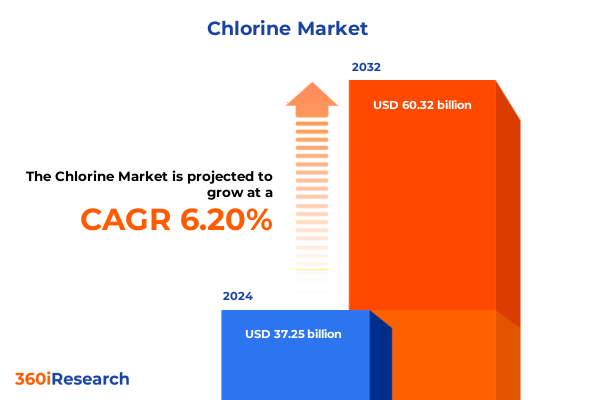

The Chlorine Market size was estimated at USD 39.00 billion in 2025 and expected to reach USD 40.83 billion in 2026, at a CAGR of 6.42% to reach USD 60.32 billion by 2032.

Understanding Chlorine’s Essential Role Across Industries and the Key Drivers Shaping Its Market Dynamics and Emerging Trends Driving Future Investment Decisions

Chlorine has long been recognized as an indispensable industrial chemical, driving critical applications ranging from water disinfection to polymer production. Its reactive properties enable effective oxidation reactions, bleaching processes, and microbial control, which collectively support public health initiatives and diverse manufacturing sectors. Against this backdrop, understanding the factors that shape chlorine’s availability and cost structures is essential for stakeholders aiming to enhance supply chain resilience and maintain regulatory compliance.

Recent developments in feedstock availability, energy pricing, and environmental regulations have further underscored chlorine’s strategic importance. In parallel, advances in electrochemical production methods and membrane technologies are redefining operational benchmarks for efficiency and sustainability. Additionally, evolving safety standards in handling and storage have prompted companies to adopt more rigorous process controls and invest in improved containment solutions.

As global demand patterns shift toward emerging economies and end-use industries prioritize environmental stewardship, chlorine producers and consumers alike must navigate complex market dynamics. This report provides a foundational overview of these trends, laying out the technical, commercial, and regulatory forces that will influence chlorine markets over the near and long term.

Analyzing Transformational Shifts in Chlorine Production and Consumption Driven by Sustainability Initiatives Technological Innovation and Regulatory Evolution

Industry-wide pressures to reduce carbon footprints have accelerated the adoption of greener chlorine production methods, most notably zero-emission electrolysis powered by renewable energy. This transformational shift not only addresses stringent environmental mandates but also enhances cost predictability in volatile fossil fuel markets. Moreover, smart process automation and digital monitoring systems are delivering real-time visibility into cell performance and energy consumption, driving continuous improvement in yield and operational reliability.

Furthermore, the landscape is being reshaped by the integration of circular economy principles. Companies now recover chlorine byproducts from downstream processes, redirecting them into value-added specialty chemicals or neutralizing them for safe disposal. Regulatory bodies are also tightening controls on mercury-based cell operations, pushing a gradual phase-out in favor of membrane cell technologies. Concurrently, blockchain-enabled traceability solutions are gaining traction, ensuring compliance with international shipping standards and bolstering stakeholder confidence in supply chain integrity.

Taken together, these responsible production initiatives and digital enhancements are redefining competitive differentiation. They encourage industry participants to reexamine legacy assets, explore joint ventures for shared infrastructure, and pursue targeted investments in breakthrough technologies that promise lower total cost of ownership and higher environmental performance.

Evaluating the Cumulative Impact of United States Tariffs Imposed in 2025 on Chlorine Supply Chains Cost Structures and Industry Competitiveness

In 2025, the United States government enacted a targeted tariff regime on imported chlorine to protect domestic manufacturing and encourage repatriation of supply chains. These measures have resulted in a stepped increase in cost bases for downstream industries, particularly affecting chemical intermediates, pulp and paper bleaching operations, and municipal water treatment facilities that rely on competitively priced imports.

Domestic producers initially experienced revenue uplifts as import volumes contracted, creating pockets of tightness in regions without nearby production assets. However, the higher duty rates have simultaneously pressured large-scale users to explore alternative oxidants and diversify feedstock sources. Consequently, several facilities have accelerated projects to retrofit existing brine electrolysis units or to develop on-site membrane cell plants to mitigate exposure to imported volumes.

Looking ahead, the cumulative impact of these tariffs is prompting industry leaders to engage more closely with policymakers, advocating for streamlined licensing processes and targeted incentives for low-emission electrochemical production. At the same time, supply chain stakeholders are exploring integrated salt-to-chlorine platforms to reduce overall landed costs. The net effect is a rebalancing of trade flows, with importers redirecting cargoes to markets in Latin America and Asia, while U.S.-based companies seek to expand capacity and modernize existing facilities.

Revealing Key Segmentation Insights Across Applications End-Use Industries Production Technologies Form Factors and Distribution Channels in the Chlorine Market

Chlorine’s market segmentation reveals a rich tapestry of end-use applications and industry verticals. In terms of application, bleaching dominates in pulp and paper and textile sectors, where chlorine-based agents play an irreplaceable role in achieving desired whiteness and purity. Meanwhile, deodorization processes leverage chlorine compounds to neutralize volatile organic compounds in food and beverage settings as well as industrial gas streams. The disinfection and oxidation segment encompasses critical services ranging from industrial wastewater treatment to municipal water systems and swimming pool sanitation, underscoring chlorine’s unmatched efficacy in microbial control.

Turning to end-use industries, chemical manufacturing firms deploy chlorine as a core feedstock for epoxy resin and vinyl chloride monomer production, underpinning the plastics and coatings markets. The food and beverage industry utilizes chlorine in bottled water sterilization and dairy processing lines, ensuring product safety and shelf stability. In oil and gas operations, it facilitates desulfurization protocols and enhanced oil recovery techniques, while the pulp and paper sector applies chlorine chemistries in both chemical and kraft pulp production. Water treatment providers, whether servicing industrial clients or municipal authorities, depend on chlorine-based disinfection to comply with health regulations and maintain operational continuity.

On the production technology front, diaphragm cell, membrane cell, and mercury cell processes each exhibit distinct performance profiles in terms of energy consumption, product purity, and environmental footprint. Chlorine is delivered to end users in multiple form factors-gas, liquid, and solid-with granular and tablet configurations tailored to ease handling and dosing accuracy. Finally, distribution channels span direct sales agreements with large-scale consumers, traditional distributors servicing regional markets, and emerging online platforms that facilitate small-batch purchases and expedited deliveries.

This comprehensive research report categorizes the Chlorine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Technology

- Form

- Application

- End Use Industry

- Distribution Channel

Highlighting Regional Dynamics and Performance Trends for Chlorine Demand Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the chlorine market are driven by a combination of raw material availability, energy costs, and infrastructure maturity. In the Americas, robust shale gas development has supported low-cost ethylene dichloride and chlorine production, fueling strong export positions while domestic demand continues to expand in municipal water treatment and specialty chemical sectors. North American producers are also investing in retrofitting aging mercury cell plants to membrane technology, aligning local capacity with environmental regulations and export requirements.

Within Europe, Middle East, and Africa, regulatory pressures on emissions and a growing emphasis on circular economy practices have catalyzed investments in closed-loop processes and byproduct recovery systems. Gulf region operators capitalize on abundant feedstock and competitive energy pricing to supply both regional and global markets, while European players focus on high-purity products and advanced process controls. Across Africa, emerging water infrastructure projects underpin a steady uptick in chlorine demand for sanitation and safe drinking water initiatives.

Asia-Pacific offers a fragmented landscape where cost-advantaged producers in China and India compete on export volumes, even as local governments enforce stricter environmental and safety regulations. Southeast Asian markets are experiencing rising demand in aquaculture and food processing applications, while Australia and Japan emphasize high-grade chlorine derivatives for electronics manufacturing. Collectively, these regional insights highlight the importance of aligning production footprints and logistics networks to capture evolving opportunities.

This comprehensive research report examines key regions that drive the evolution of the Chlorine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Chlorine Producers and Innovators and Their Strategic Initiatives Shaping Competitive Dynamics in the Global Market Landscape

A select group of global chemical companies drives innovation and capacity expansion across the chlorine supply chain. Integrated energy and chemical conglomerates leverage vertical integration to optimize feedstock flows and reduce production costs. Their strategic initiatives include ramping up green hydrogen-powered electrolysis projects and entering joint ventures to share infrastructure investments. Meanwhile, specialty chemical firms focus on high-value chlorine derivatives, investing in R&D to develop niche applications with higher margins.

Midstream service providers have differentiated by offering modular, site-agnostic membrane cell units that small and midsize producers can deploy with limited capital expenditure. These players also pilot digital twin simulations to optimize cell performance and predictive maintenance schedules, improving asset uptime and reducing total cost of ownership. In addition, third-party logistics and distribution specialists are enhancing traceability and safety compliance through blockchain-enabled documentation and automated cylinder management systems.

Innovation partnerships between technology startups and established producers are also gaining momentum, targeting new markets such as green solvent synthesis and advanced oxidation processes for wastewater reuse. Collectively, these strategic moves are reshaping competitive dynamics and underscoring the importance of agility and collaboration in capturing the next wave of growth in the global chlorine market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chlorine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anwil SA

- Chemfab Alkalis Limited

- Chemplast Sanmar Limited

- Covestro AG

- DCM Shriram Limited

- DCW Limited

- De Nora India Limited

- Ercros SA

- Formosa Plastics Corporation

- Grasim Industries Limited

- Gujarat Alkalies and Chemicals Limited

- Hanwha Solutions Corporation

- INEOS Group Holdings S.A.

- Kem One

- Meghmani Finechem Limited

- Nirma Limited

- Nouryon

- Occidental Petroleum Corporation

- Olin Corporation

- Tata Chemicals Limited

Providing Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience Drive Growth and Seize New Opportunities in the Chlorine Market

Industry leaders should prioritize investments in low-emission electrolysis technologies powered by renewable energy to safeguard against tightening environmental regulations and fluctuating fossil fuel prices. By upgrading existing brine splitting facilities with energy-efficient membrane cells, firms can achieve significant reductions in carbon intensity while maintaining product quality. Additionally, forging strategic alliances with renewable power providers or energy storage developers can further stabilize operating costs and support long-term sustainable growth.

To mitigate trade risks and tariff exposures, companies are advised to diversify their supplier base across multiple geographies and build flexible supply chain frameworks. Establishing regional blending and repackaging hubs can reduce reliance on raw imports while improving response times to shifting end-user demand. Moreover, adopting digital supply chain platforms enables real-time visibility into inventory levels, shipping status, and regulatory compliance, empowering decision-makers with timely data.

Finally, organizations should explore opportunities in adjacent specialty markets by leveraging proprietary chlorine derivatives and collaborating with R&D partners to co-develop novel applications. Such initiatives not only strengthen competitive positioning but also unlock value through higher-margin product portfolios. By aligning capital allocation with these strategic priorities, industry participants can enhance resilience, capture emerging market opportunities, and sustain profitable growth.

Outlining the Rigorous Research Methodology Employed to Gather Primary Insights and Validate Data Trends for Comprehensive Chlorine Market Analysis

This report’s findings are built on a rigorous methodology combining qualitative and quantitative research techniques. Initial secondary research reviewed industry publications, government databases, and company filings to map the global chlorine ecosystem and identify emerging trends. A comprehensive database of plant capacities, feedstock sources, and distribution networks was constructed and validated through triangulation of multiple data sources.

Primary research involved in-depth interviews with senior executives, technical experts, and supply chain managers across leading chlorine producers and end-user organizations. Insights from these conversations enriched the analysis of market dynamics, regulatory impacts, and technology adoption rates. The research team also conducted facility site visits and technology workshops to observe operational best practices and gauge investment priorities.

Data triangulation and consistency checks were applied throughout the process to ensure accuracy and reliability. Forecast assumptions and scenario analyses were subjected to sensitivity testing under varied regulatory and feedstock cost environments. The outcome is a robust framework that stakeholders can trust for strategic planning, risk assessment, and competitive benchmarking in the chlorine market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chlorine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chlorine Market, by Production Technology

- Chlorine Market, by Form

- Chlorine Market, by Application

- Chlorine Market, by End Use Industry

- Chlorine Market, by Distribution Channel

- Chlorine Market, by Region

- Chlorine Market, by Group

- Chlorine Market, by Country

- United States Chlorine Market

- China Chlorine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Summarizing the Strategic Imperatives and Long-Term Outlook for Stakeholders Navigating the Evolving Chlorine Market Environment with Confidence

As the chlorine industry navigates tightening environmental standards, evolving trade policies, and advancing production technologies, stakeholders must remain agile and informed. The intersection of sustainability initiatives, digital innovations, and regulatory developments will define the competitive landscape and determine which organizations thrive in the years ahead. Collaboration across the value chain, from feedstock suppliers to end-user service providers, will be crucial in unlocking efficiencies and driving responsible growth.

Market participants that proactively invest in green production pathways, diversify supply sources, and build data-driven supply chain capabilities will be best positioned to manage risks and seize new revenue streams. Embracing circular economy principles and exploring adjacent specialty markets can further enhance resilience and create value beyond traditional chlorine derivatives. Above all, continuous monitoring of geopolitical shifts and tariff regimes will enable companies to adapt strategies and maintain operational continuity.

In summary, the chlorine market is at a pivotal juncture where strategic foresight and decisive action can deliver enduring competitive advantage. By applying the insights and recommendations presented in this report, stakeholders can chart a course toward sustainable profitability and long-term market leadership.

Connect with Ketan Rohom to Access Comprehensive Chlorine Market Research Insights and Unlock Tailored Solutions for Strategic Growth Opportunities

In today’s rapidly evolving industrial landscape, chlorine stands as a cornerstone chemical, underpinning vital processes across water treatment, pharmaceuticals, and consumer goods manufacturing. Given its versatility, stakeholders require in-depth analysis to make informed decisions that drive operational efficiency and sustainability. This report offers a deep dive into market drivers, risk factors, and strategic imperatives, equipping executive teams with actionable intelligence.

By forging a direct dialogue with Associate Director, Sales & Marketing Ketan Rohom, clients will gain personalized guidance on leveraging the report’s insights to optimize supply chains, anticipate regulatory shifts, and explore high-potential end-use applications. Whether refining procurement strategies or evaluating green production pathways, this engagement ensures clarity on the report’s comprehensive findings and facilitates tailored research support.

Take the next step in capturing growth opportunities and safeguarding your competitive position. Reach out to our team through the provided channels to purchase the full chlorine market research report and initiate a customized consultation that aligns with your organization’s strategic objectives.

- How big is the Chlorine Market?

- What is the Chlorine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?