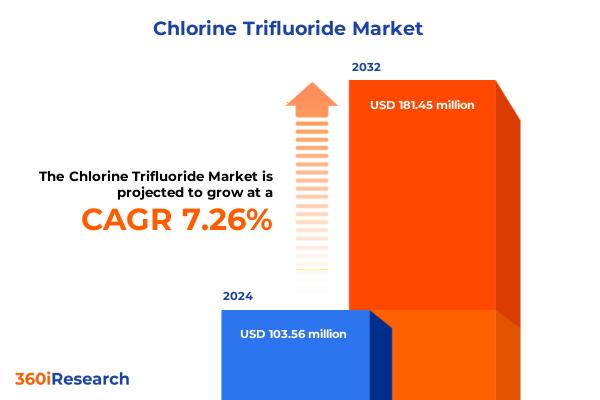

The Chlorine Trifluoride Market size was estimated at USD 110.96 million in 2025 and expected to reach USD 117.87 million in 2026, at a CAGR of 7.27% to reach USD 181.45 million by 2032.

Unveiling the Pivotal Role of Chlorine Trifluoride in Driving Innovation within Advanced Industrial and Research Arenas

Chlorine Trifluoride stands as one of the most reactive and versatile inorganic fluorides in both industrial and research settings. With a unique combination of strong oxidizing properties and high fluorine content, this compound has secured a pivotal role across a spectrum of advanced applications. Its significance is underscored by its ability to facilitate critical processes in semiconductor manufacturing and rocket propulsion, where performance and reliability are paramount. As awareness of its potential has grown, so too has the breadth of its technological applications, prompting deeper investigation by leading chemical providers and end users alike.

Over the last decade, the broader chemical industry has witnessed a heightened emphasis on performance-driven reagents and specialized intermediates. Within this context, Chlorine Trifluoride emerges not only as a high-impact reagent but also as a strategic asset for companies seeking to optimize efficiency and push the boundaries of innovation. As research laboratories expand their explorations of next-generation energy systems and advanced material synthesis, Chlorine Trifluoride’s unique reactivity profile positions it at the forefront of emergent technological breakthroughs. Consequently, understanding its evolving utility and potential risks has become essential for stakeholders aiming to harness its full capabilities while maintaining the highest safety standards.

Charting the Technological Revolution That Is Redefining Chlorine Trifluoride’s Application Across Semiconductor and Aerospace Sectors

The landscape of Chlorine Trifluoride utilization has undergone transformative shifts driven by rapid technological advancements across multiple sectors. Breakthroughs in semiconductor etching have elevated the demand for ultra-pure fluorinating agents capable of delivering precision at nanometer scales. As feature sizes on silicon wafers continue to shrink, researchers and manufacturers have turned to ClF3 for its unique capacity to produce highly uniform and residue-free surfaces. These capabilities have been particularly crucial in emerging 3D architectures and compound semiconductor platforms.

Simultaneously, the aerospace sector has seen renewed interest in hypergolic propellants for next-generation launch systems. Owing to its storied history as a high-performance oxidizer, Chlorine Trifluoride has reemerged as a candidate for experimental rocket propulsion, promising dramatic improvements in impulse and thrust stability. Moreover, the chemical synthesis market has broadened its scope through modular and continuous flow technologies that leverage ClF3’s aggressive fluorination potential to streamline the production of high-value specialty molecules. By enabling more efficient reaction pathways, these applications have redefined the parameters of both throughput and environmental impact within chemical manufacturing.

Examining How the 2025 Tariff Revisions Are Reshaping Supply Chain Strategies and Procurement Dynamics for High-Purity Inorganic Reagents

In 2025, sweeping tariff adjustments in the United States have reverberated across global supply chains, particularly for highly specialized inorganic compounds. Chlorine Trifluoride, with its niche production base and limited number of qualified manufacturers, has felt the impact of increased import duties and more stringent trade compliance requirements. These shifts have compelled end users to reassess procurement strategies and explore alternative sourcing options that balance cost, quality, and logistical resilience.

Consequently, several key buyers in the semiconductor and aerospace industries have initiated strategic partnerships with domestic producers and allied distributors to insulate their operations from volatility. By fostering closer collaboration and leveraging long-term contracts, stakeholders have achieved greater supply chain transparency and mitigated the risk of production delays. At the same time, the elevated cost environment has prompted renewed investment in on-site storage and handling infrastructure, as companies seek to secure buffer inventories and streamline regulatory compliance. These cumulative adjustments underscore the critical interplay between trade policy and operational agility in sustaining advanced manufacturing ecosystems.

Delving into the Multifaceted Segmentation of Chlorine Trifluoride by Industry Use Case and Process Application to Reveal Demand Patterns

An in-depth exploration of end use segmentation reveals a diversified demand profile for Chlorine Trifluoride across industries ranging from complex chemical synthesis to specialized semiconductor etching. In chemical synthesis, its role as a powerful fluorination agent enables streamlined production of high-value intermediates, while in nuclear fuel processing it serves as an indispensable cleaning and refining medium. The aerospace sector’s ongoing propulsion experiments have further elevated its status as a rocket propellant oxidizer, and surface treatment specialists continue to leverage its aggressive reactivity for passivation and etching processes. Within semiconductor manufacturing, Chlorine Trifluoride’s utility as an etching agent-encompassing both dry and wet etching applications-has become integral to the fabrication of next-generation microelectronic devices.

Application-driven analysis highlights distinct sub-segments where ClF3’s reactivity profile is matched to specific process requirements. Etching applications, subdivided into dry and wet techniques, capitalize on its ability to achieve precise material removal without hazardous by-products. In fluorination and oxidation roles, its potency accelerates reaction kinetics and reduces the need for multi-step syntheses. The passivation segment splits into chemical and ion-based processes, each harnessing ClF3’s surface stabilization properties to enhance corrosion resistance and improve lifetime performance of metal components. Across purity grades, electronic grade variants command preference for the most demanding microfabrication tasks, while industrial and research grades offer practical alternatives for broader chemical and defense applications. Distribution insights indicate that direct sales models-whether through spot purchases or long-term contract agreements-provide secure channels for high-volume consumers, whereas global and local distributors broaden market access, particularly to niche research institutions. Finally, product form trends continue to center on compressed gas cylinders for routine laboratory use, complemented by larger ISO tank solutions for high-throughput manufacturing environments.

This comprehensive research report categorizes the Chlorine Trifluoride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Distribution Channel

- End Use Industry

- Application

Unraveling Regional Dynamics in the Americas EMEA and Asia-Pacific That Are Directing Chlorine Trifluoride Demand and Supply Chain Strategies

Regional performance trends across the Americas have been strengthened by a robust manufacturing resurgence, fueled in part by initiatives to repatriate critical chemical production. The United States, Mexico, and Canada have collectively invested in upgrading handling facilities (for example, pressure vessels and inert gas environments) to accommodate high-purity Chlorine Trifluoride safely. These upgrades have not only enhanced domestic supply resilience but also attracted foreign technology partnerships, particularly in advanced semiconductor assembly and aerospace propulsion research.

In Europe, the Middle East, and Africa, stringent environmental and safety regulations have shaped both the scale and structure of ClF3 usage. While Western Europe continues to emphasize low-emission production standards, Middle Eastern aerospace initiatives have driven experimental rocket fuel programs. Africa’s emerging petrochemical clusters are increasingly exploring ClF3 for specialized fluorination processes. Collectively, EMEA stakeholders have prioritized harmonized compliance frameworks to facilitate cross-border trade and shared research initiatives.

Meanwhile, the Asia-Pacific region remains the largest consumer by volume, driven by expansive semiconductor fabrication hubs in Taiwan, South Korea, and China. Government incentives to localize critical supply chains have accelerated capacity expansions at key production sites, while Japan’s legacy chemical expertise underpins ongoing research into next-generation etching chemistries. Across these markets, strategic collaborations between regional distributors and end users are delivering more agile logistics solutions, reducing lead times, and ensuring safe handling of this highly reactive reagent.

This comprehensive research report examines key regions that drive the evolution of the Chlorine Trifluoride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Investments and Collaborative Innovations That Define Leadership among Top Chlorine Trifluoride Suppliers

Key industry participants continue to differentiate themselves through investments in safety-certified handling, high-purity manufacturing standards, and vertical integration. Several leading chemical producers have implemented advanced scrubber systems and real-time monitoring technologies to ensure consistent product quality and regulatory compliance. At the same time, specialty gas suppliers have forged partnerships with semiconductor equipment manufacturers to co-develop delivery solutions that optimize purity retention through precision-engineered valves and leak-free connectors.

On the research front, collaborative ventures between academic institutions and corporate R&D centers have accelerated the exploration of ClF3 derivatives and alternative halogen trifluorides, broadening the scope of potential applications. Select organizations are piloting modular microreactor platforms to investigate continuous flow fluorination, aiming to reduce scale-up risks and waste generation. Furthermore, distributors focused on emerging markets are enhancing their service portfolios with bundled risk management consulting, underscoring the industry’s shift toward end-to-end solutions rather than standalone product sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chlorine Trifluoride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Arkema S.A.

- Central Glass Co., Ltd.

- Daikin Industries Ltd.

- Gujarat Fluorochemicals Limited

- Hanwha Solutions Corporation

- Honeywell International Inc.

- Kanto Denka Kogyo Co., Ltd.

- Linde plc

- Matheson Tri-Gas Inc.

- Merck KGaA

- Mitsui Chemicals Inc.

- Navin Fluorine International Limited

- NIPPON SANSO HOLDINGS CORPORATION

- Occidental Petroleum Corporation

- Olin Corporation

- Resonac Holdings Corporation

- Shandong Dongyue Group

- Solvay S.A.

- SRF Limited

- Tosoh Corporation

- Versum Materials

- Westlake Chemical Corporation

Crafting Proactive Strategies and Partnerships to Safeguard Operations and Unleash New Opportunities in Chlorine Trifluoride Applications

Industry leaders should prioritize the integration of advanced safety protocols and digital monitoring systems to maintain uninterrupted production and protect personnel. By adopting predictive maintenance algorithms and sensor-based analytics, operators can proactively address container integrity issues before they escalate. In parallel, securing long-term agreements with diversified suppliers ensures pricing stability and shields operations from sudden policy shifts or capacity constraints.

Moreover, forging cross-sector partnerships will catalyze innovation and open new application frontiers. Collaborating with semiconductor equipment vendors or aerospace propulsion teams can yield optimized process chemistries and customized delivery solutions. Investing in modular pilot plants and continuous flow capabilities will also enable rapid scaling of promising laboratory findings. Finally, engaging with regulatory bodies to shape practical, science-based guidelines for storage and transport can reduce compliance lead times and facilitate global expansion efforts.

Explaining the Robust Mixed-Methods Framework That Underpins the Comprehensive Analysis of Chlorine Trifluoride Market Dynamics

This research employed a multi-tiered approach combining primary industry interviews, extensive secondary literature reviews, and site visits to certified production facilities. Primary data were gathered through confidential discussions with procurement managers, process engineers, and safety compliance officers to capture real-world usage patterns and logistical challenges. Secondary sources included public filings, regulatory dossiers, and technical papers from peer-reviewed journals to validate observed trends and technological advancements.

Quantitative insights were supplemented by case study analyses of leading semiconductor fabs and aerospace test programs, providing context for supply chain innovations and application breakthroughs. Geographic coverage was ensured through targeted outreach in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific to reflect diverse regulatory environments and market maturity levels. Finally, data synthesis prioritized triangulation of findings across multiple sources, enhancing the overall reliability of conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chlorine Trifluoride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chlorine Trifluoride Market, by Purity Grade

- Chlorine Trifluoride Market, by Distribution Channel

- Chlorine Trifluoride Market, by End Use Industry

- Chlorine Trifluoride Market, by Application

- Chlorine Trifluoride Market, by Region

- Chlorine Trifluoride Market, by Group

- Chlorine Trifluoride Market, by Country

- United States Chlorine Trifluoride Market

- China Chlorine Trifluoride Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing the Critical Interplay of Innovation Safety and Strategy That Will Shape the Future of Chlorine Trifluoride Utilization

Chlorine Trifluoride’s extraordinary reactivity and versatility position it at the nexus of critical industrial and research applications. From driving next-generation semiconductor etching to enabling high-performance rocket propulsion and sophisticated chemical synthesis pathways, its utility continues to expand. Yet, evolving trade policies and stringent safety requirements demand nimble supply chain strategies and ongoing technological innovation.

As end users and suppliers alike navigate this complex landscape, success will hinge on integrating advanced process controls, strategic partnerships, and robust compliance frameworks. By aligning safety, performance, and cost considerations, stakeholders can leverage Chlorine Trifluoride to unlock new levels of operational excellence. Ultimately, those who embrace data-driven decision-making and collaborative development models will lead the market toward safer, more efficient, and more sustainable applications of this remarkable chemical reagent.

Empower Your Strategy with Direct Access to Expert Guidance on Chlorine Trifluoride Market Analysis from a Dedicated Sales Leader

To explore a comprehensive deep dive into the evolving Chlorine Trifluoride market and secure unparalleled insights, reach out directly to the Associate Director of Sales & Marketing at 360iResearch, Ketan Rohom. His expertise and personalized approach ensure that your organization gains the precise intelligence required to inform critical decision-making and stay ahead in the competitive landscape. Engage Ketan today and receive tailored guidance on accessing the full spectrum of analysis, data, and strategic recommendations that will empower your next phase of growth.

- How big is the Chlorine Trifluoride Market?

- What is the Chlorine Trifluoride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?