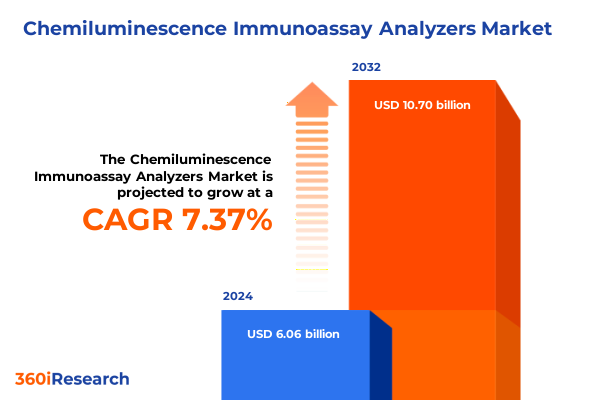

The Chemiluminescence Immunoassay Analyzers Market size was estimated at USD 6.51 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 7.36% to reach USD 10.70 billion by 2032.

A Strategic Overview Illuminating the Role of Chemiluminescence Immunoassay Analyzers in Advancing Precision Diagnostics and Clinical Decision-Making

Chemiluminescent immunoassay analyzers represent a sophisticated class of diagnostic instruments that leverage the light-emitting reaction of specific substrates to quantify antigen-antibody interactions. By harnessing chemiluminescence rather than traditional chromogenic or radioactive labels, these systems deliver superior analytical sensitivity and broad dynamic range. The mechanism involves labeling antibody or antigen molecules with luminescent compounds, which emit photons upon reaction with a trigger reagent. The intensity of emitted light correlates directly with analyte concentration, enabling precise measurement of biomarkers at trace levels

Rooted in a lineage that traces back to radioimmunoassay and enzyme-linked immunosorbent assays, chemiluminescence immunoassay techniques emerged to overcome limitations associated with radioactivity and colorimetric interference. Innovations such as electrochemiluminescent labels and magnetic bead separation have refined assay workflows, improving signal stability and minimizing background noise. These advances support multiplex detection and shorter turnaround times, making chemiluminescence immunoassays indispensable for clinical laboratories focused on early disease identification and therapeutic monitoring

Today’s chemiluminescence immunoassay analyzers range from fully automated benchtop systems designed for high-throughput central laboratories to portable units optimized for point-of-care settings. Integration with laboratory information systems and sophisticated data management software further enhances operational efficiency by streamlining sample tracking, result review, and quality control processes. This seamless connectivity, combined with robust performance metrics, underscores the critical role of chemiluminescence immunoassay analyzers in accelerating clinical decision-making across diverse healthcare environments

As healthcare shifts toward personalized medicine, the demand for rapid, accurate biomarker analysis has intensified. Chemiluminescence immunoassay analyzers meet this need by delivering highly reproducible results for a spectrum of biomarkers, including hormones, infectious disease antigens, cardiac markers, and oncology indicators. Their adaptability allows for customized assay panels, enabling clinicians to tailor diagnostic strategies to patient-specific profiles. Through continued innovation in assay chemistry and hardware design, chemiluminescence immunoassay analyzers are poised to drive the next wave of precision diagnostics

Emerging Technological and Operational Transformations That Are Redefining Chemiluminescence Immunoassay Platforms Across Research and Clinical Settings

Artificial intelligence and advanced analytics have begun to transform the functionality of chemiluminescence immunoassay analyzers, enabling real-time anomaly detection and predictive maintenance. Machine learning algorithms analyze assay signals and quality control parameters to flag deviations, reducing false positives and ensuring consistent performance. Additionally, AI-driven workflow optimization can dynamically adjust instrument settings and prioritize urgent samples, significantly improving laboratory throughput and resource allocation in high-demand environments

The proliferation of portable chemiluminescence immunoassay devices is redefining decentralized diagnostics, extending access to remote and resource-limited settings. These compact analyzers incorporate cloud-based data management, granting healthcare providers immediate visibility into test results and enabling seamless integration with electronic health records. By reducing reliance on centralized laboratory infrastructure, portable systems facilitate rapid screening during outbreaks and support on-site clinical trials, thereby accelerating the translation of research into patient care

Multiplex assay capabilities have become another pivotal trend, allowing simultaneous quantification of multiple analytes from a single sample. Innovations in microfluidic cartridge design and reagent formulations have streamlined assay workflows, minimizing sample volumes while maximizing information yield. This approach supports comprehensive diagnostic panels, ranging from cardiac risk assessment to infectious disease screening, all within a unified platform, which drives operational efficiency and reduces time to result

Service and financing models are also evolving, with manufacturers offering instrument-as-a-service arrangements and performance-based contracts. This shift reduces upfront capital requirements for laboratories and aligns vendor incentives with instrument uptime and reagent consumption. Combined with modular instrument architectures, these models enhance scalability and ensure that facilities can swiftly adapt to fluctuating testing volumes without incurring significant overhead costs

Assessing the Comprehensive Implications of 2025 United States Tariff Policies on the Supply Chain and Cost Structures of Immunoassay Solutions

In early 2025, the United States implemented a suite of tariff measures affecting a broad range of medical devices, reagents, and raw materials, with the objective of bolstering domestic manufacturing capacity. Notably, syringes, medical masks, gloves, and select diagnostic instruments faced increased import duties, with several tariff hikes scheduled to take effect on August 1, 2025. Healthcare supply chains, which rely heavily on foreign-sourced components, experienced immediate cost pressures as import duties on high-volume consumables rose from existing rates to as high as 50 percent for certain categories

Recognizing the critical nature of healthcare goods, the government granted temporary exclusions and extensions for key products. Of the 77 medical items previously exempted during earlier emergency declarations, the majority received a one-year extension through May 31, 2026, safeguarding vital supplies such as sterile drapes and anesthesia instruments from abrupt duty increases. This phased approach mitigated the risk of supply disruptions and allowed manufacturers to reassess sourcing strategies and negotiate new supplier agreements amid evolving trade policies

Beyond China-specific levies, the United States imposed a 10 percent global tariff on products entering from all trading partners starting April 5, 2025. This broad measure encompassed active pharmaceutical ingredients, laboratory plastics, and specialized electronic components integral to chemiluminescence immunoassay analyzers. Simultaneously, elevated duties on China-origin APIs, reaching up to 245 percent, compelled device manufacturers to evaluate alternative sourcing regions such as India and Germany, though these transitions introduced logistical and quality assurance challenges

Collectively, the new tariff landscape has prompted analyzers’ manufacturers and consumable suppliers to absorb higher landed costs or pass them through to end users. Diagnostic laboratories report a notable uptick in reagent pricing and consumable expenses, which in turn exerts pressure on reimbursement margins. In response, several organizations have explored reshoring component production and leveraging tariff-exempt trade corridors. However, such strategic realignment necessitates capital investment and extended qualification timelines, underscoring the complex interplay between trade policy and healthcare delivery economics

Deep Dive into Product, Component, Technological, Application, and End User Segmentation Driving Developments in Chemiluminescence Immunoassay Markets

Examining the market through the lens of product segmentation reveals divergent growth trajectories for consumables versus instrument offerings. Consumables-comprising assay kits, quality controls, and reagents-continue to experience robust demand driven by routine and specialized testing protocols. Meanwhile, instrument platforms bifurcate into benchtop systems optimized for high-throughput laboratory workflows and portable analyzers engineered for point-of-care use. The interplay between consumable utilization rates and instrument adoption underscores the importance of synchronized supply strategies to maximize uptime and analytical accuracy.

In terms of component analysis, luminometers remain the core detection modules that convert chemiluminescent emissions into quantifiable signals, while software solutions play an increasingly critical role in data acquisition and management. Data management software streamlines result archiving and audit trails, whereas workflow management tools automate task scheduling and instrument calibration. Vendors that integrate hardware and software ecosystems can deliver turnkey solutions that simplify laboratory operations and enhance regulatory compliance.

From a technological standpoint, the evolution spans advanced molecular diagnostics platforms that combine nucleic acid amplification with chemiluminescence detection to automated analyzers featuring hands-off operation and clinical laboratory analyzers designed for extensive assay menus. Point-of-care testing devices represent a separate category, leveraging compact form factors and rapid assay chemistries for decentralized settings. Each technology tier addresses distinct testing needs, from high-sensitivity oncology markers to urgent infectious disease screening, thereby shaping market dynamics across clinical and research segments.

Application area segmentation highlights the pivotal role of chemiluminescence immunoassays in cancer detection, cardiovascular biomarker testing, endocrinology panels, and infectious disease diagnostics. The versatility of assay menus enables cross-application deployment, although assay validation requirements differ by clinical domain. End users range from high-complexity diagnostic laboratories and hospital central labs to academic and industrial research institutes, as well as specialty clinics focused on niche therapeutic areas. Understanding how each segment interacts with technological and product offerings is essential for stakeholders seeking to optimize market positioning and drive targeted innovation.

This comprehensive research report categorizes the Chemiluminescence Immunoassay Analyzers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Automation Level

- Sample Type

- Connectivity

- Application Area

- End User

Unveiling Regional Dynamics: Key Insights from the Americas, EMEA, and Asia-Pacific That Are Steering Chemiluminescence Immunoassay Adoption

In the Americas, the United States serves as the primary growth engine, supported by well-established reimbursement frameworks and significant investment in laboratory infrastructure. Canada’s centralized public health system also contributes to robust demand for both automated and semi-automated analyzers, particularly in high-volume provincial labs. Regional procurement strategies emphasize total cost of ownership and instrument uptime, leading to long-term service agreements and reagent cost-sharing models that enhance sustainability and predictability.

Europe, the Middle East, and Africa present a heterogeneous landscape marked by differentiated healthcare funding mechanisms and varying regulatory requirements. Western European nations prioritize cutting-edge molecular diagnostic integration and advanced automation, while several Middle Eastern markets invest heavily in expanding laboratory capacity to meet growing population health needs. In sub-Saharan Africa, portable and cost-effective immunoassay systems facilitate decentralized testing for infectious diseases, driven by international public health initiatives and mobile outreach programs, highlighting a shift toward agility and resilience in resource-constrained settings.

Asia-Pacific exhibits some of the fastest adoption rates, fueled by government-led screening programs in countries such as China, India, and South Korea. Demand for high-throughput central lab analyzers remains strong in urban centers, whereas rural and tier-two markets increasingly utilize portable chemiluminescence platforms for point-of-care screening. Local manufacturers are scaling production to improve cost competitiveness, and strategic partnerships between global and regional firms are accelerating technology transfer and expanding distribution networks across the region.

This comprehensive research report examines key regions that drive the evolution of the Chemiluminescence Immunoassay Analyzers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Collaborators Shaping the Competitive Landscape of Chemiluminescence Immunoassay Analyzer Production and Services

Key industry players have demonstrated differing strategies to maintain competitive advantage. Established multinational corporations have focused on expanding assay menus and enhancing instrument modularity to serve diverse clinical needs. Meanwhile, emerging regional vendors leverage agile manufacturing practices and localized support services to capture market share in high-growth territories. This dual-pronged competitive dynamic fosters continuous innovation in assay development and system integration.

Collaborative ventures between instrument manufacturers and software developers have yielded cohesive solutions that streamline data workflows and regulatory reporting. Joint initiatives with reagent producers enable co-development of proprietary chemistries and optimize assay sensitivity. Such alliances accelerate time to market for novel biomarker assays and generate synergistic opportunities across R&D, production, and distribution.

Recent M&A activity and strategic investments underscore the sector’s consolidation trajectory. Several major firms have acquired smaller specialized companies to broaden their assay portfolios and secure intellectual property assets in high-value diagnostic areas. Concurrently, venture capital funding has targeted startups developing next-generation chemiluminescence platforms, particularly those integrating nanomaterials and microfluidic innovations, signaling an ongoing influx of disruptive technologies into the marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chemiluminescence Immunoassay Analyzers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agappe Diagnostics Ltd

- Beckman Coulter, Inc. by Danaher Corporation

- Beijing Hotgen Biotech Co., Ltd.

- Bio-Rad Laboratories, Inc.

- Biobase Biodusty(Shandong), Co., Ltd.

- bioMérieux S.A.

- Cardinal Health, Inc.

- Chengdu Seamaty Technology Co., Ltd.

- DiaSorin Inc.

- Diazyme Laboratories

- Epitope Diagnostics Inc.

- F. Hoffmann-La Roche Ltd.

- Fapon Biotech Inc.

- Fisons Instruments Ltd

- Getein Biotech, Inc.

- Guangzhou Wondfo Biotech Co., Ltd.

- J. Mitra & Co. Pvt. Ltd.

- Maccura Biotechnology Co., Ltd.

- Medicalsystem Biotechnology Co., Ltd

- Meril Life Sciences Pvt. Ltd.

- Nanjing Norman Biological Technology Co., Ltd.

- Nanjing Poclight Biotechnology Co., Ltd.

- Randox Laboratories Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen New Industries Biomedical Engineering Co., Ltd.

- Siemens Healthineers

- Sysmex Corporation

- Thermo Fisher Scientific, Inc.

- Werfen S.A.

- Xiamen Biotime Biotechnology Co., Ltd.

Actionable Strategic Recommendations Enabling Industry Leaders to Capitalize on Opportunities and Navigate Challenges in the Immunoassay Analyzer Sector

Industry leaders should prioritize investments in automation and AI-driven analytics to differentiate their offerings and enhance laboratory productivity. By embedding predictive maintenance and intelligent workload management within instrument firmware and software, vendors can reduce downtime and deliver measurable operational efficiencies to end users.

To mitigate trade policy volatility and tariff-related cost pressures, manufacturers and reagent suppliers must diversify sourcing strategies. Incorporating dual-sourcing agreements and exploring nearshoring opportunities can provide resilience against import duty fluctuations, while targeted inventory management practices ensure continuity of supply without exacerbating working capital constraints.

Developing multiplex assay panels tailored for high-growth application areas such as oncology and infectious disease screening can broaden revenue streams and reinforce customer loyalty. Collaborating with academic and clinical research institutions to validate novel biomarkers will accelerate clinical adoption and position vendors at the forefront of precision medicine initiatives.

Transforming traditional service contracts into outcome-based models that align vendor incentives with instrument performance metrics will strengthen long-term partnerships. Offering flexible financing and reagent subscription programs can lower barriers to entry for smaller laboratories and facilitate wider adoption of advanced chemiluminescence immunoassay technology.

Robust Research Methodology Employed to Ensure Reliable and Transparent Analysis of the Chemiluminescence Immunoassay Analyzer Market

This analysis integrates primary research through in-depth interviews with lab directors, procurement officers, and clinical specialists across major global markets. These qualitative insights provided firsthand perspectives on technology adoption drivers, operational challenges, and procurement criteria, ensuring that findings reflect real-world decision-making processes.

Secondary sources comprised peer-reviewed journals, industry publications, regulatory filings, and trade association reports. Cross-referencing data from multiple credible outlets enabled comprehensive mapping of technology trends, competitive dynamics, and policy influences.

Quantitative and qualitative data were triangulated to verify consistency and accuracy. Methodical cross-comparison of interview findings with publicly available statistics and financial disclosures enhanced the robustness of conclusions, while periodic peer reviews and expert panel validations mitigated biases and reinforced analytical rigor.

While striving for completeness, this research acknowledges limitations in publicly disclosed financial details and proprietary assay performance metrics. The scope focused on chemiluminescence immunoassay analyzers and associated consumables without extending to other immunoassay modalities, thereby offering a targeted and actionable market overview.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chemiluminescence Immunoassay Analyzers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chemiluminescence Immunoassay Analyzers Market, by Component

- Chemiluminescence Immunoassay Analyzers Market, by Type

- Chemiluminescence Immunoassay Analyzers Market, by Automation Level

- Chemiluminescence Immunoassay Analyzers Market, by Sample Type

- Chemiluminescence Immunoassay Analyzers Market, by Connectivity

- Chemiluminescence Immunoassay Analyzers Market, by Application Area

- Chemiluminescence Immunoassay Analyzers Market, by End User

- Chemiluminescence Immunoassay Analyzers Market, by Region

- Chemiluminescence Immunoassay Analyzers Market, by Group

- Chemiluminescence Immunoassay Analyzers Market, by Country

- United States Chemiluminescence Immunoassay Analyzers Market

- China Chemiluminescence Immunoassay Analyzers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Conclusive Insights Synthesizing Key Findings and Future Directions for Stakeholders in the Chemiluminescence Immunoassay Analyzer Field

The landscape of chemiluminescence immunoassay analyzers is marked by rapid technological evolution, wherein automation, software integration, and novel detection methodologies converge to drive diagnostic precision. Segmentation analysis highlights differentiated value propositions across product and application domains, while regional dynamics illustrate variable adoption patterns shaped by healthcare infrastructure and policy environments.

Going forward, the integration of AI and machine learning will become integral to analyzer performance, fostering predictive diagnostics and personalized healthcare pathways. Concurrently, supply chain resilience will remain paramount as trade policies evolve, prompting strategic diversification and localized manufacturing models.

Collaboration between instrument providers, reagent developers, and digital health platforms will be critical to unlocking new diagnostic capabilities. By aligning innovation strategies with clinical needs and regulatory expectations, stakeholders can co-create solutions that enhance patient outcomes and optimize laboratory workflows.

Ultimately, the continued refinement of chemiluminescence immunoassay technology and the implementation of forward-looking operational strategies will underpin sustainable growth and deliver transformative benefits for global healthcare systems.

Engage with Expertise: Secure Your Comprehensive Chemiluminescence Immunoassay Analyzer Report through Direct Consultation with Our Associate Director of Sales & Marketing

Maximize your strategic advantage by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise in diagnostic technology and market dynamics will guide you through the report’s comprehensive insights, enabling informed decision-making and tailored strategic planning.

He will provide personalized consultation to address your organization’s unique challenges and highlight opportunities within the chemiluminescence immunoassay analyzer sector. From segmentation deep dives to regional outlooks and tariff impact assessments, you will gain clarity on the factors shaping the competitive landscape.

Reach out today to arrange a one-on-one briefing and secure access to the full market research report. Equip your team with actionable intelligence that drives innovation and positions your organization for success in the evolving diagnostic market landscape.

- How big is the Chemiluminescence Immunoassay Analyzers Market?

- What is the Chemiluminescence Immunoassay Analyzers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?