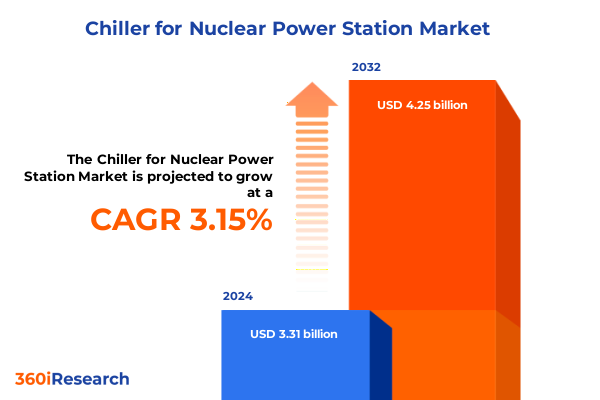

The Chiller for Nuclear Power Station Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 3.52 billion in 2026, at a CAGR of 3.15% to reach USD 4.25 billion by 2032.

Unveiling how advanced chiller solutions underpin reliable efficient cooling for modern nuclear power stations and safeguard reactor integrity

Chiller systems represent the critical cooling backbone of nuclear power stations, where precise temperature control is paramount to maintaining reactor integrity and overall safety. These systems serve to regulate heat generated by both primary and secondary loops, ensuring that core temperatures remain within stringent operational thresholds. In this context, advanced chiller solutions not only support essential reactor cooling functions but also contribute to improved plant efficiency and reduced downtime risk. As energy demands persist and regulatory oversight intensifies, the role of chillers in sustaining thermal stability has become increasingly strategic for plant operators and equipment suppliers alike.

This executive summary provides an overarching view of the current chiller landscape for nuclear power stations, highlighting the technological innovations and regulatory influences that are shaping cooling system design and deployment. The analysis underscores transformative shifts in technology development and supply chain dynamics while examining the cumulative effects of recent policy measures such as tariff adjustments. By articulating key segmentation perspectives, regional variations, and competitive strategies, the summary equips decision-makers with a comprehensive understanding of chiller system imperatives. Ultimately, the insights presented herein aim to inform strategic planning and investment decisions that will drive operational excellence in nuclear power generation.

Moreover, the integration of digital monitoring and predictive diagnostics into chiller architectures has opened new avenues for proactive maintenance, reducing unplanned outages and extending equipment life cycles. With mounting emphasis on sustainability, modern chiller designs are increasingly evaluated for energy efficiency and environmental compliance, particularly in the context of water usage and refrigerant management. Given the long operational life spans of nuclear facilities, equipment reliability, maintainability, and upgradeability rank among the top priorities for plant engineers and procurement teams. In subsequent sections, detailed discussion of segmentation, regional trends, and strategic company initiatives will further elucidate the multifaceted drivers of chiller adoption in nuclear settings.

Examining emerging disruptive technologies regulatory advancements and sustainability demands reshaping nuclear power station chiller market dynamics globally

Advancements in heat transfer materials, compressor design, and control architectures have redefined the capabilities of nuclear power station chillers. Recent innovations in magnetic bearing centrifugal compressors, for instance, have demonstrated superior rotational stability and reduced friction losses, thereby lowering energy consumption and maintenance requirements. Concurrently, developments in absorption chiller technology, especially double effect systems, offer viable alternatives where waste heat recovery is feasible. Implementation of modular skid-mounted designs has further accelerated deployment timelines and simplified retrofitting projects within existing nuclear facilities.

Alongside technological breakthroughs, regulatory evolution is exerting substantial influence on chiller system requirements. Stricter nuclear safety protocols, water usage regulations, and environmental standards for refrigerants are prompting manufacturers to adopt low global warming potential refrigerants and optimized cooling circuits. Sustainability mandates have propelled interest in air cooled configurations that minimize freshwater consumption, as well as river water systems that leverage natural resources without imposing significant ecological burdens. Moreover, emerging guidelines around digital security necessitate robust cybersecurity measures in chiller control networks to protect against unauthorized access and potential operational disruptions.

Consequently, the interplay of technology and regulation is fostering a more collaborative ecosystem among equipment suppliers, utilities, and engineering firms. Strategic alliances are emerging to co-develop high-efficiency chillers with integrated predictive analytics platforms, enabling real-time performance diagnostics. This convergence of innovation, policy, and collaboration signals a new era for nuclear chiller solutions, where adaptability and resilience are paramount for meeting the complex demands of modern power generation.

Unlocking the implications of 2025 United States tariffs on chiller equipment supply chains component costs and competitive positioning in nuclear sector

In early 2025, the United States government implemented a series of tariffs targeting imports of key chiller components, including compressors, heat exchangers, and specialized control modules. The purpose of these measures is to bolster domestic manufacturing capabilities, protect strategic supply chains, and mitigate dependency on foreign suppliers. Although the tariffs aim to enhance national resilience, they have introduced a layer of complexity for nuclear power station operators and equipment vendors, who must now navigate higher procurement costs and longer lead times for imported modules.

As a result of the increased duties, suppliers have been compelled to reassess their sourcing strategies, relocating critical production processes closer to end markets or forging joint ventures with domestic fabricators. In response to price pressures, many original equipment manufacturers have renegotiated contracts, optimized component designs for local production, and accelerated qualification of homegrown subcomponents. This shift has also incentivized aftermarket companies to expand refurbishment and spare parts services, offering cost-effective maintenance solutions to offset elevated capital expenses associated with new equipment purchases.

Looking ahead, industry participants anticipate that the upfront cost impact of the 2025 tariffs will be balanced by streamlined supply chains and strengthened local production ecosystems. Consequently, long-term operational savings may materialize through reduced logistics complexity and improved component availability. To fully capitalize on these developments, plant operators and suppliers are advised to engage in strategic supplier partnerships, invest in domestic manufacturing pathways, and leverage emerging maintenance frameworks that align with the evolving tariff landscape.

Delving into multifaceted segmentation across technology cooling type capacity range application and sales channel for nuclear power station chillers

The nuclear power station chiller market is characterized by a diverse array of cooling technologies that cater to specific operational demands and facility layouts. Based on technology, the analysis encompasses absorption systems, which are further differentiated into double effect and single effect configurations, delivering energy efficiency advantages in contexts where heat recovery is prioritized. Centrifugal chillers are categorized by bearing type, with magnetic bearing designs offering reduced mechanical wear and oil bearing options providing established reliability. Reciprocating chillers appear in single stage and two stage variants, suited to modular or phased commissioning approaches, while screw chillers present oil flood and oil free alternatives to balance performance and maintenance requirements.

Likewise, cooling type delineation reflects the importance of site-specific resource availability, as systems are designed either for air cooled operation, ideal for regions with water constraints, or for water cooled functionality that harnesses cooling towers or direct river water sources to optimize thermal exchange rates. Capacity range classification distinguishes units below five hundred kilowatts for localized equipment cooling, midrange solutions from five hundred to two thousand kilowatts for auxiliary reactor loops, and larger installations above two thousand kilowatts that support primary plant heat rejection in full scale nuclear generation settings.

Moreover, application segmentation spans HVAC support for administrative and safety buildings, instrumentation cooling for sensitive monitoring equipment, reactor auxiliary functions including primary loop and auxiliary cooling tasks, and turbine-focused roles such as generator bearing and seal oil temperature control. Sales channels further frame market access, as aftermarket services deliver refurbishment and spare parts support to sustain operational uptime, while OEM channels leverage licensed partnerships and direct manufacturer relationships to introduce fully integrated new equipment offerings.

This comprehensive research report categorizes the Chiller for Nuclear Power Station market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Cooling Type

- Capacity Range

- Application

- Sales Channel

Analyzing regional dynamics and infrastructure readiness across Americas EMEA and Asia-Pacific shaping demand for nuclear power station chiller solutions

Regional trends in nuclear power station chillers reveal varied adoption patterns driven by infrastructure development priorities, regulatory environments, and resource availability. In the Americas, established nuclear fleets in the United States and Canada are focusing on upgrading aging cooling systems with high efficiency retrofits that integrate digital monitoring platforms. Meanwhile, emerging programs in Latin America emphasize cost effective solutions to support new reactor projects, often favoring water cooled chillers that leverage existing cooling tower infrastructure while maintaining compliance with stringent safety standards.

In the Europe Middle East and Africa region, stringent environmental regulations and ambitious decarbonization goals are accelerating the deployment of alternative refrigerant technologies with low global warming potential. European operators are pioneering absorption chiller applications that recover waste heat from secondary loops, whereas utilities in the Middle East are adopting air cooled configurations to address water scarcity challenges. Across Africa, pilot cooling projects demonstrate the potential for river water systems to deliver reliable temperature management for modular reactor installations in remote locations.

Across the Asia Pacific, rapid nuclear capacity expansion in countries such as China and South Korea is driving demand for scalable chiller solutions configured for primary loop and turbine support. Major utilities are seeking partnerships with equipment providers to localize production, thereby streamlining logistics and reducing import dependency. Additionally, Japan’s focus on advanced reactor designs has spurred interest in specialized chillers for instrumentation cooling and seal oil applications, reflecting a broader trend toward customization and integrated service models that enhance plant resilience.

This comprehensive research report examines key regions that drive the evolution of the Chiller for Nuclear Power Station market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic initiatives technological leadership and competitive positioning of leading global manufacturers in the nuclear chiller equipment market

Several global equipment manufacturers have distinguished themselves through strategic investments, technological innovation, and tailored service offerings in the nuclear chiller domain. Johnson Controls and Trane have leveraged their extensive HVAC expertise to deliver modular chiller skid packages that integrate advanced controls and predictive maintenance capabilities. SPX Cooling Technologies has capitalized on its magnetic bearing compressor technology to offer centrifugal units with minimal lubrication requirements and lower lifecycle costs. Meanwhile, industry stalwarts like Daikin and Carrier continue to refine oil free screw chiller designs that reduce contamination risks and maintenance intervals in sensitive nuclear environments.

Emerging players are forging alliances with specialized fabricators and engineering firms to penetrate niche applications such as reactor primary loop cooling and high precision instrumentation support. Collaborative ventures between OEMs and aftermarket service providers are expanding refurbishment capabilities, enabling plant operators to extend equipment life spans without compromising performance. These partnerships often include joint development of digital twin platforms that simulate chiller behavior under varying operational scenarios, thereby informing proactive maintenance schedules and system upgrades.

Furthermore, consolidation trends are shaping the competitive landscape, as key players pursue acquisitions to broaden their product portfolios and regional footprints. Companies with robust global service networks are integrating chiller divisions into broader power generation offerings, capitalizing on cross functional expertise in turbine and generator collaboration. Collectively, these strategic initiatives underscore a market that values innovation, reliability, and integrated lifecycle support for nuclear power station chiller systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chiller for Nuclear Power Station market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIREDALE INTERNATIONAL AIR CONDITIONING LTD.

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Danfoss Group

- DunAnac

- Dunham-Bush Holding Bhd

- Frigel Group

- Friotherm Deutschland GmbH

- GCI Refrigeration Technologies

- GREE ELECTRIC APPLIANCES, INC.

- Guangdong Shenling

- Honeywell International

- Kilburn Engineering Limited

- LG Electronics

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Senho Machinery (Shenzhen) Co., Ltd

- Siemens AG

- SPX FLOW, Inc.

- Thermax Limited

- Trane Technologies Company, LLC

- Zhengzhou Sparkey Engineering Technology Co., Ltd.

Proposing actionable strategies and practices for industry leaders to optimize cost efficiency performance reliability and compliance in chiller operations

To navigate the evolving landscape of nuclear power station chiller systems, industry leaders should prioritize the adoption of digital monitoring and analytics platforms that enable real time performance assessment. By implementing advanced sensors and control algorithms, operators can shift from reactive maintenance to predictive maintenance regimes, reducing unplanned downtime and optimizing lifecycle costs. Strategic emphasis on modular design principles will further support rapid deployment and streamline retrofit projects, enabling facilities to accommodate capacity expansions or regulatory compliance upgrades with minimal disruption.

Moreover, engaging in collaborative partnerships with domestic manufacturing hubs will mitigate the impact of tariff induced cost pressures and enhance supply chain resilience. Equipment vendors are advised to cultivate local supplier networks for critical components, thereby reducing lead times and strengthening stakeholder relationships. In parallel, leveraging aftermarket service agreements that include refurbishment and spare parts provisioning can sustain operational continuity while managing capital expenditure. Such agreements should incorporate performance based incentives to align vendor priorities with plant reliability objectives.

Finally, sustainability and environmental compliance should be embedded as core design criteria for all chiller initiatives. Selecting low global warming potential refrigerants, optimizing water usage, and integrating waste heat recovery mechanisms will address tightening regulatory standards and bolster stakeholder confidence. By balancing cost efficiency, performance reliability, and environmental stewardship, nuclear power station operators and equipment suppliers can achieve a competitive advantage while safeguarding long term operational excellence.

Detailing rigorous research methodologies integrating expert interviews and qualitative quantitative data analysis to deliver comprehensive insights

This research adheres to a rigorous methodology that synthesizes both primary and secondary data sources to ensure comprehensive coverage of the nuclear chiller market. Primary data collection involved structured interviews with senior engineers and procurement executives from nuclear utilities, as well as consultations with leading chiller OEM representatives. These interactions provided first hand insights into technology preferences, regulatory impacts, and supply chain challenges.

Secondary research encompassed an exhaustive review of publicly available technical papers, regulatory filings, and industry whitepapers to capture historical trends and contextualize recent developments. Proprietary databases were utilized to aggregate information on plant commissioning timelines, equipment retrofit programs, and tariff policy announcements. This information was systematically cross referenced with primary feedback to validate key findings and identify emerging patterns.

Data triangulation techniques were employed throughout the analysis to reconcile discrepancies and enhance the reliability of conclusions. Qualitative assessments of technology adoption and strategic initiatives were complemented by quantitative examination of component sourcing and production capacities. Consistent throughout the process is a commitment to transparency and objectivity, with all data sources documented to facilitate replication and further research by industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chiller for Nuclear Power Station market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chiller for Nuclear Power Station Market, by Technology

- Chiller for Nuclear Power Station Market, by Cooling Type

- Chiller for Nuclear Power Station Market, by Capacity Range

- Chiller for Nuclear Power Station Market, by Application

- Chiller for Nuclear Power Station Market, by Sales Channel

- Chiller for Nuclear Power Station Market, by Region

- Chiller for Nuclear Power Station Market, by Group

- Chiller for Nuclear Power Station Market, by Country

- United States Chiller for Nuclear Power Station Market

- China Chiller for Nuclear Power Station Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing critical insights and strategic imperatives that illustrate the transformative potential of advanced chiller solutions in nuclear energy operations

The convergence of technological innovation, regulatory evolution, and supply chain realignment is driving a transformative era for nuclear power station chiller systems. As advanced centrifugal and absorption technologies gain traction alongside digital monitoring platforms, plant operators are well positioned to enhance safety, efficiency, and sustainability. Simultaneously, regional variations in water availability, environmental standards, and capacity expansion strategies underscore the need for adaptable chiller designs that cater to diverse operational contexts.

While the 2025 United States tariffs present short term cost implications, they also spur opportunities for domestic manufacturing synergies and stronger local partnerships. Industry leaders who proactively embrace predictive maintenance frameworks, modular equipment architectures, and strategic sourcing strategies can translate these policy shifts into long term value. Furthermore, sustainable refrigerant selection and waste heat recovery integration will continue to rise in importance as environmental imperatives shape the future of nuclear cooling.

In summary, the insights presented highlight a market landscape that demands agility, collaboration, and a forward looking approach to research and development. By aligning technology, strategy, and environmental priorities, stakeholders can secure a competitive edge and advance the role of innovative chiller solutions in the nuclear energy sector.

Discover how partnering with Ketan Rohom to secure the comprehensive market research report can empower your strategic decision making and competitive advantage

For a comprehensive deep dive into the trends, segmentation dynamics, regional nuances, and strategic company profiles driving the nuclear power station chiller market, readers are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in power generation research and can provide tailored guidance on how the detailed market research report can inform your next strategic move. Whether you are evaluating technology partnerships, optimizing supply chains, or refining maintenance protocols, the full report delivers the actionable intelligence needed to stay ahead of industry shifts. Reach out to Ketan Rohom to secure access to the report and accelerate your journey toward chiller system excellence.

- How big is the Chiller for Nuclear Power Station Market?

- What is the Chiller for Nuclear Power Station Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?