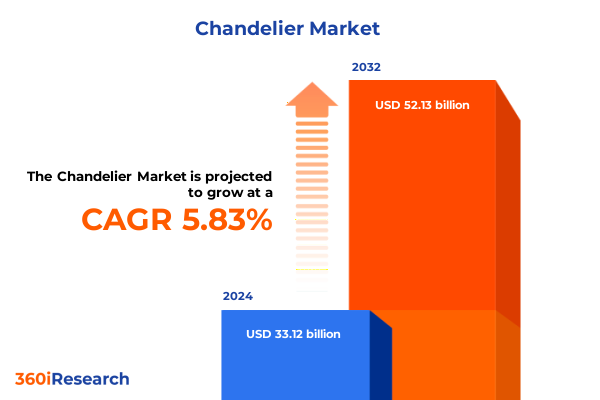

The Chandelier Market size was estimated at USD 34.87 billion in 2025 and expected to reach USD 36.72 billion in 2026, at a CAGR of 5.91% to reach USD 52.13 billion by 2032.

Exploring the Shimmering World of Chandeliers: An Overview of Market Evolution, Key Drivers, Emerging Opportunities and Future Trends

The chandelier lighting landscape has long combined artistry, craftsmanship, and functional utility to illuminate both residential and commercial spaces. From the ornate crystal fixtures of classical estates to minimalist LED-integrated designs in contemporary interiors, these lighting solutions have evolved to reflect shifting aesthetic sensibilities and technological capabilities. This introduction illuminates the underpinnings of the chandelier market by tracing its historical lineage, identifying the fundamental drivers of modern demand, and previewing the strategic insights revealed in the ensuing summary.

In this opening section, we contextualize how consumer preferences have gravitated toward personalized, energy-efficient, and design-forward fixtures over the past decade. We also highlight the pivotal role of digital commerce and direct-to-consumer models in democratizing access to custom and high-end chandeliers alike. Building upon this foundation, the subsequent analysis will delve into transformative industry shifts, tariff-driven supply impacts, granular segmentation intelligence, key regional dynamics, and actionable recommendations. By the conclusion of this executive summary, decision-makers will be equipped with a panoramic view of the chandelier market’s evolution and a roadmap for navigating its complex interplay of design innovation, regulatory adjustments, and consumer expectations.

Identifying Pivotal Shifts Reshaping the Chandelier Landscape Through Technological Innovations, Sustainable Practices, and Changing Consumer Preferences and Design Aesthetics

Industry landscapes evolve through converging forces of technology advancement, sustainability imperatives, and evolving aesthetic tastes, and the chandelier segment is no exception. Over recent years, manufacturers have integrated LED modules into traditional frames, delivering slimmer profiles, color-tunable capabilities, and reduced energy consumption. Simultaneously, growing consumer emphasis on sustainable materials has led to experiments with recycled metals, responsibly sourced crystals, and low–carbon-footprint production techniques.

Moreover, the proliferation of digital design tools and augmented reality applications has transformed the customer journey. Shoppers can now virtually preview fixture styles in situ before purchase, accelerating decision cycles and reducing return rates. In parallel, design studios have embraced modular architectures that enable rapid reconfiguration of arms, shades, and light sources to match evolving tastes. These innovations not only redefine product lifecycles but also unlock recurring revenue through upgradeable components.

Furthermore, social media platforms and curated influencer collaborations have amplified consumer desire for statement lighting. Creative partnerships with interior designers and boutique craftsmen have generated limited-edition collections that bridge art and illumination. As a result, market players that harness these transformative shifts-by blending technology, sustainability, and bespoke design-are positioned to capture both premium and mainstream segments effectively.

Analyzing the Cascading Effects of United States Tariffs on Chandelier Imports and Domestic Supply Chains Amidst Policy Adjustments in the Current Landscape

In the current business environment, the imposition of new United States tariffs on imported lighting components and finished crystal fixtures has reverberated across the chandelier sector. Import duties of up to twenty percent on selected materials have elevated landed costs, compelling retailers and distributors to reassess their sourcing strategies. As a result, several domestic manufacturers have accelerated capacity investments to offset reliance on foreign-sourced crystals and metal arms.

Transitioning to closer-to-market production hubs has had both benefits and tensions. On one hand, reduced transit times and improved supply chain visibility have mitigated the risk of inventory bottlenecks. On the other, the shift has generated cost pressures that are ultimately passed through to end buyers, potentially dampening price-sensitive segments. In response, leading fixture producers have explored value engineering techniques and alternative material blends to preserve quality while containing costs.

Looking ahead, this tariff-driven landscape underscores the importance of supply chain agility. Companies that cultivate diversified supplier ecosystems-combining domestic partners with low-tariff international sources-will be better insulated against policy fluctuations. Moreover, leveraging predictive procurement analytics can help anticipate tariff adjustments and secure favorable contracts, thereby safeguarding margin performance amid an evolving regulatory backdrop.

Unveiling Comprehensive Segmented Insights Across Product Types, End Uses, Distribution Channels, Materials, and Light Sources to Empower Strategic Positioning

When examining the chandelier market through a segmented lens, meaningful opportunities emerge at each intersection of product type, usage context, channel, material composition, and light source. Within the product typology, traditional multi-candle and single-candle configurations coexist alongside ornate crystal offerings-split between Chinese-sourced and European-sourced varieties-and contemporary modern styles that range from LED-integrated fixtures to minimalist aluminum or steel sculptures.

End use considerations reveal divergent expectations across commercial and residential applications. In corporate and hospitality venues, premium crystal and bespoke statement pieces underscore brand identity and guest experience, while retail spaces favor easily reconfigurable modular systems. Residential demand, conversely, centers on personalized living spaces: bedroom lighting that balances ambience with visual comfort, dining room fixtures that serve as focal conversation pieces, and living room chandeliers that offer both elegance and functional illumination.

Channel dynamics further shape go-to-market approaches. Department store and boutique distributors continue to cater to high-touch experiences, whereas brand websites and third-party ecommerce platforms drive reach and enable rapid introduction of new designs. Material innovations-from acrylic and clear or frosted glass to aluminum, iron, and steel alloys-pair with light source selection, whether fluorescent, halogen, incandescent, or LED, to create vast permutations configured to both aesthetic and operational needs. Recognizing how these segment intersections influence purchase behaviors is critical for shaping product portfolios and channel investments.

This comprehensive research report categorizes the Chandelier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Light Source

- End Use

- Distribution Channel

Mapping Regional Growth Narratives Across the Americas, Europe Middle East and Africa, and Asia Pacific to Highlight Divergent Market Trajectories and Opportunities

Regional market dynamics exhibit distinct growth narratives shaped by local design traditions, regulatory frameworks, and consumer spending power. In the Americas, escalating investments in hospitality infrastructure and corporate real estate have driven demand for both modern LED-driven fixtures and transitional crystal designs in urban centers. Simultaneously, the United States’ tariff adjustments have stimulated domestic chandelier manufacturing, supporting local job creation and faster product lead times.

Across Europe, the Middle East, and Africa, legacy crystal craftsmanship in European markets and opulent chandelier traditions in the Gulf Cooperation Council region continue to sustain demand for handcrafted glass and metal assemblages. Stringent energy-efficiency regulations in the European Union are accelerating the retrofit of fluorescent and halogen systems with LED conversions, resulting in renewed interest in transitional designs that marry heritage forms with modern lighting technology.

In the Asia-Pacific region, rapid urbanization in China, India, and Southeast Asia has spurred growth in both residential and commercial real estate sectors. Domestic producers are integrating traditional motifs with LED innovations to cater to growing middle-class consumers seeking aspirational yet energy-efficient lighting solutions. Cross-border trade agreements within regional economic blocs have also facilitated the flow of raw materials, enabling faster time-to-market for dynamic fixture designs.

This comprehensive research report examines key regions that drive the evolution of the Chandelier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Design Excellence, Strategic Collaborations, and Sustainability Initiatives within the Global Chandelier Ecosystem

The global chandelier ecosystem is anchored by an array of companies distinguished by design heritage, technical innovation, and strategic partnerships. Luxury crystal specialists continue to lead with artisanal mastery, launching limited-edition collections in collaboration with high-fashion houses and architectural firms. At the same time, modern lighting innovators have staked their positions by patenting LED integration techniques and developing smart connectivity features, enabling fixtures to interface seamlessly with building automation and IoT platforms.

Several mid-tier manufacturers have capitalized on value-added services-such as custom finishes, rapid prototyping, and virtual design consultations-to differentiate their offerings and foster customer loyalty. These players often partner with regional distributors and interior design networks to extend market reach in both mature and emerging geographies. Additionally, technology-driven startups are experimenting with modular, upgradable architectures that support subscription-style revenue models, anticipating recurring upgrade cycles as core product components evolve.

In parallel, material suppliers and contract fabricators are forging closer alliances with fixture designers, ensuring that new alloy compositions, recycled glass blends, and advanced coatings are integrated from concept through production. These collaborative ecosystems are pivotal in accelerating time-to-market for innovative chandelier designs, while also reinforcing sustainable practices across the value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chandelier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- ams-OSRAM AG

- Artemide S.p.A.

- Eaton Corporation plc

- Fagerhult Group AB

- FLOS SpA

- Hubbell Incorporated

- Legrand SA

- NVC Lighting Co., Ltd.

- Signify NV

- Zumtobel Group

- Zumtobel Group AG

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Navigate Tariff Challenges, and Foster Continued Innovation

To navigate the dynamic chandelier market, industry leaders must adopt a multifaceted strategy that spans product development, supply chain optimization, and customer engagement. Prioritizing LED and smart lighting integrations will not only satisfy energy-efficiency mandates but also enable differentiated user experiences through tunable light spectrums and remote control functionalities. In addition, exploring hybrid models that blend traditional materials with contemporary technologies can offer a compelling bridge between heritage and modernity.

Supply chain resilience is equally vital. By cultivating a diversified network of domestic and low-tariff international suppliers, organizations can mitigate policy risks and maintain stable lead times. Implementing predictive analytics for procurement planning will further ensure visibility into tariff adjustments and raw material price fluctuations, enabling proactive cost management.

On the market-facing side, strengthening digital channels through immersive online showrooms, interactive configurators, and personalized design consultations will foster deeper customer connections and accelerate conversion rates. Furthermore, forming strategic alliances with interior designers, contractors, and architectural firms will expand influence within specification-driven commercial and residential projects. Together, these actions will position companies to capture emerging opportunities, sustain profitability, and drive long-term growth.

Outlining Rigorous Research Methodology Combining Primary Expert Interviews, Secondary Data Analysis, and Expert Validation for Comprehensive Market Understanding and Reliability

This research is grounded in a rigorous methodology that blends primary and secondary data to ensure depth, accuracy, and reliability. Primary insights were collected through structured interviews and roundtable discussions with chandelier designers, lighting distributors, facility managers, and procurement directors. These conversations yielded firsthand perspectives on design priorities, sourcing challenges, and adoption barriers across global markets.

Secondary research involved comprehensive review of industry publications, regulatory filings, trade association reports, and academic journals relevant to lighting technology and interior design trends. Market participants’ annual reports and sustainability disclosures were analyzed to map competitive landscapes, strategic investments, and green manufacturing commitments.

Data triangulation techniques were employed to reconcile findings from diverse sources, while a dedicated expert panel conducted iterative validation sessions. This multi-layered approach-combining quantitative data analysis with qualitative expert review-ensures that the insights and recommendations presented are both robust and actionable for stakeholders seeking a nuanced understanding of the chandelier market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chandelier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chandelier Market, by Product Type

- Chandelier Market, by Material

- Chandelier Market, by Light Source

- Chandelier Market, by End Use

- Chandelier Market, by Distribution Channel

- Chandelier Market, by Region

- Chandelier Market, by Group

- Chandelier Market, by Country

- United States Chandelier Market

- China Chandelier Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Insights Emphasizing Future Prospects, Industry Resilience, and the Imperative for Adaptation within the Evolving Chandelier Market Landscape

In synthesizing the evolving dynamics of the chandelier market, several core themes emerge: the imperative for sustainable and energy-efficient design, the strategic management of tariff-induced cost pressures, the importance of granular segmentation insights for tailored product offerings, and the necessity of region-specific approaches to capitalize on varied growth narratives. By embracing modular innovation and smart lighting integrations, industry participants can meet regulatory requirements while delighting end users with customizable experiences.

Moreover, fostering resilient supply chains through diversified sourcing and predictive procurement will strengthen organizational agility against policy shifts. Enhanced digital engagement and strategic alliances with design professionals will further unlock new revenue streams and drive brand differentiation. These combined factors underscore the resilience and adaptability of the chandelier sector, which continues to reinvent itself at the intersection of art, technology, and sustainability.

As the market advances, organizations that internalize these insights-leveraging both quantitative rigor and qualitative expertise-will be best positioned to pioneer the next generation of chandelier designs and sustain competitive advantage in an increasingly complex global landscape.

Connect with Ketan Rohom to Secure This In-Depth Chandelier Market Research Report and Drive Informed Strategic Decisions Today across Business Functions

For an in-depth exploration of chandelier market dynamics and to gain actionable intelligence tailored to your strategic objectives, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Whether your organization seeks to refine product development roadmaps, optimize supply chain networks, or unlock lucrative regional growth pockets, this comprehensive research report will provide you with the detailed insights and expert analysis necessary to make confident decisions. Engaging with Ketan will also grant you access to customized consulting opportunities, ensuring that the findings align directly with your unique business challenges and growth ambitions. Don’t miss the opportunity to transform your market approach and secure a competitive edge-connect with Ketan Rohom today to discuss report options and embark on a data-driven journey toward success across business functions

- How big is the Chandelier Market?

- What is the Chandelier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?