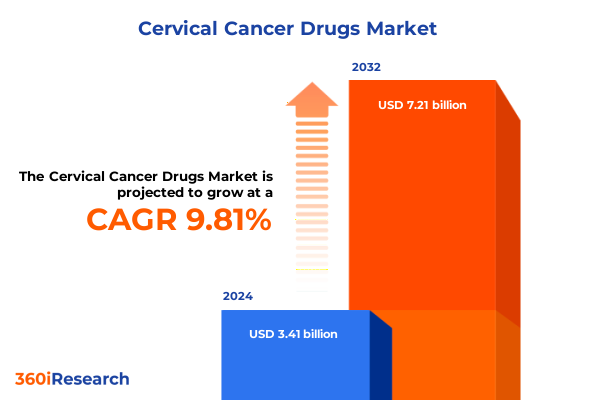

The Cervical Cancer Drugs Market size was estimated at USD 3.71 billion in 2025 and expected to reach USD 4.04 billion in 2026, at a CAGR of 9.96% to reach USD 7.21 billion by 2032.

Understanding the multifaceted landscape of cervical cancer therapeutics and the evolving market forces shaping innovation and patient access

Cervical cancer remains a critical global health challenge, ranking among the leading causes of cancer-related mortality in women worldwide. In recent years, advances in screening and prevention have contributed to early detection and a gradual decline in incidence rates within developed regions. Nevertheless, disparities persist across low- and middle-income areas, where limited access to routine screening, vaccination programs, and modern therapeutics continue to drive disease burden.

Within this complex environment, the therapeutic landscape for cervical cancer has evolved significantly beyond conventional surgery and radiotherapy. Drug-based interventions now encompass a spectrum of modalities, ranging from traditional chemotherapy to next-generation immunotherapies and targeted agents. As a result of these innovations, treatment paradigms are shifting toward more personalized regimens that aim to maximize efficacy while minimizing systemic toxicity.

Against this backdrop, the current executive summary distills the most pivotal shifts in regulatory policies, supply chain dynamics, and competitive strategies shaping this therapeutic segment. It highlights transformative developments from emerging drug classes to evolving market access pathways. Moreover, the document synthesizes segmentation and regional analyses to provide a holistic view of end-user requirements and distribution complexities.

Ultimately, this introduction frames an in-depth exploration of how stakeholders-from pharmaceutical innovators to healthcare providers-can navigate the intersection of clinical need and commercial opportunity in the cervical cancer drug arena.

Revolutionary advances in immunotherapy, targeted modalities, and digital diagnostics reshaping cervical cancer treatment paradigms

The treatment of cervical cancer has experienced a series of transformative shifts driven by scientific breakthroughs and technological integration. Initially anchored in broad-spectrum chemotherapeutic regimens, therapeutic focus has progressively migrated toward immunotherapy and targeted approaches. This evolution reflects a deeper understanding of the tumor microenvironment and molecular drivers, ushering in a new era of precision medicine that aspires to enhance patient outcomes and quality of life.

Immunotherapy has been at the forefront of this transformation, with checkpoint inhibitors demonstrating meaningful clinical benefits in patients with advanced or recurrent disease. In parallel, innovations in CAR-T cell engineering have begun to explore applications beyond hematological malignancies, signaling a potential future expansion into solid tumors, including cervical carcinoma. These modalities complement targeted therapies that leverage vulnerabilities in DNA repair pathways and kinase-driven signaling cascades, thereby broadening the therapeutic arsenal available to oncologists.

Digital health tools and biomarker-driven diagnostics further amplify these advances by enabling real-time monitoring of treatment response and facilitating adaptive trial designs. Meanwhile, collaborative ecosystems that unite academic institutions, biotech startups, and larger pharmaceutical companies have accelerated the translation of early-stage research into clinical development. Consequently, the dynamic interplay between scientific, regulatory, and commercial stakeholders continues to redefine the standard of care.

As a result of these converging forces, the cervical cancer drug landscape is no longer monolithic; rather, it comprises a diverse portfolio of modalities designed to target specific patient subpopulations. This shift underscores the importance of strategic agility for manufacturers and healthcare providers alike, ensuring timely adoption of novel therapies and alignment with evolving clinical guidelines.

Assessing the ripple effects of newly implemented United States import tariffs in 2025 on cervical cancer drug supply chains and pricing dynamics

The introduction of newly enacted United States tariffs in 2025 has introduced significant variables into the cervical cancer drug supply chain, challenging manufacturers and distributors to reassess sourcing strategies. These tariffs, applied broadly to imported pharmaceutical ingredients and certain equipment categories, have amplified cost pressures for active pharmaceutical ingredients and ancillary materials. Consequently, organizations must undertake comprehensive risk assessments to anticipate margin attrition and ensure uninterrupted production.

In addition to direct cost impacts, the tariffs have driven strategic shifts in supplier relationships. Manufacturers are now exploring expanded domestic partnerships and nearshoring alternatives to mitigate exposure to import levies. This realignment not only addresses tariff-driven expenses but also aligns with public policy initiatives aimed at bolstering local biopharmaceutical infrastructure. As a result, supply resilience has emerged as a top priority, particularly for therapies with complex manufacturing requirements, such as cellular immunotherapies and high-potency injectable formulations.

Furthermore, tariff dynamics have influenced pricing strategies and reimbursement negotiations. Payers and healthcare providers are increasingly scrutinizing total cost of therapy, fostering dialogues around value-based contracts and outcome-linked payment models. These mechanisms seek to balance patient access with sustainable pricing structures in a landscape where cost containment remains paramount.

Overall, the cumulative effect of the 2025 tariff measures demands proactive supply chain optimization and enhanced collaboration across stakeholder groups. Manufacturers that strategically diversify sourcing and engage in transparent value discussions are positioned to navigate these headwinds while maintaining the reliability of product availability for patients.

Unveiling nuanced insights across administration routes, therapeutic classes, distribution channels, and end user profiles in cervical cancer care

Analyzing the cervical cancer treatment market through multiple segmentation lenses reveals distinct patterns of product utilization and stakeholder preferences. When examining route of administration, intravenous therapies continue to dominate acute clinical settings, providing controlled dosing for high-potency agents. However, the emergence of oral formulations offers a convenient alternative that supports outpatient care and enhances patient adherence, especially in maintenance settings following initial response.

Further stratification by drug class highlights a rich mosaic of therapeutic approaches. Traditional chemotherapeutic agents remain foundational for many treatment regimens, with non-platinum and platinum-based subclasses offering tailored cytotoxic profiles. Immunotherapeutic innovations such as CAR-T platforms and checkpoint inhibitors introduce a fundamentally different mechanism, harnessing the host immune system to target malignant cells. Within checkpoint inhibitors, advances in both CTLA-4 and PD-1 blockade illustrate the incremental benefits of monotherapy and combination regimens in specific patient cohorts. Targeted therapies exploiting PARP inhibition and tyrosine kinase pathways underscore the translational success of molecular biology, while prophylactic vaccines featuring bivalent, quadrivalent, and nonavalent constructs continue to play an essential role in long-term disease prevention. Parallel efforts in therapeutic vaccines, including peptide and viral vector platforms, aim to extend immunoprophylaxis to established disease settings.

Distribution channel analysis underscores the importance of diverse access points, as hospital pharmacies facilitate inpatient and specialty compounding services, online pharmacies expand geographic reach, and retail outlets support community-based dispensing. End users range from clinics and homecare environments to hospital networks-both private and public-as well as dedicated oncology centers within larger healthcare systems or as standalone facilities. Each channel and user type exhibits unique procurement, storage, and administration requirements, driving nuanced distribution strategies.

By integrating these segmentation insights, stakeholders can align product development, supply chain logistics, and commercial initiatives with the specific needs of each administration route, therapeutic class, and end-user context.

This comprehensive research report categorizes the Cervical Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Route Of Administration

- Drug Class

- Distribution Channel

- End User

Exploring region-specific drivers and access challenges across the Americas, EMEA, and Asia-Pacific that shape cervical cancer therapy adoption

Regional dynamics exert a profound influence on the adoption and accessibility of cervical cancer therapeutics. In the Americas, robust healthcare infrastructure and established reimbursement frameworks support the rapid uptake of advanced immunotherapies and targeted agents. Meanwhile, Latin American countries are expanding vaccination programs and strengthening screening initiatives, which collectively reduce disease burden and shift demand toward maintenance and salvage therapies. Market access in North America, driven by centralized purchasing and value-based care models, contrasts with the variable public-private mix found across Latin America.

In the Europe, Middle East, and Africa region, access to novel therapies is shaped by differential regulatory environments and payer policies. Western European markets often lead in innovative therapy reimbursements, while Eastern European and select Middle Eastern countries prioritize cost-effective solutions due to budget constraints. Africa remains heterogeneous, with pockets of rapid immunization uptake alongside areas of unmet diagnostic capacity. Governments and international health agencies are collaborating to enhance supply chains and reduce logistical barriers, creating incremental opportunities for vaccine distribution and oral therapy adoption.

Asia-Pacific encompasses a wide spectrum of healthcare systems, from highly advanced markets in Japan and Australia to emerging economies in Southeast Asia and India. Japan’s regulatory incentives facilitate early approvals for immunotherapies, whereas country-level variations in procurement processes influence access timelines. China’s evolving oncology guidelines and ambitious domestic innovation programs continue to reshape market entry strategies, prompting global players to forge strategic alliances with local biotechs. In India, government-led vaccination drives and price-sensitive procurement models emphasize cost containment, driving manufacturers to optimize production and supply efficiency.

Understanding these region-specific drivers and challenges enables pharmaceutical and medical device stakeholders to tailor market entry strategies, distribution partnerships, and value propositions in alignment with local healthcare priorities.

This comprehensive research report examines key regions that drive the evolution of the Cervical Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading pharmaceutical innovators and agile biotech partnerships driving breakthroughs in cervical cancer drug development

The competitive landscape of cervical cancer therapeutics features a blend of established pharmaceutical leaders and dynamic biotechnology innovators, each contributing unique strengths to the market. Keytruda, an anti-PD-1 antibody, remains a cornerstone for immunotherapy in advanced disease settings, and its clinical performance underscores the pivotal role of checkpoint blockade in cervical cancer care. Other immuno-oncology frontrunners, including CTLA-4 inhibitors, continue to be evaluated in combination regimens, driving collaborative trials and co-development agreements.

In the targeted therapy domain, PARP inhibitors have garnered attention for their ability to exploit DNA repair deficiencies, while tyrosine kinase inhibitors address angiogenesis and proliferation pathways. Companies specializing in small molecule development and antibody engineering are actively expanding their cervical cancer portfolios through in-licensing deals and strategic acquisitions. These transactions often aim to bolster pipelines with first-in-class candidates or differentiated follow-on compounds with improved safety profiles.

Vaccine developers are equally influential, as prophylactic constructs have demonstrated population-level impacts in reducing HPV-driven cervical cancer incidence. Meanwhile, emerging therapeutic vaccines leverage peptide epitopes and viral vector platforms to induce anti-tumor immune responses in patients with existing disease. Partnerships between academic research centers and private biotechs accelerate these modalities through translational research collaborations and early-stage clinical trials.

Distribution and commercialization strategies have evolved in parallel, with digital health platforms facilitating patient support programs and adherence monitoring. Moreover, real-world evidence initiatives have become integral to post-launch value demonstrations, as payers demand robust data on long-term outcomes. Together, these company-level insights reveal a competitive environment defined by scientific innovation, strategic collaboration, and a relentless focus on patient-centric care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cervical Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bayer AG

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Genmab A/S

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- ImmunoGen, Inc.

- Iovance Biotherapeutics, Inc.

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Regeneron Pharmaceuticals, Inc.

- Roche Holding AG

- Sanofi S.A.

- Seagen Inc.

- Takeda Pharmaceutical Company Limited

Strategic imperatives for optimizing R&D focus, supply chain resilience, and value-based partnerships in cervical cancer drug development

Industry leaders must embrace a multifaceted strategic agenda to capitalize on emerging opportunities in cervical cancer therapeutics. First, prioritizing targeted research investments in next-generation immunotherapies and vaccine platforms will sustain the momentum of clinical innovation. By aligning research priorities with molecular and immunological biomarkers, organizations can accelerate patient stratification efforts and enhance trial efficiency.

Simultaneously, strengthening supply chain resilience is essential to mitigate risks associated with import tariffs and global disruptions. Establishing diversified manufacturing capabilities, including regional API production and specialized fill-finish sites, will reduce dependency on single sources and improve agility in responding to demand fluctuations. Furthermore, adopting advanced analytics for demand forecasting and inventory optimization can drive operational efficiencies and cost savings.

Engaging proactively with payers and regulatory bodies is equally critical. Crafting compelling value dossiers that integrate clinical efficacy data, real-world outcomes, and pharmacoeconomic modeling will facilitate favorable reimbursement decisions. In addition, exploring innovative contracting models, such as risk-sharing arrangements and milestone-based payments, can align stakeholder incentives and expand patient access.

Finally, fostering cross-sector collaborations with digital health providers and patient advocacy groups will enhance adherence support and educational outreach. Leveraging telemedicine platforms and mobile applications to deliver personalized treatment guidance can improve patient engagement and outcomes. Altogether, these recommendations offer a roadmap for industry players seeking to navigate a rapidly evolving therapeutic landscape and drive sustainable growth.

Comprehensive research framework integrating primary interviews, secondary intelligence, and rigorous validation processes for cervical cancer drug market analysis

This study employs a rigorous mixed-methods approach, integrating both qualitative and quantitative research techniques to ensure robust market insights. Primary research consisted of in-depth interviews with clinical oncologists, hospital pharmacy directors, and health economics experts, generating firsthand perspectives on treatment paradigms, patient pathways, and reimbursement dynamics. These interviews were complemented by surveys of key decision-makers in distribution and procurement functions to capture evolving logistical and channel preferences.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory filings, clinical trial registries, and government health databases. High-quality data sources provided validation of therapeutic efficacy, safety profiles, and competitive positioning. In addition, industry publications and conference proceedings were analyzed to identify emerging pipeline candidates and collaborative ventures.

Data triangulation processes ensured consistency across multiple inputs, while thematic analysis techniques uncovered underlying trends in drug innovation and market access. Finally, findings underwent a multi-layer validation process involving cross-functional experts in clinical development, regulatory affairs, and commercial strategy. This iterative review cycle refined key assumptions, identified potential data gaps, and reinforced the credibility of the conclusions drawn.

By combining primary stakeholder engagement with extensive secondary intelligence and stringent validation protocols, this methodology delivers actionable and reliable insights into the cervical cancer therapeutics landscape without relying on unsupported market sizing or forecasting.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cervical Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cervical Cancer Drugs Market, by Route Of Administration

- Cervical Cancer Drugs Market, by Drug Class

- Cervical Cancer Drugs Market, by Distribution Channel

- Cervical Cancer Drugs Market, by End User

- Cervical Cancer Drugs Market, by Region

- Cervical Cancer Drugs Market, by Group

- Cervical Cancer Drugs Market, by Country

- United States Cervical Cancer Drugs Market

- China Cervical Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing critical insights on scientific innovation, market dynamics, and strategic priorities to illuminate the future trajectory of cervical cancer therapeutics

In conclusion, the cervical cancer drug landscape is defined by a convergence of scientific innovation, regulatory evolution, and strategic collaboration. Immunotherapeutic breakthroughs and targeted agents are shifting long-standing treatment paradigms toward more personalized and durable modalities. Concurrently, dynamics such as newly implemented tariffs and region-specific access challenges necessitate adaptive supply chain and pricing strategies.

Segmentation analysis highlights the nuanced interplay between administration routes, therapeutic classes, distribution channels, and end-user requirements. These insights underscore the importance of tailored clinical and commercial approaches to meet the diverse needs of patient cohorts and healthcare systems. Furthermore, regional examinations reveal significant variability in adoption patterns, driven by infrastructure maturity, reimbursement policies, and local manufacturing capabilities.

Key company profiles illustrate a competitive environment marked by strategic alliances, in-licensing deals, and robust pipeline development. At the same time, actionable recommendations emphasize targeted R&D investments, operational resilience, and proactive payer engagement as foundational imperatives. Meanwhile, patient-centric partnerships with digital health and advocacy groups promise to enhance treatment adherence and educational outreach.

Ultimately, stakeholders equipped with these integrated insights will be better positioned to navigate uncertainty, capitalize on emerging opportunities, and advance the future of cervical cancer care. This report serves as a strategic compass, guiding decision-makers through a rapidly evolving therapeutic landscape.

Engaging with Ketan Rohom to secure exclusive access to advanced cervical cancer drug market insights and strategic guidance

To gain comprehensive access to the detailed findings and strategic insights presented in this report, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He is ready to guide you through the nuanced analyses on therapeutic classes, regional dynamics, and regulatory shifts that will influence your strategic planning. By engaging directly with Ketan, you will benefit from personalized support, ensuring that the report’s rich data empowers your organization’s next decisions. Secure your copy today to stay ahead in the rapidly evolving field of cervical cancer drug development and market strategies

- How big is the Cervical Cancer Drugs Market?

- What is the Cervical Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?