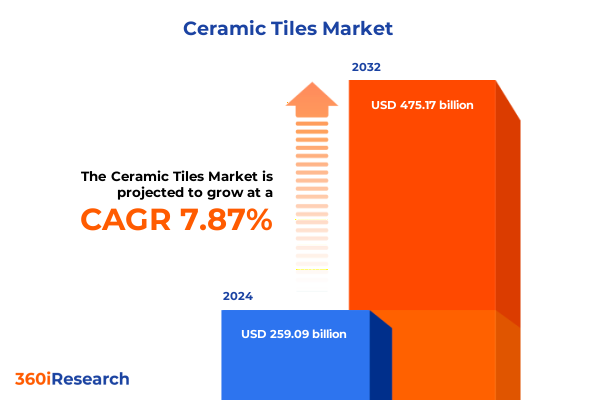

The Ceramic Tiles Market size was estimated at USD 279.15 billion in 2025 and expected to reach USD 300.77 billion in 2026, at a CAGR of 7.89% to reach USD 475.17 billion by 2032.

Unveiling the Strategic Imperatives and Market Dynamics Shaping the Evolution of the Ceramic Tile Industry in a Competitive Global Ecosystem

The executive summary presents a strategic overview of the ceramic tile industry, highlighting critical market dynamics, evolving consumer preferences, and disruptive factors that will influence competitiveness in the coming years. Rapid advancements in manufacturing technologies have elevated traditional ceramic and porcelain offerings, while heightened environmental regulations and sustainability demands have accelerated adoption of eco-friendly materials and energy-efficient processes. As design aesthetics merge with functional performance, market participants are compelled to innovate across product lines and operational models. Moreover, the integration of digital capabilities-from online visualization tools to automated production workflows-has redefined how stakeholders engage with architects, contractors, and end consumers. Against this backdrop, an informed understanding of transformational shifts, policy implications, segmentation nuances, regional variances, and corporate strategies is indispensable for leaders seeking to navigate complexities, mitigate risks, and capture emerging growth corridors.

This summary synthesizes rigorous research findings to equip decision-makers with clarity on strategic imperatives. It underscores the cumulative impact of critical regulatory changes, especially recent trade policy adjustments, and offers granular insights into how distinct material and application segments will evolve. By articulating competitive benchmarks, regional demand trajectories, and forward-looking recommendations, the document provides a cohesive framework for formulating investment strategies, optimizing product portfolios, and reinforcing value propositions in a rapidly changing global landscape.

Identifying Pivotal Technological, Sustainability and Consumer Preference Shifts Disrupting Traditional Ceramic Tile Manufacturing and Distribution Models

The ceramic tile landscape has undergone transformative shifts fueled by the convergence of technological innovation, sustainability imperatives, and evolving purchase behaviors. Digital inkjet printing techniques now enable unparalleled customization, allowing manufacturers to replicate natural stone and wood aesthetics with remarkable precision while reducing material waste through prooferless workflows. Concurrently, the industry has witnessed a surge in demand for low-carbon production methods, prompting investments in renewable energy integration, circular manufacturing processes, and bio-based glazing agents. These eco-conscious drivers have also extended into the distribution side, where digital platforms and virtual showrooms are reshaping the customer journey, delivering immersive design experiences that reduce reliance on expansive physical footprints.

Furthermore, automation and Industry 4.0 applications have streamlined supply chains, improved production flexibility, and enhanced quality assurance through real-time monitoring and predictive maintenance capabilities. As these shifts take hold, traditional business models are being redefined: manufacturers are forging strategic partnerships with technology providers, adopting servitization approaches that bundle installation services, and leveraging data analytics to forecast trends and optimize inventory. Taken together, these transformative forces create both challenges and opportunities, compelling stakeholders to recalibrate strategies across product development, operational excellence, and go-to-market execution in order to thrive in a dynamically evolving marketplace.

Analyzing the Broad-Spectrum Consequences of 2025 US Tariff Implementation on Raw Material Sourcing Production Costs and Competitive Positioning for Ceramic Tile Stakeholders

In early 2025, the United States implemented a series of tariffs targeting imported ceramic tile components and raw materials, designed to bolster domestic production and protect strategic industries. These duties have led to a recalibration of global supply chains as manufacturers re-evaluate sourcing partnerships, substitute materials where feasible, and adjust pricing structures to offset increased input costs. Many producers have accelerated nearshoring initiatives, establishing or expanding facilities in North America to avoid tariff exposure and reduce lead times. This redistribution of capacity has also triggered competitive realignments, with regional players leveraging proximity advantages to secure high-value contracts in both infrastructure and residential renovation segments.

Moreover, the cost pass-through to end users has exerted pressure on project budgets, prompting architects and contractors to explore alternative materials or cost-effective design modifications. In response, savvy manufacturers have introduced value-added services-such as turnkey installation packages and performance warranties-to maintain margin integrity while preserving customer loyalty. Although short-term disruptions have reverberated throughout the value chain, the tariff-driven localization trends are expected to enhance domestic industry resilience, stimulate investment in advanced manufacturing capabilities, and foster closer collaboration between tile producers and end-market stakeholders across the design and construction ecosystem.

Decoding Nuanced Performance Drivers Across Material Types Product Categories Application Verticals Distribution Pathways and Surface Finishes to Reveal Growth Opportunities in Ceramic Tiles

A nuanced understanding of market segments is critical for identifying where strategic investments and tailored offerings will yield the greatest returns. Material types such as ceramic and porcelain continue to dominate in terms of application versatility and cost-effectiveness, while natural stone variants command a premium position in luxury residential and high-end commercial projects. Glass tiles occupy a specialized niche, often employed for design accents and bespoke installations where light reflection and surface finish are paramount. Distinguishing between floor and wall tiles further elucidates divergent product performance criteria: floor tiles must prioritize durability, slip resistance, and load-bearing capacity, whereas wall tiles emphasize thinness, design flexibility, and ease of installation.

In end use applications, residential segments thrive on renovation cycles and emerging lifestyle trends that favor open-concept layouts and integrated indoor-outdoor spaces. Commercial and industrial segments demand robust performance characteristics to withstand high-traffic environments and stringent hygiene requirements. Distribution channels reveal distinct purchase behaviors; offline channels such as branded flagship showrooms and specialty retailers provide tactile experiences that reinforce brand credibility, while online platforms-ranging from manufacturer sites to third-party marketplaces-cater to digitally empowered buyers seeking streamlined ordering processes and rapid fulfillment. Surface finish preferences further segment the market: glazed offerings-including glossy and semi-gloss variants-deliver enhanced stain resistance and aesthetic depth, whereas matte finishes in both smooth and textured forms address design trends that favor subdued, naturalistic surfaces. These layered segmentation insights inform precise go-to-market strategies and product innovation roadmaps.

This comprehensive research report categorizes the Ceramic Tiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Surface Finish

- End Use Application

- Distribution Channel

Mapping Diverse Regional Demand Patterns Supply Chain Complexities and Competitive Landscapes to Illuminate Strategic Imperatives Across the Americas Europe Middle East Africa and Asia Pacific

Regional nuances reveal distinct demand patterns and operational considerations that require bespoke strategic responses. Within the Americas, mature housing markets and robust commercial construction pipelines underpin sustained demand for mid- to high-range ceramic and porcelain tiles, with an increasing emphasis on energy-efficient manufacturing and locally sourced materials. Infrastructure spending and public-sector renovation initiatives further reinforce growth across both restorative and new-build applications. Moving to Europe, Middle East and Africa, market dynamics vary significantly; Western European regions place a strong premium on environmental certifications and waste reduction, while Middle East markets demonstrate an appetite for opulent natural stone aesthetics, often driven by landmark construction projects. African markets, though nascent, are emerging as important frontiers, with urbanization and industrialization accelerating tile adoption in residential and hospitality sectors.

Across Asia-Pacific, production hubs in key countries continue to innovate at scale, driving cost competitiveness globally. Domestic demand is fueled by rapid urban expansion, government-backed infrastructure programs, and rising consumer spending power in emerging economies. Furthermore, technological collaborations between Asian manufacturers and global brands have catalyzed advancements in digital printing, low-emission kilns, and high-performance porcelain composites. These regional insights underscore the importance of aligning product offerings, supply chain footprints, and marketing narratives with localized requirements and regulatory frameworks to maximize market penetration and long-term profitability.

This comprehensive research report examines key regions that drive the evolution of the Ceramic Tiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Competitive Positioning and Innovation Profiles of Leading Global and Regional Ceramic Tile Manufacturers Driving Market Leadership

Leading industry participants are distinguishing themselves through strategic initiatives that encompass product innovation, portfolio diversification, and geographic expansion. A prominent multinational has invested heavily in advanced digital inkjet printing capabilities to offer customizable surface designs while reducing capital expenditure on conventional tile presses. Another fast-growing regional champion has forged partnerships with logistics providers to deliver rapid, door-to-door fulfillment for e-commerce orders, capturing digitally native consumer segments. At the same time, technology-focused entrants are leveraging data analytics and smart manufacturing platforms to optimize yield rates, minimize downtime, and enhance predictive maintenance protocols.

In parallel, several major manufacturers have pursued vertical integration strategies, securing key raw material sources and establishing in-house glazing operations to ensure consistent quality and cost control. Collaborative ventures between tile producers and material science firms have yielded next-generation low-water-consumption processes and bio-based glazes that cater to increasing sustainability mandates. Furthermore, leading companies are refining their value propositions through service-oriented offerings-ranging from design consultation and specification support to post-sales technical training-that strengthen customer relationships and generate recurring revenue streams. These corporate strategies highlight the diverse pathways industry leaders are employing to sustain competitive advantage, navigate supply chain disruptions, and respond to evolving end-market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ceramic Tiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anatolia Tile + Stone

- Antelope Enterprise Holdings Ltd.

- Ceramiche Atlas Concorde S.p.A.

- Cersanit S.A.

- CERÁMICA SALONI, SAU by Victoria PLC

- Fea Ceramic

- Florida Tile Inc.

- Florim S.p.A. SB

- George Home Group Inc.

- Johnson Tiles

- Kajaria Ceramics Limited

- Kohler Co.

- Orient Bell Limited

- Pamesa Ceramica S.A.

- RAK Ceramics India

- SCG Ceramics Co., Ltd.

- Simpolo Ceramics

- Somany Ceramics Limited

- Varmora Granito Pvt. Ltd.

Delivering Targeted Strategic Recommendations to Empower Industry Leaders in Enhancing Competitive Advantage Sustainability and Operational Agility in Ceramic Tiles

To navigate a complex and rapidly evolving marketplace, industry leaders should prioritize investments in sustainable manufacturing technologies that align with tightening environmental regulations and consumer demand for low-carbon products. At the same time, integrating advanced digital printing and automation solutions will enable scalable customization and enhanced production efficiency. It is imperative to cultivate robust, diversified sourcing networks that mitigate tariff exposure and supply chain volatility, while exploring nearshoring opportunities in strategic regions to reduce lead times and logistics costs.

Moreover, expanding omnichannel distribution capabilities-by enhancing experiential showrooms and strengthening direct-to-consumer e-commerce channels-will cater to both traditional buyers and emerging digitally driven segments. Companies should cultivate strategic alliances with material innovators and technology providers to accelerate R&D cycles and introduce groundbreaking surface finishes, such as antimicrobial and self-cleaning tiles, that address evolving safety and hygiene priorities. Additionally, embedding service-based revenue models-including design consultancy, specification assistance, and lifecycle maintenance programs-can fortify customer loyalty and unlock higher-margin streams. By implementing these recommendations with disciplined execution and cross-functional collaboration, organizations will reinforce their market positioning, improve operational resilience, and capitalize on new growth avenues.

Elucidating Rigorous Multi-Stage Research Methodologies Data Validation Techniques and Analytical Frameworks Underpinning a Comprehensive Ceramic Tile Market Study

This research employs a multi-stage methodology that combines extensive secondary analysis with primary data collection to ensure depth and rigor. Initially, publicly available corporate disclosures, trade association reports, and regulatory filings were meticulously reviewed to establish a foundational understanding of industry structure, key technological trends, and policy developments. Following this, in-depth interviews were conducted with senior executives, supply chain managers, and design professionals across leading manufacturing and distribution organizations to capture qualitative insights on strategic priorities and emerging challenges.

Quantitative validation was achieved through structured surveys and data triangulation techniques, cross-referencing multiple sources to confirm consistency and accuracy. The analytical framework incorporates segmentation modeling, scenario analysis, and sensitivity assessments to dissect market dynamics across material, product, application, and distribution dimensions. Geographic insights are derived from macroeconomic indicators, construction activity data, and localized regulatory reviews. To enhance robustness, all findings were subjected to peer review by an advisory panel of industry experts, ensuring that conclusions reflect real-world considerations and strategic relevance. This comprehensive approach delivers a balanced perspective, enabling stakeholders to make informed decisions based on reliable, multi-faceted research outputs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ceramic Tiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ceramic Tiles Market, by Material Type

- Ceramic Tiles Market, by Product Type

- Ceramic Tiles Market, by Surface Finish

- Ceramic Tiles Market, by End Use Application

- Ceramic Tiles Market, by Distribution Channel

- Ceramic Tiles Market, by Region

- Ceramic Tiles Market, by Group

- Ceramic Tiles Market, by Country

- United States Ceramic Tiles Market

- China Ceramic Tiles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Consolidating Key Insights and Strategic Implications to Provide a Cohesive Perspective on the Future Trajectory of the Global Ceramic Tile Industry

In summary, the ceramic tile industry stands at an inflection point where technological innovation, sustainability mandates, and evolving buyer behaviors intersect to redefine competitive landscapes. Digital printing and automation are transforming traditional manufacturing paradigms, while environmental imperatives are driving investments in eco-friendly processes and materials. Regulatory changes, such as the 2025 tariff adjustments, have prompted strategic realignments in sourcing and production footprints, highlighting the importance of supply chain diversification and nearshoring strategies. Through granular segmentation analysis, it becomes evident that tailored approaches across material types, application segments, and distribution channels are essential to address distinct performance and design requirements.

Regional dynamics further underscore the need for localized strategies, as demand drivers, regulatory contexts, and competitive pressures vary significantly between the Americas, Europe, Middle East and Africa, and Asia-Pacific. Leading companies are responding with differentiated innovation initiatives, vertical integration efforts, and service-based offerings that strengthen customer engagement and margin profiles. By implementing the actionable recommendations outlined herein and leveraging robust research methodologies, stakeholders can navigate market complexities with confidence and seize growth opportunities in a rapidly evolving global environment.

Engage Directly with Ketan Rohom to Secure In-Depth Market Intelligence Enhance Sales Strategies and Drive Growth Through Customized Ceramic Tile Industry Research

To access a comprehensive deep dive into the transformative forces, emerging opportunities, and competitive dynamics shaping the ceramic tile industry today, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He brings specialized expertise in customizing market intelligence to align precisely with your strategic goals, whether you are seeking advanced segmentation analysis, in-depth tariff impact modeling, or tailored regional insights. Engaging with Ketan will unlock exclusive access to proprietary research methodologies, proprietary data sets, and actionable recommendations designed to accelerate your market entry or reinforce your leadership position. Connect directly to explore bespoke research packages, obtain priority support for unique analytical requests, and secure immediate delivery of the full market research report that will empower your organization to capitalize on emerging trends without delay

- How big is the Ceramic Tiles Market?

- What is the Ceramic Tiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?