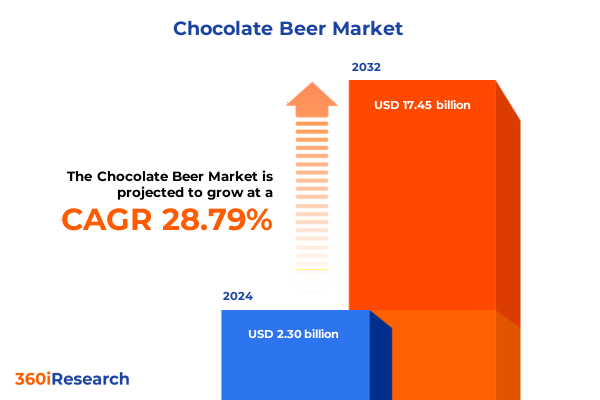

The Chocolate Beer Market size was estimated at USD 2.91 billion in 2025 and expected to reach USD 3.67 billion in 2026, at a CAGR of 29.16% to reach USD 17.45 billion by 2032.

Unveiling the Rise of Chocolate-Infused Beers as an Artisanal Craft Phenomenon Capturing Connoisseurs’ Palates with Decadent Flavor Exploration

The chocolate beer segment has emerged from the fringes of experimental craft brewing to claim a sophisticated niche among discerning consumers. In recent years, brewers have experimented with cacao beans, chocolate extracts, and pastry-inspired adjuncts to create beers that blend the robust nuances of malt with the seductive allure of chocolate. This fusion has resonated powerfully with enthusiasts seeking multisensory experiences that transcend traditional beer profiles. As a result, what began as seasonal stouts infused with dark chocolate have matured into a full-fledged category offering diverse formats and flavor intensities.

Throughout this evolution, artisanal breweries have seized the opportunity to differentiate their portfolios by showcasing craftsmanship and innovation. They have forged strategic partnerships with chocolatiers and specialty ingredient suppliers to source bean-to-bar chocolate variants tailored for brewing. At the same time, consumer curiosity around unique taste discoveries has accelerated trial rates, encouraging mainstream breweries to introduce limited-edition releases. Consequently, chocolate beer has transitioned from novelty to a compelling subsegment that drives foot traffic in taprooms and premium shelf space in retail outlets. This introduction sets the stage for exploring the transformative shifts, regulatory impacts, segmentation nuances, and strategic imperatives that define this dynamic sector.

Charting the Transformations Redefining the Chocolate Beer Sector and Accelerating Innovation in Flavor Development Distribution Methods and Consumer Engagement

Innovation in chocolate beer formulation has accelerated, propelled by advancements in extraction technologies and ingredient customization. Brewing teams are increasingly leveraging precision-controlled roasting profiles and high-purity cacao liquids to achieve consistent flavor balance. In parallel, the integration of non-traditional adjuncts-such as cocoa nibs, cacao husk tea, and lactose-has expanded the sensory spectrum, enabling brewers to fine-tune sweetness levels, mouthfeel, and aromatic complexity. These technical refinements have been pivotal in elevating chocolate beer from a specialty release to a mainstream craft offering that appeals to a broader audience.

Furthermore, distribution models have undergone significant transformation. Digital channels and direct-to-consumer platforms now play a central role in product launches and limited-edition drops. Breweries harness social media and e-commerce portals to build anticipation, using virtual tastings and subscription services to sustain engagement beyond traditional retail and on-premise channels. Simultaneously, collaborative ventures between large-scale and craft brewers are reshaping supply chains, integrating co-packing agreements and joint marketing initiatives to scale innovations rapidly.

Moreover, consumer expectations have evolved toward experiential and convenient consumption. Pop-up tasting events, chocolate pairing dinners, and brewery tours featuring behind-the-scenes brewing workshops are now standard. As a result, brands that adeptly combine flavor ingenuity with immersive experiences have secured enhanced brand loyalty and created new benchmarks for what chocolate beer can deliver.

Analyzing the Cumulative Effects of Newly Imposed United States Tariffs on Chocolate Beer Imports and Domestic Production Dynamics in 2025

The introduction of new tariff measures in early 2025 has reshaped the economics of chocolate beer, influencing both import costs and domestic production dynamics. With higher levies on imported cacao derivatives and beer kegs, breweries reliant on overseas suppliers have encountered elevated input prices. These cost pressures have prompted many producers to reexamine their sourcing strategies, fostering local alliances with cocoa processors and incentivizing investments in domestic chocolate extract facilities. Consequently, while imported volumes of specialized brewing ingredients have contracted, a localized supply base is beginning to take root, offering competitive alternatives and enhancing supply chain resilience.

On the consumer side, the increased cost of raw materials has led to modest price adjustments for limited-edition and barrel-aged chocolate beers. Retailers and on-premise venues have responded by repositioning these products as premium offerings, emphasizing artisanal quality and exclusivity to justify higher price points. Meanwhile, standard chocolate-infused lagers and lighter stouts have maintained competitive pricing through economies of scale achieved via streamlined production methods and strategic procurement of alternative sweetening agents.

Looking ahead, breweries are actively exploring tariff mitigation tactics, including tariff engineering-modifying packaging formats and transit routes to qualify for reduced rates-as well as leveraging trade agreements with partner nations to secure favorable import conditions. These adaptive strategies are critical for sustaining the momentum of chocolate beer innovation and ensuring that the category remains accessible to a wide range of consumers despite evolving trade policies.

Uncovering Critical Insights from Market Segmentation Dimensions Spanning Type Packaging Flavor Alcohol Content and Distribution Channels

An in-depth examination of the chocolate beer category through Type segmentation reveals that ale-based infusions deliver a lighter, fruit-forward backdrop that appeals to novice craft drinkers, whereas porter formulations leverage roasted malt characteristics to create a balanced bridge between bitterness and cocoa intensity. Stout variants, celebrated for their dense textures and pronounced dark chocolate profiles, continue to command attention among enthusiasts seeking the richest sensory experiences. As a result, brewers strategically position each Type to align with varying consumer familiarity and taste preferences.

Packaging segmentation underscores the dual importance of shelf presence and convenience. Bottles, offered in both 330 milliliter and 500 milliliter configurations, maintain the perception of premium gifting and collectible releases. In contrast, cans in equivalent sizes have catalyzed trial among younger demographics by capitalizing on portability and freshness preservation. At the same time, kegs in 30-liter and 5-liter formats remain indispensable for on-trade venues, enabling efficient draft service during pairing events and chocolate-themed tap takeovers.

Further nuance emerges when assessing Flavor Profile alongside Alcohol Content and Distribution Channel. Dark chocolate-infused brews, often positioned as high-alcohol indulgences, dominate bar menus and specialty retail shelves. Meanwhile, milk chocolate variants with regular alcohol strength have become popular in supermarkets and convenience outlets, offering an approachable taste entry point. The emergence of white chocolate adaptations in the low-alcohol segment has also found traction online, especially through e-commerce platforms and manufacturer websites that cater to mindful consumers. Off-trade channels such as liquor stores and supermarkets, alongside on-trade settings like bars and restaurants, thus form the backbone of distribution strategies, with digital platforms rapidly gaining share as a direct link to targeted audiences.

This comprehensive research report categorizes the Chocolate Beer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Flavor Profile

- Alcohol Content

- Distribution Channel

Revealing Regional Nuances and Market Drivers in the Chocolate Beer Industry across the Americas Europe Middle East Africa and Asia-Pacific

Regional distinctions in the chocolate beer sector underscore the importance of localized consumer tastes and distribution ecosystems. In the Americas, producers in the United States and Canada have spearheaded the introduction of high-cacao stouts and porter blends, leveraging established craft beer networks and specialty retailers. Latin American markets, traditionally associated with cocoa production, have begun importing experimental barrel-aged chocolate beers to capitalize on cultural affinities with cacao.

Across Europe Middle East and Africa, long-standing brewing traditions in Western Europe have given way to innovative small-batch chocolate beers. The United Kingdom’s craft community, in particular, has embraced collaborations with boutique chocolatiers, while German and Belgian brewers explore dark chocolate spicing techniques that complement their heritage styles. In the Middle East and North Africa, a growing experiential hospitality sector has introduced chocolate beer flights within upscale lounges, despite regulatory limitations on alcohol consumption in certain jurisdictions.

Meanwhile Asia-Pacific markets are charting unique trajectories. In Australia and New Zealand, craft breweries have popularized white chocolate saison releases, drawing on the region’s affinity for fruit-forward beer styles. Japanese microbreweries have introduced precision-dosed milk chocolate infusions, appealing to the nation’s meticulous quality standards. In emerging economies such as China Southeast Asia and India, chocolate beer remains nascent; however, digital-first breweries are leveraging online communities to spark interest and accelerate awareness.

This comprehensive research report examines key regions that drive the evolution of the Chocolate Beer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategies and Competitive Positioning of Leading Chocolate Beer Producers and Craft Brewers Driving Innovation and Market Growth

Leading innovators within the chocolate beer landscape have adopted diverse strategies to differentiate their offerings and capture dedicated followings. Established craft brewers have invested heavily in co-branding initiatives with renowned chocolatiers, creating limited-edition runs that command premium placement in both on-premise and off-premise accounts. Others have focused on technological enhancements, utilizing high-pressure infusion systems to enhance cocoa flavor extraction without compromising beer stability.

Emerging players have carved out positions by targeting underrepresented niches. Some small-scale brewers have concentrated on low-alcohol chocolate beers paired with health-forward ingredients, such as adaptogens and antioxidants, appealing to wellness-oriented consumers. Meanwhile, others have developed specially designed packaging-such as resealable cans and collectible bottle series-to foster brand loyalty and social media engagement. Joint ventures between beverage conglomerates and craft startups have also accelerated distribution, allowing innovative small-batch chocolate beers to reach mainstream grocery and convenience channels.

Additionally, several market participants are prioritizing sustainability across the chocolate beer lifecycle. By sourcing single-origin cacao from certified farms and implementing carbon-neutral brewing operations, these companies aim to align with consumer expectations for ethical production. Such initiatives not only elevate brand reputations but also create compelling narratives that differentiate offerings in an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chocolate Beer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anderson Valley Brewing Company

- Anheuser‑Busch InBev SA/NV

- Bell’s Brewery, Inc.

- BrewDog plc

- Celt Experience Brewery Ltd.

- D.G. Yuengling & Sons, Inc.

- Deschutes Brewery, LLC

- Dogfish Head Craft Brewery, Inc.

- Founders Brewing Co., LLC

- Lakewood Brewing Company

- Left Hand Brewing Company, LLC

- Minhas Craft Brewery LLC

- New Belgium Brewing Company

- New Glarus Brewing Company

- North Coast Brewing Company, LLC

- Omer Vander Ghinste NV

- Oskar Blues Brewery, LLC

- Rogue Ales & Spirits, LLC

- Samuel Smith Old Brewery Ltd.

- Sierra Nevada Brewing Co.

- Stone Brewing Co., LLC

- The Boston Beer Company, Inc.

- The Brooklyn Brewery Corporation

- Thornbridge Brewery Limited

- Young & Co.’s Brewery plc

Empowering Industry Leaders with Strategic Recommendations to Capitalize on Chocolate Beer Opportunities and Navigate Emerging Market Challenges Effectively

Industry leaders seeking to harness the upward trajectory of chocolate beer should prioritize investment in flavor innovation research and development. By collaborating with specialty chocolate artisans and enlisting sensory scientists, companies can refine product formulations to achieve optimal balance between richness and drinkability. Concurrently, exploring alternative adjuncts such as cacao husk infusions and natural sweeteners can open new avenues for differentiation and cost optimization.

In parallel, diversifying packaging portfolios to include both premium glass bottles in collectible formats and lightweight aluminum cans will meet the needs of varying consumption occasions. Implementing digital engagement strategies-such as targeted social media campaigns, virtual tasting sessions, and subscription-based release clubs-can extend customer reach beyond traditional retail and on-premise channels. Aligning these efforts with dynamic price tiering strategies, informed by nuanced understanding of high, regular, and low alcohol segments, will ensure appropriate positioning across segments.

Finally, proactive tariff mitigation and supply chain resilience measures are essential. Companies should evaluate options such as tariff engineering, local ingredient partnerships, and multi-modal logistics planning to minimize the impact of trade policy shifts. By integrating these strategic initiatives, industry leaders can not only sustain growth but also establish defensible competitive advantages in the expanding chocolate beer arena.

Detailing the Rigorous Research Methodology Combining Primary Qualitative Interviews Secondary Data Analysis and Benchmarking to Ensure Comprehensive Insights

The methodology underpinning this analysis combined primary and secondary research to ensure a holistic perspective on the chocolate beer market. Primary efforts centered on in-depth interviews with brewery executives, distribution specialists, and on-premise beverage directors. These conversations provided qualitative insights into sourcing strategies, innovation roadmaps, and consumer engagement tactics. At the same time, focus group sessions with craft beer consumers offered direct feedback on flavor profiles, packaging preferences, and purchase drivers, illuminating the nuanced factors that influence trial and repurchase rates.

Secondary research complemented these insights by drawing on reputable industry publications, regulatory filings, and trade association reports. Data triangulation techniques were employed to validate trends identified in interviews, while competitive benchmarking against analogous beverage categories-such as coffee-infused beers and spiced ales-helped contextualize the chocolate beer segment’s growth patterns. Additionally, a sensitivity analysis of tariff scenarios was conducted to assess potential cost impacts and mitigation strategies. This rigorous approach ensures that the findings reflect both the strategic imperatives of market participants and the evolving preferences of a diverse consumer base.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chocolate Beer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chocolate Beer Market, by Type

- Chocolate Beer Market, by Packaging

- Chocolate Beer Market, by Flavor Profile

- Chocolate Beer Market, by Alcohol Content

- Chocolate Beer Market, by Distribution Channel

- Chocolate Beer Market, by Region

- Chocolate Beer Market, by Group

- Chocolate Beer Market, by Country

- United States Chocolate Beer Market

- China Chocolate Beer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing Key Takeaways on the Evolution Opportunities and Strategic Imperatives Shaping the Future of the Chocolate Beer Sector

In summary, the chocolate beer category has transformed from a novelty experiment to a sophisticated, differentiated offering within the craft beverage landscape. Technological advancements in flavor extraction, strategic collaborations, and adaptive distribution models have collectively elevated the segment, making it a focal point for both established and emerging brewers. Regulatory changes, particularly United States tariff adjustments in 2025, have presented challenges and opportunities, prompting shifts toward localized sourcing and premium repositioning.

Segment-level insights highlight the importance of tailoring product formulations and packaging to distinct consumer preferences, from ale aficionados to stout purists, and across a spectrum of packaging and distribution channels. Regional analyses underscore how cultural affinities and regulatory frameworks shape market dynamics in the Americas, EMEA, and Asia-Pacific, while competitive profiling reveals a landscape characterized by creative differentiation and sustainability commitments.

Moving forward, companies that leverage these insights-by investing in flavor R&D, embracing agile supply chain strategies, and deploying targeted engagement tactics-will be well positioned to capture value in this burgeoning market. The convergence of artisanal craftsmanship and strategic innovation promises continued evolution of chocolate beer, offering abundant potential for growth and brand elevation.

Engage with Associate Director Ketan Rohom Today to Secure Your Comprehensive Market Research Report and Unlock Actionable Insights in Chocolate Beer Trends

To explore the full depth of these insights and gain an unparalleled understanding of the chocolate beer market’s trajectory, engage with Associate Director Ketan Rohom today. His expertise in sales and marketing ensures you will receive personalized guidance on how these findings can be applied to your organization’s objectives. Secure your comprehensive market research report now to unlock the actionable intelligence that will empower your team to innovate, differentiate, and lead in this rapidly evolving space.

Don’t let competitors capture the advantage. Connect with Ketan Rohom to tailor a solution that aligns with your strategic needs and accelerates your decision-making. Your next breakthrough in chocolate beer innovation is just one conversation away.

- How big is the Chocolate Beer Market?

- What is the Chocolate Beer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?