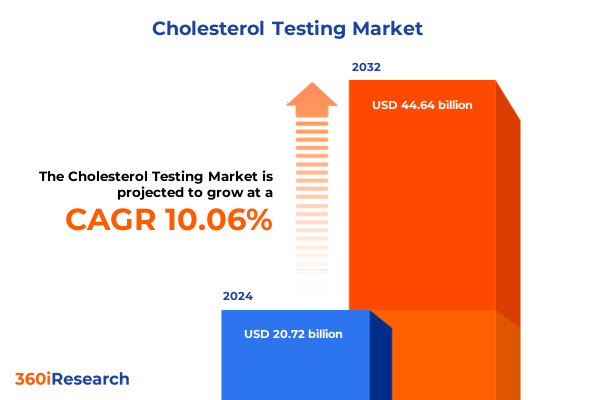

The Cholesterol Testing Market size was estimated at USD 22.82 billion in 2025 and expected to reach USD 24.75 billion in 2026, at a CAGR of 10.05% to reach USD 44.64 billion by 2032.

Unveiling the Critical Role of Comprehensive Cholesterol Testing Protocols in Enhancing Cardiovascular Health Screening and Patient Outcomes

Cholesterol testing remains an indispensable pillar of cardiovascular preventive care, providing insight into lipid profiles crucial for assessing atherosclerotic risk. According to the National Health and Nutrition Examination Survey conducted from August 2021 to August 2023, 11.3% of adults exhibited high total cholesterol, while 13.8% experienced low high-density lipoprotein cholesterol levels, reflecting enduring gaps in lipid management and the need for more robust screening protocols.

In contemporary practice, cholesterol analysis extends beyond traditional laboratory settings to encompass a spectrum of delivery models, including CLIA-waived point-of-care instruments and fully remote home testing kits. Devices such as the portable Cholestech LDX analyzer empower clinicians to obtain lipid panels within minutes directly in outpatient and community health settings, enhancing diagnostic agility without reliance on centralized labs.

Guidelines from leading cardiovascular authorities now advocate for routine lipid profiling beginning in early adulthood, with low-risk adults recommended to undergo testing every four to six years and more frequent assessment for those with comorbidities or elevated risk profiles. As non-fasting lipid panels gain acceptance, these developments underscore the imperative to align testing paradigms with patient convenience and clinical accuracy.

Embracing Revolutionary Technological and Care Delivery Advances That Are Redefining Cholesterol Testing and Cardiovascular Risk Management Standards

The cholesterol testing landscape is experiencing a profound transformation driven by breakthroughs in sensor technology, data analytics, and care delivery models. Advanced biosensors now enable rapid quantification of lipid fractions using minimal blood volumes, leveraging microfluidics and nanomaterials to enhance analytical precision while reducing assay times to mere minutes. Coupled with smartphone integration, these innovations deliver immediate results and seamless data transmission to electronic health records, facilitating real-time clinical decision support.

Simultaneously, wearable technologies are extending cholesterol monitoring beyond discrete testing moments to continuous risk surveillance. Emerging solutions incorporate photometric and amperometric sensors into sleeves and patches, estimating lipid fluctuations and correlating them with lifestyle data captured by companion mobile apps. This shift toward proactive health engagement supports earlier intervention and personalized behavior modification, marking a departure from episodic testing models.

Telehealth platforms and virtual care networks have further redefined access to cholesterol management services. Integrated programs now offer end-to-end solutions that combine at-home sample collection with live care navigation, ensuring that patients receive timely guidance based on their lipid profiles and risk stratification. By converging digital health, remote diagnostics, and patient-centered support, the industry is forging a more accessible, efficient, and personalized framework for cardiovascular preventive care.

Assessing the Far-Reaching Consequences of New United States Tariff Policies on Cholesterol Testing Supply Chains and Diagnostic Cost Structures

Beginning April 5, 2025, the United States introduced a universal 10% tariff on imported goods, encompassing diagnostic instruments, consumables, and active pharmaceutical ingredients critical to cholesterol testing workflows. In addition, reciprocal tariffs of up to 20% on European imports and a staggering 245% levy on Chinese‐sourced APIs have imposed significant cost pressures on test kit manufacturers, clinical laboratories, and decentralized testing services.

These tariff escalations have translated into higher input costs for cholesterol test strips, enzymatic reagents, colorimetric sensors, and immunoassay components, eroding margins across the value chain. Laboratories and point-of-care providers are reporting extended lead times and supply bottlenecks for essential consumables, prompting a reevaluation of sourcing strategies and inventory practices. Despite legal challenges that have temporarily paused parts of the tariff regime, uncertainty persists, as stakeholders await final determinations and exemption carve-outs for health care equipment.

In response, industry groups such as the American Hospital Association and AdvaMed have lobbied for targeted exclusions, arguing that broad tariffs on medical and diagnostic supplies could hamper innovation, elevate patient costs, and exacerbate supply chain fragility during critical periods of preventive screening and chronic disease management.

Diving Deep into Product, Technology, and End User Segmentation to Illuminate Multifaceted Dynamics of Cholesterol Testing Market

Market segmentation by product type reveals distinct trajectories for professional use kits deployed in clinical and laboratory environments and self-administered home testing solutions that range from finger prick assays to mail-in collection systems. Professional devices generally employ more sophisticated sensor architectures and deliver higher analytical throughput, whereas self testing kits prioritize ease of use, minimal sample volume requirements, and integration with digital reporting platforms.

A technology-centric perspective highlights the nuanced performance attributes of colorimetric sensors, whether photometric or visual, that leverage chromogenic reactions to quantify cholesterol, compared with electrochemical sensors that detect electron transfer events via amperometric or potentiometric methods. Meanwhile, enzymatic assays based on cholesterol esterase and cholesterol oxidase chemistries remain a mainstay in both point-of-care and laboratory workflows, complemented by immunoassays such as ELISA and rapid lateral flow tests designed for targeted accuracy in LDL or HDL quantification.

End-user segmentation illustrates a diverse array of demand drivers, spanning high-volume diagnostic laboratories that require standardized protocols and validated workflows to home care settings where convenience and timeliness are paramount. Hospitals integrate integrated point-of-care analyzers within care pathways to support immediate decision making, while pharmacies increasingly offer cholesterol screening services as part of preventive care initiatives.

Test parameter focus underscores the critical need to measure multiple lipid fractions-HDL cholesterol, LDL cholesterol, total cholesterol, and triglycerides-to generate comprehensive cardiovascular risk profiles. Distribution channels range from direct sales agreements with health systems to consumer-facing online pharmacies and retail pharmacy networks, each adapting pricing, packaging, and support models to specific customer requirements.

This comprehensive research report categorizes the Cholesterol Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Test Parameter

- End User

- Distribution Channel

Investigating Diverse Regional Dynamics Across Americas, EMEA and Asia-Pacific That Shape Global Cholesterol Testing Accessibility and Adoption

The Americas continue to be a leading hub for cholesterol testing innovation, benefiting from advanced health infrastructure, favorable reimbursement frameworks, and high consumer health awareness. North America is characterized by mature laboratory networks and widespread adoption of point-of-care devices, with integrated care pathways that emphasize preventive screening in primary care settings.

In Europe, Middle East & Africa (EMEA), regulatory harmonization under the In Vitro Diagnostic Regulation (IVDR) has accelerated the approval of novel biosensor technologies, while public health initiatives in Western Europe are driving uptake of self-testing kits. Conversely, markets in Eastern Europe and parts of Africa face infrastructure and reimbursement constraints, leading to slower adoption curves and a greater reliance on centralized laboratory services.

Asia-Pacific represents one of the fastest-growing regions for cholesterol testing, propelled by rising cardiovascular disease prevalence, expanding healthcare access, and digital health penetration. China and India are investing heavily in point-of-care and home testing solutions to address rural health disparities, whereas developed markets like Japan and Australia are leveraging telehealth platforms to integrate remote lipid management programs within existing care frameworks.

This comprehensive research report examines key regions that drive the evolution of the Cholesterol Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Actions and Innovations from Leading Industry Players Driving the Evolution of Cholesterol Testing Solutions

Leading diagnostic and device manufacturers are advancing the cholesterol testing market through continuous product innovation and strategic partnerships. Abbott Laboratories, for instance, introduced a digital cholesterol test strip in July 2024, integrating mobile app compatibility to support longitudinal lipid monitoring and remote data sharing with clinicians. Roche Diagnostics followed with a next-generation point-of-care analyzer that harnesses advanced biosensor technology to deliver rapid, lab-quality results at the bedside.

Siemens Healthineers has expanded its footprint in underserved communities by partnering with major health systems to deploy mobile cholesterol testing units accompanied by telehealth-enabled care pathways. Meanwhile, BioTech Innovations has emerged as a disruptive entrant with a smartphone-integrated biosensor kit designed for direct-to-consumer distribution, enabling patients to execute reliable finger stick tests from home and receive actionable insights within minutes.

In the realm of laboratory services, major players like Quest Diagnostics and Laboratory Corporation of America have broadened their outpatient lipid panel offerings to include home sample collection kits and digital reporting portals, reinforcing the trend toward decentralized testing and personalized care coordination.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cholesterol Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arkray Inc

- Beckman Coulter Inc

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- Danaher Corporation

- Erba Diagnostics Mannheim GmbH

- Eurofins Scientific SE

- F. Hoffmann-La Roche Ltd

- HORIBA Ltd

- Laboratory Corporation of America Holdings

- Ortho Clinical Diagnostics Inc

- PTS Diagnostics LLC

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd

- SD Biosensor Inc

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc

- Tosoh Corporation

Presenting Pragmatic Strategic Imperatives and Recommendations to Empower Industry Leaders to Navigate Cholesterol Testing Market Challenges

To successfully navigate the evolving cholesterol testing landscape, industry leaders should prioritize diversification of supply chains to mitigate tariff disruptions by establishing alternative partnerships in regions with favorable trade policies. Engaging with policy makers to secure carve-outs for diagnostic consumables can protect margins and ensure continuity of preventive screening programs. Concurrently, investing in advanced sensor research and digital health integration will be paramount to delivering differentiated solutions that combine accuracy, convenience, and clinical interoperability.

Strengthening collaborations between device manufacturers, telehealth providers, and care networks can accelerate the rollout of integrated cholesterol management services. By co-developing end-to-end platforms that seamlessly link at-home testing, real-time data analytics, and virtual care navigation, stakeholders can enhance patient adherence and reduce the burden of cardiovascular disease. Finally, tailoring go-to-market strategies to regional regulatory and reimbursement landscapes will be essential for capturing growth in emerging markets, where pricing flexibility and distribution partnerships are critical success factors.

Detailing Rigorous Research Methodology and Analytical Framework Underpinning the Robust Cholesterol Testing Market Exploration

This analysis was underpinned by a comprehensive research methodology incorporating both secondary and primary data sources. Secondary research entailed an exhaustive review of academic literature, peer-reviewed journals, industry publications, regulatory filings, and government databases to identify technological innovations, tariff frameworks, and testing guidelines.

Primary research included structured interviews with key opinion leaders, laboratory directors, procurement managers, and clinical end users across major geographic regions to validate market drivers, supply chain challenges, and adoption barriers. Quantitative data were triangulated through cross-referencing import/export statistics, trade policy announcements, and diagnostic equipment shipment records. All findings were subjected to rigorous quality control protocols, ensuring consistency, accuracy, and defensibility of insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cholesterol Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cholesterol Testing Market, by Product Type

- Cholesterol Testing Market, by Technology

- Cholesterol Testing Market, by Test Parameter

- Cholesterol Testing Market, by End User

- Cholesterol Testing Market, by Distribution Channel

- Cholesterol Testing Market, by Region

- Cholesterol Testing Market, by Group

- Cholesterol Testing Market, by Country

- United States Cholesterol Testing Market

- China Cholesterol Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Insights and Strategic Implications to Illuminate the Future Trajectory of Cholesterol Testing Innovation and Adoption

The confluence of advanced sensor technologies, digital health integration, and evolving care delivery models is reshaping the cholesterol testing market, offering unprecedented opportunities for improved patient outcomes. Despite headwinds from tariff policy shifts and supply chain disruptions, the market’s trajectory remains defined by innovation in home testing solutions, enriched data analytics, and collaborative care networks. As regulatory frameworks adapt to accommodate non-fasting lipid panels and decentralized testing, stakeholders that proactively align product development, strategic partnerships, and policy advocacy will be best positioned to drive the next wave of growth and deliver holistic cardiovascular preventive care.

Seize Expert Insights and Secure Your Comprehensive Cholesterol Testing Market Report Consultation with Ketan Rohom Today

To seize an unparalleled advantage in understanding the evolving dynamics of cholesterol testing, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for an in-depth consultation. During this personalized discussion, you will gain exclusive insights into the most critical findings of this comprehensive market analysis, explore tailored strategies to address your organization’s specific challenges, and discover how to leverage segmentation, regional, and tariff intelligence to accelerate growth. Don’t miss the opportunity to transform these insights into strategic action and secure your leadership position in the cholesterol testing landscape.

Reach out to schedule your consultation today and obtain immediate access to proprietary data, detailed company profiles, and expert recommendations that can guide your next investment or partnership decisions. Partnering with Ketan Rohom ensures you receive dedicated support in interpreting this research and crafting a roadmap for innovation and market expansion.

- How big is the Cholesterol Testing Market?

- What is the Cholesterol Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?