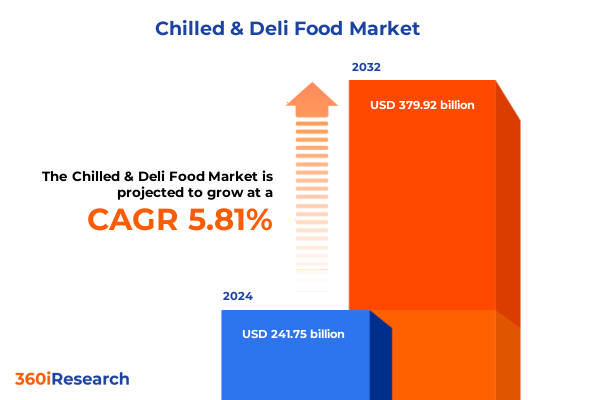

The Chilled & Deli Food Market size was estimated at USD 251.91 billion in 2025 and expected to reach USD 262.50 billion in 2026, at a CAGR of 6.04% to reach USD 379.92 billion by 2032.

A compelling overview of changing consumer behaviors, operational priorities, and strategic imperatives shaping the chilled and deli food sector in contemporary markets

The chilled and deli food segment is at an inflection point driven by shifting consumer lifestyles, heightened food safety expectations, and a surge in demand for convenient, flavorful, and health-conscious options. Consumers continue to favor ready-to-eat and ready-to-heat formats while also seeking premiumization in taste and provenance. Retailers and foodservice operators are responding by expanding chilled assortments, refining in-store merchandising, and increasing private-label innovation to balance margin pressures with differentiation.

At the same time, supply-chain resilience, ingredient transparency, and packaging sustainability have become non-negotiable strategic priorities. Manufacturers are investing in cold-chain technologies, flexible packaging formats, and streamlined production processes to increase shelf life without compromising quality. The result is a landscape where product development, channel strategy, and operational efficiency converge to determine who captures consumer loyalty and who faces margin erosion.

Transitioning from broad trends to tactical implications, organizations must align portfolio decisions with consumer segmentation and channel dynamics. This introduction frames the rest of the analysis by emphasizing the interplay between convenience, health and dietary preferences, and distribution innovation, establishing a foundation for more detailed examination of transformative shifts, tariff effects, segmentation intelligence, regional differentiation, and practical recommendations.

How demand-driven innovation, packaging advances, and tightened supply-chain governance are collectively reshaping competitive dynamics across chilled and deli food categories

The industry is undergoing transformative shifts characterized by demand-side innovation, supply-chain modernization, and regulatory tightening. On the demand side, convenience remains a dominant driver, manifested in the expansion of single-serve and dual-serve offerings alongside more sophisticated premium pre-packaged sandwiches and prepared salads. At the same time, dietary preferences such as gluten-free, Halal and Kosher certification, and plant-based alternatives are reshaping product pipelines and encouraging cross-category innovation.

Supply-side transformation is visible in packaging and processing technologies. Resealable pouches, vacuum sealing, and tray innovations designed for both sustainability and extended shelf life are being increasingly adopted. Simultaneously, manufacturers are optimizing lean manufacturing, modular cold-chain logistics, and digital traceability to improve operational resilience and meet stricter food-safety standards. These initiatives reduce spoilage and enable faster response to demand fluctuations.

Regulatory and retail channel shifts are also significant. Retailers are leveraging data-driven assortment strategies to tailor chilled ranges to local demand, while procurement teams are re-evaluating supplier diversification to mitigate geopolitical and tariff-related risks. Together, these forces create an environment where agility, consumer-centric innovation, and operational excellence determine competitive advantage, and where companies that integrate demand insights with supply capabilities will lead the next phase of sector growth.

Assessing how 2025 tariff adjustments will catalyze sourcing reconfiguration, pricing recalibration, and intensified supply-chain risk management across chilled and deli food players

The implementation of tariff adjustments in 2025 introduces a complex set of pressures across sourcing, pricing, and channel strategies. Tariff changes increase the cost of certain imported inputs, prompting manufacturers to reassess supplier relationships and consider nearshoring, ingredient reformulation, or substitution strategies to manage margin compression. Procurement teams are prioritizing supply-chain visibility and dual-sourcing agreements to reduce exposure and maintain continuity in raw materials and packaging components.

In response to cost pressures, pricing strategies will be calibrated to protect volumes and brand equity. Retailers may absorb a portion of the added cost to preserve promotional cadence, while premium lines could bear incremental price increases justified by perceived value and provenance. Conversely, private-label players may lean into cost optimization to offer competitively priced alternatives, thereby intensifying category-level pricing competition.

Logistics and inventory practices will also shift; companies will favor flexible inventory models and enhanced cold-chain monitoring to avoid waste and optimize working capital. Additionally, trade compliance teams will expand their focus on tariff classification and duty mitigation tactics, including leveraging preferential trade agreements where applicable. Collectively, the cumulative impact of these tariff changes will accelerate structural adaptations across sourcing, pricing, and operations, increasing the strategic importance of agility and forward-looking supply-chain risk management.

Actionable segmentation intelligence linking product types, packaging innovations, dietary preferences, and channel dynamics to prioritized growth opportunities

Segmentation analysis reveals nuanced pathways for product development, channel strategy, and consumer targeting. Product-type decisions must reflect category-level preferences from cured meat varieties through to savory appetizers. Within cured meats, demand dynamics differ between bacon, ham, and sausage, while fermented meat subcategories such as chorizo, pepperoni, and salami require differentiated approaches to flavor innovation and regulatory compliance. Pate formulations split consumer appeal between chicken and duck variants, and pre-packaged sandwich strategies vary by classic versus gourmet positioning. Prepared salads encompass distinct consumption occasions across coleslaw, pasta salad, and potato salad, and savory appetizers and snacks serve both impulse and planned consumption moments. Each product-type pathway demands tailored processing, shelf-life management, and merchandising tactics.

Nature and positioning influence purchasing behavior across conventional and organic lines, with organic offerings necessitating transparent sourcing and potentially different channel routes. Packaging-type choices-from metal and plastic cans to resealable and vacuum-sealed pouches, and paper or plastic trays-affect transport efficiency, shelf presentation, and sustainability narratives. Dietary preferences such as gluten-free options, Halal and Kosher certifications, and plant-based and vegan products expand addressable audiences but also introduce certification, ingredient sourcing and cross-contamination controls into manufacturing operations.

Preparation requirements segment the portfolio into ready-to-cook, ready-to-eat, and ready-to-heat formats, each with unique production workflows and consumer messaging; breaded or marinated ready-to-cook items contrast with microwave-only or oven-ready ready-to-heat SKUs. Portion size considerations from single-serve to family-size and party platters inform packaging economics and promotional strategies. Finally, distribution channels span offline formats-convenience stores, hypermarkets and supermarkets, specialty stores-and online sales, while end users split between commercial and individual buyers, each with distinct order cycles and service-level expectations. These segmentation dimensions together guide where investment in innovation, certification, and channel partnerships will yield the greatest return.

This comprehensive research report categorizes the Chilled & Deli Food market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Nature

- Packaging Type

- Dietary Preferences

- Preparation Requirement

- Portion Size

- Distribution Channel

- End User

How regional demand patterns, regulatory frameworks, and distribution structures across major global regions are redefining product, packaging, and channel strategies

Regional dynamics shape strategic priorities and operational design in different ways across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, consumer demand for convenience and premiumization supports expansion of single-serve, prepared salads, and gourmet sandwich offerings, while cold-chain infrastructure and retail modernization enable broader chilled assortments. Meanwhile, sustainability expectations and regulatory focus on labeling drive investment in packaging innovation and ingredient transparency.

Across Europe, Middle East & Africa, regulatory complexity and diverse dietary preferences create a premium on product adaptability and certification. Provenance claims, Halal and Kosher certifications, and plant-based alternatives are particularly salient, and manufacturers must navigate heterogeneous retail landscapes and logistics networks. In addition, established retail chains in this region often drive private-label growth, prompting suppliers to offer flexible co-manufacturing and tailored trading terms.

The Asia-Pacific region exhibits rapid innovation in flavor profiles, convenience formats, and digital distribution, with e-commerce playing an outsized role in chilled consumption trends. High-density urban centers favor single-serve and on-the-go formats, while evolving middle-class preferences create demand for both traditional localized flavors and globally inspired gourmet options. Across all regions, companies that align product portfolios with local taste profiles, distribution nuances, and regulatory requirements will be best positioned to capitalize on regional growth corridors.

This comprehensive research report examines key regions that drive the evolution of the Chilled & Deli Food market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling competitive strengths and partnership strategies among leaders, specialized brands, and private-label operators that drive differentiation in chilled and deli foods

Competitive dynamics in the chilled and deli food sector are shaped by diverse players ranging from specialized niche brands to large-scale manufacturers and private-label suppliers. Leaders differentiate through integrated approaches that combine product innovation, superior cold-chain capabilities, and deep retailer relationships. These companies often invest in advanced processing, traceability technologies, and sustainability initiatives to meet retailer and consumer expectations and to protect margins amid cost volatility.

Mid-sized and niche players frequently focus on category specialization-such as fermented meats or plant-based deli alternatives-and leverage agility to trial new formats, limited-edition flavors, and premium positioning. Such firms commonly adopt targeted channel strategies, concentrating on specialty stores and online platforms to reach discerning consumers. Private-label manufacturers and contract packers play a pivotal role by offering scalable production capacity and flexibility for retailers seeking to expand chilled assortments without heavy capital investment.

Across this competitive spectrum, strategic partnerships and co-manufacturing arrangements are increasingly common as companies seek to extend product portfolios, access new channels, and manage capital intensity. Moreover, cross-sector collaborations with ingredient suppliers, packaging innovators, and logistics providers create differentiated value propositions that accelerate time-to-market and reduce operational friction, enabling companies to respond more rapidly to consumer trends and regulatory shifts.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chilled & Deli Food market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 2 Sisters Food Group Ltd by Boparan Holdings Limited

- Bell Food Group Ltd by Coop Group Cooperative

- BONDUELLE Group

- Cargill, Incorporated

- Conagra Brands, Inc.

- ElPozo Alimentación, S.A.

- FLEURY MICHON

- FoodStory Brands, LLC by Seoul Juice LLC

- General Mills Inc.

- Greencore Group plc

- JBS S.A.

- Kerry Group plc

- Maple Leaf Foods Inc.

- McCain Foods Limited

- Nestlé S.A.

- Nippon Access, Inc.

- Nisshin Seifun Group Inc.

- Olymel L.P. by Sollio Cooperative Group

- Perdue Farms Inc.

- Reser’s Fine Foods, Inc

- SAMWORTH BROTHERS LIMITED

- Shinobu Foods Products Co., Ltd.

- Sigma Alimentos, S.A. de C.V by Alfa, S. A. B. de C. V.

- Smithfield Foods, Inc.

- Sofina Foods Inc.

- The Compleat Food Group Limited

- The Hain Celestial Group, Inc.

- The Kraft Heinz Company

- TOYOTA TSUSHO FOODS Corp.

- Tyson Foods, Inc.

- Unicharm Corporation

- Unilever PLC

- Vion Food Group

Practical strategic moves and operational investments that will strengthen resilience, accelerate innovation, and capture emerging opportunities across chilled and deli categories

To capitalize on evolving consumer preferences and mitigate emerging risks, industry leaders should pursue a set of prioritized, actionable moves. First, integrate consumer insights with product development cycles to accelerate roll-out of targeted SKUs across key segmentation axes such as single-serve, gluten-free options, and plant-based alternatives. This alignment will improve conversion rates and reduce time-to-shelf.

Second, strengthen supply-chain resilience by diversifying suppliers, investing in cold-chain monitoring technologies, and developing contingency plans for tariff-related disruptions. Enhanced procurement analytics and scenario planning will enable more nimble responses to input-cost volatility. Third, optimize packaging strategies by weighing trade-offs among shelf-life extension, sustainability credentials, and cost; adopting resealable, vacuum, or recyclable tray solutions where they align with consumer expectations and retailer requirements will provide competitive advantage.

Fourth, calibrate channel strategies to maximize reach and margin: tailor premium and gourmet offerings to modern grocery and specialty channels, expand ready-to-eat assortments for convenience and online platforms, and deploy private-label capabilities strategically to defend price-sensitive segments. Finally, invest in certifications, traceability, and food-safety practices to support brand trust and enable entry into regulated or faith-sensitive markets. Implementing these measures in a coordinated manner will enhance resilience and create differentiated value across consumer segments and channels.

Transparent research approaches combining practitioner interviews, secondary literature review, and scenario analysis to deliver dependable strategic insights and operational guidance

This analysis synthesizes multiple research approaches to ensure a rounded and actionable perspective. Primary research involved structured interviews with category buyers, procurement leads, and R&D managers, complemented by discussions with logistics and certification specialists to capture operational constraints and compliance requirements. Secondary research integrated publicly available industry literature, regulatory announcements, and trade publications to contextualize interview findings and to map recent advances in packaging, cold-chain, and dietary certification practices.

Analytical methods included qualitative thematic analysis to identify recurring strategic priorities, scenario-based assessment to evaluate the implications of tariff changes and supply disruptions, and segmentation mapping to align product, packaging, and channel attributes with consumer occasions. Cross-validation steps ensured internal consistency, with iterative feedback loops from industry practitioners refining interpretations and recommended actions. Careful attention was paid to avoiding proprietary or restricted data sources and to maintaining neutrality in framing competitive dynamics and regional distinctions.

The resulting methodology emphasizes transparency and replicability: insights are anchored in practitioner testimony and corroborated by observable shifts in product assortments, retail promotions, and technology adoption. This layered approach yields a robust foundation for strategic decision-making and operational planning without relying on single-source assumptions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chilled & Deli Food market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chilled & Deli Food Market, by Product Type

- Chilled & Deli Food Market, by Nature

- Chilled & Deli Food Market, by Packaging Type

- Chilled & Deli Food Market, by Dietary Preferences

- Chilled & Deli Food Market, by Preparation Requirement

- Chilled & Deli Food Market, by Portion Size

- Chilled & Deli Food Market, by Distribution Channel

- Chilled & Deli Food Market, by End User

- Chilled & Deli Food Market, by Region

- Chilled & Deli Food Market, by Group

- Chilled & Deli Food Market, by Country

- United States Chilled & Deli Food Market

- China Chilled & Deli Food Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3180 ]

Summative insights on strategic priorities, operational investments, and capability-building required to thrive in a rapidly evolving chilled and deli food landscape

In conclusion, the chilled and deli food sector is navigating a period of accelerated change where consumer convenience, dietary diversity, and sustainability expectations converge with operational and regulatory pressures. Companies that excel will be those that marry deep consumer understanding with agile supply-chain strategies, targeted segmentation execution, and packaging innovations that balance shelf life with environmental considerations. Strategic investments in traceability, certification, and flexible manufacturing will also be decisive in managing tariff and sourcing uncertainties.

Looking ahead, success will depend on the capacity to translate segmentation intelligence into distinct product propositions, to align channel strategies with occasion-based demand, and to deploy technology-enabled logistics that minimize waste and protect margins. By adopting the recommended actions-ranging from procurement diversification to certification investments-organizations can strengthen their competitive position and respond nimbly to evolving market conditions. The cumulative effect of these changes will reward those who act with clarity, speed, and operational rigor.

Secure the comprehensive chilled and deli food market report through a direct engagement with the sales lead to accelerate decision-ready insights and tailored deliverables

For decision-makers seeking immediate access to authoritative analysis and practical insights, connect directly with Ketan Rohom (Associate Director, Sales & Marketing) to secure a tailored purchase of the full chilled and deli food market research report and complementary advisory support to inform strategy, sourcing, and go-to-market plans.

A direct discussion will clarify the scope of deliverables, available data visualizations, and options for custom addenda such as supply-chain sensitivity analysis, tariff impact scenario planning, and consumer preference segmentation. In addition, purchasers can request executive briefings and bespoke slide decks that align the report’s findings with corporate objectives, product pipelines, and distribution strategies.

Engaging with the sales lead accelerates procurement timelines and ensures that the purchased package reflects current priorities, whether those relate to product innovation, packaging optimization, dietary portfolio expansion, or regional distribution realignment. Prospective buyers are encouraged to outline their research priorities in advance so the sales team can recommend the optimal report configuration and value-added services.

Act now to transform market intelligence into actionable plans; reaching out will initiate an efficient purchase process and enable immediate implementation of insights that strengthen competitive positioning and operational resilience.

- How big is the Chilled & Deli Food Market?

- What is the Chilled & Deli Food Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?