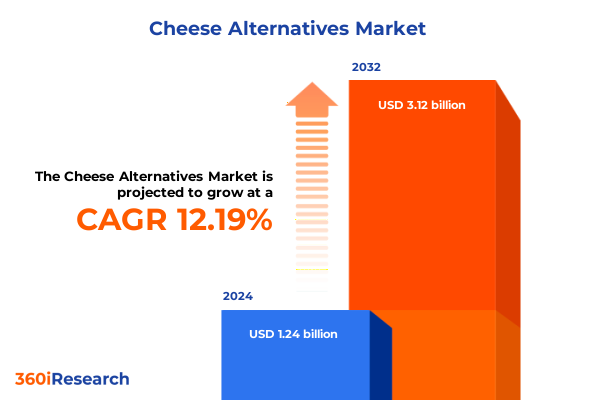

The Cheese Alternatives Market size was estimated at USD 1.37 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 12.43% to reach USD 3.12 billion by 2032.

Unveiling the Rapid Ascent of Cheese Alternatives and Their Role in Revolutionizing Dietary Trends and Industrial Applications Worldwide

The cheese alternatives category has transcended its origins as a niche segment to become a formidable force reshaping consumer diets and industrial formulations. Founded on the confluence of health-conscious eating patterns, increasing concerns around animal welfare, and a powerful sustainability narrative, this domain has witnessed sustained interest from diverse demographic cohorts. Today’s consumers seek products that not only align with personal values but also deliver sensory experiences indistinguishable from traditional dairy. Consequently, manufacturers have intensified their focus on the intersection of culinary authenticity and nutritional fortification, driving innovation at every stage-from sourcing of raw materials and refinement of texturizing agents to advanced fermentation techniques that enhance flavor complexity.

Against this backdrop, this executive summary offers a distilled yet comprehensive overview of the forces propelling the cheese alternatives market forward. It highlights pivotal technological advancements, the ramifications of the United States’ 2025 tariff regime, insights gleaned from critical market segmentation, regional variations in adoption patterns, and the strategic postures of leading industry participants. Moreover, the narrative culminates in a suite of actionable recommendations aimed at equipping decision-makers with the foresight needed to navigate this dynamic environment. By integrating these perspectives, stakeholders will emerge better prepared to harness emerging opportunities, mitigate risks, and sustain competitive momentum.

Highlighting the Major Shifts Driving the Evolution of Cheese Alternatives in Production Technology and Consumer Behavior Dynamics

The cheese alternatives landscape has undergone transformative shifts driven by breakthroughs in production methodologies and evolving consumer expectations. In recent years, precision fermentation has emerged as a game-changing technology. By leveraging genetically optimized microbial strains to produce casein analogs, manufacturers can recreate the meltability, stretch, and mouthfeel traditionally achieved through dairy rennet. This biotechnological leap has enabled the release of new product formats that closely mimic everything from melty pizza slices to creamy ricotta fills.

Simultaneously, ingredient innovation has accelerated diversification beyond soy and coconut bases, incorporating lesser-explored sources such as oats, peas, and cultured microbial extracts. These developments have fostered unprecedented textural and nutritional profiles, prompting a redefinition of quality benchmarks. Moreover, the integration of artificial intelligence and predictive analytics in supply chain management has augmented traceability and demand forecasting, ensuring that producers can respond swiftly to local consumer preferences while minimizing wastage. Consequently, industry stakeholders now operate within a highly fluid environment where rapid prototyping, consumer co-creation, and digital engagement coalesce to chart the future of cheese alternatives.

Examining the Far-Reaching Consequences of United States’ 2025 Tariff Implementation on Imports and Supply Chains for Cheese Alternatives

In 2025, the United States implemented a revised tariff structure on imported dairy substitutes, altering the competitive calculus for global and domestic suppliers of cheese alternatives. The levy, which imposes a graduated duty on almond, cashew, coconut, soy, and oat-based cheeses, has raised landed costs for importers and heightened price volatility. As a direct consequence, manufacturers relying heavily on imported plant-derived ingredients have experienced margin compression, prompting urgent exploration of alternative sourcing strategies. This shift has catalyzed domestic investment in local cultivation of nuts and legumes and stimulated partnerships with regional fermentation companies that can mitigate exposure to fluctuating trade barriers.

Additionally, the reciprocal trade measures enacted by key export markets have reverberated across the global supply chain, compelling stakeholders to reassess distribution architectures. Importers are negotiating longer-term contracts to hedge against future tariff escalations, while producers are localizing production closer to demand centers to avoid cross-border duties. These adaptations have enhanced resilience but also introduced complexity in logistics, requiring advanced trade compliance protocols and dynamic pricing models to maintain competitiveness. Consequently, the 2025 tariff adjustments serve not only as a cost driver but also as an impetus for strategic realignment throughout the cheese alternatives ecosystem.

Revealing Critical Segmentation Insights That Illuminate How Product Type, Source, Application, and Distribution Channels Shape Market Opportunities

Segmentation by product type has illuminated distinct growth trajectories for blocks, shreds, slices, and spreads, each serving specific culinary and manufacturing use cases. Blocks and shreds remain the backbone for at-home cooking and artisan production, whereas slices and spreads cater to convenience-driven consumption and foodservice applications. Recognizing these differences enables stakeholders to calibrate texture, meltability, and flavor intensity in accordance with end-user requirements.

When considering source, the market bifurcates into microbial or biotech-based and plant-based offerings. Microbial platforms pride themselves on near-identical casein and whey analogs, appealing to purist sensibilities. Conversely, the plant-based category has diversified into almond, cashew, coconut, oats, pea, rice, and soy, each imparting unique fat, protein, and flavor profiles. This array allows producers to formulate blends that optimize nutritional attributes and taste profiles while addressing allergen concerns.

Application segmentation further refines this landscape by delineating uses across food processing, foodservice, and household channels. Within food processing, cheese alternatives have penetrated bakery products, ready meals, sauces & dressings, and snacks, reflecting the multifunctional nature of these ingredients. Finally, distribution channel segmentation underscores the importance of both offline and online retail: brick-and-mortar outlets maintain their role in premium experiential shopping, while e-commerce platforms facilitate rapid product discovery and direct consumer engagement. Together, these four lenses provide a holistic framework to identify unmet needs and target value propositions.

This comprehensive research report categorizes the Cheese Alternatives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Product Type

- Application

- Distribution Channel

Insights into Regional Nuances Demonstrating How the Americas, EMEA, and Asia-Pacific Markets Diverge in Preferences and Growth Catalysts for Cheese Alternatives

In the Americas, the United States and Canada lead consumer adoption, driven by well-established vegan communities and robust retail penetration. Latin America is emerging as a dynamic frontier, bolstered by increasing consumer awareness of plant-based nutrition and supportive government initiatives to promote sustainable agriculture. North American producers have leveraged established distribution networks and concentrated R&D investments to introduce high-fidelity cheese alternatives that resonate with mainstream palates.

Europe, Middle East & Africa (EMEA) presents a heterogeneous landscape shaped by stringent regulatory frameworks and progressive sustainability mandates. Western Europe has witnessed rapid mainstreaming of plant-based dairy substitutes, fueled by environmental policies and consumer activism. In contrast, Eastern European markets are characterized by a more gradual uptake, where traditional dairy culture remains prevalent. Meanwhile, the Middle East and Africa are nascent yet promising arenas, with increasing import volume and nascent local production projects aimed at reducing reliance on costly imports.

Asia-Pacific exhibits a spectrum of maturity levels, from sophisticated markets in Japan, South Korea, and Australia to burgeoning sectors in Southeast Asia and India. Here, local flavor preferences and innovative ingredient sourcing-such as rice, chickpea, and mung bean-have shaped unique product portfolios. Additionally, the region’s e-commerce infrastructure has accelerated access to niche and premium offerings, making Asia-Pacific a vital arena for both global and regional players seeking to expand their footprint.

This comprehensive research report examines key regions that drive the evolution of the Cheese Alternatives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Industry Participants and Their Strategic Initiatives Shaping the Competitive Landscape of the Cheese Alternatives Sector

A cadre of forward-looking companies now dominates the competitive arena, each differentiating through specialized competencies and strategic alliances. Leading the charge, custom fermentation firms have secured partnerships with multinational food processors to supply bespoke casein analogs. Meanwhile, established plant-based brands have diversified their portfolios by incorporating novel sources such as pea and oat proteins, extending their reach into foodservice and ready-to-eat segments. In parallel, emerging start-ups have capitalized on agile product development cycles to launch regionally tailored offerings that reflect local taste profiles and dietary customs.

Strategic collaborations between ingredient suppliers, co-manufacturers, and retailers have further accelerated market penetration. Joint ventures focusing on capacity expansion and distribution synergies have enabled rapid scaling while maintaining cost efficiency. Moreover, some enterprises have adopted direct-to-consumer models through proprietary e-commerce platforms, bypassing traditional retail constraints and fostering stronger brand-consumer relationships. Collectively, these strategic maneuvers underscore a competitive landscape characterized by dynamic alliances, ongoing innovation, and a relentless pursuit of product excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cheese Alternatives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blue Diamond Growers Inc.

- Bute Island Foods Ltd.

- Califia Farms, LLC

- Dai Juba Group Co., Ltd.

- Daiya Foods Inc.

- Danone S.A.

- Follow Your Heart LLC

- Good Planet Foods

- Kite Hill Foods, Inc.

- Miyoko’s Creamery

- Noumi Limited

- Parmela Creamery

- SunOpta Inc.

- The Hain Celestial Group Inc.

- Tnuva Food Industries Ltd.

- Tofutti Brands Inc.

- Treeline Cheese

- Violife Foods

- Vitasoy International Holdings Limited

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Navigate Trade Barriers, and Foster Innovation in Cheese Alternative Products

To capitalize on emerging trends in the cheese alternatives landscape, industry leaders should prioritize investment in precision fermentation research and strategic partnerships with biotech innovators. By doing so, they can secure preferential access to cutting-edge enzymatic and microbial solutions that yield superior sensory performance. Additionally, companies must fortify supply chains against tariff volatility through diversified sourcing strategies and near-shoring of critical ingredient processing facilities.

Beyond operational resilience, fostering brand trust through transparent supply chain narratives and third-party sustainability certifications will resonate with environmentally conscious consumer segments. Leaders should also explore co-marketing and co-development programs with foodservice providers, leveraging the culinary expertise of chefs to drive trial and adoption. Furthermore, digital engagement-such as interactive cooking tutorials and personalized nutrition platforms-can amplify consumer education and foster advocacy. Ultimately, a balanced approach that integrates technological innovation, strategic alliances, and consumer-centric storytelling will position companies to capture value as the cheese alternatives sector continues its expansion.

Outlining the Comprehensive Research Methodology Underpinning the Market Analysis, Ensuring Rigorous Data Collection, Validation, and Analytical Integrity

The research underpinning this analysis employed a multi-tiered methodology to ensure rigor and reliability. It commenced with an extensive secondary data aggregation phase, drawing on peer-reviewed journals, trade publications, and industry white papers to map the technological and regulatory landscape. This was complemented by a structured primary research effort, which included in-depth interviews with C-level executives, R&D heads, procurement managers, and culinary experts across key geographies to validate emerging trends and strategic priorities.

To augment qualitative insights, a carefully designed survey instrument gathered quantitative input from a broad cross-section of manufacturers, distributors, and end-users. The resultant dataset was subjected to data triangulation protocols, reconciling discrepancies between disparate sources and reinforcing the credibility of findings. Throughout the process, stringent quality controls-such as peer review, corroborative fact-checking, and iterative expert validation-ensured analytical integrity. Ultimately, this blended approach delivered a nuanced portrayal of the cheese alternatives market, balancing macro-level industry dynamics with ground-level operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cheese Alternatives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cheese Alternatives Market, by Form

- Cheese Alternatives Market, by Source

- Cheese Alternatives Market, by Product Type

- Cheese Alternatives Market, by Application

- Cheese Alternatives Market, by Distribution Channel

- Cheese Alternatives Market, by Region

- Cheese Alternatives Market, by Group

- Cheese Alternatives Market, by Country

- United States Cheese Alternatives Market

- China Cheese Alternatives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Key Findings and Implications to Reinforce Strategic Decision-Making in the Expanding Cheese Alternatives Ecosystem

This executive summary encapsulates the pivotal developments defining the cheese alternatives market: the ascendancy of advanced fermentation and ingredient innovation, the strategic responses to the United States’ 2025 tariff adjustments, and the nuanced dynamics revealed by multi-dimensional segmentation and regional analyses. Leading companies are forging alliances and establishing agile production models to navigate cost pressures and shifting consumer tastes, while emerging players harness rapid prototyping to capture underserved niches.

Looking ahead, stakeholders equipped with these insights are better positioned to make informed decisions regarding technology investments, portfolio expansions, and market entry strategies. By synthesizing segmentation intelligence with regional demand patterns, industry participants can tailor their offerings to resonate with distinct consumer cohorts. Moreover, the actionable recommendations outlined herein provide a practical blueprint for strengthening resilience, amplifying innovation, and sustaining growth. As the cheese alternatives ecosystem continues to evolve, the ability to translate data-driven analysis into strategic action will determine long-term viability and competitive advantage.

Engaging with Ketan Rohom to Secure In-Depth Market Intelligence and Unlock Competitive Advantage through a Detailed Report Acquisition

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive analysis can empower your organization with actionable intelligence and strategic foresight in the cheese alternatives domain. Engaging with Ketan will provide you direct access to an in-depth market research report that delves into the most critical trends, competitive dynamics, and regulatory developments shaping this rapidly evolving sector. By securing this report, you will gain the clarity needed to optimize product portfolios, refine go-to-market initiatives, and anticipate emerging opportunities before they materialize.

Schedule a discussion with Ketan at your earliest convenience to discuss tailored licensing options, enterprise-wide deployment models, and complementary advisory services designed to accelerate your time to insight. With his expertise in facilitating data-driven decision making, Ketan will guide you through the report’s findings, highlight strategic imperatives, and outline next steps to integrate these insights into your organizational roadmap. Reach out now to ensure your business is positioned to lead the charge in innovation and growth within the cheese alternatives landscape.

- How big is the Cheese Alternatives Market?

- What is the Cheese Alternatives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?