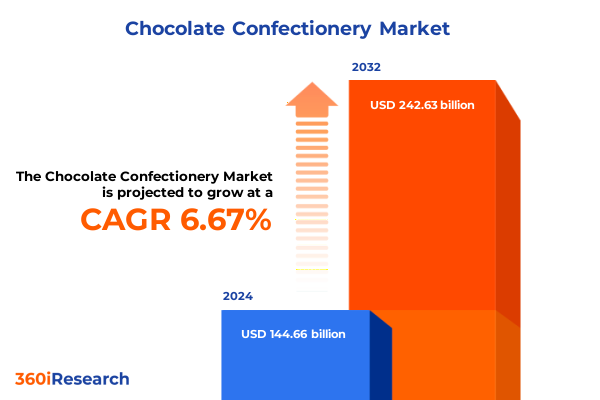

The Chocolate Confectionery Market size was estimated at USD 152.11 billion in 2025 and expected to reach USD 162.47 billion in 2026, at a CAGR of 7.39% to reach USD 250.57 billion by 2032.

How Shifting Consumer Preferences and Ingredient Innovations Are Reshaping the Chocolate Confectionery Landscape and Driving Sustainable Growth Pathways

The chocolate confectionery arena has evolved into a vibrant tapestry of sensory experiences and consumer aspirations, reflecting a complex interplay of tradition, innovation, and sustainability. Over recent years, chocolate products have transcended their status as simple indulgences to become vehicles for health claims, ethical sourcing narratives, and premiumization. This heightened role underscores the importance of understanding nuanced consumer psychology as well as ingredient sourcing and processing methodologies. As new generations of consumers prioritize transparent supply chains and functional benefits, brands must navigate a landscape that rewards authenticity and penalizes ambiguity, underscoring why comprehensive market intelligence is more critical than ever.

Against this backdrop, the confluence of global flavor exploration and local heritage crafting has infused the category with unprecedented creativity. From spice-infused bars to botanical-enhanced bites, the boundaries of chocolate confectionery are expanding, challenging manufacturers to balance innovation with operational feasibility. The interplay between artisanal craftsmanship and industrial-scale production has never been sharper, demanding nimble strategies that accommodate small-batch experimentation alongside robust mass-market distribution.

Given these dynamics, the research seeks to illuminate the forces propelling market shifts and distill strategic imperatives for stakeholders across the value chain. By synthesizing qualitative insights from industry leaders with quantitative analyses of consumption and distribution trends, the study provides an indispensable foundation for decision-makers aiming to capitalize on both enduring and emerging growth vectors in the chocolate confectionery sector.

Emerging Health Trends and Sustainability Priorities Propel a Major Transformation in Chocolate Confectionery Products and Consumer Engagement

The chocolate confectionery sector is undergoing transformative shifts characterized by a radical reevaluation of traditional product attributes and consumer engagement models. Health and wellness priorities have propelled a surge in demand for formulations enriched with functional ingredients such as adaptogens, collagen, and vitamins, redefining chocolate as more than a mere sweet treat. Concurrently, heightened awareness around environmental impact has accelerated adoption of regenerative and agroforestry practices within cocoa sourcing, prompting brands to integrate lifecycle analyses and carbon footprint disclosures into their packaging narratives.

Digital transformation has emerged as another critical vector of change, with direct-to-consumer platforms enabling brands to forge deeper emotional connections and harvest real-time feedback loops. Social commerce and influencer-driven activations have converged to create micro-moments that extend consumption beyond taste to encompass community-building around shared values. This shift toward experiential marketing has encouraged manufacturers to invest in immersive brand storytelling and limited-edition collaborations that leverage pop culture and regional identities.

Finally, ingredient transparency has galvanized a reexamination of supply chains, elevating traceability solutions such as blockchain recording and cloud-based digital ledgers. Partnerships with nonprofit organizations and third-party certifiers further validate ethical commitments and resonate with discerning customers. This confluence of health focus, technological enablement, and ethical accountability marks a profound evolution in the industry, demanding that stakeholders embrace integrated strategies to remain competitive and relevant.

Understanding the Deepening Effects of 2025 US Trade Tariffs on Chocolate Confectionery Supply Chains and Pricing Strategies Across the Industry

The imposition of new United States tariffs in 2025 has introduced notable complexities across the chocolate confectionery value chain, affecting raw material procurement, manufacturing costs, and retail pricing dynamics. Sourcing strategies have pivoted toward greater diversification of cocoa and dairy origins, with manufacturers seeking to mitigate exposure to elevated import duties by forging alliances with West African cooperatives and exploring novel Latin American and South Pacific sources. These shifts in procurement have not only altered cost structures but have also influenced product development timelines and innovation roadmaps.

Within production facilities, higher input costs have incentivized investments in process efficiencies and automation to preserve margin integrity. Some manufacturers have implemented advanced sorting and grading systems to optimize yield from each batch of raw beans, while others have explored recipe reformulations that balance premium ingredients with cost-effective substitutes without compromising perceived quality. Retailers, in turn, have adjusted promotional calendars and packaging formats to maintain consumer accessibility amid price adjustments.

Despite these challenges, the tariff-driven impetus has catalyzed a strategic recalibration toward nearshoring and backward integration. By expanding domestic processing capabilities and strengthening relationships with local dairy producers, stakeholders have sought to insulate operations from continued duty volatility. As a result, the cumulative impact of these policy shifts underscores the imperative for agile supply chain design and proactive scenario planning in an era of geopolitical uncertainty.

Unlocking Market Complexity Through Type Form Variations Ingredient Choices Flavor Innovations Distribution Channels and End-User Behaviors in Chocolate Confectionery

Interrogating the chocolate confectionery landscape through a segmentation lens reveals the intricate tapestry of consumer preferences and distribution mechanics that define market behavior. When viewed by type, the enduring appeal of dark chocolate has been bolstered by perceptions of antioxidant benefits, even as milk chocolate innovations leverage indulgent textures to sustain mass-market loyalty and white chocolate continues to find niche applications in premium gifting. Considering the various forms, solid bars maintain their share through recognizable convenience, while blocks facilitate foodservice and industrial uses; chips and bites cater to at-home baking trends and on-the-go snacking, and syrups underscore a crossover into beverage and confectionery topping applications.

Examining ingredient distinctions highlights a clear bifurcation between non-organic formulations, which benefit from established supply chains and cost advantages, and organic variants that command premium positioning among health-conscious and environmentally minded consumers. Meanwhile, the flavor divide between classic chocolate creations and inventive flavor pairings demonstrates that culinary experimentation fuels engagement, whether through spice blends, fruit infusions, or savory-sweet hybrids. In distribution channels, offline touchpoints remain foundational, with convenience stores driving impulse purchases, specialty shops serving as incubators for indie brands, and supermarkets and hypermarkets offering scale-driven assortments; online channels are gaining traction, with brand-owned direct sales fostering personalized experiences and e-commerce partnerships expanding reach across digital marketplaces.

Finally, the end-user segmentation underscores divergent demand profiles: commercial entities such as bakeries, cafes, and restaurants prioritize consistent volume and cost reliability, whereas individual consumers seek product narratives and sensory experiences aligned with personal values. These intersecting dimensions form the structural backbone of category strategy, illuminating pathways for differentiation and value capture.

This comprehensive research report categorizes the Chocolate Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Ingredients

- Packaging Type

- End-User

- Distribution Channel

Exploring Regional Nuances Across Americas Europe Middle East & Africa and Asia-Pacific That Define Distinct Chocolate Confectionery Market Drivers

Regional perspectives in chocolate confectionery reveal foundational differences in consumption patterns, supply chain priorities, and innovation catalysts that drive market heterogeneity. In the Americas, strong legacy brands coexist with agile craft chocolatiers, and consumer enthusiasm for premium and functional offerings is matched by an emphasis on domestic sourcing and traceability. This region showcases rapid uptake of hybrid formats, such as protein-fortified bars and keto-friendly variants, supported by an extensive network of specialty retailers and a vibrant online ecosystem.

Across Europe, the Middle East, and Africa, deeply entrenched chocolate traditions intersect with evolving health regulations and sustainability frameworks. European consumers, in particular, demand rigorous fair trade certifications and regenerative farming disclosures, spawning collaborative models between manufacturers and cocoa cooperatives. Middle Eastern markets are witnessing a growing appetite for luxury chocolate experiences and cross-category tie-ins with regional flavors, while several African nations are scaling local processing to capture greater value from cocoa cultivation.

The Asia-Pacific landscape is characterized by exponential growth in emerging economies, where premiumization trends are intersecting with expanding urban retail footprints. Domestic players are forging partnerships with global innovators to introduce regionally nuanced flavors, and omnichannel distribution strategies are gaining momentum as online grocery and social commerce platforms proliferate. These regional distinctions highlight that a one-size-fits-all approach is untenable, necessitating nuanced strategies that respect local sensibilities and leverage each area’s unique strengths.

This comprehensive research report examines key regions that drive the evolution of the Chocolate Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How Leading Chocolate Confectionery Brands and Emerging Players Are Innovating Product Portfolios and Strengthening Competitive Positioning

Across the competitive landscape, leading chocolate confectionery brands have distinguished themselves through strategic investments in R&D and consumer engagement, while nimble new entrants are carving out specialized niches. Established multinationals continue to leverage global supply chains to drive economies of scale, simultaneously allocating resources toward sustainability certifications and supply chain transparency initiatives. These commitments reinforce brand equity among socially conscious buyers and provide compelling marketing narratives.

At the same time, innovative mid-sized players are capitalizing on agility to pilot unique ingredient partnerships and limited-run flavor collections that generate buzz on social platforms. By shortening development cycles and engaging with micro-influencers, these companies can rapidly validate concepts and scale successful launches. Smaller artisanal chocolatiers are also harnessing storytelling around single-origin beans and heritage recipes, cultivating dedicated followings that appreciate authenticity and craftsmanship.

Additionally, several omnichannel retailers and digital-first brands are integrating data analytics into their product and promotional strategies, leveraging purchase analytics, customer relationship management platforms, and AI-driven recommendations to tailor assortments and cross-sell related offerings. This combination of established scale, entrepreneurial innovation, and digital sophistication defines the competitive frontier, setting benchmarks for operational excellence and consumer relevance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chocolate Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACK Chocolate Industries LLC

- Al Nassma Chocolate LLC

- Askinosie Chocolate, LLC

- August Storck KG

- Barry Callebaut AG

- Cacau Show

- Chocoladefabriken Lindt & Sprüngli AG

- Endangered Species Chocolate

- Ezaki Glico Co., Ltd.

- Ferrero Group

- FUJIYA CO., LTD.

- Lake Champlain Chocolates

- LEE Chocolate

- Lotte Corporation

- Mars, Incorporated

- Max Felchlin AG

- Meiji Holdings Co., Ltd.

- Mondelēz International, Inc.

- Morinaga & Co., Ltd.

- Nestlé S.A.

- Notions Group

- Orion Corporation

- pladis Foods Ltd by Yıldız Holding

- Raaka Chocolate Ltd.

- The Hershey Company

- Tony’s Chocolonely Ltd.

- Zokolat

Strategic Initiatives and Actionable Recommendations for Industry Leaders to Navigate Tariff Challenges and Evolving Consumer Demands Effectively

To navigate the evolving chocolate confectionery landscape, industry leaders should prioritize strategic initiatives that align with consumer and regulatory imperatives. First, brand owners must solidify commitments to transparent and ethical ingredient sourcing, employing traceability technologies and third-party certifications to fortify consumer trust. Parallel investments in regenerative agriculture partnerships will not only mitigate environmental impact but also strengthen long-term supply stability.

Second, companies should accelerate innovation cycles by establishing agile product development frameworks that integrate consumer feedback loops, rapid prototyping, and pilot launches in select markets. This approach enables faster response to emerging flavor and format trends, reducing time-to-market and minimizing large-scale trial risks. Embedding data analytics into these processes will further refine targeting and personalization efforts.

Third, given the tariff environment, diversifying procurement sources and deepening domestic processing capabilities are essential to ensure cost efficiency and continuity. Collaborative ventures with regional ingredient suppliers and cross-industry partnerships for shared logistics can alleviate duty pressures and foster resilience. Concurrently, exploring dynamic pricing strategies and value-added packaging can help maintain affordability without eroding brand equity.

Finally, omnichannel growth demands a cohesive digital commerce strategy that unites direct-to-consumer platforms with retail partnerships. Investing in e-commerce infrastructure, loyalty ecosystems, and immersive brand experiences-both online and offline-will be critical to capturing market share and sustaining growth in an increasingly competitive environment.

Comprehensive Research Methodology Employing Multi-Source Data Gathering Expert Interviews and Rigorous Analytical Frameworks for Chocolate Market Insights

This analysis draws upon a rigorous, multi-phase research methodology designed to ensure depth, accuracy, and relevance. Primary data was collected through in-depth interviews with strategic and operational executives across the chocolate confectionery value chain, including procurement directors, R&D leads, and senior marketing officers. These qualitative insights were complemented by structured surveys targeting retailers, distributors, and end consumers to validate thematic trends and gauge emerging demand signals.

Secondary research encompassed an extensive review of proprietary and publicly available information sources, including industry publications, trade association reports, regulatory filings, and sustainability disclosures. Advanced analytics techniques were applied to triangulate multiple data inputs, identify correlation patterns, and highlight causal relationships. Where applicable, machine-learning models were used to classify product attributes and sentiment analysis algorithms assessed consumer perceptions across social media and review platforms.

Additionally, regional case studies were conducted to capture localized nuances, encompassing site visits and stakeholder workshops in the Americas, Europe, Middle East & Africa, and Asia-Pacific. Scenario planning exercises and sensitivity analyses informed strategic implications under varying tariff and supply chain disruption scenarios. Throughout, the research process adhered to strict data governance protocols to ensure the integrity and confidentiality of all proprietary information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chocolate Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chocolate Confectionery Market, by Type

- Chocolate Confectionery Market, by Form

- Chocolate Confectionery Market, by Ingredients

- Chocolate Confectionery Market, by Packaging Type

- Chocolate Confectionery Market, by End-User

- Chocolate Confectionery Market, by Distribution Channel

- Chocolate Confectionery Market, by Region

- Chocolate Confectionery Market, by Group

- Chocolate Confectionery Market, by Country

- United States Chocolate Confectionery Market

- China Chocolate Confectionery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Underlining Critical Trends Market Shifts and Strategic Imperatives Shaping the Future of Chocolate Confectionery Industry

The consolidation of insights within this executive summary underscores pivotal themes that will shape the chocolate confectionery industry’s trajectory. Innovation continues to be the bedrock of competitive differentiation, whether through functional enhancements, novel flavor pairings, or format extensions. Concurrently, sustainability and ethical sourcing have moved from peripheral considerations to central strategic imperatives, influencing procurement decisions and consumer perceptions alike.

Tariff-induced cost pressures have precipitated a recalibration of supply chain strategies, accentuating the need for agility through geographic diversification and domestic processing capabilities. These adjustments not only secure margin resilience but also open pathways for value-added product formulations tailored to local preferences. Moreover, the expansion of direct and digital channels has redefined consumer engagement, elevating the importance of data-driven personalization and immersive brand narratives.

In synthesizing these developments, it is clear that stakeholders who proactively embrace integrated approaches-merging innovation, sustainability, and operational flexibility-will be best positioned to capture growth opportunities and navigate uncertainties. The interplay of evolving consumer expectations, regulatory shifts, and technological advancements mandates a holistic strategy that transcends traditional silos. This research provides the strategic compass required to align corporate initiatives with market realities and future-proof business models.

Engage Directly with Ketan Rohom to Secure Comprehensive Chocolate Confectionery Market Insights and Propel Your Strategic Decision-Making Forward

To explore the full breadth of insights on chocolate confectionery market dynamics, procurement teams, strategists, and product innovators are invited to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, whose expertise will guide you through tailored data packages and strategic counsel. Through a personalized consultation, stakeholders can unlock proprietary analyses that align precisely with organizational objectives and consumer trends. Ketan Rohom’s deep understanding of market segmentation, regional intricacies, and competitive landscapes ensures that your investment translates to actionable intelligence and clear ROI. Reach out today to arrange a one-on-one briefing, secure early access to key findings, and receive custom addenda that underscore emerging opportunities in flavor innovation, distribution channel expansion, and tariff mitigation strategies. Don’t miss the chance to gain a competitive edge by leveraging this comprehensive chocolate confectionery market research report, designed to inform high-stakes decisions and drive sustainable growth.

- How big is the Chocolate Confectionery Market?

- What is the Chocolate Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?