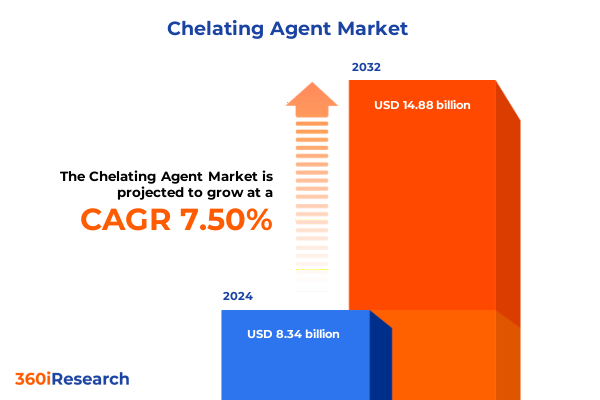

The Chelating Agent Market size was estimated at USD 8.89 billion in 2025 and expected to reach USD 9.49 billion in 2026, at a CAGR of 7.63% to reach USD 14.88 billion by 2032.

An early look at why chelating agents are transforming key industries through advanced chemical interactions that enhance performance and sustainability

Chelating agents have emerged as indispensable components across diverse industrial and consumer applications, driving enhancements in metal ion control, nutrient availability, and product stability. Their molecular structures enable them to form stable complexes with metal ions, thereby preventing undesirable precipitation and oxidation reactions that can compromise quality and performance. As a result, chelating agents underpin critical processes ranging from water treatment and agricultural nutrient management to personal care formulations and pharmaceutical manufacturing. Moreover, the heightened focus on sustainability and eco-efficient chemistry has elevated the importance of chelating agents in enabling lower energy consumption and reduced waste generation.

Navigating the transformative shifts reshaping the chelating agent landscape as regulatory, technological, and sustainability forces drive new market paradigms

The chelating agents landscape has undergone a profound transformation driven by stringent regulatory frameworks, evolving consumer preferences, and rapid technological innovation. Environmental mandates targeting metal discharge and wastewater quality have compelled manufacturers to adopt chelating solutions that deliver robust performance at lower dosages. Concurrently, end users are demanding more biodegradable and bio-based options, spurring research into naturally derived chelants and next-generation formulations. Digitization and process automation in industrial settings further amplify the need for consistent, high-purity chelating agents that seamlessly integrate into advanced control systems. As a result, market players are realigning their portfolios, forging cross-sector partnerships, and accelerating investment in novel chemistries to remain at the forefront of this dynamic environment.

Assessing the cumulative effects of 2025 United States tariffs on supply chain resilience, domestic production expansion, and cost optimization strategies

The introduction of new tariffs in the United States during 2025 has generated both challenges and opportunities for chelating agent suppliers and consumers. Increased import duties on key raw materials, including certain acetic acid derivatives and specialty amines, have escalated input costs for top-tier manufacturers. In response, several producers have accelerated localization efforts, establishing or expanding domestic production facilities to mitigate exposure to tariff-related price volatility. Meanwhile, downstream users in water treatment and agriculture have begun seeking alternative supply agreements and long-term contracts to secure more predictable cost structures.

Despite these initial headwinds, the tariffs have also catalyzed innovation within the value chain. Suppliers are investing in process intensification and greener synthesis routes to offset cost pressures while maintaining performance standards. At the same time, the reshaping of global trade flows has opened avenues for regional suppliers to strengthen their foothold in the U.S. market. Ultimately, the net effect of the 2025 tariff landscape is forging a more resilient supply base, fostering closer collaboration between domestic producers and end users, and accelerating the adoption of cost-effective, high-performance chelating agents.

Exploring how each chelating agent type, application, and end use creates unique market demand profiles refined by form and distribution channels

A nuanced understanding of market segmentation reveals the diverse drivers shaping chelating agent demand across multiple dimensions. Based on type, the industry includes Diethylene Triamine Pentaacetic Acid, Ethylene Diamine Tetraacetic Acid, Glutamic Acid Diacetic Acid, and Methyl Glycine Diacetic Acid, each offering specific affinities and stability profiles suited to distinct end uses. Shifting to applications, these chemistries are integral in agricultural and horticultural nutrient formulations, household and industrial detergents and cleaners, food and beverage preservation, personal care and cosmetic stabilization, pharmaceutical intermediate synthesis, and municipal and industrial water treatment processes. Examining the market through an end use industry lens underscores the significance of agriculture, chemical manufacturing, food and beverage, personal care, and pharmaceuticals as the primary engines of volume growth. In addition, the physical form segment encompasses granules, liquid preparations, and powder blends, enabling precise dosing and handling characteristics across applications. Last, the distribution channel framework spans offline avenues-comprising direct sales and distributor networks-and online routes through e-commerce, which includes both manufacturer websites and third-party platforms seeking to improve reach and convenience for diverse customer types.

This comprehensive research report categorizes the Chelating Agent market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End Use Industry

- Distribution Channel

Revealing regional contrasts that shape chelating agent demand from high-purity specialty needs to broad-spectrum agricultural and industrial applications

Geographic nuances significantly influence chelating agent consumption patterns and strategic priorities. In the Americas, mature markets in North America are driving demand for high-purity specialty chelants used in pharmaceutical and advanced water treatment applications, while Latin American agricultural expansion is elevating interest in nutrient-chelation technologies to maximize crop yields under varied soil conditions. Across Europe, Middle East and Africa, stringent environmental regulations and wastewater standards are fueling the adoption of biodegradable chelating solutions, particularly in industrial cleaning and municipal water treatment sectors. Meanwhile, emerging economies in the Middle East and Africa are prioritizing lower-cost, multipurpose chelants to support expanding chemical and agricultural operations. In the Asia-Pacific region, rapid industrialization and urbanization are creating robust markets for chelating agents in pulp and paper, textiles, and electronics manufacturing, with China, India, and Southeast Asian nations at the forefront of capacity expansion.

This comprehensive research report examines key regions that drive the evolution of the Chelating Agent market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Understanding how established global manufacturers and regional specialists are jockeying for position through innovation, partnerships, and consolidation strategies

Competitive dynamics in the chelating agent market are characterized by both established multinational chemical manufacturers and agile regional producers. Leading global players leverage extensive R&D capabilities to develop tailored solutions addressing specific end use challenges, while also optimizing production efficiency through integrated supply chains. At the same time, regional specialists capitalize on local raw material availability and intimate market knowledge to offer cost-competitive alternatives. Strategic collaborations between chemical producers and technology startups are advancing next-generation bio-based and sustainable chelants, often supported by government incentives for green chemistry. Furthermore, M&A activity remains robust as larger entities seek to expand their geographic reach and product portfolios, and smaller innovators aim to access broader distribution networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chelating Agent market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Clariant AG

- Dow Inc.

- Evonik Industries AG

- Huntsman International LLC

- Kemira Oyj

- Lanxess AG

- Merck KGaA

- Mitsubishi Chemical Group Corporation

- Nouryon Chemicals B.V.

- Solvay S.A.

Actionable strategic imperatives for securing supply resilience and driving sustainable innovation in the dynamic chelating agents sector

Industry leaders aiming to capitalize on the evolving chelating agents landscape should prioritize an integrated approach that balances innovation, sustainability, and market agility. Investment in advanced R&D platforms will be critical for developing next-generation biodegradable and bio-based chelants that can meet tightening regulatory and consumer demands. Simultaneously, strengthening supply chain resilience through strategic partnerships and dual-sourcing initiatives will mitigate tariff-induced volatility and raw material disruptions. In tandem, companies should deepen collaborations with key end users in agriculture and water treatment to co-create application-specific solutions that enhance performance and reduce overall system costs. Finally, optimizing digital and e-commerce channels will unlock new customer segments and improve responsiveness to shifting procurement behaviors in both industrial and consumer markets.

Applying a multi-stage research framework combining technical literature, expert interviews, and market data for comprehensive chelating agent insights

This analysis is underpinned by a rigorous multi-stage research methodology integrating primary and secondary data collection, expert interviews, and rigorous validation processes. Initially, a comprehensive review of technical literature, patent filings, and regulatory documents established a foundation of current chelating chemistry trends and legislative frameworks. Subsequent primary research encompassed structured interviews with industry executives, R&D specialists, and procurement leaders across multiple end use sectors to capture nuanced perspectives on emerging requirements and market challenges. In parallel, a global network of secondary data sources-including trade journals, scientific publications, and international trade databases-was leveraged to track production, distribution, and consumption patterns. Finally, all insights underwent triangulation through cross-referencing and peer reviews to ensure accuracy, relevance, and actionable clarity for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chelating Agent market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chelating Agent Market, by Type

- Chelating Agent Market, by Form

- Chelating Agent Market, by Application

- Chelating Agent Market, by End Use Industry

- Chelating Agent Market, by Distribution Channel

- Chelating Agent Market, by Region

- Chelating Agent Market, by Group

- Chelating Agent Market, by Country

- United States Chelating Agent Market

- China Chelating Agent Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of sector evolution and strategic imperatives required to capitalize on emerging chelating agent opportunities

The chelating agents sector stands at a pivotal juncture, shaped by evolving sustainability mandates, shifting trade environments, and rapidly advancing chemistries. As industries from agriculture to high-tech manufacturing seek more efficient and environmentally responsible solutions, the ability to innovate and adapt will define market leadership. The cumulative impact of U.S. tariffs has highlighted the importance of supply chain resilience, catalyzing greater localization and cost optimization efforts. At the same time, segmentation insights underscore the complexity of meeting diverse performance requirements across types, applications, and regional contexts. By aligning strategic investments with emerging demand patterns and regulatory trajectories, organizations can position themselves to harness the full potential of chelation technologies, ensuring operational excellence and lasting competitive advantage.

Discover how expert guidance from Ketan Rohom can unlock strategic advantages and accelerate your growth in the chelating agents sector

If you are seeking to gain a competitive edge in the rapidly evolving chelating agents market, our comprehensive report provides the clarity and strategic insights you need to navigate complex industry dynamics. Reach out to Ketan Rohom to discuss how this analysis can inform your product development roadmaps, distribution strategies, and partnership opportunities.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke research packages tailored to your unique business challenges and to secure your copy of the full report. Act now to position your organization for sustainable growth and innovation in a market poised for transformation.

- How big is the Chelating Agent Market?

- What is the Chelating Agent Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?