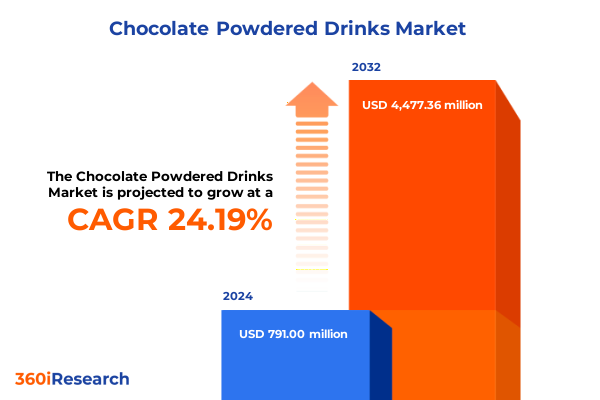

The Chocolate Powdered Drinks Market size was estimated at USD 982.85 million in 2025 and expected to reach USD 1,206.15 million in 2026, at a CAGR of 24.18% to reach USD 4,477.36 million by 2032.

Unveiling the Chocolate Powdered Drinks Revolution: Exploring Consumer Preferences, Market Dynamics, and Industry Innovation Driving Growth

Chocolate powdered drinks have evolved far beyond the simple mix of cocoa and milk that defined the category for decades. Today’s consumers demand experiences that balance indulgence with nutrition, convenience with sustainability, and proven classics with daring innovations. From households seeking quick yet satisfying morning rituals to on-the-go professionals craving functional beverages, chocolate powder formulations are adapting through richer flavor profiles and enhanced nutritional fortification. Technological advancements in processing and flavor encapsulation have enabled manufacturers to deliver consistent solubility and sensory appeal across a variety of milk and plant-based bases, forging deeper connections with both legacy audiences and new entrants.

Simultaneously, the convergence of premium ingredients and value-adding nutrients such as protein, fiber, and probiotics is opening new avenues for differentiation. This shift is supported by consumers’ growing health consciousness, which compels brand owners to optimize ingredient lists and reduce added sugars without sacrificing the indulgent mouthfeel and aroma that define the chocolate experience. As a result, strategic collaborations between flavor houses, dairy innovators, and emerging ingredient suppliers are accelerating novel launches and limited-edition offerings. With digital marketing and personalized subscription models gaining traction, the competitive environment is more dynamic than ever, challenging organizations to refine their go-to-market strategies in order to drive retention and brand loyalty within an overcrowded shelf space.

Transitioning seamlessly from formulation breakthroughs to commercial execution, the landscape of chocolate powdered beverages now combines traditional retail dominance with rapidly expanding e-commerce channels, multi-tier distribution agreements, and foodservice partnerships. This integration allows for a broader geographic reach and the agility to respond to regional demand patterns. As a result, stakeholders must remain vigilant in tracking both consumer behavior shifts and secondary market disruptions to capitalize on emerging opportunities. By focusing on experiential innovation paired with operational excellence, industry players are poised to deliver sustained growth amid evolving preferences and supply chain constraints.

How Health, Sustainability, Premiumization, Digital Transformation, and Functional Ingredient Trends Are Redefining the Chocolate Powdered Drinks Market

The chocolate powdered drinks market is at the nexus of several powerful trends reshaping the broader food-and-beverage industry. Health and wellness considerations have moved to the forefront, prompting the reformulation of traditional blends to lower sugar content and introduce nutrient-dense ingredients. Organic, non-GMO, and plant-based certifications have become more than decorative labels, reflecting genuine commitments to transparency and clean label philosophies that resonate with discerning consumers. In parallel, sustainability has taken center stage, with ingredient sourcing and packaging materials under heightened scrutiny. Brands are increasingly partnering with certified cocoa suppliers and adopting recyclable or compostable packaging formats to meet stakeholder expectations and mitigate environmental impact.

Meanwhile, the premiumization of chocolate powdered drinks is driving a proliferation of artisanal and heritage cocoa offerings. Single-origin powders and blends enriched with flavor inclusions such as sea salt, chili, and exotic spices appeal to sophisticated palates and create opportunities for premium price positioning. These high-end products are often showcased through curated retail displays and digital storytelling campaigns that emphasize provenance and craftsmanship. Consumers who value authenticity are willing to pay for a differentiated experience that aligns with their lifestyle aspirations.

Digital transformation is fundamentally altering purchase behavior and supply chain operations. E-commerce platforms, social commerce, and direct-to-consumer subscription models enable brands to gather richer consumer insights and tailor offerings through data-driven personalization. Real-time analytics support dynamic pricing and targeted promotions, while automated production and inventory management systems enhance responsiveness and minimize waste. Functional ingredient trends, including collagen, adaptogens, and prebiotic fibers, are being integrated into chocolate powdered drinks to expand the category’s appeal beyond indulgence to performance and well-being. By leveraging these multi-dimensional trends, businesses can capture incremental market share and strengthen brand equity in a rapidly evolving competitive arena.

Assessing the Combined Effects of Escalating Cocoa Tariffs and Trade Policies on U.S. Chocolate Powdered Drinks Procurement and Pricing Strategies

The cumulative impact of recent U.S. tariffs on processed cocoa imports represents a significant headwind for manufacturers of chocolate powdered drinks. With the United States maintaining a 15 percent levy on cocoa liquor, powder, and butter imported from key supply regions, input costs have surged by approximately 18.2 percent since January 2025, exerting upward pressure on finished good prices and compressing margins for exporters and domestic producers alike. These tariffs are compounded by the threat of retaliatory measures, including potential 21 percent duties on cocoa from West African nations such as Ivory Coast and Ghana, which supply the majority of the world’s cocoa beans. The convergence of these duties has intensified cost volatility, prompting leading firms to explore exemption requests and tariff mitigation strategies.

In interviews following first-quarter earnings disclosures, several major manufacturers disclosed material exposures to cocoa-related tariffs, forecasting incremental expenses of up to $100 million in the back half of 2025 once on-hand inventory is depleted. These cost burdens have translated into both smaller pack sizes, a phenomenon commonly labeled shrinkflation, and low double-digit list price increases for flagship products. Moreover, the uncertainty surrounding tariff timelines and legislative negotiations has incentivized companies to pursue longer-term procurement contracts and diversify sourcing to regions with more favorable trade agreements. Some have also accelerated investments in domestic processing capabilities and alternative ingredients to buffer against future policy shifts.

As a result, procurement teams are reevaluating supplier portfolios and prioritizing integrated supply chain solutions that offer greater visibility and flexibility. Forward-looking organizations are modeling different tariff scenarios to refine pricing strategies, segmenting customer agreements to protect core volumes while introducing incremental surcharges for higher-risk product lines. The interplay of regulatory developments and cost management imperatives is reshaping the competitive intensity within the chocolate powdered drinks sector, with early movers securing critical advantages in cost structure and customer resilience.

Unlocking Growth Through Nuanced Product, Distribution, Packaging, Flavor, and End-Use Segmentation Insights in Chocolate Powdered Drinks Market

Product type segmentation distinguishes between instant formulas and regular cocoa blends, with each category addressing distinct consumer needs. Instant chocolate powders prioritize rapid dissolution and convenience, catering to busy lifestyles and enabling on-the-go consumption. In contrast, regular formulations appeal to enthusiasts who value artisanal preparation and richer taste profiles, often mixing powders with steamed or alternative plant-based milks to craft bespoke beverages. Distribution channels also play a critical role, as offline retail outlets such as grocery chains and specialty stores remain essential for showcasing the product range and facilitating impulse purchases, while online platforms, including direct-to-consumer websites and third-party marketplaces, drive personalized ordering and subscription models that reinforce brand loyalty.

Packaging type segmentation reveals the diverse preferences of end users, from large jars designed for frequent at-home use to pouches optimized for shelf stacking and portability. Single-serve sachets meet demand in travel and hospitality settings, whereas tins convey a premium image and appeal to gift-givers seeking an elevated unboxing experience. Flavors in the category span classic chocolate heritage offerings to emerging dark and white chocolate variants, as well as milk chocolate formats that balance sweetness with cocoa intensity. Regional taste profiles and seasonal promotions further influence flavor innovation, leading to limited-edition releases and cross-category collaborations.

End use segmentation underscores the importance of foodservice and home consumption channels. Within foodservice, powder-based cocoa beverages are gaining traction across cafeterias, full-service restaurants, hotel catering, and quick service restaurants, where they serve both as standalone offerings and as menu enhancements in specialty lattes or dessert accompaniments. In parallel, the home segment continues to be driven by product versatility, family-friendly packaging sizes, and value-oriented multipacks. Understanding the interplay of these segmentation dimensions enables companies to tailor product portfolios, optimize channel strategies, and deliver targeted marketing campaigns that resonate with specific consumer cohorts.

This comprehensive research report categorizes the Chocolate Powdered Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Packaging Type

- Flavor

- End Use

Decoding Regional Dynamics: In-Depth Analysis of the Americas, EMEA, and Asia-Pacific Trends Shaping the Chocolate Powdered Drinks Market

The Americas region stands as a mature market with deeply entrenched consumption habits, underpinned by iconic brands and well-established distribution networks. In North America, demand is characterized by ongoing innovation in flavor extensions and functional formulations, as well as a resurgence in artisanal brands leveraging direct-to-consumer models. Latin America presents unique growth opportunities driven by regional cocoa heritage and strong cultural affinity for chocolate beverages, with local players adapting global portfolio strategies to meet diverse consumer palettes and price sensitivities.

In Europe, the Middle East, and Africa, the landscape is marked by heterogeneity. Western European markets such as the United Kingdom and Germany exhibit high per capita consumption and openness to premium and health-focused powders, while Eastern European markets are experiencing steady uptake informed by rising household incomes. In the Middle East, consumers show interest in both traditional Arabic coffee integrations and chocolate powder innovations enriched with localized flavor notes. Across Africa, nascent retail infrastructures and supportive trade policies are catalyzing the emergence of domestic processing hubs, although logistical challenges remain a key consideration.

The Asia-Pacific region is experiencing the fastest overall expansion, driven by burgeoning middle-class demographics, increasing urbanization, and rising disposable incomes. Markets such as China and India are witnessing accelerated e-commerce penetration, fostering the rapid introduction of new brands alongside established global names. Southeast Asia offers strong opportunities for premium segment growth, particularly where consumers seek indulgent yet aspirational products. In addition, regional collaborations and joint-venture partnerships are facilitating knowledge transfer and scale economics, positioning Asia-Pacific as a pivotal source of innovation and growth for the worldwide chocolate powdered drinks sector.

This comprehensive research report examines key regions that drive the evolution of the Chocolate Powdered Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Spotlighting Leading Player Strategies and Innovations Driving Momentum in the Chocolate Powdered Drinks Sector

Nestlé continues to leverage brand equity across its NESQUIK portfolio, recently introducing Protein Plus, a high-protein ready-to-drink milk beverage supported by a tongue-in-cheek campaign that targets adult consumers seeking nutritional benefits without compromising indulgence. The strategic rollout of Protein Plus across convenience channels and select grocery outlets underscores the company’s commitment to functional innovation and appeals to a growing adult segment that views protein-enhanced beverages as both meal replacements and post-activity recovery options.

Meanwhile, Hershey has navigated pricing pressures arising from elevated cocoa costs and trade tariffs through a combination of strategic tariff exemption requests and calibrated list price adjustments. The company disclosed material exposure to cocoa-related levies, forecasting incremental tariff expenses of up to $100 million for the second half of 2025. In response, Hershey is intensifying advocacy efforts with legislative stakeholders and exploring international partnerships to secure more favorable supply chain terms. At the same time, the organization is streamlining its powdered beverage portfolio to emphasize SKU rationalization and targeted innovation, balancing cost containment with the need to maintain consumer trust.

Associated British Foods’ Ovaltine brand has focused on brand revitalization through updated packaging aesthetics and expanded sachet offerings, enhancing portion control and trialability. The company is also piloting plant-based formulations in select European markets to capture health-conscious consumers while preserving the brand’s quintessential malt-chocolate heritage. Other notable players such as Mars’ Dove brand are investing in antioxidant-rich formulations and limited-edition collaborations to differentiate within crowded retail landscapes. Across the competitive spectrum, leading firms are aligning R&D priorities with emerging taste profiles and nutritional trends to secure sustainable growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chocolate Powdered Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Barry Callebaut AG

- BD Associates Ghana Ltd

- Cargill, Incorporated

- Chocoladefabriken Lindt & Sprüngli AG

- Confluence Valley Flavours Private Limited

- ECOM Agro‑Industrial Corporation Ltd

- Fuji Oil Company, Ltd.

- GlaxoSmithKline plc

- Godiva Chocolatier, Inc.

- Guittard Chocolate Holdings Co.

- Idilia Foods, S.L.

- Kanegrade Ltd

- Mars, Incorporated

- Mondelēz International, Inc.

- Nestlé S.A.

- Olam International Ltd

- PepsiCo, Inc.

- Starbucks Corporation

- Swiss Miss

- The Hershey Company

Strategic Imperatives: Actionable Recommendations for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in Chocolate Powdered Drinks

Industry leaders should prioritize diversified sourcing strategies to mitigate exposure to fluctuating commodity prices and tariff-related disruptions. Establishing alternative supply lines, including partnerships with certified origin suppliers in regions with favorable trade terms, will enhance resilience and safeguard critical ingredient availability. In addition, the integration of digital procurement platforms can streamline vendor management, optimize cost structures, and provide real-time visibility into global logistics networks.

Innovation pipelines must be aligned with evolving consumer priorities by embracing multi-dimensional product development. Brands should invest in advanced formulation techniques that reduce sugar content while enhancing sensory attributes, such as microgranulation for improved solubility and encapsulated flavors for sustained release. Concurrently, strategic collaborations with start-ups and academic institutions can accelerate the adoption of novel functional ingredients, including plant-based proteins and prebiotic fibers, thereby broadening the category’s value proposition.

Optimizing channel strategies is another critical imperative. Companies should leverage data analytics to refine the balance between offline and online distribution, deploying targeted promotions and dynamic pricing models to capture incremental demand. Subscription services and personalized e-commerce experiences can foster deeper consumer engagement and predictable revenue streams. In parallel, strengthening partnerships with foodservice operators across cafeterias, full-service restaurants, hotel catering, and quick service restaurants will unlock additional volume streams and enhance brand visibility in out-of-home settings.

Finally, sustainability initiatives should be embedded across the value chain, from responsible cocoa sourcing and ethical labor practices to eco-friendly packaging solutions. Transparent reporting and third-party certifications will not only meet regulatory requirements but also build consumer trust. By adopting a holistic approach that integrates supply chain resilience, customer-centric innovation, channel optimization, and sustainability, industry leaders can effectively navigate the competitive terrain and drive long-term growth.

Comprehensive Research Methodology Employed to Deliver Actionable, Insight-Driven Analysis on Chocolate Powdered Drinks Market Dynamics and Trends

The analysis presented in this report is grounded in a rigorous research framework combining both primary and secondary data collection. Primary research involved structured interviews with key industry stakeholders, including procurement directors, R&D leaders, regulatory experts, and senior executives from leading chocolate powdered drink companies. These conversations provided qualitative insights into supplier relationships, procurement strategies, and innovation roadmaps, as well as emerging regulatory and trade policy implications in major markets.

Secondary research encompassed an exhaustive review of trade publications, government databases, and commodity price trackers. Tariff schedules and trade documents were analyzed to quantify the cost impacts of existing and proposed duties on cocoa imports and processed cocoa products. Market intelligence platforms and company financial reports were employed to assess product launches, SKU rationalization, and strategic initiatives across major players. Regional consumption patterns were evaluated using economic indicators, retail audit data, and e-commerce performance metrics.

To ensure robustness, data triangulation techniques were applied to reconcile discrepancies between multiple sources. Proprietary modeling tools were used to simulate different tariff scenarios and to project the effects on procurement costs, pricing strategies, and profitability metrics. Scenario analyses incorporated variables such as currency fluctuations, logistical disruptions, and geopolitical developments to deliver stress-tested findings. The methodological rigor is designed to equip decision-makers with actionable intelligence and to support evidence-based strategic planning in the dynamic chocolate powdered drinks landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chocolate Powdered Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chocolate Powdered Drinks Market, by Product Type

- Chocolate Powdered Drinks Market, by Distribution Channel

- Chocolate Powdered Drinks Market, by Packaging Type

- Chocolate Powdered Drinks Market, by Flavor

- Chocolate Powdered Drinks Market, by End Use

- Chocolate Powdered Drinks Market, by Region

- Chocolate Powdered Drinks Market, by Group

- Chocolate Powdered Drinks Market, by Country

- United States Chocolate Powdered Drinks Market

- China Chocolate Powdered Drinks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis and Strategic Outlook Summarizing Key Takeaways, Future Directions, and Imperatives for Chocolate Powdered Drinks Market Stakeholders

The chocolate powdered drinks market stands at a pivotal juncture, where the convergence of consumer demands for health, convenience, and sustainability is driving rapid transformation. Segmentation insights reveal that success lies in tailoring formulations and go-to-market approaches to specific consumer cohorts, leveraging product type, distribution channel, packaging, flavor, and end use to connect with target audiences. Regional dynamics underscore the necessity of nuanced strategies that address the maturity of Americas markets, the heterogeneity of EMEA, and the rapid growth potential of Asia-Pacific.

The overlay of cocoa tariffs and supply chain constraints requires a dual approach of cost management and innovation investment. Organizations that proactively secure alternative sourcing agreements and pursue tariff mitigation tactics will be best positioned to defend margins, while those that accelerate the development of value-added formulations will enhance consumer appeal and foster brand differentiation. Early movers that capitalize on digital transformation and data analytics will gain a strategic edge by anticipating market shifts and personalizing consumer experiences.

Looking ahead, stakeholders should maintain a forward-thinking posture by monitoring legislative developments, technological advancements in powder processing, and evolving consumer lifestyles. Continuous portfolio optimization, combined with robust sustainability commitments, will sustain brand equity and meet rising stakeholder expectations. By implementing the recommendations outlined herein, market participants can navigate existing challenges and capitalize on greenfield opportunities, securing a leadership position in the chocolate powdered drinks category for years to come.

Connect with Ketan Rohom for Exclusive Insights and Bespoke Support to Secure Your Chocolate Powdered Drinks Market Research Intelligence

Elevate your strategic decision-making with a comprehensive market research report tailored to the chocolate powdered drinks industry. Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, offers personalized consultations to address your specific business challenges and growth objectives. His in-depth expertise in consumer trends, trade policy analysis, and competitive benchmarking ensures that you receive actionable insights and data-driven recommendations.

Whether you are seeking to refine your product portfolio, optimize procurement and supply chain resilience, or enhance market penetration across the Americas, EMEA, and Asia-Pacific regions, Ketan Rohom can design a research package aligned with your organizational priorities. Reach out today to explore custom research solutions, scenario planning workshops, and executive briefings that empower your teams to navigate market complexities and drive sustainable growth. Unlock the full potential of your chocolate powdered drinks strategy by partnering with our seasoned professionals and gaining access to proprietary data, simulation models, and trend forecasts. Contact Ketan Rohom now to secure your competitive advantage and realize your vision for market leadership.

- How big is the Chocolate Powdered Drinks Market?

- What is the Chocolate Powdered Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?