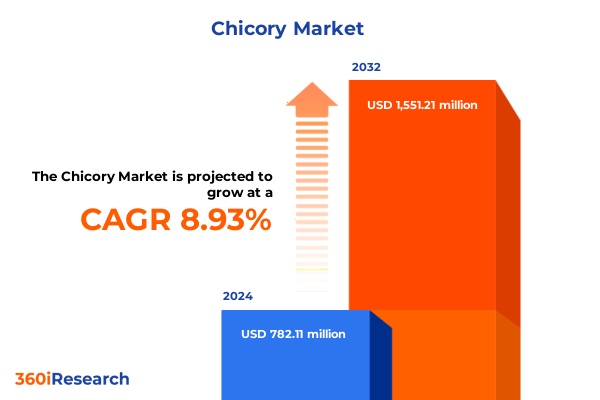

The Chicory Market size was estimated at USD 838.64 million in 2025 and expected to reach USD 901.91 million in 2026, at a CAGR of 9.18% to reach USD 1,551.20 million by 2032.

Deep Dive into the Multifaceted World of Chicory Root Fibers Revealing Market Dynamics, Health Trends, and Supply Chain Realities

Chicory root fibers, predominantly extracted as inulin, have emerged as an indispensable functional ingredient across food, beverage, pharmaceutical, and cosmetic industries. Rooted in centuries of traditional use, modern demand is now propelled by a convergence of consumer wellness priorities and technological advancements in extraction and processing. Notably, the supply chain for chicory-derived inulin remains anchored in Europe, where specialized processing facilities ensure consistent quality and scale to meet global needs. This geographic concentration, however, introduces considerations around trade policies and logistics, particularly as businesses seek resilient sourcing strategies amid evolving international regulations.

As natural, plant-based prebiotics gain traction for their proven benefits to gut microbiota, appetite regulation, and digestive health, end markets are rapidly diversifying. Manufacturers are leveraging chicory fibers to enhance texture, reduce sugar content, and fortify nutritional profiles in everything from coffee substitutes and tea blends to bakery and dairy products. Meanwhile, the cosmetics and personal care sector values the gentle, clean-label appeal of chicory-derived ingredients for skin and hair formulations. Against this backdrop, industry stakeholders must navigate both opportunities and complexities inherent in a segment defined by innovation, regulatory scrutiny, and rapidly shifting consumer priorities.

Navigating the Wave of Transformative Shifts in Consumer Preferences, Technology Innovations, and Sustainability Practices Driving Chicory Market Evolution

The chicory market landscape is currently defined by transformative shifts that span technologies, consumer expectations, and sustainability imperatives. At the heart of this evolution is consumer awareness; global interest in prebiotic fibers has climbed markedly, with surveys indicating an increase from 51% in 2018 to 61% in 2022 in the share of consumers actively seeking prebiotic products. This behavioral change is driving food and beverage innovators to incorporate inulin not only for its functional benefits but also for its alignment with plant-based and clean-label trends.

On the technological front, extraction and separation methods have progressed far beyond conventional hot-water techniques. Pioneers such as Sensus have adopted closed-loop water systems and are piloting enzyme-assisted processes designed to lower energy consumption and enhance molecular weight control in final inulin grades. Concurrently, membrane filtration and chromatographic approaches are enabling producers to tailor inulin chain lengths for specific applications, from high-viscosity food gels to low-viscosity supplement blends.

Sustainability has also emerged as a critical focus area. Investments in energy efficiency, water reuse, and process integration are setting new industry standards. For example, automated real-time quality monitoring and AI-driven process controls are increasingly used to reduce waste and optimize resource utilization. These advancements not only respond to consumer demands for responsible sourcing but also underpin cost competitiveness and supply security in a highly dynamic marketplace.

Unpacking the Layered Effects of United States Tariffs and Trade Policies on Chicory Ingredient Sourcing and Cost Structures in 2025

United States trade policy developments in 2025 have introduced layered tariffs that directly affect the importation of chicory-derived ingredients, particularly inulin. Effective April 5, a universal 10% tariff was imposed on a wide range of non-exempt imports, followed by reciprocal country-specific duties of 11–50% beginning April 9. These measures are additive to existing Section 301 tariffs, resulting in a cumulative rate that can reach as high as 145% on goods originating from China. Such steep duties have immediate implications for cost structures, squeezing margins and compelling ingredient buyers to reassess supply routes.

Inulin was explicitly included in proposed second-wave tariffs, joining an array of botanical fibers and botanical extracts under heightened scrutiny. While industry associations are actively lobbying for tariff exemptions on prebiotic fibers given their critical role in nutrition and health products, regulatory outcomes remain uncertain. Some dietary ingredients, such as certain vitamins and amino acids, have been granted exemptions as of early April, yet inulin’s status remains in flux, keeping procurement costs volatile and spot prices under pressure.

The tariff environment underscores the importance of strategic sourcing diversification. Many manufacturers are exploring local processing partnerships in the Americas and Asia-Pacific to hedge against escalating duties. Meanwhile, forward-looking stakeholders are engaging directly with policymakers and trade bodies to shape more favorable regulatory frameworks for prebiotic ingredients. These multifaceted dynamics illustrate the critical need for continuous monitoring of trade policies to maintain supply reliability and cost discipline.

Revealing Key Segmentation Insights Across Applications, Product Types, Forms, and Distribution Channels Informing Strategic Chicory Market Decisions

A nuanced appreciation of market segmentation reveals where strategic value can be unlocked across diverse industry applications. Within animal feed, livestock and poultry formulations are embracing chicory derivatives to improve gut health in animals, while premium pet food brands seek natural fiber sources to differentiate their offerings. Meanwhile, the beverage segment is innovating with coffee substitutes and specialty tea blends that leverage inulin’s solubility and clean-label credentials to enhance flavor profiles and mouthfeel.

In cosmetics, manufacturers are capitalizing on chicory’s gentle profile in hair conditioning and skin hydration formulations, highlighting its prebiotic properties in marketing to health-conscious consumers. In food processing, bakery, dairy, and snack producers recognize chicory fibers as multifunctional ingredients that both improve texture and reduce sugar content, fitting squarely within the wider movement toward reduced-sugar and high-fiber product lines. The pharmaceutical and dietary supplement sector continues to adopt digestive health products and prebiotic supplements by exploiting the clinically supported bifidogenic effects of chicory inulin.

Product type segmentation further underscores the scope for tailored solutions. Inulin, supplied in powder or syrup, dominates applications requiring soluble dietary fibers with specific chain length distributions. Raw chicory inputs in the form of dried leaves and fresh roots serve specialized supply chains, while roasted chicory powders and granules have a long-standing tradition in caffeine-free coffee analogues. The choice of form-whether granules, liquid extracts, or powders-permits formulators precise control over application consistency and dosage.

Distribution channels also shape market dynamics. Although offline retail through specialty stores and supermarket shelves remains vital for consumer-facing products, direct sales and ecommerce websites have surged as digital adoption accelerates. The interplay between physical and digital commerce channels is prompting ingredient suppliers to refine packaging, traceability, and consumer engagement strategies to optimize reach and brand loyalty.

This comprehensive research report categorizes the Chicory market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Distribution Channel

Deciphering Regional Nuances in Consumer Behavior, Production Landscapes, and Growth Drivers Shaping Chicory Demand in Key Global Zones

Regional dynamics in the chicory market reflect a complex tapestry of production strengths and consumption trends. In the Americas, while the United States and Canada rely heavily on imports of chicory inulin, there is a growing emphasis on domestic extraction facilities and partnerships designed to mitigate tariff exposure and strengthen supply chain resilience. Latin American markets, driven by rising disposable incomes and expanding health and wellness sectors, are also emerging as attractive downstream destinations for value-added fiber ingredients.

Europe, Middle East, and Africa collectively anchor the global supply base for chicory root fibers. Belgium, France, and the Netherlands remain pivotal processing hubs with established infrastructure and deep expertise in inulin refinement. Investment in energy-efficient production and sustainable agronomic practices is particularly salient in Western Europe, where regulatory frameworks and consumer pressures converge to demand lower carbon footprints. In contrast, the Middle East and Africa are characterized by nascent but rapidly growing food processing industries that are beginning to integrate chicory-derived fibers as they expand their nutritional and functional product portfolios.

Asia-Pacific is undergoing its own renaissance in functional fiber consumption, led by heightened awareness of gut health and digestive well-being across China, Japan, Australia, and India. Increasing consumer interest in plant-based diets and digital commerce growth are reshaping distribution models. Concurrently, regional manufacturing capabilities in food ingredient processing are advancing, with capacity additions in China and Australia poised to complement traditional European supply channels. These shifts are fostering new trade relationships and prompting global incumbents to align production footprints more closely with regional demand centers.

This comprehensive research report examines key regions that drive the evolution of the Chicory market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market-Leading Chicory Root Fiber Producers Championing Innovation, Sustainability, and Strategic Expansion in a Dynamic Industry Landscape

Industry-leading producers of chicory root fibers are distinguishing themselves through strategic investments, sustainability credentials, and process innovations. BENEO, for example, completed a €90 million investment in its Pemuco, Chile facility, boosting global capacity for prebiotic chicory fibers by 30% while simultaneously reducing specific energy consumption by 35% through process optimization and energy reuse systems. This dual focus on scale and sustainability demonstrates a model for enhancing competitive positioning in a market where environmental stewardship is critical.

Sensus, a prominent Dutch cooperative, has been at the forefront of deploying green extraction technologies, implementing closed-loop water systems and piloting enzyme-assisted processes that lower operational temperatures and improve yield selectivity for high-purity inulin extracts. Its patent portfolio around membrane filtration configurations underscores a commitment to offering customized inulin grades tailored to specific applications, from high-viscosity gel systems to fast-dissolve powder blends.

Cosucra, another major player rooted in Belgium, has secured €45 million in new financing to advance an ambitious transformation and growth plan. This funding supports both an energy transition across its pea and chicory factories-targeting a 50% reduction in carbon footprint per kilogram of product-and a significant increase in chicory production capacity under the FIBRULINE™ brand through 2030. By aligning its clean energy initiatives with capacity expansion, Cosucra is reinforcing its value proposition around both performance and sustainability in functional fiber markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chicory market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs-AG

- Archer Daniels Midland Company

- Beneo GmbH

- Biorigin Lda

- Cargill, Incorporated

- Cosucra Groupe Warcoing SA

- Cremer Oleo GmbH & Co. KG

- Emsland Group GmbH

- Ingredion Incorporated

- Shaanxi Sciphar Natural Product Co Ltd.

- ZuChem, Inc.

Driving Growth and Resilience in the Chicory Sector Through Innovative Strategies, Policy Engagement, and Operational Excellence for Industry Leaders

As the chicory segment matures, industry leaders must adopt a multifaceted roadmap to drive resilient growth. First, diversifying supply sources to include regional extraction partners in the Americas and Asia-Pacific can mitigate exposure to tariff volatility and logistics bottlenecks. Engaging in joint ventures with local processors ensures timelier access to raw materials and fosters knowledge transfer in extraction best practices.

Second, capital investments in advanced extraction and separation technologies, including enzymatic and membrane-based systems, are essential to achieve product differentiation and operational efficiency. Organizations should prioritize pilot programs that integrate real-time process analytics, automation, and AI-enabled quality monitoring to reduce waste and enhance throughput while maintaining stringent purity standards.

Simultaneously, active policy engagement with trade authorities and industry associations is important to secure or extend tariff exemptions for critical ingredients. By articulating the nutritional significance of prebiotic fibers to regulatory bodies, stakeholders can influence the design of import duty frameworks and accelerate the resolution of trade disputes that jeopardize market stability.

Finally, strengthening omnichannel distribution strategies-through collaborative retail partnerships, engaging digital marketing campaigns, and transparent traceability initiatives-will cultivate consumer trust and loyalty. Educational outreach on the benefits of chicory-derived inulin, supported by clinical evidence and sustainability credentials, will underpin brand differentiation and long-term value creation.

Unveiling the Rigorous Multiphase Research Framework, Data Triangulation Techniques, and Expert Validation Underpinning Chicory Market Insights

The research methodology underpinning this analysis encompasses a rigorous, multiphase approach to data collection, validation, and interpretation. Secondary research began with an exhaustive review of trade databases, tariff schedules, and import-export statistics to quantify the evolving tariff landscape and its impact on inulin sourcing. Simultaneously, an extensive patent and technology assessment identified breakthroughs in extraction processes, with special attention to closed-loop, enzyme-assisted, and membrane filtration innovations documented in industry publications and patent registries.

Primary research involved structured interviews with senior executives, process engineers, and regulatory affairs specialists across key ingredient suppliers and end-user segments. These discussions provided qualitative insights into strategic responses to regulatory shifts, investment priorities, and emerging consumer expectations. Additionally, feedback from supply chain and logistics experts helped map the implications of duty rate changes on cost structures and inventory management practices.

Data triangulation was achieved by cross-referencing proprietary interview findings with secondary sources, including selected peer-reviewed studies on gut microbiome impacts of chicory fibers, reputable industry news outlets, and international customs data. This layered validation approach ensures that conclusions are robust, unbiased, and reflective of real-world operational conditions faced by stakeholders across the value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chicory market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chicory Market, by Product Type

- Chicory Market, by Form

- Chicory Market, by Application

- Chicory Market, by Distribution Channel

- Chicory Market, by Region

- Chicory Market, by Group

- Chicory Market, by Country

- United States Chicory Market

- China Chicory Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Core Lessons from Market Forces, Consumer Trends, and Policy Dynamics to Illuminate the Future Path of Chicory Root Fiber Applications

In synthesizing the forces that shape the chicory market, several core lessons emerge. First, the growing consumer orientation toward gut health and plant-based nutrition is driving unprecedented demand for prebiotic fibers, embedding chicory root in applications that extend well beyond traditional coffee substitutes to mainstream food, beverage, and personal care products. Second, the rapid pace of extraction technology innovation-from enzymatic methods to sophisticated membrane separations-is enabling producers to deliver tailored inulin grades that meet precise functional requirements, establishing product differentiation as a key competitive advantage.

Third, regulatory and trade dynamics, particularly the layered tariff structures introduced in 2025, underscore the critical importance of supply chain flexibility. Geographic diversification of production and processing, coupled with proactive policy engagement, are essential strategies for stabilizing costs and ensuring consistent ingredient flow. Fourth, sustainability is no longer optional but a strategic imperative; leading companies are integrating energy efficiency, water stewardship, and carbon reduction goals into core operational roadmaps, thereby fortifying brand equity in increasingly values-oriented markets.

Looking ahead, stakeholders who align technological capabilities with consumer-driven product innovation, regulatory acumen, and sustainable operational practices will emerge as market frontrunners. The trajectory of chicory root fiber applications will be shaped by how effectively organizations harness these interconnected dynamics to deliver differentiated, value-rich solutions in a rapidly evolving global landscape.

Seize the Opportunity to Deepen Your Strategic Edge by Acquiring the Comprehensive Chicory Market Intelligence Report Through a Personalized Consultation

Ready to transform strategic decision-making with in-depth analysis and forward-looking insights, this tailored market intelligence report on chicory root fibers offers the depth and context needed to outpace competitors. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized walkthrough of the report’s comprehensive findings, ensuring you gain clarity on how emerging regulatory shifts, evolving consumer trends, and cutting-edge technological advancements will uniquely impact your business objectives. Don’t miss the opportunity to harness data-driven recommendations and expert perspectives that will sharpen your competitive advantage and guide your next steps in the dynamic functional fiber landscape.

- How big is the Chicory Market?

- What is the Chicory Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?