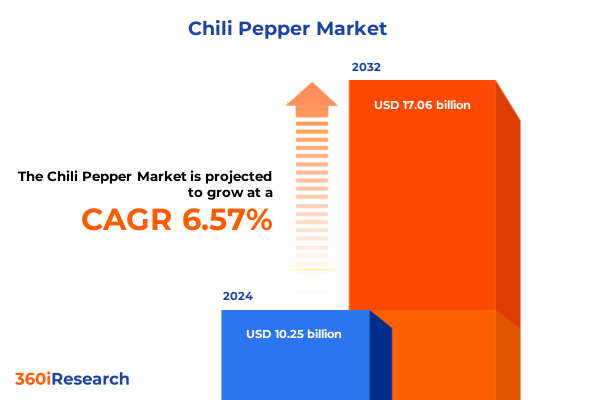

The Chili Pepper Market size was estimated at USD 10.88 billion in 2025 and expected to reach USD 11.56 billion in 2026, at a CAGR of 6.63% to reach USD 17.06 billion by 2032.

Unveiling the Global Chili Pepper Market Dynamics with Strategic Context, Defining Growth Drivers, Industry Drivers, and Emerging Opportunities

Chili peppers have transcended their traditional culinary role to become a pivotal ingredient influencing multiple industrial sectors, making it essential to comprehend their evolving market dynamics. The escalating consumer appetite for bold and exotic flavors has placed chili peppers at the forefront of food innovation, spurred by Gen Z and millennial preferences and a global palate increasingly attuned to complex heat profiles. This introduction lays the groundwork for an in-depth executive summary by framing the current landscape within the broader contexts of consumer behavior, technological advancements, and supply chain resilience.

In recent years, globalization and digital retail channels have amplified the reach of chili pepper products, enabling producers to cater to diverse culinary traditions and health-driven formulations. The integration of chili extracts in pharmaceuticals and cosmetics, such as capsaicin-based topical applications, underscores the versatile utility of these fruits beyond gastronomy. Consequently, a holistic evaluation of market drivers-ranging from regulatory frameworks and trade policies to sustainability imperatives-becomes indispensable for stakeholders navigating this multifaceted industry.

Moreover, the surge in functional food development, which capitalizes on capsaicin’s metabolic and anti-inflammatory benefits, reflects an ongoing convergence between wellness trends and flavor innovation. As such, this executive summary will systematically dissect transformative landscape shifts, tariff implications, segmentation nuances, regional differentiators, and competitive intelligence. By establishing a foundational understanding of the core drivers and emerging opportunities, decision-makers can chart informed strategies that align with both current realities and future industry trajectories.

Mapping the Radical Evolution of Chili Pepper Industry Dynamics Influenced by Consumer Trends, Technological Innovation, and Supply Chain Adaptation

The chili pepper market is undergoing profound transformation driven by a confluence of consumer trends, technological progress, and regulatory shifts. Foremost among these is the escalating demand for authentic, region-specific flavor experiences, as evidenced by the integration of Latin American, African, and Levantine influences in mainstream product lines. Flavor innovators are increasingly leveraging chili pepper varieties such as gochujang, yuzu, and kimchi-inspired blends to satisfy consumers seeking sensory excitement beyond mere heat intensity.

Simultaneously, advancements in precision agriculture and supply chain analytics have enabled more efficient cultivation and distribution of high-value chili cultivars. Companies are implementing data-driven practices to optimize yield, reduce waste, and ensure traceability from farm to fork. These developments are complemented by a shift toward sustainable packaging solutions and renewable energy integration, reflecting heightened environmental accountability across the value chain. As a result, producers are not only enhancing operational resilience but also aligning with consumer expectations for ethical and eco-friendly sourcing practices.

Furthermore, digital commerce platforms and direct-to-consumer models have redefined market access, empowering small-scale chili farmers to reach international buyers without intermediaries. This democratization of trade has spurred a wave of artisanal and craft chili products, elevating niche heat categories and driving incremental innovation. Consequently, traditional industry boundaries are blurring, prompting stakeholders to re-evaluate partnership frameworks, distribution strategies, and product portfolios to remain competitive in this dynamic landscape.

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Chili Pepper Trade Flows, Pricing Structures, and Regional Sourcing Patterns

The implementation of new U.S. tariffs in early 2025 has had a pronounced effect on chili pepper trade flows, compelling industry participants to adjust sourcing strategies and pricing models. Effective March 4, 2025, a 25% duty was levied on imports from Mexico and Canada, while Chinese imports now carry an additional 10% surcharge on top of existing tariffs. These measures have elevated costs for businesses that rely heavily on traditional supply origins, triggering a strategic pivot toward alternative producers in India, Vietnam, and Indonesia.

Major spice firms have responded by deploying advanced analytics and diversified procurement frameworks to mitigate tariff-induced cost pressures. For example, a leading global flavor house has projected potential annual tariff impacts in the tens of millions, yet plans to offset the majority through optimized sourcing and selective price adjustments. Smaller market entrants, however, face greater vulnerability, as they lack the scale and vendor networks required to absorb or pass on higher import taxes.

Consequently, companies are reevaluating their global supply footprints, exploring nearshoring options in the U.S., and forming strategic alliances with emerging chili-growing regions. This reconfiguration aims to enhance agility against future policy shifts while preserving product quality and continuity. Simultaneously, procurement teams are engaging with government stakeholders and industry associations to seek targeted tariff exemptions for non-substitutable pepper varieties, underscoring the critical role of advocacy in navigating an increasingly complex trade environment.

Illuminating Critical Market Segmentation in the Chili Pepper Industry Across Product Types, Heat Levels, Packaging, End Uses, and Distribution Channels

A nuanced understanding of market segmentation reveals how chili pepper demand varies across product forms, heat intensities, packaging preferences, end-use applications, and distribution pathways. Based on product type segmentation, the market encompasses Fresh Peppers with subcategories including banana peppers, bell peppers, and poblano peppers, alongside Processed Peppers comprising canned, dried, frozen, and pickled formats. Heat level segmentation further distinguishes Extreme Heat cultivars like Carolina Reaper, ghost pepper, and habanero from Hot Heat varieties such as cayenne and serrano, as well as Medium Heat cherries and jalapeños, and Mild Heat bell peppers and pepperoncini.

In parallel, packaging type segmentation highlights consumer and industrial requirements for bags, cans, jars, and pouches, each offering distinct logistical and shelf-life advantages. End use industry segmentation spans agricultural applications-ranging from crop enhancement to pest control-to cosmetics divisions that include skin and hair care products, as well as food and beverage sectors covering beverages, ready-to-eat meals, sauces, and snacks. Pharmaceuticals round out this category with capsaicin creams and pain relievers. Finally, distribution channel segmentation underscores the interplay between Offline Retail outlets and burgeoning Online Retail platforms, reflecting shifts in buyer purchasing behaviors.

By integrating these segmentation insights, stakeholders can tailor product development, marketing strategies, and supply chain configurations to address specific market niches and end-user needs, thereby enhancing competitiveness and driving targeted growth.

This comprehensive research report categorizes the Chili Pepper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Heat Level

- Packaging Type

- Cultivation Method

- Processing Method

- End Use Industry

- Distribution Channel

Exploring Regional Variations and Market Nuances for Chili Peppers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping chili pepper market opportunities and challenges across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North America remains a leading consumer market buoyed by premium seasonings, health-driven positioning, and home cooking trends fueled by climate-controlled herb and vegetable production facilities in states like California and Florida. Latin American nations continue to leverage indigenous pepper varieties, driving export-led growth and fostering a landscape where craft and artisanal producers flourish.

Europe Middle East & Africa presents a multifaceted market environment where culinary traditions intersect with regulatory emphasis on food safety and sustainability. European demand for specialty chilis is reinforced by cross-border supply chains that balance volume imports from Asia with localized organic farming initiatives. Meanwhile, Middle Eastern and North African regions have seen an uptick in both domestic consumption and value-added processing, bolstered by emerging halal-certified product lines that meet stringent quality standards.

In the Asia-Pacific region, robust domestic cultivation in countries such as India, China, and Thailand supports extensive use in food processing and condiments. The prevalence of fermentation-based flavor innovations and the integration of chilis in functional and fortified foods underscore the region’s role as both a production hub and trendsetter. Moreover, rapid digitalization and e-commerce adoption have accelerated market penetration, enabling producers to scale distribution across urban and rural segments alike.

This comprehensive research report examines key regions that drive the evolution of the Chili Pepper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Chili Pepper Producers and Innovators with Strategic Partnerships, Operational Excellence, and Competitive Positioning Highlights

Leading players in the chili pepper industry have ramped up investments in innovation, supply chain optimization, and strategic partnerships to secure competitive advantages. A global spice conglomerate has navigated tariff-related headwinds by deploying advanced sourcing analytics, which enabled it to offset a substantial portion of increased costs through alternative procurement strategies and selective price adjustments. This approach underscores the critical importance of data-driven decision-making in maintaining margin resilience.

Meanwhile, premium spice houses are capitalizing on domestic manufacturing capabilities and artisanal branding to differentiate their offerings. A Midwest-based specialty spice firm has highlighted the challenges imposed by global tariffs on its imported ingredients, yet it continues to invest in in-house grinding and blending operations to uphold quality and consistency. Such vertically integrated operations not only streamline production but also foster consumer trust through transparency and traceability.

Emerging firms are forging alliances with agricultural cooperatives and R&D institutions to develop proprietary chili cultivars with enhanced yields, disease resistance, and unique flavor profiles. These collaborations are further augmented by co-branding initiatives that align product innovation with culinary influencers and health advocates. Collectively, these strategies reflect a marketplace where agility, differentiation, and partnership ecosystems are paramount to sustaining growth and capturing new segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chili Pepper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B&G Foods, Inc.

- Badia Spices, LLC

- Bayer CropScience Limited

- Conagra Brands, Inc.

- Conservas La Costeña S.A. de C.V.

- Diemen’s Pty Ltd.

- Frontier Co-op

- Goya Foods, Inc.

- iHerb, LLC

- La Preferida, Inc.

- McCormick & Company, Inc.

- McIlhenny Company

- MegaMex Foods, LLC

- Orleans Packing Co

- Penzeys, Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- Sensient Technologies Corporation

- Syngenta India Limited

- Tapatio Foods LLC

Delivering Targeted Strategic Recommendations to Empower Chili Pepper Industry Leaders in Optimizing Supply Chains, Product Innovation, and Market Expansion Plans

Industry leaders must embrace a multifaceted approach to navigate the confluence of market complexities, regulatory pressures, and evolving consumer demands. First, optimizing supply chain flexibility through diversified sourcing agreements and dynamic inventory management can mitigate exposure to tariff fluctuations and geopolitical disruptions. By proactively identifying alternative production regions and fostering direct grower relationships, companies will enhance resilience and cost efficiency.

Second, intensifying investment in product innovation is vital to capture premium segments and health-conscious consumers. Developing value-added offerings-such as organic, low-sodium, and fermented chili products enriched with functional ingredients-can strengthen differentiation and command higher margins. Collaborative R&D partnerships with academic institutions and flavor houses will accelerate the introduction of proprietary cultivars and formulations.

Third, advancing digital marketing and e-commerce capabilities will unlock new growth channels, particularly in emerging urban markets across Asia-Pacific and EMEA. A robust omnichannel strategy that integrates personalized content, consumer loyalty programs, and seamless fulfillment will enhance brand engagement and drive repeat purchase behavior. Furthermore, engaging in sustainability certifications and transparent ESG reporting will resonate with eco-conscious buyers and bolster corporate reputation.

Collectively, these actionable recommendations provide a strategic blueprint for industry players to navigate uncertainty, capitalize on market shifts, and maintain a competitive edge in the dynamic chili pepper landscape.

Detailing the Robust Research Methodology Employed for Comprehensive Chili Pepper Market Analysis Including Data Sources, Validation, and Analytical Framework

This research employs a rigorous multi-source methodology to ensure the accuracy and comprehensiveness of the chili pepper market analysis. Primary data was collected through interviews and surveys conducted with growers, processors, distributors, and end-use industry experts, complemented by field visits to key cultivation regions across North America, Latin America, Europe, and Asia-Pacific. Secondary research included a systematic review of trade publications, regulatory filings, company reports, and reputable news outlets.

Quantitative insights were validated using cross-referencing techniques that triangulated information from industry associations, academic studies, and public datasets. Qualitative assessments were informed by thematic analysis of consumer behavior trends, technological advancements, and policy developments. A proprietary analytical framework was then applied to segment the market, evaluate competitive positioning, and identify strategic growth levers.

To uphold research integrity, data collection and analysis processes were subject to peer review and quality checks, ensuring consistency and minimizing potential bias. This robust methodology provides stakeholders with reliable insights and a clear understanding of the factors shaping the global chili pepper market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chili Pepper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chili Pepper Market, by Product Type

- Chili Pepper Market, by Heat Level

- Chili Pepper Market, by Packaging Type

- Chili Pepper Market, by Cultivation Method

- Chili Pepper Market, by Processing Method

- Chili Pepper Market, by End Use Industry

- Chili Pepper Market, by Distribution Channel

- Chili Pepper Market, by Region

- Chili Pepper Market, by Group

- Chili Pepper Market, by Country

- United States Chili Pepper Market

- China Chili Pepper Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Consolidating Strategic Takeaways and Forward-Looking Perspectives to Guide Decision-Makers in the Evolving Global Chili Pepper Market Ecosystem

The global chili pepper market is characterized by dynamic consumer preferences, evolving regulatory environments, and transformative supply chain practices. Key takeaways include the critical role of segmentation in tailoring product strategies, the necessity of agility in response to tariff policies, and the growing importance of sustainable and digital initiatives. Stakeholders who leverage data-driven procurement and innovation-focused partnerships will be best positioned to navigate the complexities of this market.

Looking ahead, the convergence of health and flavor trends presents significant opportunities for value-added formulations and functional applications. Meanwhile, regional diversification and technological adoption will continue to reshape competitive dynamics. Decision-makers must remain vigilant to emerging microtrends and regulatory shifts, ensuring that strategic plans incorporate flexibility and foresight.

In conclusion, a holistic understanding of segmentation, regional nuances, and competitive strategies, underpinned by a robust research methodology, will enable industry leaders to capitalize on growth opportunities and drive long-term success in the vibrant global chili pepper market ecosystem.

Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Specialized Insights Designed to Propel Your Chili Pepper Business Forward

Ready to transform your strategic approach in the chili pepper sector? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the full comprehensive market research report and unlock tailored insights that will drive your business forward. Don’t miss this opportunity to secure authoritative intelligence designed to accelerate decision-making and optimize your competitive positioning in a rapidly evolving landscape

- How big is the Chili Pepper Market?

- What is the Chili Pepper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?