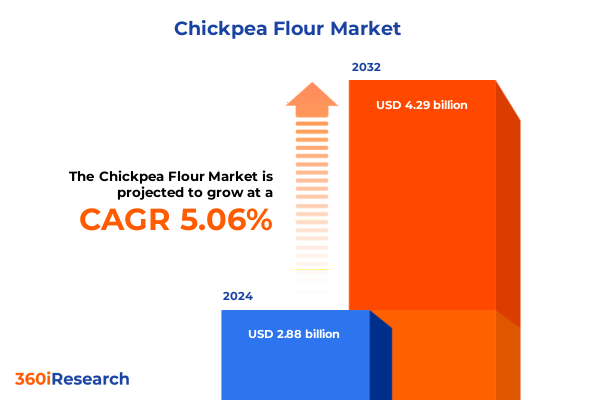

The Chickpea Flour Market size was estimated at USD 3.03 billion in 2025 and expected to reach USD 3.19 billion in 2026, at a CAGR of 5.07% to reach USD 4.29 billion by 2032.

Unveiling the Potential of Chickpea Flour: Exploring Nutritional, Market, and Consumer Dynamics Driving Its Rise in Global Food Innovation

As the global food industry continues its rapid evolution, chickpea flour has emerged as a versatile and nutritious ingredient that bridges traditional culinary applications and modern dietary demands. The surge in consumer preference for plant-based proteins, combined with heightened awareness of gluten sensitivities, has propelled chickpea-derived products into both mainstream and specialty markets. Beyond its culinary versatility, chickpea flour boasts a nutrient profile rich in protein, fiber, vitamins, and minerals, making it an attractive choice for formulators aiming to enhance the nutritional value of baked goods, pasta, snacks, and more.

Fueled by evolving consumer lifestyles that prioritize health, convenience, and sustainability, manufacturers are innovating with chickpea flour across an expanding array of applications. From gluten-free pastries that deliver structure and mouthfeel to savory snacks that capitalize on chickpea flour’s unique flavor profile, the ingredient is carving out a distinct position within product portfolios. At the same time, regulatory bodies in key markets are increasingly recognizing the importance of clear allergen labeling and clean-label formulations, further catalyzing the adoption of chickpea flour as a transparent and consumer-friendly ingredient.

Navigating Radical Industry Transformations: How Shifting Consumer Preferences, Technological Advances, and Sustainability Imperatives Are Reshaping Chickpea Flour Markets

Over the past few years, the chickpea flour market has experienced profound shifts driven by changing consumer priorities, technological advancements, and evolving supply chain models. Initially prized primarily for its traditional role in Middle Eastern and South Asian cuisines, chickpea flour is now at the forefront of plant-based and gluten-free innovations. This evolution has been underpinned by a convergence of healthier eating trends, environmental concerns over animal protein, and a growing emphasis on ingredient transparency.

Technological developments in milling, fractionation, and formulation have enhanced the functional properties of chickpea flour, enabling food developers to deliver consistent quality and performance in applications ranging from bakery to dairy alternatives. Concurrently, digitization across procurement and distribution has introduced greater agility, allowing industry participants to optimize sourcing and respond quickly to demand fluctuations. Sustainability initiatives, encompassing regenerative agriculture practices and optimized water usage, have strengthened the ingredient’s appeal to environmentally conscious consumers.

As industry stakeholders collaborate on research and development and forge new partnerships, chickpea flour’s role within the food innovation ecosystem is set to expand further. Collectively, these transformative shifts are redefining competitive benchmarks, requiring companies to align their strategies with consumer expectations for health, sustainability, and culinary excellence.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Reforms on Chickpea Flour Supply Chains, Cost Structures, and Industry Adaptation Strategies

In 2025, the introduction of new U.S. tariffs on agricultural imports has had a pronounced effect on chickpea flour supply chains, altering cost structures and compelling rapid adaptation. By elevating duties on key importing regions, these policies have driven up input costs for manufacturers reliant on external suppliers. As a result, end-to-end value chains have experienced pressure, with many processors passing higher raw material costs downstream to maintain margins, leading to price adjustments for end consumers.

At the same time, domestic growers and millers have accelerated capacity expansions to capitalize on the tariff-induced shift away from certain international sources. This surge in local production has not only spurred investments in advanced processing technologies but also fostered a more resilient regional value chain. Food companies are diversifying procurement by forging partnerships with non-tariffed origin markets, leveraging flexible contracts and hedging strategies to mitigate exchange rate volatility and minimize exposure to bilateral trade tensions.

Taken together, these developments underscore the importance of strategic agility and diversified sourcing models. The initial tariff shock has prompted industry leaders to reevaluate their supplier portfolios, invest in midstream processing capabilities, and strengthen collaborations with policymakers. As the regulatory environment continues to evolve, companies that effectively balance domestic scaling with intelligent global sourcing will be best positioned to navigate further trade policy shifts.

Deep Dive into Chickpea Flour Market Segmentation Reveals Critical Certification, Product Types, Distribution Methods, Varietal Preferences, and Application Trends

The chickpea flour market exhibits nuanced segmentation across multiple dimensions, each offering insights into consumer behavior, product innovation, and distribution strategies. Certification pathways reveal a bifurcation between conventional and organic, with organic variants commanding a price premium driven by the clean-label movement and the quest for chemical-free sourcing. Within product types, raw flour maintains its dominance in traditional applications, while roasted options gain traction among specialty food developers seeking intensified flavor profiles and extended shelf life.

Distribution channels further diversify market access, with online retail capturing the convenience-driven consumer and specialty stores catering to gourmet and health-oriented shoppers. Meanwhile, supermarkets and hypermarkets remain critical for mass-market penetration, leveraging promotional capabilities and extensive distribution networks. Variety preferences between Desi and Kabuli cultivars continue to influence formulation choices, as Desi’s robust flavor suits ethnic cuisines, while Kabuli’s milder profile aligns with Western-style baked goods.

On the demand side, household consumption remains the cornerstone of volume, benefiting from increasing at-home cooking trends. Food service channels, particularly quick-service and casual dining, are embedding chickpea flour into high-margin menu innovations. At the industrial level, manufacturers integrate chickpea flour into co-manufactured products such as nutraceuticals and pet nutrition, underscoring the ingredient’s adaptability. Lastly, applications span bakery products, confectionery, pasta, and snacks, each segment exhibiting tailored functional requirements that drive specialized product development and performance optimization.

This comprehensive research report categorizes the Chickpea Flour market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Certification

- Type

- Variety

- Distribution Channel

- End User

- Application

Regional Dynamics Steering Chickpea Flour Demand Patterns Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets Amid Diverse Economic and Cultural Contexts

Regional dynamics are instrumental in shaping the trajectory of chickpea flour deployment, reflecting distinct economic, cultural, and regulatory landscapes. In the Americas, a convergence of plant-based dietary shifts and robust e-commerce infrastructure has spurred rapid adoption. The United States, as a major consumer and importer of chickpea flour, is witnessing innovation in both retail and food service, while Canada’s strong agricultural base supports upstream growth and export potential.

Across Europe, the Middle East, and Africa, consumption patterns are deeply rooted in culinary traditions, yet are evolving alongside health and sustainability concerns. Western European markets are championing organic certification and clean-label formulation, while Middle Eastern manufacturers leverage established legumes expertise to expand into adjacent markets. In regions of North and sub-Saharan Africa, chickpea flour is increasingly recognized for its nutritional benefits amid food security initiatives, stimulating local processing investments and public–private collaborations.

The Asia-Pacific region presents a complex tapestry of opportunities and challenges. India remains the world’s largest chickpea producer, with integrated value chains connecting smallholder farmers to commercial processors. Simultaneously, Southeast Asian markets are emerging as innovation hotspots for snack products and gluten-free bakery, fueled by rising disposable incomes and shifting dietary aspirations. Regulatory harmonization and infrastructure enhancements across key Asia-Pacific economies are further facilitating cross-border trade and technology transfer.

This comprehensive research report examines key regions that drive the evolution of the Chickpea Flour market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players in the Chickpea Flour Industry: Strategic Alliances, Innovation Pipelines, Production Capacity Expansions, and Market Positioning Narratives

Leading companies in the chickpea flour industry are distinguishing themselves through strategic alliances, capacity expansions, and a relentless focus on innovation. Global agribusiness giants are leveraging their extensive processing networks to introduce premium chickpea flour variants, combining scale efficiencies with rigorous quality controls. Mid-size specialized millers are forging joint ventures with technology providers, integrating novel fractionation and functionalization techniques to develop high-protein, reduced-carb formulations.

Many organizations are cultivating partnerships with research institutions to accelerate the development of application-specific blends, targeting the bakery, snack, and meat alternative sectors. These collaborations often extend into co-innovation centers, where cross-functional teams pilot new processing methods and performance-enhancing additives. In parallel, leading producers are investing in digital traceability platforms to ensure end-to-end supply chain transparency, satisfying both regulatory requirements and consumer expectations for sourcing integrity.

Competitive positioning is further reinforced by targeted marketing campaigns that emphasize clean-label credentials, non-GMO endorsements, and sustainable agronomy practices. Several major players have also announced expansions of their on-site analytical laboratories, enabling real-time quality assurance and rapid scale-up of proprietary ingredient technologies. Collectively, these initiatives underscore the strategic imperative to blend operational excellence with consumer-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chickpea Flour market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anthony’s Goods LLC

- Archer Daniels Midland Company

- Ardent Mills, LLC

- Axiom Foods, Inc.

- Bob’s Red Mill Natural Foods, Inc.

- Cargill, Incorporated

- CHS Inc.

- Ingredion Incorporated

- Nature Bio-Foods Ltd.

- Navitas LLC

- Parakh Agro Industries Limited

- PLT Health Solution

- Puris Foods, LLC

- Rani Foods, LP

- Roquette Frères S.A.

- Soofer Co., Inc.

- Tate & Lyle PLC

- The Scoular Company

- Woodland Foods, Ltd.

- Xinghua Lianfu Food Co., Ltd.

Pragmatic Strategies for Chickpea Flour Industry Leaders to Capitalize on Emerging Opportunities Through Product Innovation, Strategic Sourcing, and Operational Excellence

Industry leaders can harness emerging opportunities by adopting a multi-pronged strategy that emphasizes strategic sourcing, product innovation, and operational resilience. Developing flexible procurement frameworks allows companies to pivot between domestic and international suppliers, ensuring continuity amid tariff fluctuations and geopolitical uncertainties. By integrating advanced analytics into sourcing decisions, organizations can anticipate price volatility and optimize contract timing for raw material purchases.

Simultaneously, investing in research-driven product development will unlock new application horizons. Leveraging novel processing technologies, such as high-protein extraction and taste-masking techniques, can differentiate product portfolios and command premium pricing. Collaborations with academic and commercial partners will accelerate the introduction of functional blends customized for specific use cases, from gluten-free baking to plant-based meat analogs.

Operationally, optimizing manufacturing footprint and enhancing digital supply chain capabilities will bolster cost efficiency and responsiveness. Implementing real-time monitoring systems and predictive maintenance protocols ensures high equipment uptime and consistent quality output. Finally, deepening engagement with end-user segments through targeted marketing and co-creation initiatives will strengthen brand loyalty and expand market share in both traditional and emerging channels.

Methodical Research Framework Underpinning Chickpea Flour Market Insights Through Integrated Primary and Secondary Data, Expert Interviews, and Rigorous Validation

This research integrates a blend of primary and secondary methodologies to ensure comprehensive market intelligence. Secondary sources include industry publications, trade journals, regulatory filings, and publicly available financial records, which provide a foundational understanding of historical trends, competitive landscapes, and regulatory frameworks. These insights are triangulated with proprietary databases and supply chain analyses to capture real-time developments and regional nuances.

Primary research involved structured interviews and surveys with key stakeholders across the value chain, including cultivators, processors, food manufacturers, distributors, and end users. These engagements yielded qualitative perspectives on evolving consumer preferences, technology adoption rates, and unmet market needs. A series of expert panels and workshops facilitated in-depth discussions on emerging applications, sustainability practices, and risk mitigation strategies related to trade policies and supply disruptions.

Analytical techniques such as cross-segmentation analysis, scenario planning, and sensitivity testing were employed to validate findings and stress-test strategic assumptions. Rigorous data validation processes, including consistency checks and peer reviews, underpin the credibility of the insights. Together, this multi‐layered approach ensures that the report delivers actionable guidance grounded in empirical research and robust analytical frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chickpea Flour market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chickpea Flour Market, by Certification

- Chickpea Flour Market, by Type

- Chickpea Flour Market, by Variety

- Chickpea Flour Market, by Distribution Channel

- Chickpea Flour Market, by End User

- Chickpea Flour Market, by Application

- Chickpea Flour Market, by Region

- Chickpea Flour Market, by Group

- Chickpea Flour Market, by Country

- United States Chickpea Flour Market

- China Chickpea Flour Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Insights on the Evolving Chickpea Flour Landscape: Synthesis of Key Trends, Strategic Imperatives, and Future Outlook for Industry Stakeholders

In summary, the chickpea flour landscape is undergoing a significant metamorphosis driven by dietary shifts, technological innovation, and evolving trade policies. The ingredient’s nutritional advantages and functional versatility have positioned it as a key component in health-oriented and specialty food formulations. Simultaneously, transformative trends in supply chain digitization and sustainability practices are redefining competitive dynamics.

The imposition of new tariffs in 2025 has served both as a disruptor and a catalyst for domestic scaling and strategic sourcing realignments. Companies that have embraced flexible procurement models and invested in processing innovations are demonstrating resilience in the face of policy volatility. At the same time, segmentation and regional analyses reveal diverse growth trajectories shaped by consumer behaviors, regulatory regimes, and infrastructural capabilities.

Looking ahead, sustained collaboration among industry participants, research institutions, and policymakers will be critical to navigating future challenges and capturing new growth avenues. By balancing market responsiveness with strategic investments in technology and partnerships, stakeholders can harness the full potential of chickpea flour as a cornerstone of the modern food innovation agenda.

Connect with Ketan Rohom to Access the Comprehensive Chickpea Flour Market Research Report for Strategic Insights, Custom Analysis, and Growth Acceleration

For tailored insights and in-depth analysis of the global chickpea flour landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the report’s detailed findings and strategic recommendations. By engaging directly with Ketan Rohom, you’ll gain privileged access to customized data extracts, expert consultations, and advanced market intelligence tailored to your unique business challenges. Accelerate your strategic planning and stay ahead of evolving consumer and regulatory trends by securing your copy of the comprehensive chickpea flour market research report today

- How big is the Chickpea Flour Market?

- What is the Chickpea Flour Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?