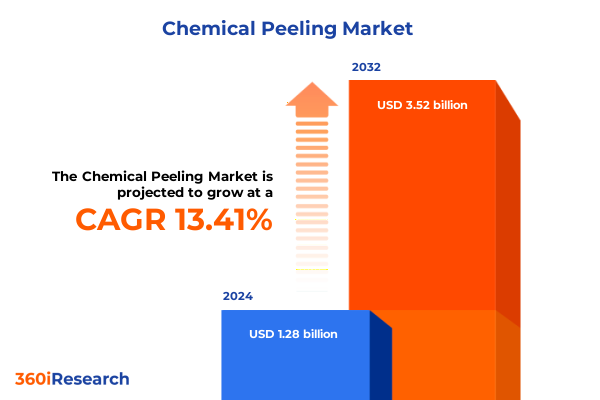

The Chemical Peeling Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.64 billion in 2026, at a CAGR of 13.39% to reach USD 3.52 billion by 2032.

Exploring the Evolution of Chemical Peeling and Its Role in Delivering Customized Skin Rejuvenation and Enhanced Aesthetic Outcomes

Chemical peeling, a cornerstone of aesthetic dermatology, traces its origins to the ancients who sought smoother, more radiant skin through natural exfoliants. Queen Cleopatra’s famed sour milk baths delivered lactic acid from fermented milk, resulting in noticeably brighter complexions and laying the groundwork for modern alpha hydroxy acid (AHA) peels. In the late 19th century, Austrian dermatologist Ferdinand Ritter von Hebra advanced the practice by applying caustic combinations of phenol and other agents to address pigmentation disorders and skin irregularities. By the early 20th century, pioneers like Paul G. Unna and George MacKee refined formulations of salicylic acid, trichloroacetic acid (TCA), and modified phenol solutions, defining the deep, medium, and superficial peel categories that remain in use today.

How Innovations and Consumer Demands Are Driving Transformational Shifts in Chemical Peeling Formulations and Digital Delivery Platforms

As consumer expectations evolve, chemical peeling has undergone transformative shifts driven by innovation in formulation science and digital integration. Leading practitioners now leverage personalized peel protocols engineered to match individual skin types and concerns, harnessing advances in AHA and BHA technology to optimize efficacy while minimizing irritation. Concurrently, the rise of at-home chemical peel kits has democratized access to gentle exfoliation, with younger demographics embracing convenience and affordability in do-it-yourself regimens that deliver clinically meaningful results. Integration of chemical peels with complementary aesthetic modalities-such as microneedling, laser therapy, and injectable neuromodulators-has further enhanced treatment outcomes, enabling comprehensive approaches to wrinkles, pigmentation, and scar revision that boost patient satisfaction and retention. Digital transformation has also reshaped practice workflows: AI-driven image analysis and mobile teledermatology apps now streamline consultations, enabling practitioners to assess hydration, barrier integrity, and pigmentation patterns remotely with high precision, ultimately tailoring peel strength and composition on a per-patient basis. Meanwhile, the sustainability trend has spurred the adoption of eco-friendly acids and biodegradable packaging, aligning product portfolios with consumer demand for clean formulations and lower environmental impact amid tightening cosmetic regulations.

Assessing the 2025 U.S. Tariff Landscape and Its Ripple Effects on Chemical Peel Supply Chains, Cost Structures, and Market Accessibility

In 2025, sweeping U.S. tariff measures have introduced new cost dynamics across the chemical peeling supply chain, significantly affecting raw material sourcing and pricing. The implementation of a baseline 10 percent reciprocal tariff on non-Chinese chemical imports, alongside heightened duties on select metals and specialty chemicals, has increased input costs for key peel agents such as glycolic acid, ethanol, and phenol derivatives. Furthermore, proposed fees under Section 301 investigations threaten to add a multimillion-dollar load to freight and handling expenses for acid precursors imported from major trading partners, exacerbating margin pressures on both manufacturers and clinics. The beauty sector’s 30 percent levy on finished cosmetic products has also reshaped competitive positioning, forcing brands to reevaluate their global production footprints and consider nearshore alternatives to mitigate duty burdens. As a result, many chemical peel producers are negotiating new sourcing agreements, pivoting toward domestic acid synthesis or secure free-trade zones, while some smaller players face the risk of passing elevated costs to consumers or sacrificing market share.

Uncovering Key Segmentation Insights for Chemical Peeling Markets Spanning Agents, End Users, Applications, and Distribution Channels

Key segmentation analysis reveals that chemical peeling markets are intricately structured around four critical dimensions. First, agent selection spans alpha hydroxy acids-most notably glycolic, lactic, and malic acids-and beta hydroxy acid formulations centered on salicylic acid, alongside legacy peels like phenol and trichloroacetic acid, each tailored to depth and skin condition. Second, end-user segments encompass professional environments such as cosmetic surgery centers and dermatology clinics, complemented by the growing home-use channel and service-oriented venues including spas and salons, reflecting diverse practice models and consumer access points. Third, application-based differentiation captures the distinct objectives of acne treatment, pigmentation removal, scar revision, and wrinkle reduction, driving specialized peel protocols and marketing strategies. Finally, distribution channels bifurcate into offline procurement through clinical and retail outlets and online platforms, underscoring the rising influence of e-commerce on product reach and consumer education.

This comprehensive research report categorizes the Chemical Peeling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Chemical Agent

- End User

- Application

- Distribution Channel

Revealing Regional Dynamics Shaping Chemical Peeling Adoption and Growth Across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics continue to shape the global trajectory of chemical peeling adoption. In the Americas, robust demand stems from established healthcare infrastructure and a high prevalence of minimally invasive aesthetic procedures, positioning the United States as a leading revenue source and innovation hub. Meanwhile, the Europe, Middle East & Africa region sustains steady growth driven by aging demographics, regulatory harmonization under the EU’s cosmetic framework, and expanding private-pay medical practices. The Asia-Pacific market emerges as the fastest-growing territory, propelled by rising disposable incomes in urban centers, burgeoning medical tourism in countries such as South Korea and India, and a cultural emphasis on preventative skincare regimens, collectively fueling double-digit expansion in peel-based treatments.

This comprehensive research report examines key regions that drive the evolution of the Chemical Peeling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Chemical Peel Innovators and Brands That Are Defining Market Competition Through Product Excellence and Strategic Partnerships

Market competitiveness is defined by a cadre of leading innovators and established brands that drive product excellence and strategic outreach. Allergan (AbbVie) holds a prominent position with its SkinMedica peel series, renowned for delivering consistent clinical trial-backed outcomes and safety profiles. Merz Pharma, leveraging its global dermatology network, offers a diverse portfolio spanning mild AHAs to medium-depth TCA formulations, supported by practitioner training programs. Valeant’s Obagi Medical continues to expand its Blue Peel legacy, targeting hyperpigmentation and photoaging with concentrated glycolic and salicylic treatments. Galderma, through strategic partnerships, integrates Neocutis peptides into medium-depth peels, while specialized brands such as Glytone and IMAGE Skincare focus on high-percentage glycolic acid solutions for professional use. Emerging players from Asia and Latin America are also making inroads, capitalizing on localized formulation preferences and cost advantages, intensifying competition across regional markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemical Peeling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allergan Aesthetics, an AbbVie Company

- Bodycraft Salon Skin & Cosmetology Pvt. Ltd.

- Cosderma India Pvt. Ltd.

- Deciem Beauty Group Inc.

- Dermalogica, LLC

- Disha Skin & Laser Institute Pvt. Ltd.

- Dr. Dennis Gross Skincare, LLC

- Dr. Gondhane Skin & Cosmetic Centre Pvt. Ltd.

- Fasderma India Pvt. Ltd.

- Image Skincare, LLC

- Johnson & Johnson Services, Inc.

- L'Oréal S.A.

- Mediderma S.L.

- MedPeel, LLC

- NeoStrata Company, Inc.

- Obagi Cosmeceuticals LLC

- PCA Skin, LLC

- SkinLab India Pvt. Ltd.

- TEJ Skin & Cosmetic Clinic

- The Estée Lauder Companies Inc.

Actionable Strategies for Industry Leaders to Navigate Tariffs, Accelerate Innovation, and Capture Emerging Opportunities in Chemical Peeling

To navigate the evolving environment, industry leaders should prioritize supply chain resilience by diversifying acid precursors and securing tariff-exempt sources through free trade agreements or domestic synthesis facilities, thereby buffering the impact of duty fluctuations. Embracing a modular formulation strategy that allows for rapid customization of peel strength and agent composition can also empower practitioners to respond to emerging skin health trends and demographic shifts. Investment in digital platforms-ranging from AI-driven skin assessment tools to teleconsultation services-will enhance patient acquisition and foster long-term engagement, particularly among tech-savvy cohorts. Furthermore, forging partnerships with eco-certification bodies and integrating biodegradable packaging can reinforce brand credibility and meet growing sustainability mandates. Finally, continuous collaboration with regulatory stakeholders will ensure proactive compliance and facilitate expedited product launches in key regions.

Detailing a Robust Multi-Method Research Framework Integrating Primary Interviews and Secondary Data to Deliver Authoritative Market Insights

This market analysis employed a rigorous multi-method framework combining primary and secondary research phases. Expert interviews with dermatologists, clinic operators, and formulation scientists provided qualitative insights into practice trends and unmet needs, while a structured survey of over 120 industry professionals validated segmentation and pricing assumptions. Secondary research leveraged publicly available trade and regulatory databases, peer-reviewed dermatology literature, and proprietary import–export records to quantify tariff impacts and regional demand patterns. Data triangulation through cross-referencing multiple sources ensured the reliability of critical inputs, and an iterative validation process with subject matter experts refined the forecast scenarios and sensitivity analyses. Ethical protocols, including anonymization of interview data and compliance with international data privacy standards, were strictly adhered to throughout the research process.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemical Peeling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemical Peeling Market, by Chemical Agent

- Chemical Peeling Market, by End User

- Chemical Peeling Market, by Application

- Chemical Peeling Market, by Distribution Channel

- Chemical Peeling Market, by Region

- Chemical Peeling Market, by Group

- Chemical Peeling Market, by Country

- United States Chemical Peeling Market

- China Chemical Peeling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Observations to Conclude on the Outlook, Challenges, and Opportunities in the High-Growth Chemical Peeling Landscape

In summary, the chemical peeling landscape stands at an inflection point defined by advanced formulation science, digital enablers, and shifting trade dynamics. The convergence of personalized peel protocols, AI-powered consultations, and sustainable product strategies underscores the market’s maturation and complexity. Although new U.S. tariffs present short-term cost headwinds, they also catalyze supply chain innovation and localized production initiatives. Regional disparities in demand growth and regulatory environments will require tailored approaches, and competitive differentiation will hinge on agility in product development and distribution. By aligning strategic priorities with emerging consumer preferences and policy shifts, stakeholders can drive robust growth and solidify their positions within this vibrant market.

Engage With Ketan Rohom to Secure Comprehensive Chemical Peeling Market Intelligence and Drive Strategic Decisions Starting Today

To explore this indispensable resource and elevate your strategic decision-making, please contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive Chemical Peeling Market Research Report today

- How big is the Chemical Peeling Market?

- What is the Chemical Peeling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?