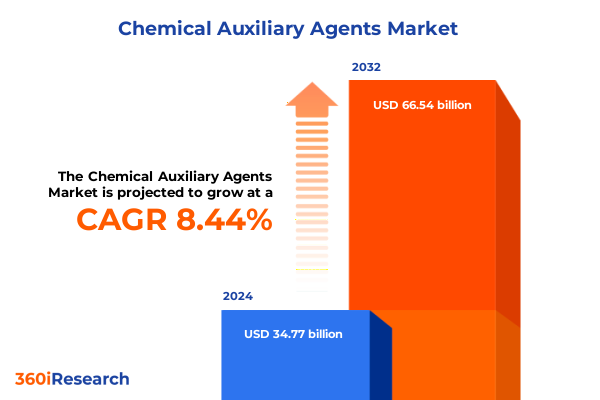

The Chemical Auxiliary Agents Market size was estimated at USD 37.69 billion in 2025 and expected to reach USD 40.34 billion in 2026, at a CAGR of 8.45% to reach USD 66.54 billion by 2032.

Laying the Foundation for Strategic Clarity Around Environmental, Regulatory, and Innovation Drivers Transforming Chemical Auxiliary Agents

The chemical auxiliary agents segment, encompassing a diverse array of functional additives, plays a pivotal role across manufacturing, processing, and formulation applications. These agents, from emulsifiers and dispersants to surfactants and solubilizers, serve as critical enablers of performance enhancement, process efficiency, and product stability. In an era defined by environmental mandates, fluctuating raw material availability, and rapid technological evolution, understanding the dynamic interplay of demand drivers, regulatory landscapes, and innovation pipelines is paramount. Amid this backdrop, organizations are rethinking how auxiliary chemistries can unlock synergies between cost, sustainability, and performance metrics.

Against this complex industry canvas, our executive summary provides a concise yet comprehensive lens into the forces shaping the auxiliary agents market. The analysis begins by charting transformative shifts in industry priorities, before exploring the ramifications of recent tariff policies within the United States context. We then delve into segmentation insights that illuminate product, form, source, and application vectors, followed by regional performance considerations and competitive landscapes. Each section builds upon the last to construct a coherent narrative that arms decision-makers with the insights necessary to navigate uncertainty and seize emerging opportunities. Ultimately, this introduction sets the stage for a nuanced exploration of strategic imperatives, ensuring you have a roadmap to guide investment, innovation, and growth in the chemical auxiliary agents domain.

Uncovering the Confluence of Sustainability Mandates Digital Innovation and Supply Chain Resilience Driving Auxiliary Agent Market Evolution

The auxiliary agents industry is undergoing a paradigm shift as sustainability priorities, digital integration, and advanced materials converge to redefine market expectations. For instance, increasing emphasis on bio-based chemistries has accelerated research into renewable feedstocks, prompting suppliers to innovate beyond traditional petrochemical derivatives. This sustainability wave dovetails with stricter regulations, driving the adoption of green chemistry principles and lifecycle assessments to ensure compliance and bolster brand reputation.

Simultaneously, digital transformation is reshaping formulation development and supply chain transparency. Artificial intelligence and machine learning tools now facilitate rapid screening of candidate molecules, while blockchain-based traceability solutions are improving accountability across raw material sourcing. These technological advances are complemented by heightened focus on supply chain resilience, as recent disruptions have underscored the need for multi-sourcing strategies and agile production capabilities.

Amid these developments, collaboration models are evolving to support open innovation platforms, joint development agreements, and cross-industry partnerships. By leveraging shared expertise and infrastructure, stakeholders can accelerate time-to-market for novel auxiliary solutions that meet both functional and environmental targets. Together, these transformative trends set the stage for a more efficient, sustainable, and technologically sophisticated chemical auxiliary agents ecosystem.

Analyzing the Ripple Effects of U S Tariff Adjustments on Cost Structures Supply Partnerships and Regional Production Trends

The implementation of revised U.S. tariff measures in early 2025 introduced new cost pressures and strategic considerations for both domestic processors and global suppliers of auxiliary agents. Tariffs targeting key petrochemical derivatives and specialty intermediates have elevated input costs, prompting formulators to reassess ingredient choices and negotiate alternative supply agreements. As a result, many manufacturers have begun diversifying their vendor portfolios, exploring lower-cost feedstocks from non-tariffed regions in order to mitigate margin erosion.

At the same time, the tariff landscape has recalibrated the competitive balance in end-use sectors such as paints and coatings, oil and gas, and personal care. Suppliers integrated into local North American manufacturing networks have gained an edge, while import-reliant processors face the dual challenge of managing elevated landed costs and maintaining product performance criteria. These dynamics have accelerated nearshoring initiatives, including investments in domestic production capacity and partnerships with regional players.

In parallel, tariff-induced cost fluctuations have underscored the importance of transparent pricing models and collaborative long-term contracts to stabilize supply chains. Through forward-looking procurement strategies and closer alignment between raw material producers and auxiliary formulators, the industry is adapting to the new trade environment with resilience and strategic foresight.

Delivering Insights into How Source Form Application and Product Type Segmentation Define Performance and Sustainability Tradeoffs

Segmentation analysis offers critical insight into how diverse product attributes and end-use requirements shape auxiliary agent strategies. Within source classification, the market splits between bio-based and synthetic feedstocks, with the former category gaining momentum amid sustainability imperatives and consumer demand for renewable content. This shift has spurred R&D investments in enzymatic and fermentation routes, rapidly expanding the portfolio of functional bio-derived additives.

Form factors also exhibit significant differentiation, spanning liquid, powder, semi-solid, and solid presentations. Within liquids, aqueous systems dominate water-based applications, whereas solvent-based formulations cater to performance-driven industrial coatings. The semi-solid space, characterized by gel and paste textures, aligns closely with personal care and specialty processing requirements, while solid flake and granular formats offer ease of handling and enhanced stability for downstream blending.

Application segmentation further reveals where auxiliary agents deliver maximum value. In agriculture and food and beverage, performance additives enhance processing efficiency and product quality, whereas in oil and gas, specific chemistries optimize cementing, drilling fluids, and enhanced oil recovery. Paints and coatings differentiate decorative finishes from industrial protective systems, while personal care, pharmaceuticals, pulp and paper, and textile processing each demand tailored functionality.

Distinguishing product types, the landscape comprises defoamers, dispersants, emulsifiers, filter aids, solubilizers, and surfactants. Emulsifiers split into natural and synthetic varieties, reflecting a balance between sustainability and cost; surfactants range from amphoteric to anionic, cationic, and nonionic classes, each selected to meet precise interfacial and performance criteria.

This comprehensive research report categorizes the Chemical Auxiliary Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Form

- Product Type

- Application

Unraveling How Regulatory Regimes Feedstock Availability and End-Use Demand Shape Auxiliary Agent Performance Across Key Regions

Regional dynamics in the auxiliary agents market underscore the interplay between regulatory environments, feedstock availability, and end-use demand profiles. In the Americas, strong consumer focus on sustainable and bio-based solutions is fueling the expansion of green chemistry initiatives, particularly within North America’s manufacturing hubs. Concurrently, Latin America offers abundant agricultural by-product streams, providing unique opportunities for converting bio-waste into high-value functional additives.

Across Europe, Middle East and Africa, stringent environmental regulations and initiatives like the European Green Deal have propelled demand for low-impact chemistries, driving cross-border collaboration on R&D and pilot projects. Meanwhile, the Middle East’s evolving petrochemical infrastructure continues to support high-volume supply chains, feeding global specialty markets.

The Asia-Pacific region remains a powerhouse of downstream consumption, with rapid urbanization and industrialization in China, India, and Southeast Asia underpinning robust growth in paints and coatings, personal care, and textile sectors. At the same time, countries such as Japan and South Korea lead in advanced material research, fostering next-generation additive technologies. These regional insights highlight where companies should prioritize investment, partnerships, and innovation to capture emerging opportunities.

This comprehensive research report examines key regions that drive the evolution of the Chemical Auxiliary Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Innovation Pipelines Strategic Partnerships and Value-Added Services Differentiate Leaders in the Auxiliary Agents Market

In the competitive arena of chemical auxiliary agents, strategic positioning hinges on innovation pipelines, manufacturing footprint, and customer engagement models. Leading global participants are investing heavily in proprietary chemistries, often leveraging internal application laboratories to tailor solutions for high-value sectors like pharmaceuticals and oil and gas. Simultaneously, several regional specialists are capitalizing on niche applications, such as eco-friendly emulsifiers for personal care or advanced dispersants for industrial coatings, thereby carving out defensible market positions.

Partnerships between material science firms and end-use customers are becoming more common, enabling co-development of custom formulations that meet stringent performance, regulatory, and sustainability targets. To support these efforts, top-tier players are expanding pilot-scale facilities and adopting modular production units, which allow for rapid scale-up of successful prototypes. Additionally, a growing number of companies are integrating digital platforms for real-time performance monitoring, predictive maintenance, and supply chain optimization.

Competitive differentiation also rests on value-added services, including technical training, regulatory consulting, and joint innovation programs. By embedding themselves within customer value chains, companies are transitioning from commodity suppliers to strategic partners, thereby fostering long-term contracts and collaborative roadmaps for future product development. These strategies collectively define the front-runners in the dynamic auxiliary agents landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical Auxiliary Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- BYK-Chemie GmbH

- Clariant AG

- Croda International Plc

- Dow Inc.

- Elementis plc

- Evonik Industries AG

- Huntsman International LLC

- Kao Corporation

- Kolb Distribution Ltd.

- Lanxess AG

- Momentive Performance Materials Inc.

- Münzing Chemie GmbH

- Nouryon Chemicals Holding B.V.

- Sanyo Chemical Industries, Ltd.

- Schill + Seilacher AG

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Stepan Company

- The Lubrizol Corporation

- Tianjin Surfychem Co., Ltd.

- Wacker Chemie AG

Charting a Path for Sustainable Innovation Digital Integration and Collaborative Networks to Strengthen Competitive Resilience

Industry leaders must embrace a multi-pronged approach that balances innovation, sustainability, and operational resilience. Foremost, organizations should prioritize the development of bio-based and recyclable chemistries, adopting green chemistry frameworks to align product portfolios with evolving environmental regulations and customer expectations. By integrating life cycle assessments early in formulation design, companies can preemptively address compliance risks and differentiate their offerings on sustainability performance.

At the same time, digitalization efforts should extend beyond R&D into procurement and logistics. Implementing advanced analytics for demand forecasting and automated procurement platforms can drive cost efficiency and buffer against tariff-induced price volatility. Collaborating with strategic suppliers on joint risk-sharing contracts will further stabilize raw material supply and foster innovation in feedstock sourcing.

To maintain competitive advantage, firms should cultivate open innovation networks through partnerships with academic institutions, start-ups, and cross-industry consortia. These alliances can accelerate access to emerging technologies, from enzyme-catalyzed production methods to novel interfacial chemistries. Finally, investing in talent development and upskilling programs ensures that teams possess the expertise to navigate regulatory complexities, harness digital tools, and translate sustainability goals into commercially viable products.

Ensuring Rigorous Analysis Through Comprehensive Secondary Review Integrated Primary Interviews and Triangulated Data Validation

Our research methodology integrates a rigorous blend of secondary and primary investigations to deliver a robust and verifiable market analysis. Initially, extensive secondary research was conducted by reviewing industry publications, scientific journals, regulatory filings, and patent databases to map historical trends and emerging technical developments. This groundwork informed the design of targeted primary data collection, which comprised in-depth interviews with senior industry executives, R&D leaders, and supply chain managers across major producing and consuming regions.

Quantitative validation was achieved through structured surveys distributed to a global panel of formulation chemists, procurement specialists, and application engineers, ensuring representation across key end-use sectors. These insights were cross-referenced with publicly available financial disclosures and third-party import-export databases to triangulate volume and trade flow observations. In parallel, technical workshops held with subject matter experts enabled peer review of preliminary findings, enhancing the accuracy of segmentation classifications and regional assessments.

Throughout the study, a dynamic quality assurance process was maintained, encompassing data normalization, consistency checks, and scenario stress-testing to account for potential market disruptions. This comprehensive approach yields an authoritative and transparent view of the chemical auxiliary agents landscape, providing stakeholders with a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical Auxiliary Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical Auxiliary Agents Market, by Source

- Chemical Auxiliary Agents Market, by Form

- Chemical Auxiliary Agents Market, by Product Type

- Chemical Auxiliary Agents Market, by Application

- Chemical Auxiliary Agents Market, by Region

- Chemical Auxiliary Agents Market, by Group

- Chemical Auxiliary Agents Market, by Country

- United States Chemical Auxiliary Agents Market

- China Chemical Auxiliary Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Capturing the Imperative for Sustainability Driven Innovation and Data-Centric Operations in the Evolving Auxiliary Agents Industry

The chemical auxiliary agents market is at an inflection point, driven by a confluence of sustainability imperatives, technological advancements, and evolving trade dynamics. Companies that can adeptly navigate tariff environments, harness digital tools for formulation and supply chain optimization, and deliver eco-effective chemistries will gain a decisive competitive edge. Segmentation insights underscore the need for tailored strategies across source, form, application, and product type, while regional intelligence highlights distinct investment priorities from the Americas through EMEA and into Asia-Pacific.

Moving forward, the most successful market participants will integrate open innovation models, foster collaborative partnerships, and embed life cycle thinking at every stage of product development. By doing so, they will not only meet stringent regulatory requirements but also unlock new opportunities in high-growth applications such as enhanced oil recovery, advanced coatings, and specialty personal care formulations. In sum, the future of auxiliary agents rests on the ability to balance performance excellence with sustainability, supported by agile operations and data-driven decision-making.

Empower Your Strategy with Expert Guidance From Ketan Rohom to Secure the Comprehensive Chemical Auxiliary Agents Insights You Need for Growth

To gain an in-depth understanding of the evolving chemical auxiliary agents landscape and equip your organization with actionable intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, whose expertise can guide you through tailored solutions and strategic recommendations. By engaging directly with his team, you will be able to access the comprehensive market research report, unlocking a rich repository of analysis that spans regulatory overviews, technological advancements, competitor benchmarking, and regional performance insights. Collaborating with his leadership will ensure that you receive personalized guidance designed to accelerate decision-making, optimize product portfolios, and identify untapped growth opportunities in key segments. Don’t miss the chance to sharpen your competitive edge and capitalize on emerging trends-connect with Ketan Rohom today to secure your copy of the report and embark on a data-driven strategy that positions your enterprise for sustained success in the chemical auxiliary agents sector.

- How big is the Chemical Auxiliary Agents Market?

- What is the Chemical Auxiliary Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?