptions and stress-test strategic recommendations under varying market conditions. Through these combined approaches, the research delivers robust, actionable, and transparent insights tailored to the ceramic textile ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Textile market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Textile Market, by Product Type

- Ceramic Textile Market, by Fiber Type

- Ceramic Textile Market, by Application

- Ceramic Textile Market, by End User

- Ceramic Textile Market, by Region

- Ceramic Textile Market, by Group

- Ceramic Textile Market, by Country

- United States Ceramic Textile Market

- China Ceramic Textile Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Summarizing Critical Insights Emphasizing Innovation Imperatives and Forward-Looking Strategic Considerations for Ceramic Textile Industry Advancement

As ceramic textiles continue to advance in performance and diversity, their role across high-temperature and high-strength applications will only intensify. The intersection of emerging fiber technologies, digital manufacturing tools, and sustainability imperatives sets a course for materials that are not only superior in function but also aligned with broader environmental goals. Companies that can navigate evolving trade landscapes, integrate vertically to secure critical feedstocks, and collaborate closely with end users will be best positioned to harness these opportunities.

Moreover, regional dynamics underscore the necessity of tailored market approaches. While North America and Europe demand the highest levels of technical performance and compliance, Asia-Pacific offers scale and growth potential that can catalyze innovation economics. Looking ahead, proactive engagement with policy developments, coupled with strategic investment in circularity solutions, will define the competitive playing field. In this context, the ability to anticipate end-user needs and translate them into fiber and textile innovations will remain a key differentiator.

Ultimately, stakeholders across the ceramic textile value chain must adopt an integrated mindset that balances technological excellence with supply chain adaptability and sustainability commitment. By doing so, they will not only thrive in current markets but also shape the future trajectory of advanced textile materials. The insights and recommendations offered herein provide a strategic compass for organizations seeking to unlock performance gains and capture emerging opportunities in this dynamic sector.

Engaging Directly with Ketan Rohom Associate Director Sales Marketing to Unlock Comprehensive Ceramic Textile Market Intelligence and Secure Your Report

To secure unparalleled insights into the evolving ceramic textile market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise and personalized guidance will ensure you access the precise data and strategic analysis required to stay ahead of industry trends. Act now to gain comprehensive visibility into emerging opportunities and competitive landscapes, and equip your organization with the information needed to drive informed decisions. Engage with Ketan to customize your research package, unlock exclusive findings, and empower your team to capitalize on the momentum within the ceramic textile sector.

- How big is the Ceramic Textile Market?

- What is the Ceramic Textile Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?