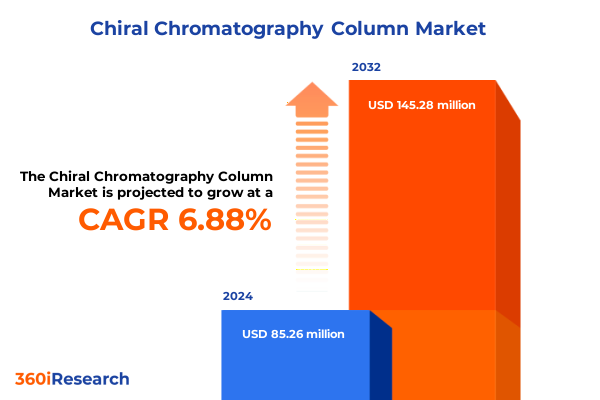

The Chiral Chromatography Column Market size was estimated at USD 91.20 million in 2025 and expected to reach USD 100.83 million in 2026, at a CAGR of 7.89% to reach USD 155.28 million by 2032.

Groundbreaking Insights into the Evolving Chiral Chromatography Column Landscape Shaping Next-Generation Analytical Capabilities and Market Dynamics

Chiral chromatography has emerged as an indispensable analytical technique in modern drug development, driven by stringent regulatory requirements and a paradigm shift toward enantiomerically pure therapeutics. Between 2013 and 2022, the U.S. Food and Drug Administration approved 278 new small-molecule drugs, of which nearly 59% were developed as single-enantiomer formulations rather than racemic mixtures. This evolution underscores the critical role of high-performance chiral columns in ensuring drug safety, efficacy, and compliance with international guidelines.

Beyond pharmaceuticals, the quest for enantiomeric purity extends into agrochemicals, food and beverages, environmental testing, and academic research. Advances in chiral stationary phases, such as novel polysaccharide derivatives and hybrid silica supports, are reshaping separation capabilities by enhancing selectivity and resilience under diverse mobile phase conditions. As laboratories increasingly demand rapid, reliable, and sustainable solutions, chiral chromatography columns stand at the forefront of scientific innovation and quality control workflows.

Revolutionary Technological Breakthroughs and Automation Trends Accelerating Precision and Efficiency in Chiral Chromatographic Separations

The integration of automation and artificial intelligence within chiral HPLC platforms is revolutionizing laboratory operations by drastically reducing method development timelines. Automated column screening systems now leverage machine learning algorithms to predict separation outcomes, trimming traditional weeks-long workflows to mere days and cutting development costs by up to 50%. This synergy between robotics and intelligent software not only boosts throughput but also minimizes human error, enabling research teams to focus on higher-value tasks and accelerating time-to-insight for complex enantiomeric analyses.

Simultaneously, regulatory pressures continue to amplify demand for enantiopure compounds, with major agencies like the FDA and EMA enforcing rigorous chiral purity standards. As a result, over half of current drug candidates require specialized chiral separations, driving pharmaceutical R&D facilities to adopt a broader array of stationary phase chemistries. While HPLC remains the dominant technique, supercritical fluid chromatography is capturing nearly 30% of pharmaceutical chiral separations due to its faster run times and reduced solvent consumption.

Innovation in column design further accelerates this transformation. The emergence of microfluidic-based devices and sub-2-micron superficially porous particles compatible with UHPLC systems delivers unmatched resolution and sensitivity. These advances coincide with a growing emphasis on greener practices, prompting the development of longer-lifetime columns and alternative solvents that align with sustainability goals across life sciences and fine chemical industries.

Significant U.S. Tariff Measures and Their Compounded Impact on Chiral Chromatography Column Availability, Cost Structures, and Research Operations

In April 2025, sweeping tariff measures imposed a 10% global levy on nearly all goods entering the U.S., with targeted duties soaring up to 245% on Chinese-origin active pharmaceutical ingredients. These escalated import costs threaten to inflate the price of critical chromatographic columns and consumables, complicating procurement strategies for research institutions and commercial laboratories alike. With APIs and specialized reagents now subject to steep tariffs, R&D budgets face unprecedented pressure.

The chemical and life sciences sectors anticipate that these additional costs will ripple through supply chains, leading to heightened instrument prices and reduced purchasing power. Given that the U.S. is the world’s largest importer of laboratory and diagnostic agents, disruptions in affordability risk delaying project timelines and constraining method development efforts. As researchers grapple with budgetary constraints, the urgency to optimize column usage and explore domestic manufacturing alternatives intensifies.

Moreover, broader trade tensions have already prompted chemical manufacturers to reassess global sourcing models. The Society of Chemical Manufacturers & Affiliates reports that raw material price spikes, driven by tariffs on petrochemicals and essential feedstocks, could elevate operational expenses by up to 37%. Such economic headwinds underscore the need for strategic inventory management and supplier diversification to mitigate the compounded impact of U.S. trade policies.

Comprehensive Segmentation Analysis Reveals Critical Insights Spanning Column Types, Technologies, Applications, End Users, Operation Modes, and Particle Dimensions

A nuanced understanding of market segmentation reveals the intricate tapestry of chiral chromatography column demand. Crown ether, cyclodextrin, macrocyclic antibiotic, Pirkle type, polysaccharide-based, and protein-based column chemistries each offer distinct enantioselectivity profiles. Within the polysaccharide category, amylose and cellulose derivatives further branch into specialized chemistries such as amylose tris(3,5-dichlorophenylcarbamate), amylose tris(3,5-dimethylphenylcarbamate), cellulose tris(3,5-dichlorophenylcarbamate), and cellulose tris(3,5-dimethylphenylcarbamate), catering to a diverse array of molecular targets.

Technology underpins another key axis of differentiation. High-performance liquid chromatography remains foundational, while supercritical fluid chromatography and ultra-high-performance liquid chromatography expand the envelope of separation efficiency and speed. Application-driven segmentation spans agrochemicals, environmental testing, food and beverages, pharmaceuticals, and research and academia, each with unique purity and throughput requirements. Correspondingly, end users range from academic and research institutes through to agrochemical companies, environmental testing laboratories, food and beverage producers, and pharmaceutical and biotechnology firms. Operational modes bifurcate into analytical and preparative functions, and particle size selections-2–5 micron, sub-2 micron, and greater than 5 micron-enable tailored performance metrics to meet scale and resolution demands.

This comprehensive research report categorizes the Chiral Chromatography Column market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Column Type

- Technology

- Mode Of Operation

- Particle Size

- Application

- End User

Diverse Regional Dynamics Highlight Emerging Opportunities and Strategic Challenges Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional market dynamics for chiral chromatography columns reflect distinct strategic opportunities and operational challenges. In the Americas, robust R&D infrastructure and substantial pharmaceutical manufacturing capacity drive significant demand for high-performance enantiomeric separations. U.S. regulatory harmonization and ongoing investment in academic research fuel a sustained appetite for cutting-edge HPLC, SFC, and UHPLC solutions, while Canada’s expanding biotechnology sector fosters collaborative innovation.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by stringent EU chemical regulations and burgeoning life sciences clusters in countries like Germany, Switzerland, and the U.K. Regulatory agencies across these jurisdictions emphasize sustainability and green chemistry principles, catalyzing the adoption of eco-friendly column technologies. Meanwhile, the Asia-Pacific region exhibits rapid growth fueled by India and China’s pharmaceutical and agrochemical markets, which leverage cost-advantage manufacturing and increasingly stringent domestic purity standards. This region’s focus on capacity expansion and local production alliances underscores the imperative for column providers to establish regional partnerships and localized support networks.

This comprehensive research report examines key regions that drive the evolution of the Chiral Chromatography Column market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Showcasing Strategic Innovations, Partnerships, and Competitive Differentiators in the Chiral Chromatography Column Arena

Leading providers of chiral chromatography columns are distinguishing themselves through targeted innovation and strategic alliances. Daicel’s CHIRALPAK IJ series, with its immobilized cellulose-based stationary phase compatibility for both HPLC and SFC, exemplifies a commitment to broad-spectrum method development and extended column lifetimes. Likewise, ColumnTek’s Enantiocel IDA and IDB offerings leverage advanced silica supports and tailored functional groups to enhance enantioselectivity across multiple chromatographic modalities.

Major analytical instrumentation firms such as Agilent Technologies, Thermo Fisher Scientific, and Shimadzu continue to integrate proprietary chiral phases into comprehensive separation platforms, providing turnkey solutions with embedded data analytics. Merck’s Sigma-Aldrich portfolio expands access to diverse column chemistries, while niche specialists are forging collaborations with academic research centers to co-develop next-generation stationary phases. These competitive differentiators set the stage for an increasingly dynamic market, driven by partnerships that combine chemical expertise with high-throughput instrumentation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chiral Chromatography Column market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Daicel Corporation

- Danaher Corporation

- JASCO Corporation

- Merck KGaA

- Osaka Soda Co., Ltd.

- PerkinElmer, Inc.

- Regis Technologies, Inc.

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Waters Corporation

Actionable Strategies for Industry Leaders to Optimize Investment Portfolios, Enhance Supply Chains, and Drive Sustainable Growth in Chiral Separation Technologies

Industry leaders must prioritize integration of automated workflows to streamline enantiomeric method development and maintain competitive cost structures. Investing in predictive modeling software and lab automation not only accelerates column screening but also safeguards method robustness under evolving regulatory requirements. Concurrently, expanding in-house synthesis capabilities for chiral selectors can mitigate exposure to volatile tariff environments.

Diversifying supply chains through regional manufacturing partnerships will enhance resilience amid shifting trade policies. Establishing collaborative test labs in key geographies supports rapid customer service and localized method optimization. To capture emerging market segments, companies should tailor product portfolios for high-volume preparative applications in agrochemicals and fine chemicals, while simultaneously offering specialized sub-2-micron columns for pharmaceutical QC laboratories.

Finally, embedding sustainability criteria into product design-such as recyclable column formats and green solvent compatibility-will differentiate offerings and align with global eco-regulatory trends. By leveraging data-driven market insights and fostering cross-sector partnerships, industry leaders can craft agile strategies that maximize growth and mitigate risk.

Robust Multisource Research Methodology Combining Expert Interviews, Secondary Data Analysis, and Triangulation to Ensure Comprehensive Market Insights

This research integrates a robust, multi-pronged methodology to ensure comprehensive and accurate market insights. Secondary data collection encompassed an extensive review of peer-reviewed journals, industry white papers, regulatory guidelines, and corporate disclosures to map technological advancements and competitive landscapes. Proprietary databases provided detailed information on product launches, patent filings, and tariff schedules.

Primary research involved structured interviews with senior executives and technical experts from pharmaceutical R&D centers, academic institutions, and specialty chemical firms. These conversations validated secondary findings and offered nuanced perspectives on regional adoption patterns and supply chain challenges. The final analysis applied data triangulation techniques to reconcile diverse data sources and employed rigorous quality checks to confirm consistency and credibility of insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chiral Chromatography Column market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chiral Chromatography Column Market, by Column Type

- Chiral Chromatography Column Market, by Technology

- Chiral Chromatography Column Market, by Mode Of Operation

- Chiral Chromatography Column Market, by Particle Size

- Chiral Chromatography Column Market, by Application

- Chiral Chromatography Column Market, by End User

- Chiral Chromatography Column Market, by Region

- Chiral Chromatography Column Market, by Group

- Chiral Chromatography Column Market, by Country

- United States Chiral Chromatography Column Market

- China Chiral Chromatography Column Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Chiral Chromatography Market Insights Underscores the Strategic Imperatives for Innovation, Risk Mitigation, and Sustainable Advancement

The evolving chiral chromatography column market is defined by converging forces of regulatory demand, technological innovation, and geopolitical dynamics. As pharmaceutical and life science stakeholders intensify their focus on enantiomeric purity, advanced stationary phases and automated workflows will drive competitive differentiation. Concurrently, U.S. tariff policies underscore the importance of resilient supply chains and regional manufacturing alliances.

Market participants who harness segmentation insights to tailor offerings by application, end user, and operational scale will capture high-value opportunities. Regional strategies that align with local regulatory frameworks and sustainability agendas will prove essential. Ultimately, the fusion of strategic collaborations, green chemistry initiatives, and digital integration will chart a path for sustainable advancement across the global chiral separation landscape.

Secure Comprehensive Chiral Chromatography Market Intelligence Today by Partnering with Ketan Rohom to Elevate Your Strategic Decision-Making

Unlock exclusive access to the most comprehensive chiral chromatography market intelligence available. Reach out today to Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this in-depth research can empower your strategic initiatives and guide critical investment decisions.

- How big is the Chiral Chromatography Column Market?

- What is the Chiral Chromatography Column Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?