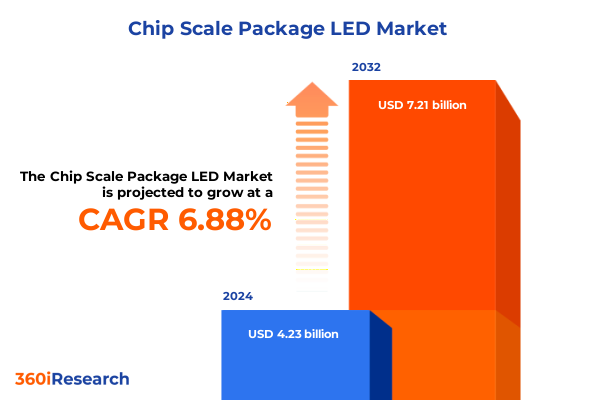

The Chip Scale Package LED Market size was estimated at USD 4.52 billion in 2025 and expected to reach USD 4.83 billion in 2026, at a CAGR of 6.89% to reach USD 7.21 billion by 2032.

Unveiling the Dynamics of Chip Scale Package LED Technology Revolutionizing Efficiency Miniaturization and Integrated Lighting Solutions

Chip scale package (CSP) LED technology represents a pivotal evolution in semiconductor-based illumination, whereby each light-emitting diode emerges from fabrication at a footprint nearly identical to its die size. By eliminating traditional packaging layers and substrate attachments, CSP LEDs achieve superior thermal performance and streamlined optical output, aligning perfectly with the demands of modern electronics where space and efficiency are paramount.

In recent years, the convergence of enhanced phosphor deposition techniques and advanced substrate materials has propelled CSP LED into a central role across multiple end markets. These improvements have not only reduced thermal resistance but have also delivered higher luminous efficacy, enabling designers to rethink form factors and embed powerful lighting elements into ultra-slim devices. As a result, CSP LEDs are ushering in a new era of integration where high-brightness lighting coexists with sophisticated electronics in domains ranging from automotive to wearable technology.

Embracing Miniaturization and Integration Trends as Game Changers Reshaping the CSP LED Market in Emerging Applications

The landscape of CSP LED solutions is being redefined by an unrelenting push toward miniaturization and functional consolidation. Semiconductor firms are leveraging GaN-on-Si platforms, which not only reduce production costs but also facilitate the integration of micro-LED arrays onto flexible substrates. This shift is enabling next-generation display backlighting systems that offer unparalleled contrast and color accuracy while occupying a fraction of the space required by conventional LED packages.

Meanwhile, the proliferation of Internet of Things (IoT) architectures is accelerating deployment of intelligent lighting networks that can adapt in real time to environmental cues. CSP LEDs, with their compact form and high thermal tolerance, serve as ideal nodes in these adaptive systems, powering everything from smart city street lamps to in-vehicle ambient lighting. As automotive OEMs increasingly prioritize energy efficiency and design flexibility, the demand for CSP-based adaptive headlights and interior mood lighting has surged, underscoring how cross-sector collaboration is reshaping product roadmaps and supply chains.

Assessing the Amplified Cost Pressures and Supply Chain Reconfigurations from 2025 U.S. Semiconductor Tariff Hikes on CSP LED Sector

With effect from January 1, 2025, U.S. tariff rates on semiconductor components under HTS headings 8541 and 8542 were raised from 25% to 50%, directly impacting CSP LED imports and domestic pricing structures. This doubling of duties has reverberated across the supply chain, compelling manufacturers to absorb higher input costs or pass these to customers, thereby altering procurement strategies and contract negotiations.

Beyond cost pressures, the tariff escalation has catalyzed geographic diversification of production footprints. Many firms have accelerated nearshoring initiatives, shifting critical assembly operations to Mexico and Southeast Asia to mitigate duty exposures. Simultaneously, the imposition of non-exempt status on lighting components has highlighted the need for advocacy and engagement with policymakers to secure targeted relief.

On a macroeconomic level, the Information Technology and Innovation Foundation projects that sustained semiconductor tariffs could suppress U.S. GDP growth by as much as 0.76% over the next decade, translating into an average household loss exceeding $4,000 cumulatively. This underscores the broader economic stakes tied to trade policy decisions and the critical importance of dynamic scenario planning for corporate executives navigating these headwinds.

Revealing Critical Insights Across LED Types Applications and End Use Verticals That Define CSP LED Market Dynamics

In dissecting market behavior by LED type, it becomes evident that monochrome CSP LEDs continue to dominate applications requiring high luminance at low cost, such as general illumination modules for residential and commercial environments. Conversely, RGB CSP LEDs have unlocked new frontiers in dynamic signage and display backlighting, where the ability to render precise color gradients underpins next-generation visual experiences. White CSP LEDs, enriched with multi-phosphor coatings, strike a balance between broad-spectrum output and energy efficacy, making them the preferred choice for architectural lighting and specialized industrial uses.

Application-based segmentation reveals that the automotive segment is bifurcated between exterior illumination, where CSP LED headlamps deliver adaptive beam patterns and reduced power draw, and interior ambient lighting systems that cater to evolving consumer demands for customizable cabin experiences. Display backlighting, with its subdivisions of monitors, smartphones, and televisions, exploits CSP LEDs' high pixel density and uniformity to elevate contrast ratios and color fidelity. In the realm of signage, outdoor fixtures leverage CSP LEDs' robust moisture resistance and thermal stability, while indoor signage benefits from their compact footprint and rapid response times.

From an end-use perspective, the automotive industry’s stringent performance and reliability criteria have spurred specialized CSP LED packages with reinforced thermal management. Commercial applications, encompassing retail and hospitality venues, have gravitated toward CSP LED modules that integrate dimming protocols and intelligent controls. Industrial use cases prioritize ruggedized assemblies capable of withstanding harsh environments, while residential segments capitalize on compact, energy-saving CSP LED bulbs that conform to modern aesthetic sensibilities.

This comprehensive research report categorizes the Chip Scale Package LED market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- LED Type

- Application

- End Use

Dissecting Regional Variations in Technology Adoption and Regulatory Environments Shaping CSP LED Growth Across Global Markets

Across the Americas, robust government incentives for energy-efficient lighting have driven accelerated adoption of CSP LEDs in both urban infrastructure projects and electric vehicle platforms. Automotive hubs in Michigan and Ontario are increasingly sourcing adaptive headlamp solutions domestically, while smart city pilots in major U.S. metros showcase CSP LED streetlights equipped with sensor-driven dimming functions.

Europe, the Middle East, and Africa present a heterogeneous regulatory landscape wherein the European Union’s upcoming Ecodesign Directive revisions are poised to tighten efficiency standards for luminaires, compelling manufacturers to bolster CSP LED performance thresholds. Simultaneously, investment in sustainable building initiatives has elevated demand for CSP-based lighting systems capable of integrating with Building Management Systems across major EMEA urban centers.

Asia-Pacific remains the epicenter of CSP LED manufacturing, anchored by leading LED foundries in China, Taiwan, and South Korea. The region’s consumer electronics behemoths continue to drive global demand for CSP LED backlighting in high-resolution displays. Moreover, rapid urbanization in India and Southeast Asia has catalyzed large-scale deployment of CSP LED fixtures in public infrastructure, with several governments financing smart street lighting networks to curtail energy expenditures and support smart city goals.

This comprehensive research report examines key regions that drive the evolution of the Chip Scale Package LED market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Strengths of Leading CSP LED Manufacturers Driving Innovation and Market Leadership

Nichia Corporation has maintained its leadership position through continuous investment in GaN-on-Si research, enhancing luminous efficacy and color stability for both general illumination and automotive applications. Samsung Electronics has leveraged its vertically integrated production capabilities, optimizing thermal management in CSP LED modules for ultra-slim TVs and monitors. OSRAM Opto Semiconductors distinguishes itself with high-power CSP LEDs engineered for industrial and outdoor lighting, underscoring its commitment to durability and long-term reliability.

Wolfspeed (formerly Cree LED) has doubled down on partnerships with electric vehicle OEMs to embed high-brightness CSP LED arrays in next-generation headlamp assemblies, while Seoul Semiconductor’s expertise in phosphor materials has enabled the development of bespoke white CSP LEDs with superior color rendering. Across the competitive landscape, these key players are engaging in strategic collaborations and IP licensing deals to accelerate time-to-market for advanced CSP LED solutions and secure footholds in emerging verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chip Scale Package LED market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams OSRAM AG

- Cree, Inc.

- Epistar Corporation

- Everlight Electronics Co., Ltd.

- Genesis Photonics Inc.

- Lextar Electronics Corp.

- LG Innotek Co., Ltd.

- Lumileds Holding B.V.

- Nichia Corporation

- Samsung Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Shenzhen MTC Co. Ltd.

- Toshiba Corporation

Strategic Actions and Partnerships Industry Leaders Must Embrace to Capitalize on CSP LED Market Opportunities and Mitigate Risks

Industry leaders should prioritize the development of differentiated phosphor formulations to achieve superior color rendering and spectral tunability that set their CSP LED offerings apart. It is imperative to expand cross-sector alliances, linking semiconductor firms with automotive OEMs and display manufacturers to co-create next-generation lighting modules that anticipate end-customer needs. Furthermore, diversifying supply chains through a combination of nearshore and strategic Asian partnerships will help mitigate tariff risks and ensure uninterrupted production.

To capitalize on the burgeoning smart lighting trend, executives must accelerate investment in IoT-enabled CSP LED platforms, incorporating advanced sensor integration and machine learning algorithms for adaptive illumination control. Concurrently, proactive engagement with policymakers and participation in trade association efforts can help shape favorable regulatory outcomes and secure targeted tariff relief for lighting components. By instituting robust scenario-planning frameworks, organizations can swiftly adapt to evolving geopolitical pressures while maintaining agile cost-management disciplines.

Detailing Rigorous Data Collection and Analytical Approaches Employed to Ensure Comprehensive Insights Into the CSP LED Market Landscape

This analysis synthesizes data drawn from primary interviews with senior executives across semiconductor firms, OEMs, and key industry stakeholders, supplemented by field surveys capturing real-world performance metrics of CSP LED implementations. Secondary research encompassed a comprehensive review of trade publications, regulatory filings, patent databases, and HTS tariff schedules to verify supply chain and policy developments.

We employed triangulation methods to cross-validate insights, integrating quantitative cost and efficiency benchmarks with qualitative perspectives on strategic priorities. Data points have been corroborated through iterative expert review sessions, ensuring that this report reflects a balanced, up-to-date assessment of market dynamics. Quality assurance protocols, including peer review and alignment checks against publicly disclosed corporate earnings, underpin the methodological rigor of our findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chip Scale Package LED market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chip Scale Package LED Market, by LED Type

- Chip Scale Package LED Market, by Application

- Chip Scale Package LED Market, by End Use

- Chip Scale Package LED Market, by Region

- Chip Scale Package LED Market, by Group

- Chip Scale Package LED Market, by Country

- United States Chip Scale Package LED Market

- China Chip Scale Package LED Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Key Takeaways and Emphasizing the Strategic Imperatives for CSP LED Stakeholders in a Rapidly Evolving Industry

The confluence of miniaturization, integration with intelligent systems, and evolving trade policies has positioned CSP LED technology at the heart of transformative change across multiple industries. As manufacturers contend with elevated tariff pressures and shifting supply chain geographies, targeted investments in R&D and strategic partnerships will be critical to sustaining competitive advantage.

Segment-specific opportunities abound in automotive adaptive lighting, high-resolution display backlighting, and smart infrastructure deployments. Regional nuances-from incentives in the Americas to regulatory tightening in EMEA and manufacturing prowess in Asia-Pacific-must inform tailored go-to-market strategies. By aligning operational agility with deep market insight, CSP LED stakeholders can navigate the evolving landscape and drive robust, sustainable growth.

Secure Your Competitive Edge With Personalized Guidance From Associate Director of Sales & Marketing Ketan Rohom to Access the Comprehensive CSP LED Market Report

Are you prepared to transform your strategic vision into market leadership by tapping into deep insights tailored to your business needs? Ketan Rohom is ready to guide you through the complexities of the Chip Scale Package LED market, offering expert advice and customized access to an in-depth report designed to inform crucial decisions and unlock growth opportunities. Connect directly with the Associate Director of Sales & Marketing to explore how this research can equip your organization with the intelligence necessary to outpace competitors and drive innovation in your sector.

- How big is the Chip Scale Package LED Market?

- What is the Chip Scale Package LED Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?