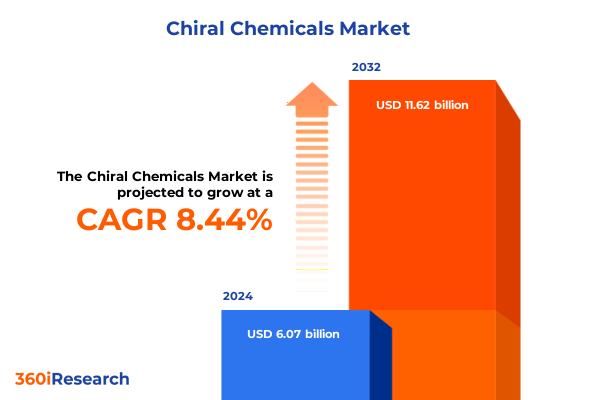

The Chiral Chemicals Market size was estimated at USD 6.57 billion in 2025 and expected to reach USD 7.10 billion in 2026, at a CAGR of 8.49% to reach USD 11.62 billion by 2032.

Establishing the strategic context of chiral chemicals shaped by unprecedented innovation, regulatory focus, and evolving global supply dynamics

The chiral chemicals sector has undergone a profound evolution, driven by scientific breakthroughs and heightened regulatory scrutiny. In recent years, the imperative to produce enantiomerically pure compounds has extended beyond pharmaceuticals, permeating agrochemicals, fine chemicals, and flavor and fragrance applications. As regulatory authorities worldwide underscore the necessity for optical purity to ensure safety and efficacy, the industry has responded with a surge of innovation in synthesis, analysis, and separation technologies. This evolving regulatory landscape has stimulated strategic collaborations between research organizations and chemical producers, fostering the rapid adoption of advanced chiral catalysts and separation media.

Moreover, shifts in global supply chains and escalating geopolitical tensions have prompted companies to reassess sourcing strategies for sensitive intermediates. Manufacturers are increasingly looking to diversify feedstock origins and invest in modular production facilities to mitigate risk. Concurrently, customers are demanding greater transparency in the provenance and manufacturing processes of chiral compounds, reinforcing the importance of traceability and digital data management. Taken together, these forces have set the stage for a vibrant era of growth and transformation in the chiral chemicals industry, one that rewards agility, technical expertise, and an unwavering commitment to quality.

Uncovering the transformative breakthroughs and disruptive trends redefining chiral chemical production, purification, and application across industries

A wave of technological breakthroughs is reshaping the chiral chemicals landscape, fundamentally altering how these intricate molecules are synthesized, separated, and applied. At the forefront of this transformation is the maturation of biocatalysis platforms, which harness the exquisite selectivity of enzymes to achieve high-purity enantiomer production under mild conditions. Companies that once relied exclusively on classical asymmetric catalysis are now integrating enzyme-derived processes to reduce waste, lower energy consumption, and improve overall yield.

In parallel, digital flow chemistry systems have emerged as a game-changer, enabling continuous, scalable synthesis with real-time process control and analytics. This paradigm shift reduces batch-to-batch variability and accelerates time-to-market for new chiral intermediates. Enhanced chiral chromatography techniques, featuring novel stationary phases and high-throughput separators, are also driving efficiency gains, particularly at commercial scales. Collectively, these innovations are not only redefining cost and performance benchmarks, but also opening new application horizons where precise stereochemical configuration is non-negotiable. As a result, the industry stands at the cusp of a new era, characterized by leaner operations and heightened responsiveness to evolving customer requirements.

Assessing how the new 2025 United States tariff measures are reshaping cost structures, supply chains, and competitive positioning in chiral chemicals

The introduction of new United States tariff measures in early 2025 has triggered a recalibration of cost structures and sourcing strategies across the chiral chemicals value chain. Suppliers of key intermediates such as chiral alcohols and amines have confronted immediate margin pressures, leading to negotiated contracts that incorporate variable duty pass-through mechanisms. In response, several multinational firms have accelerated efforts to localize production within North America, forging partnerships with domestic custom synthesis providers to maintain price competitiveness.

At the same time, companies in regions impacted by higher export duties are exploring joint ventures and licensing agreements to share tariff burdens while preserving market access. These collaborations often involve technology transfers in asymmetric preparation and biological separation methods, bolstering regional capabilities and fostering cross-border innovation. While short-term disruptions in availability and lead times have been reported, industry stakeholders anticipate that these adjustments will ultimately enhance supply chain resilience and reduce dependence on single-source imports. In the near term, however, end-users should prepare for elevated procurement costs and strategic contract renegotiations driven by the evolving tariff landscape.

Illuminating the segmentation of the chiral chemicals market through product, chirality, synthesis approaches, distribution channels, and application domains

Segmentation analysis underscores the multifaceted nature of the chiral chemicals market and its varied demand drivers. When viewed through the lens of product type, the landscape encompasses a broad spectrum of enantiomerically pure compounds ranging from simple chiral alcohols and amines to more specialized entities such as binaphthyls, carboxylic acids, esters, phosphines, phosphoric acids, piperidines, and pyrrolidines. Each of these product classes addresses unique end-use requirements, from catalytic auxiliaries to active pharmaceutical intermediates. Moreover, the inherent chirality type-whether axial, central, helical, or planar-introduces nuanced considerations for synthetic route selection and performance optimization.

In terms of manufacturing approaches, the market divides into asymmetric preparation, biological separation, and traditional separation routes, each offering distinct trade-offs in terms of yield, selectivity, cost, and sustainability. Distribution pathways further segment the market into offline and online channels, reflecting evolving procurement preferences and digital commerce capabilities. Finally, end-use applications span high-value segments such as pharmaceuticals, agrochemicals, flavors and fragrances, and specialty chemicals. Understanding how these dimensions interrelate provides a clear view of where investment, capacity expansion, and process innovation should be prioritized.

This comprehensive research report categorizes the Chiral Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Chirality Type

- Synthesis Techniques

- Distribution Channel

- Application

Exploring the growth drivers, regulatory environments, and innovation hubs defining the chiral chemicals landscape in Americas, EMEA, and Asia-Pacific regions

Regional dynamics play a pivotal role in shaping global competitive positioning and innovation trajectories in the chiral chemicals sector. In the Americas, established research hubs and a robust regulatory framework foster early adoption of cutting-edge synthesis technologies, with localized production facilities serving both domestic and export markets. This environment facilitates rapid technology transfer from academic institutions to pilot-scale operations, enabling agile scale-up for newly developed enantiopure compounds.

Meanwhile, the Europe, Middle East & Africa region is characterized by deep collaborations between large specialty chemical producers and contract development organizations. Regulatory harmonization within the European Union has created a fertile ground for certifying chiral intermediates under stringent quality and traceability standards. At the same time, strategic investments in sustainable practices, including green catalysis and waste recycling, are reinforced by regional policy incentives. In the Asia-Pacific landscape, aggressive capacity additions and competitive feedstock sourcing have propelled significant cost advantages, particularly for commodity-grade chiral chemicals. Several nations in the region are now moving up the value chain, investing in next-generation asymmetric catalysis and bioprocessing platforms. Each of these geographic zones offers distinct opportunities and challenges, underscoring the importance of tailored regional strategies.

This comprehensive research report examines key regions that drive the evolution of the Chiral Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the strategies, technological strengths, and partnership initiatives of leading players steering the chiral chemicals sector toward competitive advantage

Leading companies are deploying a variety of strategic levers to differentiate their offerings and secure market leadership in the chiral chemicals arena. Some global players emphasize proprietary asymmetric catalysts and column technologies, leveraging decades of process development expertise to achieve unparalleled enantiomeric purity. Others prioritize integrated service models, combining custom synthesis of chiral building blocks with downstream application support and formulation services.

Strategic partnerships and joint ventures are also on the rise, as firms seek to augment their technological capabilities and expand geographic footprints. In particular, collaborations between established specialty chemical producers and fast-growing biotech innovators are accelerating the commercialization of advanced biocatalytic processes. Meanwhile, targeted acquisitions are reshaping competitive dynamics, with large conglomerates absorbing niche specialists to broaden their chiral portfolio. This concentration trend is fostering greater investment in R&D, leading to faster method validation and scale-up timelines. Collectively, these initiatives highlight how agility, technological depth, and collaborative ecosystems are becoming core differentiators in a rapidly evolving market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chiral Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abcr GmbH

- Ambeed

- Ascensus Specialties LLC

- Bachem AG

- BASF SE

- Bharavi Laboratories (P) Ltd.

- BLD Pharmatech Ltd.

- Buchler GmbH

- Cambrex Corporation

- Chiral Chemicals

- ChiroBlock GmbH

- Daicel Corporation

- Enamine Ltd.

- Evonik Industries AG

- Glentham Life Sciences Limited

- Kaival Chemicals Pvt. Ltd.

- Kaneka Corporation

- LianYunGang Chiral Chemical(China)CO.,Ltd.

- Merck KGaA

- Nissan Chemical Corporation

- SANYO FINE CO., LTD.

- Shanghai Chiral Chemicals Inc.

- Solvias AG

- Spectrum Chemical Mfg. Corp.

- Sumitomo Chemical Co., Ltd.

- Takasago International Corporation

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Toray Industries, Inc.

- W. R. Grace & Co.

- Zhejiang Yongtai Technology Co., Ltd.

Delivering actionable imperatives for industry leaders to strengthen resilience, drive innovation, and capture value across the chiral chemicals landscape

Industry leaders should prioritize building end-to-end capabilities that align with the growing demand for high-purity chiral compounds. This begins with enhancing process flexibility through modular equipment investments and digital control systems that support both batch and continuous flow operations. In addition, allocating resources to biocatalysis research can yield substantial gains in selectivity and sustainability, positioning organizations ahead of tightening environmental regulations.

Furthermore, firms must diversify supply chains by establishing multiple sourcing routes for critical intermediates, thereby minimizing exposure to tariff-induced disruptions. Collaborating with regional custom synthesis providers and securing strategic alliances will be essential to maintaining cost competitiveness. Equally important is the development of advanced analytics and quality-by-design frameworks, which can reduce development timelines and ensure consistent product performance. By adopting these pragmatic measures, executives can not only mitigate current market risks but also unlock new avenues for growth in high-value applications.

Detailing the rigorous research methodology combining primary insights, secondary data, and analytical frameworks that underpin this chiral chemicals study

This study integrates extensive primary research with exhaustive secondary data collection to ensure robust, unbiased analysis. Primary inputs were garnered through in-depth interviews with senior executives, research scientists, and procurement specialists across leading chemical companies, contract research organizations, and end-user industries. These expert conversations provided firsthand perspectives on technical challenges, investment priorities, and market entry strategies.

Secondary research drew upon peer-reviewed journals, patent filings, regulatory filings, and publicly available company disclosures to construct a detailed view of technological adoption trends and competitive activity. Data triangulation methods were employed to validate key findings, cross-referencing insights from multiple sources to enhance accuracy. Advanced analytical frameworks, including SWOT and Porter’s Five Forces, were applied to evaluate strategic positioning and growth drivers. Finally, all data points underwent rigorous quality checks to ensure consistency and relevance. This comprehensive approach underpins the credibility of the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chiral Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chiral Chemicals Market, by Product

- Chiral Chemicals Market, by Chirality Type

- Chiral Chemicals Market, by Synthesis Techniques

- Chiral Chemicals Market, by Distribution Channel

- Chiral Chemicals Market, by Application

- Chiral Chemicals Market, by Region

- Chiral Chemicals Market, by Group

- Chiral Chemicals Market, by Country

- United States Chiral Chemicals Market

- China Chiral Chemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing the findings and strategic takeaways that will guide decision-makers navigating the competitive complexities of the chiral chemicals sector

Through this analysis, it becomes clear that the chiral chemicals industry is at a strategic inflection point, driven by regulatory imperatives, technological innovation, and shifting trade dynamics. Key takeaways include the critical role of advanced synthesis and separation technologies in meeting evolving purity standards, the necessity of regional supply chain diversification in the face of tariff pressures, and the competitive advantage conferred by targeted R&D partnerships and acquisitions.

As industry stakeholders navigate this complex landscape, focusing on process agility, sustainable practices, and data-driven decision making will be paramount. The interplay between established chemical producers and emerging biotech innovators is reshaping the value chain, underscoring the importance of collaboration and capability integration. By internalizing these conclusions and aligning strategic initiatives accordingly, decision-makers will be better positioned to capture opportunities, mitigate risks, and steer their organizations toward sustained success.

Empowering your strategic decisions with this detailed chiral chemicals intelligence—reach out to Ketan Rohom to secure your copy of the comprehensive report today

To access the full breadth of insights, data, and strategic frameworks that will empower your organization to navigate the complex chiral chemicals arena, simply reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the bespoke features of the report, helping you identify the exact sections and analyses most relevant to your strategic objectives. Engaging directly with Ketan ensures you receive personalized support on report scope, supplemental consulting options, and licensing arrangements. Don’t miss the opportunity to leverage this intensive research to accelerate your growth, strengthen your competitive positioning, and derive actionable intelligence. Contact Ketan Rohom today to secure your copy of the comprehensive chiral chemicals market research report.

- How big is the Chiral Chemicals Market?

- What is the Chiral Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?