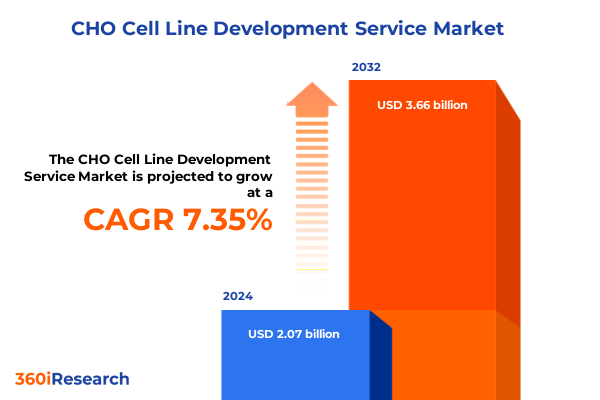

The CHO Cell Line Development Service Market size was estimated at USD 2.18 billion in 2025 and expected to reach USD 2.35 billion in 2026, at a CAGR of 7.65% to reach USD 3.66 billion by 2032.

Discover the strategic significance of CHO cell line development in modern bioprocessing and its role in fast-tracking biologic therapeutics delivery

CHO cell line development has emerged as the cornerstone of biologics manufacturing, underpinning the creation of life-saving therapies such as monoclonal antibodies, recombinant proteins, and vaccines. As pharmaceutical and biotechnology companies strive to meet the growing demand for high-quality biologics, the selection and optimization of Chinese Hamster Ovary (CHO) cells have become critical determinants of process efficiency, yield, and regulatory compliance. By leveraging advanced genetic engineering techniques and rigorous screening protocols, research organizations and contract service providers can achieve cell lines that exhibit superior productivity, stability, and safety profiles.

This executive summary provides a comprehensive overview of the CHO cell line development landscape, highlighting the factors driving its transformation and the strategies that industry leaders are adopting to maintain technological and operational excellence. Through an exploration of recent innovations, regulatory shifts, segmentation nuances, and regional dynamics, decision makers will gain actionable insights to guide their strategic initiatives. The insights presented here reflect the latest trends in expression technology, service offerings, and supply chain management, ensuring that stakeholders can navigate emerging challenges and leverage new opportunities for growth. By establishing a clear understanding of the evolving environment, organizations can chart a path toward accelerated development timelines, optimized resource allocation, and sustained competitive advantage.

Explore how technological innovations and regulatory shifts are redefining CHO cell line development workflows to drive biologics manufacturing forward

The CHO cell line development landscape is undergoing a profound transformation, driven by advances in genetic engineering, automation, and regulatory expectations. Technologies such as site-specific integration using CRISPR-Cas systems and Cre-Lox recombination have enabled researchers to achieve targeted gene insertion, leading to clones with predictable performance characteristics and reduced positional effects. At the same time, improvements in screening throughput and data analytics are allowing teams to evaluate thousands of candidates in parallel, identifying top performers with unprecedented speed.

Regulatory bodies have also raised the bar for cell line characterization, requiring detailed assessments of genetic stability, copy number integration, and clonal purity. As a result, service providers are investing in next-generation platforms that combine genomic sequencing, high-content imaging, and bioinformatics pipelines to generate robust datasets that satisfy stringent compliance requirements. Moreover, the integration of artificial intelligence and machine learning into clone selection workflows is enabling dynamic optimisation based on multi-parameter performance metrics.

In parallel, the convergence of process intensification and continuous manufacturing paradigms is reshaping upstream development strategies. Industry leaders are embracing intensified bioreactor configurations and perfusion-based culture systems, which demand cell lines capable of maintaining high viability and productivity over extended durations. These shifts not only accelerate development timelines but also reduce overall facility footprints and resource consumption, positioning CHO cell line development as a key enabler of sustainable biologics production.

Assessing the comprehensive effects of new United States tariffs implemented in 2025 on CHO cell line development supply chains and cost dynamics

In 2025, the introduction of new United States tariffs on key biotechnology reagents, cell culture equipment, and critical consumables has had a cascading impact on CHO cell line development services. The added import duties have increased lead times for essential items such as serum alternatives, single-use bioreactor components, and molecular biology enzymes, prompting organizations to reevaluate their supplier networks. Many development teams have responded by diversifying sourcing strategies, exploring domestic manufacturers, and negotiating volume-based agreements to mitigate cost pressures and ensure uninterrupted project timelines.

These tariffs have also intensified focus on cost-effective process design, driving interest in modular workcells and lean facility layouts that optimize resource utilization. Development groups are adopting integrated automation platforms that reduce manual intervention and inventory waste, thereby offsetting the impact of higher material costs. In addition, partnerships between service providers and reagent suppliers have emerged, fostering customized formulations and prevalidated kits that streamline cell line creation and simplify supply chain logistics.

As a result, strategic planning for CHO cell line development is increasingly incorporating tariff scenarios and geopolitical considerations into risk assessments. Cross-functional teams are collaborating closely with procurement, legal, and quality assurance to develop contingency frameworks that balance cost, compliance, and performance. Ultimately, these adaptations are reinforcing organizational resilience and highlighting the importance of agile infrastructure in a market characterized by evolving trade policies and global uncertainties.

Unveiling critical segmentation perspectives across end users business models expression technologies applications and service type nuances

A nuanced understanding of market segmentation offers clarity on the varied demands and decision criteria across service users. End users such as academic and research institutes prioritize flexibility and experimental freedom, often valuing rapid turnaround times and customizable screening panels over cost efficiencies. Biopharmaceutical companies, by contrast, look for robust, scalable workflows and deep regulatory expertise to support late-stage development and commercial manufacturing. Contract research organizations occupy a unique position, requiring both the technical versatility to accommodate diverse client projects and the operational robustness to meet strict project timelines.

Business models also play a decisive role in how organizations invest in cell line development capabilities. Inhouse groups often integrate development workflows within their broader process development and manufacturing networks, emphasizing long-term cost control and seamless technology transfer. Outsourced providers offer modular services that enable resource-constrained teams to access specialized platforms without significant capital outlay, with service portfolios spanning from initial cell line characterization to master cell banking and regulatory support.

Expression technology choices further differentiate offerings. Platforms based on artificial chromosome technology provide expansive genomic capacity for complex construct expression, while random integration approaches using non-viral or viral vectors deliver rapid, high-throughput screening. Site-specific techniques such as Cre-Lox recombination, CRISPR-Cas technology, and zinc finger nuclease systems afford precision and stability, supporting the demands of high-value molecules.

Applications ranging from monoclonal antibodies to recombinant proteins and vaccines necessitate tailored cell line attributes, whether that entails high volumetric productivity, glycosylation consistency, or viral clearance compatibility. Finally, service type segmentation-encompassing cell line characterization, clone screening, genetic engineering, master cell banking in GMP or research grade, and regulatory support-reflects the end-to-end nature of development, underlining the importance of integrated solutions that align scientific rigor with compliance requirements.

This comprehensive research report categorizes the CHO Cell Line Development Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Expression Technology

- Business Model

- End User

- Application

Illuminating regional variations to reveal how Americas EMEA and Asia Pacific landscapes uniquely shape CHO cell line development priorities

Regional dynamics exert a profound influence on CHO cell line development priorities and service delivery models. In the Americas, robust research ecosystems and significant biopharmaceutical investment have fueled demand for turnkey solutions that integrate automation, high-throughput screening, and advanced analytics. North American organizations benefit from established regulatory pathways and deep capital markets, facilitating rapid adoption of novel expression platforms and digital tracking systems.

The Europe, Middle East and Africa region presents a mosaic of regulatory regimes and market maturities, where centralized European guidelines coexist with country-level variations in approval processes. Providers in this region emphasize localization of quality systems and strategic alliances with academic institutions to navigate diverse compliance landscapes. Meanwhile, emerging markets across the Middle East and Africa are investing in foundational infrastructure, creating opportunities for modular service offerings that accelerate local biologics capabilities.

In Asia-Pacific, large-scale manufacturing hubs in China and India are expanding upstream capacity to support domestic and global demand. Regulatory authorities in key markets are enhancing biosafety and cell bank qualification standards, prompting service providers to extend their offerings to include comprehensive master cell banking and genetic stability testing. Collaboration between multinational companies and regional partners is on the rise, reflecting a shared focus on reducing development timelines and optimizing production processes. These regional insights guide strategic prioritization and inform the design of scalable, compliant workflows tailored to each geography’s unique challenges.

This comprehensive research report examines key regions that drive the evolution of the CHO Cell Line Development Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into leading organizations strategies investments and collaborations that are defining excellence in CHO cell line development services

Leading organizations are setting new benchmarks in CHO cell line development by combining strategic investments with pioneering research collaborations. Major life science suppliers have expanded their footprint through acquisitions of specialized service providers and proprietary technology platforms, integrating capabilities that span from high-throughput clone screening to advanced gene editing. Several global reagents manufacturers have launched dedicated development centers to co-innovate with biopharmaceutical sponsors, accelerating technology transfer and reducing time to clinic.

Contract research organizations are differentiating through modular service models that offer flexibility in engagement scope and depth of technical support. By investing in automated cell culture workstations and cloud-based data management systems, these providers are enhancing transparency and enabling real-time monitoring of cell line performance metrics. Meanwhile, inhouse development teams at leading biopharma firms are forging partnerships with academic innovators and biotech startups, leveraging novel expression vectors and bioinformatics tools to unlock higher titers and product quality.

Collaboration networks between equipment vendors, reagent suppliers, and end users are increasingly common, reflecting a trend toward integrated ecosystems that deliver standardized, scalable workflows. Intellectual property strategies and cross-licensing agreements are facilitating broader access to site-specific integration technologies, while shared validation protocols are streamlining compliance across multiple jurisdictions. These strategic moves underscore the importance of partnership-driven models in sustaining competitive advantage and fostering continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the CHO Cell Line Development Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Biologics

- Aragen Life Sciences

- Boehringer Ingelheim International GmbH

- BPS Bioscience Inc

- Catalent Inc

- Charles River Laboratories

- Creative Bioarray

- Curia

- Eurofins Scientific S.E.

- ExcellGene SA

- FairJourney Biologics

- Fujifilm Diosynth Biotechnologies

- GenScript Biotech Corporation

- GTP Bioways

- Horizon Discovery

- KBI Biopharma

- Lonza Group Ltd

- Merck KGaA

- Samsung Biologics Co Ltd

- Sartorius Group

- Selexis SA

- Thermo Fisher Scientific Inc

- WuXi Biologics

Actionable strategies for industry leaders to optimize CHO cell line development operations accelerate innovation and secure competitive advantage

To optimize CHO cell line development operations, organizations should prioritize the adoption of precision gene editing platforms, focusing on site-specific integration techniques to ensure consistent clone behavior and streamline downstream process transfer. Investing in high-throughput screening automation and artificial intelligence-driven analytics will enhance decision accuracy and reduce development timelines, enabling rapid identification of high-performance candidates.

Supply chain resilience should be addressed through diversified sourcing strategies and strategic partnerships with reagent and equipment suppliers. Establishing domestic and regional supply agreements can mitigate the impact of international tariffs and logistical disruptions, while collaborative formulation development reduces reliance on single-source materials. Risk assessments must incorporate geopolitical factors, ensuring that procurement, quality, and legal teams align to maintain project continuity.

Regulatory alignment is critical; early engagement with validation and compliance experts can integrate characterization requirements into development workflows, reducing delays during technology transfer and clinical phase transitions. Organizations are encouraged to embed quality-by-design principles, leveraging data-rich platforms to generate robust evidence packages that satisfy global regulatory standards. Finally, fostering collaborative research ecosystems through alliances with academic centers and technology innovators will accelerate access to emerging expression technologies and drive sustainable improvements in cell line performance.

Detailed overview of research methodology combining primary and secondary approaches to ensure accuracy depth and reliability of insights

The research methodology underpinning this report blends primary and secondary approaches to deliver comprehensive and reliable insights. Initial scoping involved a thorough review of peer-reviewed scientific literature, patent filings, and regulatory guidelines to establish the technical and compliance context of CHO cell line development. Concurrently, exploratory interviews were conducted with senior R&D leaders, process development scientists, and quality assurance professionals to capture firsthand perspectives on emerging challenges and priorities.

To quantify qualitative findings, a series of structured surveys and expert panel workshops were held, focusing on technology adoption rates, service model preferences, and regional operational specifics. Data triangulation was employed to reconcile inputs from various sources, ensuring that conclusions reflect a balanced view of market dynamics and stakeholder requirements. Analytical frameworks incorporated scenario planning around factors such as trade policy shifts and technological breakthroughs, enabling the development of risk-adjusted strategic recommendations.

Throughout the research process, rigorous validation protocols were applied, including peer review by subject matter experts and iterative feedback loops with key opinion leaders. This iterative approach ensured that insights remained current, accurate, and actionable, providing stakeholders with a robust foundation for decision making in the rapidly evolving CHO cell line development landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CHO Cell Line Development Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CHO Cell Line Development Service Market, by Service Type

- CHO Cell Line Development Service Market, by Expression Technology

- CHO Cell Line Development Service Market, by Business Model

- CHO Cell Line Development Service Market, by End User

- CHO Cell Line Development Service Market, by Application

- CHO Cell Line Development Service Market, by Region

- CHO Cell Line Development Service Market, by Group

- CHO Cell Line Development Service Market, by Country

- United States CHO Cell Line Development Service Market

- China CHO Cell Line Development Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding perspective on the evolving CHO cell line development landscape and its implications for stakeholders across the bioprocessing continuum

The landscape of CHO cell line development is characterized by rapid technological advancement, shifting regulatory expectations, and complex supply chain considerations. Organizations that master site-specific integration, leverage high-throughput automation, and foster resilient supplier networks will be best positioned to navigate emerging challenges. Regional differences underline the need for tailored strategies, while segmentation insights emphasize that end-user objectives and application requirements must drive service design.

Strategic collaborations between technology providers, academic innovators, and biopharmaceutical developers are creating cohesive ecosystems that accelerate time to clinic and enhance process robustness. As tariffs and trade policies continue to influence cost structures, agile operational planning and diversified procurement strategies will be essential for maintaining competitive advantage.

By synthesizing the latest trends and delivering targeted recommendations, this report equips decision makers with the knowledge required to realize efficient, compliant, and scalable CHO cell line development programs. The path forward demands a proactive approach, integrating advanced engineering platforms with data-driven quality frameworks to support the next generation of biologic therapeutics.

Request personalized insights and discuss tailored CHO cell line development solutions with Ketan Rohom Associate Director Sales and Marketing

To gain an in-depth understanding of CHO cell line development strategies and tailor them to your organization’s unique needs, reach out to Ketan Rohom, Associate Director Sales and Marketing. Engage in a personalized consultation to explore how this comprehensive research can inform your decision making, enhance operational efficiency, and accelerate biologic product pipelines. Begin the conversation today to secure a copy of the full report and unlock the insights that will drive your competitive edge in the rapidly advancing field of CHO cell line development.

- How big is the CHO Cell Line Development Service Market?

- What is the CHO Cell Line Development Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?