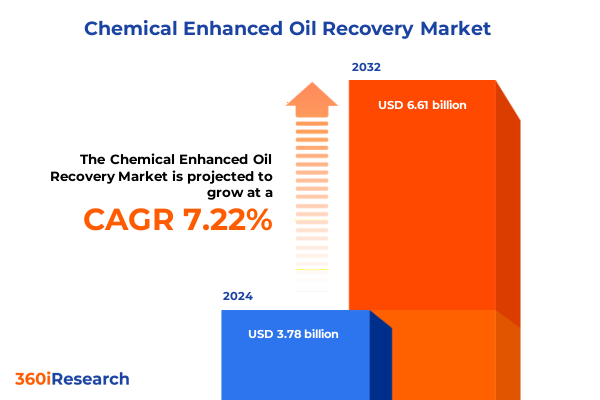

The Chemical Enhanced Oil Recovery Market size was estimated at USD 4.05 billion in 2025 and expected to reach USD 4.34 billion in 2026, at a CAGR of 7.23% to reach USD 6.61 billion by 2032.

Unveiling the Strategic Imperatives, Technological Foundations, and Industry Drivers Shaping the Future of Chemical Enhanced Oil Recovery Worldwide

Chemical enhanced oil recovery leverages tailored chemical formulations to mobilize residual hydrocarbons from subsurface reservoirs. Rather than relying solely on pressure depletion or conventional waterflooding, this advanced tertiary recovery approach introduces surfactants, polymers, and alkalis to alter fluid properties and rock wettability. As traditional production techniques near their performance limits in mature fields, chemical EOR emerges as a critical tool to boost sweep efficiency and reduce capillary trapping of oil.

The significance of chemical enhanced oil recovery has risen in step with growing global energy demands and the progressive depletion of easily accessible reservoirs. Secondary recovery approaches commonly extract only a fraction of original oil in place, leaving substantial untapped reserves behind. In contrast, chemical EOR can extend the productive life of aging assets, offering operators a cost-effective pathway to sustain output without dependent on new exploration ventures.

Key drivers shaping the chemical EOR landscape include the imperative of enhancing energy security, the push for lower carbon intensity in production, and rapid advancements in reservoir modeling and chemical design. Evolving crude price dynamics have reignited interest in maximizing per-well recovery, while stricter environmental standards are motivating the development of more eco-friendly chemical solutions.

Implementing chemical enhanced oil recovery, however, demands rigorous reservoir characterization and compatibility testing. Matching chemical formulations to reservoir mineralogy, temperature, and salinity profiles is essential to avoid formation damage and ensure fluid injectivity. Safe handling procedures and robust logistics protocols must also be established to manage aggressive agents responsibly.

Operators adopting chemical EOR must embrace an integrated strategy that combines innovative chemistry, digital monitoring, and adaptive process control. This executive summary distills the latest industry trends, tariff influences, segmentation insights, regional dynamics, and targeted recommendations, laying out a comprehensive roadmap for navigating the complexities of chemical EOR deployment.

Examining the Pivotal Technological, Regulatory, and Market Dynamics That Are Revolutionizing Chemical Enhanced Oil Recovery Strategies in 2025

The landscape of chemical enhanced oil recovery is undergoing a profound transformation fueled by rapid technological advancement and evolving regulatory frameworks. Digitalization has become a cornerstone of modern EOR operations, with real-time reservoir monitoring and analytics delivered via cloud platforms and machine learning algorithms. These innovations enable operators to fine-tune injection parameters dynamically, reducing chemical consumption while maximizing incremental oil recovery.

Meanwhile, materials science breakthroughs are introducing next-generation chemical agents designed for high-performance in extreme reservoir conditions. Smart polymers that adjust viscosity in response to temperature and salinity changes, biodegradable surfactants sourced from renewable feedstocks, and engineered nanoparticles tailored for pore-scale flow control are setting new performance benchmarks. These advanced chemistries not only improve sweep efficiency but also address end-of-life disposal challenges.

On the regulatory front, key producing regions have enacted stricter environmental guidelines governing water usage, effluent treatment, and carbon emissions. Operators must now incorporate comprehensive monitoring of chemical residues in produced water streams and undertake detailed environmental impact assessments before scaling EOR pilots. Incentive structures are increasingly tied to carbon intensity reduction metrics, prompting closer alignment between EOR projects and broader decarbonization goals.

Economic pressures, driven by fluctuating oil prices and heightened capital discipline, have reshaped project evaluation criteria. Service providers and operators prioritize lean project designs, leveraging dynamic reservoir simulations and predictive analytics to mitigate financial risks. This emerging focus on value per barrel invested underscores the strategic importance of optimized chemical EOR deployment.

Collaboration has likewise intensified, with joint ventures between technology developers, chemical producers, and integrated oil companies accelerating the validation and scale-up of innovative formulations. Such partnerships facilitate shared field trials and pooled resources, hastening the path from laboratory breakthrough to commercial implementation.

Collectively, these transformative shifts call for a decisive response from stakeholders. Embracing digital integration, green chemistry solutions, compliance readiness, and strategic alliances will be essential to unlocking the full potential of chemical enhanced oil recovery.

Assessing the Comprehensive Impact of Newly Introduced United States Tariff Measures on Chemical Enhanced Oil Recovery Supply Chains and Cost Structures

In early 2025, the United States introduced a series of tariff measures targeting imported specialty chemicals critical to chemical enhanced oil recovery, including selected polymers, surfactants, and alkali compounds. These measures, enacted to bolster domestic manufacturing and protect local producers, have reverberated across EOR supply chains, altering procurement strategies and cost structures for operators and service providers alike.

The imposition of tariffs on high-performance polymers used for mobility control has elevated raw material costs for polymer flooding applications. Surfactant imports, essential for interfacial tension reduction in surfactant flooding, are now subject to additional duties that have increased landed prices by double-digit percentages in many cases. Likewise, alkali agents such as sodium carbonate and sodium metaborate, vital for alkaline flooding formulations, have seen unit costs rise, squeezing project margins.

These shifts have prompted operators to reassess supply chain strategies. Many are exploring partnerships with domestic chemical manufacturers to establish local production lines, aiming to mitigate tariff exposure and ensure agile material delivery. Stockpiling of critical reagents has emerged as a short-term tactic to lock in pre-tariff pricing, while long-term plans focus on backward integration or joint ventures to produce key chemicals onshore.

The cumulative effect of increased chemical expenditures and logistical realignments has influenced project scheduling and capital allocation decisions. Some operators have deferred planned EOR pilots pending deeper cost-benefit analyses, whereas others have redesigned well patterns and injection schemes to optimize chemical utilization.

Looking forward, industry stakeholders are actively engaging with policymakers to seek tariff relief or carve-outs for EOR-grade chemicals, emphasizing the strategic importance of domestic energy production. Simultaneously, research into alternative, non-tariffed chemistries is gaining momentum, potentially diversifying the toolkit available for future EOR campaigns.

Overall, the tariff landscape in 2025 underscores the need for adaptive procurement strategies and close collaboration between operators, chemical suppliers, and regulatory bodies to sustain the momentum of chemical enhanced oil recovery initiatives.

Illuminating Product, Reservoir, End User, and Distribution Channel Segmentation Insights Shaping Precision Applications of Chemical Enhanced Oil Recovery

When examining product segmentation within chemical enhanced oil recovery, alkali flooding applications pivot around cost-effective reagents like sodium carbonate, sodium hydroxide, and sodium metaborate, each selected based on reservoir pH and mineralogy. Polymer flooding strategies emphasize the use of biopolymers, hydrolyzed polyacrylamide, and xanthan gum, chosen for their stability in high-temperature or high-salinity environments. Surfactant flooding formulations are tailored through anionic, cationic, or nonionic chemistries, with each class optimized to reduce interfacial tension under specific reservoir conditions.

Reservoir type segmentation further refines chemical EOR design. Carbonate formations, whether marked by high permeability or restricted flow channels, demand distinct fluid rheology and wettability alteration protocols compared to conglomerate reservoirs that exhibit heterogeneous permeability distributions. Sandstone reservoirs, universally characterized by a broad permeability range, require carefully calibrated injection pressures and chemical concentrations to avoid fingering and ensure uniform sweep efficiency.

End user diversity shapes market adoption patterns across independents, international oil companies, and national oil companies. Smaller independent operators often prioritize cost containment and modular pilot programs, favoring proven chemical blends with predictable performance. Integrated international producers leverage global research networks to conduct large-scale trials, while state-owned national companies balance strategic resource development objectives with domestic supply imperatives and long-term energy security mandates.

Distribution channel segmentation influences how chemical EOR solutions reach the field. Direct sales models facilitate close collaboration between service engineers and operator teams, ensuring bespoke formulation and on-site technical support. Distributors expand geographic reach, offering standardized chemical packages and logistical infrastructure in emerging markets. E-commerce platforms are gradually gaining traction by streamlining order placement and delivery tracking, particularly for supplemental or smaller-volume chemical orders.

Through a nuanced understanding of product, reservoir, end user, and distribution channel segmentation, stakeholders can tailor chemical EOR strategies to achieve precision performance and optimize resource utilization across diverse operating environments.

This comprehensive research report categorizes the Chemical Enhanced Oil Recovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Reservoir Type

- Chemical Type

- Distribution Channel

- End User

Exploring Distinct Regional Trends and Strategic Imperatives Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Chemical Enhanced Oil Recovery

In the Americas, a robust landscape of onshore and offshore operations is driving renewed interest in chemical enhanced oil recovery. North American operators are investing in water-based surfactants and bio-derived polymers, leveraging advanced analytics and wellbore monitoring to maximize incremental recovery in mature shale and conventional reservoirs. Latin American producers, conversely, are focusing on alkali-polymer hybrid techniques to address high-salinity carbonate formations, often partnering with service firms to pilot customized EOR blends under challenging environmental conditions.

Across Europe, the Middle East, and Africa, regulatory pressures and initiatives to reduce carbon footprints are influencing chemical EOR adoption. North Sea operators prioritize low-toxicity surfactants and efficient chemical recycling methods to comply with stringent effluent standards. Middle Eastern national oil companies are allocating capital toward polymer flooding projects in high-temperature sandstone reservoirs, while regulatory frameworks in African onshore basins encourage pilot demonstrations that integrate EOR with renewable power sources for water treatment and injection systems.

Asia-Pacific markets exhibit a dynamic interplay between state-driven development goals and rapid technological uptake. Chinese and Indian refiners are collaborating with global chemical providers to scale polymer flooding in aging sandstone fields, with an emphasis on domestic manufacturing and technology transfer. In Southeast Asia and Australia, field trials of biodegradable surfactants are underway, reflecting a broader shift toward sustainable chemistry and water stewardship. These regional nuances underscore the importance of localized formulation design and supply chain resilience in driving chemical EOR success.

This comprehensive research report examines key regions that drive the evolution of the Chemical Enhanced Oil Recovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Strategies, Innovative Partnerships, and Research Development Priorities Among Key Providers in Chemical Enhanced Oil Recovery Industry

Leading service providers and chemical manufacturers are differentiating themselves through integrated solution offerings that combine chemicals with advanced digital monitoring platforms. Major technology firms are forging joint ventures with specialty chemical producers to develop proprietary polymers and surfactants engineered for specific reservoir profiles. These alliances enable rapid co-development cycles and facilitate field validation of novel formulations.

Competitive strategies among top-tier operators include strategic investments in research centers focused on next-generation EOR chemistries and pore-scale modeling capabilities. By collaborating with academic institutions and national laboratories, key companies accelerate the discovery of environmentally benign agents and refine reservoir simulation tools that predict chemical performance under complex subsurface conditions.

Notably, the pursuit of sustainable EOR solutions has spurred cross-industry partnerships, bringing together water treatment specialists, carbon capture technology providers, and waste management experts. This ecosystem approach addresses the full life cycle of injection fluids, from sourcing and deployment to produced water handling and chemical recovery.

Innovation race dynamics are also evident in the patent landscape, where incremental improvements in polymer architecture and surfactant molecular design point to a maturing market that prizes incremental yield gains. Strategic licensing agreements facilitate technology access for mid-sized operators, broadening the adoption curve beyond traditional integrated operators.

Through proactive collaboration, targeted R&D investments, and value-add service models, leading companies in the chemical EOR sector are establishing new performance benchmarks and creating barriers to entry that reinforce their market positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical Enhanced Oil Recovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baker Hughes Company

- BASF SE

- Canadian Natural Resources Limited

- Cenovus Inc.

- ChampionX Corporation

- Chevron Corporation.

- Clariant AG

- Croda International PLC

- Dow Inc.

- DuPont de Nemours, Inc.

- Exterran Corporation by Enerflex Ltd.

- Halliburton Company

- Hemisphere Energy Corporation

- Lukoil Oil Company

- Oil Chem Technologies

- Oil Plus Ltd

- Premier Oilfield Group LLC

- RCS Group of Companies

- Royal Dutch Shell PLC

- Schlumberger Limited

- Secure Energy Services Inc.

- SGS Société Générale de Surveillance SA

- SNF Group

- Stepan Company

- Sulzer

- TechnipFMC PLC

- Titan Oil Recovery Inc.

- Ultimate EOR Services LLC

- Vizag Chemical International

Proactive and Targeted Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency, Reduce Risks, and Drive Sustainable Chemical EOR Success

To capitalize on emerging opportunities in chemical enhanced oil recovery, industry leaders should prioritize diversification of chemical supply chains by forging strategic alliances with domestic and regional manufacturers. Localized production capabilities can mitigate exposure to tariff fluctuations and shipping constraints while fostering cost efficiency through closer proximity to injection sites.

Investing in digital transformation initiatives is equally critical. By deploying predictive reservoir modeling, real-time injection monitoring, and automated chemical metering systems, operators can fine-tune flood designs, reduce operational variability, and lower chemical consumption per incremental barrel recovered. This data-driven approach enhances both economic and environmental performance.

Leaders must also integrate environmental due diligence into EOR project planning. Implementing closed-loop water treatment and chemical recycling processes not only aligns with stringent effluent regulations but also supports corporate sustainability targets. Engaging third-party environmental experts early in the project lifecycle can streamline permitting and minimize downstream compliance risks.

Cross-sector collaboration should extend to joint R&D ventures and pilot consortiums that pool financial and technical resources. Shared field trials accelerate the validation of advanced chemistries and facilitate knowledge transfer across diverse reservoir settings, reducing the time from laboratory innovation to commercial roll-out.

Finally, maintain active dialogue with regulatory bodies to anticipate policy shifts and advocate for favorable tariff structures or exemptions for critical EOR materials. Proactive engagement will enable industry leaders to shape a regulatory environment conducive to long-term investment in chemical enhanced oil recovery.

Detailing Rigorous Research Methodology Integrating Primary Interviews, Expert Consultations, and Data Triangulation to Ensure Comprehensive Analysis Rigor

This analysis integrates a hybrid research design combining extensive secondary research and targeted primary outreach. The secondary research phase involved reviewing peer-reviewed journals, technical conference proceedings, and publicly available regulatory filings to map recent advancements in chemical EOR technologies and policies.

Primary data collection included in-depth interviews with senior engineers at operating oil and gas companies, technical experts at specialized service firms, and policy advisors overseeing environmental regulations. These qualitative insights provided first-hand perspectives on operational challenges, best practices, and evolving market dynamics.

Quantitative data points were triangulated through cross-referencing production case studies, chemical consumption reports, and publicly disclosed financial statements of leading industry players. This multi-source validation approach ensured a balanced representation of cost structures, technology adoption rates, and risk factors.

Expert consultations with subsurface modeling specialists and polymer chemists enriched the analysis by illuminating the technical underpinnings of novel EOR formulations and the practical implications for reservoir management. Ongoing peer review cycles with independent domain experts further enhanced the rigor and credibility of the findings.

Limitations of this methodology include the proprietary nature of certain pilot results and the potential for regional variability in regulatory enforcement. Nevertheless, the comprehensive framework employed here delivers a robust foundation for strategic decision-making in chemical enhanced oil recovery initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical Enhanced Oil Recovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical Enhanced Oil Recovery Market, by Product Type

- Chemical Enhanced Oil Recovery Market, by Reservoir Type

- Chemical Enhanced Oil Recovery Market, by Chemical Type

- Chemical Enhanced Oil Recovery Market, by Distribution Channel

- Chemical Enhanced Oil Recovery Market, by End User

- Chemical Enhanced Oil Recovery Market, by Region

- Chemical Enhanced Oil Recovery Market, by Group

- Chemical Enhanced Oil Recovery Market, by Country

- United States Chemical Enhanced Oil Recovery Market

- China Chemical Enhanced Oil Recovery Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Strategic Synthesis Highlighting Key Insights, Emerging Opportunities, and Long-term Implications for Stakeholders in Chemical Enhanced Oil Recovery

This executive summary has synthesized key strategic imperatives, transformative technology shifts, and regulatory influences that collectively define the current state of chemical enhanced oil recovery. By examining tariff impacts, segmentation insights, regional trends, and competitive landscapes, decision-makers can pinpoint critical levers to optimize EOR performance.

Emerging opportunities, from eco-friendly surfactants to AI-driven injection control, underscore the sector’s evolution toward more sustainable and cost-effective recovery methods. Meanwhile, the interplay of economic pressures and environmental mandates creates a dynamic environment in which agility and innovation are paramount.

As operators and service providers chart their course, the insights detailed in this summary offer a roadmap for integrating advanced chemistries, digital tools, and strategic partnerships. Embracing these recommendations will enable stakeholders to enhance asset recovery, mitigate risk, and secure long-term competitiveness in the ever-evolving energy landscape.

Drive Strategic Decision-Making and Obtain Comprehensive Chemical EOR Market Intelligence by Connecting with Ketan Rohom to Access the Full Report Today

To unlock the full depth of insights, detailed analysis, and strategic guidance on chemical enhanced oil recovery, connect with Ketan Rohom, the Associate Director of Sales & Marketing. Ketan brings extensive expertise in energy markets, a deep understanding of EOR applications, and a proven track record in guiding operators through complex technology adoption challenges.

By partnering with Ketan Rohom, you gain direct access to the comprehensive market research report that synthesizes tariff impacts, regional trends, segmentation intelligence, and forward-looking recommendations. This actionable resource equips you to refine investment priorities, optimize project economics, and innovate with confidence. Don’t miss the opportunity to elevate your strategic planning with the most current and authoritative insights available in the chemical EOR landscape. Reach out today to secure your copy and drive competitive advantage in this evolving sector.

- How big is the Chemical Enhanced Oil Recovery Market?

- What is the Chemical Enhanced Oil Recovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?