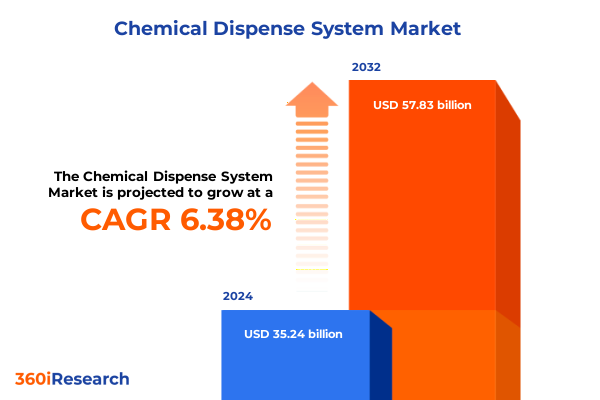

The Chemical Dispense System Market size was estimated at USD 37.31 billion in 2025 and expected to reach USD 39.93 billion in 2026, at a CAGR of 6.46% to reach USD 57.83 billion by 2032.

Setting the Stage for Chemical Dispense System Evolution Amid Rising Demands and Technological Advancements Driving Operational Excellence

Chemical dispense systems have become a cornerstone of process optimization across a wide range of industries, setting new benchmarks for precision, safety, and efficiency. As organizations contend with increasingly stringent quality standards and seek to minimize waste, the role of these systems has expanded from simple liquid handling to sophisticated platforms integrating advanced sensors and automated controls. In this dynamic environment, manufacturers and end users alike are exploring how chemical dispense solutions can support lean operations and drive superior outcomes.

The rapid convergence of operational requirements and technological capability has propelled the evolution of dispense systems from manual configurations toward fully integrated, data-driven solutions. Manual devices such as traditional bottle dispensing systems and hand pumps continue to serve low-volume applications, but the shift toward semi-automated batch and metered dispensing highlights the growing demand for repeatability and ease of use. Above all, the rise of fully automated integrated systems and versatile standalone units underpins a broader move toward Industry 4.0, where digital interfaces and remote management redefine how chemicals are stored, dosed, and monitored for maximum reliability.

Identifying Key Transformations Shaping the Chemical Dispense System Landscape Through Digitalization Sustainability and Regulatory Pressures Driving Innovation

The chemical dispense system landscape is undergoing transformative shifts driven by digitalization, sustainability imperatives, and regulatory forces. Digital transformation has introduced real-time monitoring and predictive maintenance capabilities, enabling operators to detect anomalies before they escalate into costly downtime. Meanwhile, the integration of cloud-based data analytics and Internet of Things connectivity has elevated system visibility, fostering smarter process control and facilitating remote diagnostics across geographically dispersed facilities.

Concurrently, environmental and safety regulations are catalyzing investments in more precise dosing technologies that reduce chemical waste and mitigate exposure risks. End users in sectors such as pharmaceuticals and water treatment are demanding eco-friendly solutions, prompting suppliers to incorporate materials and designs that comply with stricter emissions and handling standards. In parallel, the push toward decentralized production and just-in-time inventory management encourages the development of compact, modular dispense modules that can adapt to fluctuating throughput requirements while maintaining consistent performance.

Assessing the Cumulative Impact of Recent United States Tariffs on Chemical Dispense Systems Supply Chains and Component Costs Through 2025

United States tariffs implemented through 2025 have exerted cumulative effects on the supply chain for chemical dispense system components and raw materials. Initial rounds of Section 301 levies targeted imports from key manufacturing hubs, including precision pump parts and electronic control units, prompting suppliers to reevaluate sourcing strategies. Subsequent steel and aluminum duties under Section 232 further elevated costs for structural frames and pressure vessels, driving some original equipment manufacturers to explore alternative alloys or domestic fabrication partnerships.

The cascading impact of these measures has been felt in extended lead times, increased capital expenditures for tariff-inclusive budgeting, and the adoption of bonded warehouse arrangements to defer duties. In response, a growing number of system integrators and end users have embraced localized assembly and nearshoring to mitigate exposure, while strategic alliances with domestic component producers have emerged to bolster supply chain resilience. Although these adaptations have partially absorbed the duty burden, the cumulative impact underscores the importance of proactive tariff compliance planning and agile procurement models in maintaining competitive positioning.

Revealing Critical Segmentation Insights Across Product Type Applications End Users Technologies and Flow Rates Driving Market Differentiation

The chemical dispense market exhibits pronounced differentiation when viewed through multiple segmentation lenses, each catering to specific operational demands. When considering product type, fully automated solutions bifurcate into integrated systems designed for high-throughput, centralized dosing and standalone units optimized for point-of-use applications. Manual configurations remain relevant for low-volume tasks, with traditional bottle dispensing tools and hand pumps offering cost-effective simplicity. In between, semi-automated platforms balance control and convenience, delivering either batch dispensing capabilities for processes with larger volumes or metered dosing modules for precise, repeatable measurements.

Analyzing application segments reveals tailored opportunities across diverse industries. Within chemical processing, agrochemical formulators and polymer producers benefit from dispense systems configured for corrosive and viscous media. In the food and beverage sector, beverage manufacturers and dairy processors require hygienic designs that ensure product safety and traceability. The oil and gas value chain spans upstream exploration, where pump robustness is paramount, to downstream refining operations emphasizing integration with process control suites. Pharmaceutical users divide between biotechnology labs focused on cell culture media handling and drug formulation facilities demanding validation-ready equipment. Water treatment providers serving drinking water and wastewater treatment plants prioritize both accuracy and robustness against chemical aggressiveness.

End users further refine demand profiles, with commercial venues such as food services and hospitality favoring compact, easy-maintenance dispensers, while industrial environments in manufacturing and petrochemical settings pursue heavy-duty systems capable of continuous operation. Residential applications, including home water treatment and private pool management, emphasize user-friendly interfaces and low-maintenance designs. From a technology perspective, diaphragm pumps subdivide into air-operated and solenoid-driven variants, while gear pumps appear as either external or internal gear configurations. Peristaltic alternatives offer multi-tube or single-tube approaches to isolation and cross-contamination prevention. Finally, flow rate requirements range below ten liters per hour-spanning one-to-five and five-to-ten riffles-to a mid-range of ten-to-one hundred with finer increments, and beyond one hundred liters per hour to five hundred or more, dictating component sizing and control strategies.

This comprehensive research report categorizes the Chemical Dispense System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Technology

- Flow Rate

Exploring Regional Dynamics and Growth Drivers in the Americas EMEA and Asia Pacific Chemical Dispense System Markets Amid Economic and Regulatory Variations

Regional dynamics exert a profound influence on how chemical dispense systems are adopted and customized, as each area contends with unique economic conditions and regulatory environments. Across the Americas, robust investment in water treatment infrastructure and pharmaceutical manufacturing centers in North America align with demand for advanced automation. Latin American markets are increasingly prioritizing reliable dosing equipment to support agrochemical production and potable water projects, while trade dynamics with major exporters shape cost structures and localization strategies.

Within Europe, Middle East, and Africa, stringent environmental and safety standards in countries such as Germany and Saudi Arabia drive the uptake of precision dosing solutions integrated with digital compliance tools. Emerging economies in Africa are focused on potable water access and wastewater treatment, creating pathways for modular, lower-capital systems that can be rapidly deployed. At the same time, Middle Eastern petrochemical hubs continue to seek high-capacity, corrosion-resistant dispense architectures tailored to complex feedstock handling.

In the Asia-Pacific region, rapid industrialization and urbanization spur investments in manufacturing, oil and gas, and municipal water programs. China’s push for pollution control and Japan’s emphasis on process efficiency reinforce demand for high-precision dosing. Southeast Asian nations leverage regional trade agreements to access competitively priced components, while Australia’s mining and water management sectors favor durable, remote-monitoring-enabled units to address geographic dispersion and resource scarcity. Across these geographies, manufacturers adapt service models and financing options to align with local procurement preferences and infrastructure readiness.

This comprehensive research report examines key regions that drive the evolution of the Chemical Dispense System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Strategies Partnerships and Technological Innovations That Are Shaping the Chemical Dispense System Industry Landscape

The competitive arena for chemical dispense system providers is characterized by strategic partnerships, targeted acquisitions, and a relentless focus on digital innovation. Leading equipment manufacturers are forging alliances with control system vendors to embed advanced analytics and enhance remote troubleshooting capabilities. Meanwhile, specialized pump innovators are expanding their portfolios through bolt-on acquisitions that bolster their presence in emerging segments such as water treatment and biologics.

Technology leaders have accelerated investments in modular system architectures, allowing end users to rapidly scale throughput without extensive retrofitting. Partnerships between dispense solution providers and materials science firms have given rise to coatings and elastomers that extend component lifespans in aggressive chemical environments. Simultaneously, some organizations are licensing or co-developing software platforms that offer subscription-based monitoring services, creating new revenue streams while strengthening customer engagement.

Across the board, companies are optimizing global supply chains through nearshoring initiatives and regional distribution centers to reduce lead times and tariff exposure. They are also piloting additive manufacturing for custom pump housings and fittings, bringing design-to-production cycles in-house. These strategic moves collectively shape the competitive landscape, enabling nimble responses to evolving regulatory demands and accelerating time to value for system integrators and end users alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical Dispense System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Blue-White Industries, Ltd.

- Cica-Huntek Chemical Technology Taiwan Co., Ltd.

- Entegris, Inc.

- Grundfos Holding A/S

- HORIBA, Ltd.

- Hydro Systems Company

- Kanto Corporation

- Milton Roy, LLC

- NETZSCH Pumpen & Systeme GmbH

- ProMinent GmbH

- PSG Biotech by Dover Corporation

- Seko S.p.A.

- Technochem Industries

- Watson-Marlow Fluid Technology Group Limited

Delivering Actionable Strategic Recommendations for Industry Leaders to Enhance Operational Efficiency and Competitive Advantage in Chemical Dispensing

Industry leaders can proactively nurture resilience and drive differentiation by embracing a suite of strategic initiatives centered on digital integration and operational agility. Prioritizing the development of modular dispense platforms equipped with standardized digital communication protocols enables seamless interoperability with existing process control systems, reducing integration complexity and accelerating deployment timelines. Concurrently, establishing collaborative partnerships with local component manufacturers can mitigate tariff impacts and strengthen supply chain continuity, while co-innovation efforts with software providers unlock predictive maintenance and data-driven optimization capabilities.

Another critical step is to invest in scalable training programs that upskill technician workforces in advanced troubleshooting, data analytics, and compliance management. This focus on human capital not only ensures proper system commissioning but also fosters a culture of continuous improvement. Furthermore, adopting sustainability-by-design principles-such as materials selection that reduces chemical ingress and waste generation-help organizations align with tightening environmental regulations and customer expectations. Finally, piloting pay-per-use or subscription service models for dispense equipment can lower the barrier to entry for smaller end users, expanding addressable markets and creating recurring revenue streams without the need for heavy upfront capital.

Detailing Robust Research Methodology Combining Primary Interviews Secondary Data Collection and Analytical Techniques for Comprehensive Market Understanding

This study synthesizes insights from a rigorous research methodology combining primary and secondary sources to ensure comprehensive market understanding. The primary research phase included structured interviews with senior executives at original equipment manufacturers, system integrators, end users in water treatment, pharmaceuticals, and oil and gas, as well as consultations with regulatory experts. These interactions provided first-hand perspectives on technology adoption drivers, tariff mitigation tactics, and service expectations.

In parallel, secondary data collection drew upon publicly available technical standards, regulatory filings, trade journals, patent databases, and company financial disclosures to validate trends and triangulate market sentiments. Quantitative and qualitative data points were systematically integrated through data triangulation, ensuring consistency and reducing bias. Analytical techniques, including SWOT analysis and comparative benchmarking, were applied to identify competitive differentiators and strategic imperatives. Throughout the process, findings were vetted by an expert advisory panel to reinforce impartiality and ensure that all conclusions accurately reflect evolving industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical Dispense System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical Dispense System Market, by Product Type

- Chemical Dispense System Market, by Application

- Chemical Dispense System Market, by End User

- Chemical Dispense System Market, by Technology

- Chemical Dispense System Market, by Flow Rate

- Chemical Dispense System Market, by Region

- Chemical Dispense System Market, by Group

- Chemical Dispense System Market, by Country

- United States Chemical Dispense System Market

- China Chemical Dispense System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Synthesizing Key Findings and Insights to Guide Strategic Decision Making and Drive Future Growth in the Chemical Dispense System Sector

The landscape for chemical dispense systems is defined by accelerating technological innovation, evolving regulatory frameworks, and shifting tariffs that together shape strategic decision making for equipment providers and end users. As digitalization and sustainability initiatives continue to converge, organizations that integrate advanced monitoring and precision dosing capabilities will outpace competitors in efficiency and compliance performance. Tariff-driven supply chain adjustments underscore the importance of localized sourcing strategies and agile procurement models.

Segmentation insights reveal diverse requirements across product typologies, industries, and operating environments, highlighting the need for both modular product architectures and customized service offerings. Regional dynamics further emphasize the value of adaptive go-to-market approaches, tailored financing options, and collaboration with local distributors. By aligning corporate strategies with these core trends-focusing on interoperability, sustainability-by-design, and tariff resilience-businesses can secure long-term competitive advantage and drive future growth in the dynamic chemical dispense system sector.

Engaging Directly with Associate Director Sales and Marketing Ketan Rohom to Secure the Comprehensive Chemical Dispense System Market Research Report Today

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, offers a direct pathway to equip your organization with the in-depth insights and strategic guidance provided in this comprehensive market research report. By partnering with Ketan, you gain a tailored consultation that explores how cutting-edge innovations, regulatory considerations, and emerging opportunities in chemical dispense technologies can be applied to your unique operational challenges. This personalized interaction ensures that your procurement of the report is aligned with your strategic priorities and delivers maximum value, empowering you to make informed investment decisions.

Take the initiative today to reach out and secure your copy of the market research report. Ketan’s expertise and understanding of industry dynamics will facilitate a seamless purchasing experience and provide you with the critical intelligence needed to stay ahead of technological shifts, tariff impacts, and competitive developments. Elevate your organization’s strategic planning and operational readiness by engaging with Ketan Roshom and accessing the knowledge that will shape the future of your chemical dispense system applications.

- How big is the Chemical Dispense System Market?

- What is the Chemical Dispense System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?