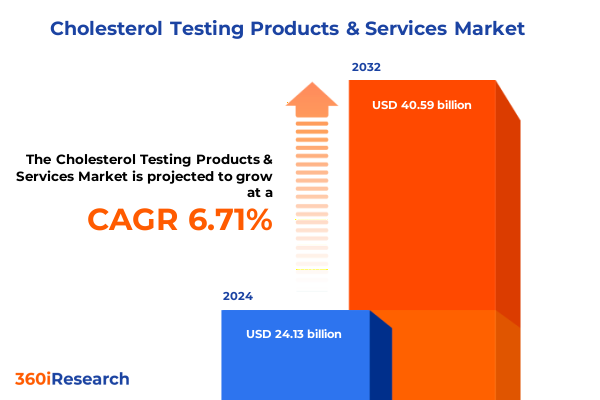

The Cholesterol Testing Products & Services Market size was estimated at USD 25.74 billion in 2025 and expected to reach USD 27.36 billion in 2026, at a CAGR of 6.72% to reach USD 40.59 billion by 2032.

Elevating Understanding of Cholesterol Testing Innovations Shaping Patient Outcomes and Healthcare Delivery Models Across Clinical and Home Settings

Cholesterol testing occupies a critical nexus between preventive care and chronic disease management, positioned at the forefront of cardiovascular health innovation. Advances in biochemical assays merged with digital platforms have elevated diagnostic accuracy while deepening real-time patient engagement. Amid growing awareness of hyperlipidemia’s systemic impact, healthcare providers and technology firms are collaborating to streamline cholesterol screening processes, optimize laboratory workflows, and deliver seamless home monitoring experiences.

This executive summary synthesizes the most relevant industry shifts, regulatory influences, and segment-specific insights to inform decision-makers about the current market landscape. Drawing on qualitative interviews, cross‐industry benchmarking, and supply chain analyses, the summary outlines the transformative dynamics shaping product development, pricing strategies, and go-to-market approaches. It sets the stage for a deeper exploration of how stakeholders can harness emerging opportunities to drive sustained value creation in cholesterol testing.

Navigating a Transformative Shift in Cholesterol Testing Driven by Digital Health Integration, Regulatory Evolution, and Patient-Centric Care Models

Over the past few years, the cholesterol testing landscape has undergone a profound transformation catalyzed by digital health integration, evolving regulatory frameworks, and an intensified focus on patient-centric care models. The increasing convergence of software and services has embedded predictive analytics and real-time dashboards into routine screening workflows, enabling clinicians to anticipate lipid fluctuations and personalize intervention plans. Simultaneously, remote monitoring capabilities powered by cloud-based platforms and mobile apps are reshaping the traditional monitoring paradigm, permitting timely feedback loops and adherence monitoring outside conventional clinical settings.

Moreover, testing methodologies have diversified as biosensor-based electrochemical devices and fluorescent spectrophotometry extend analytical capabilities to portable format, bridging performance gaps between laboratory-grade and point-of-care assays. These methodological shifts, alongside colorimetric enzymatic innovations, underscore a broader industry drive toward accuracy, speed, and accessibility. In parallel, strategic collaborations among device manufacturers, software developers, and healthcare networks are accelerating integrated solutions, enhancing interoperability, and unlocking new clinical pathways for chronic disease management.

Analyzing the Cumulative Impact of United States 2025 Tariff Adjustments on Supply Chains, Cost Structures, and Market Dynamics in Cholesterol Testing

The United States’ 2025 tariff adjustments have introduced notable cost pressures and supply chain complexities across cholesterol testing equipment and consumables. Import duties on key reagents and components have incrementally increased landed costs, leading manufacturers to reassess sourcing strategies and inventory allocations. In response, several industry players have negotiated volume-based purchasing agreements with alternative suppliers and expanded domestic manufacturing collaborations to mitigate exposure to fluctuating duties.

These tariff-induced cost realignments have also prompted a strategic repricing of test strips and analytical devices, influencing procurement decisions among hospitals, diagnostic labs, and home care providers. While some organizations have absorbed incremental expenses through operational efficiencies, others have leveraged service model innovation-such as subscription-based maintenance contracts and pay-per-test arrangements-to stabilize total cost of ownership for end users. As tariffs continue to shape supply chain resilience and pricing dynamics, decision-makers must proactively evaluate alternate logistics networks and develop flexible service offerings to preserve competitive positioning.

Uncovering Key Insights Through Robust Segmentation Across Product Types, Testing Methods, End Users, Distribution Channels, and Service Models in Cholesterol Testing

Insight emerges most vividly when the market is parsed across multiple segmentation lenses, revealing nuanced demand patterns and investment priorities. From a product type standpoint, the coexistence of software and services with test strips and testing devices highlights a balance between digital innovation and core consumable growth. Within software and services, data analytics holds a commanding role as predictive analytics tools and real-time dashboards guide therapeutic decisions, while remote monitoring through cloud-based platforms and mobile apps ensures continuous patient oversight. Meanwhile, multi-use cartridges and single-use strips underpin the consumables segment, reflecting labs’ and home users’ divergent requirements. Testing devices, split between benchtop analyzers-ranging from fully automated to multi-parameter systems-and portable meters including handheld and wearable monitors, illustrate how usability and throughput trade-offs drive adoption.

When evaluating testing methods, the segmentation between biosensor, enzymatic, and spectrophotometric approaches reveals distinct value propositions. Electrochemical and optical biosensors cater to rapid point-of-care applications, colorimetric and electrochemical enzymatic assays support cost-effective laboratory screening, and fluorescence alongside UV spectrophotometry offers high-sensitivity assessments. End users span clinics, diagnostic labs, home care environments with both assisted and self-testing options, and hospitals differentiated by general and specialized centers. Distribution channels vary from direct B2B contracts and government tenders to pharmacy-based pathways including hospital, online, and retail outlets. Finally, service models such as maintenance contracts, managed services, pay-per-test arrangements, and subscription offerings illustrate how providers align revenue streams with customer preferences, emphasizing flexibility and support.

This comprehensive research report categorizes the Cholesterol Testing Products & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Method

- Service Model

- End User

- Distribution Channel

Exploring Distinct Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia-Pacific Cholesterol Testing Markets

Regional dynamics in cholesterol testing exhibit pronounced variation driven by healthcare infrastructure maturity, reimbursement policies, and technology adoption rates. In the Americas, established reimbursement frameworks and a proactive preventive care ethos have accelerated uptake of both advanced benchtop analyzers in clinical diagnostics and portable devices for home monitoring. Public health initiatives and insurer incentives in North America have further imbued the market with an emphasis on early screening and chronic disease management.

In Europe Middle East and Africa, heterogeneous regulatory landscapes and varying levels of healthcare investment produce diverging adoption curves. Western Europe’s consolidated laboratory networks favor high-throughput multi-parameter analyzers and service contracts, while emerging markets in the region leverage mobile testing solutions and managed services to extend reach. Meanwhile, Asia-Pacific showcases some of the most rapid expansion fueled by government-led screening programs, growing patient awareness, and an expanding private healthcare sector. Markets such as India and China are witnessing skyrocketing demand for cost-effective enzymatic test strips and cloud-integrated monitoring platforms, underpinned by domestic manufacturing scale and digital health partnerships.

This comprehensive research report examines key regions that drive the evolution of the Cholesterol Testing Products & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Industry Players’ Strategic Initiatives, Innovation Portfolios, and Collaborative Partnerships in the Cholesterol Testing Arena

Leading companies within the cholesterol testing sector are pursuing convergent strategies that intertwine product innovation, strategic alliances, and service expansion. Several multinational diagnostics firms continue to refine benchtop analyzer performance by integrating automation modules and multi-parameter capabilities, thus enhancing lab throughput and accuracy. Simultaneously, emerging medtech startups focus on user-friendly portable meters and wearable monitors, often embedding biosensor or spectrophotometric technologies to enable real-time lipid tracking.

Strategic partnerships between device manufacturers and digital health firms are also proliferating, reinforcing end-to-end solutions encompassing predictive analytics, remote patient monitoring, and integrated reporting tools. Some industry incumbents have bolstered their service portfolios through managed service agreements, subscription offerings, and outcome-based contracts, reflecting a shift toward value-based care. Moreover, cross-border alliances aimed at co-development and shared distribution infrastructures are gaining traction as a way to navigate tariff complexities while accessing high-growth regional markets. Collectively, these strategic moves underscore an ecosystem-level approach, where collaboration and differentiation converge to create sustainable competitive moats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cholesterol Testing Products & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. Menarini Diagnostics S.r.l.

- Abbott Laboratories

- AccuTech, LLC

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- FUJIFILM Holdings Corporation

- Horiba, Ltd.

- Laboratory Corporation of America Holdings

- Meridian Bioscience, Inc.

- Nipro Corporation

- Nova Biomedical

- Ortho Clinical Diagnostics

- Polymedco, Inc.

- PTS Diagnostics

- Quest Diagnostics Incorporated

- Randox Laboratories Ltd.

- Sekisui Diagnostics LLC

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Actionable Recommendations for Industry Leaders to Drive Innovation, Optimize Operations, and Enhance Patient Engagement in Cholesterol Testing

Industry leaders should prioritize several strategic imperatives to capitalize on emergent market opportunities. First, integrating advanced data analytics within core testing workflows can unlock predictive modeling capabilities that guide patient-specific interventions and improve clinical decision-making. By fostering collaborations with software developers, companies can accelerate the deployment of real-time dashboards and machine learning algorithms that translate raw lipid data into actionable health insights.

Second, diversifying supply chain networks and establishing localized manufacturing partnerships will be essential to mitigate ongoing tariff risks and currency fluctuations. Companies can further differentiate by offering flexible service models-such as subscription-based maintenance and pay-per-test arrangements-that align cost structures with customer usage patterns. Emphasizing interoperability standards and open-architecture platforms will also enhance integration with electronic health record systems, delivering seamless data exchange and elevating customer satisfaction.

Finally, expanding into underpenetrated regions requires tailored go-to-market strategies that consider local regulatory frameworks, reimbursement pathways, and cultural attitudes toward home-based care. By leveraging multi-channel distribution networks, including direct institutional contracts and digital pharmacy portals, organizations can unlock new revenue streams while promoting inclusive access to cholesterol testing innovations.

Detailing the Comprehensive Research Methodology Underpinning Data Collection, Analysis Frameworks, and Validation Processes in Cholesterol Testing Research

The findings presented in this summary are grounded in a robust research methodology designed to ensure rigor, reliability, and relevance. Primary research entailed in-depth interviews with clinical laboratory directors, healthcare providers, and industry executives, supplemented by surveys among home care patients and diagnostic end users. These qualitative insights were cross-referenced against secondary sources, including peer-reviewed journals, regulatory filings, and white papers, to validate emerging trends and technological breakthroughs.

Quantitative analyses leveraged supply chain data, procurement records, and service contract portfolios to map cost trajectories and tariff impacts. A multi-stage triangulation process was applied to reconcile data from diverse channels, ensuring consistency across segment-specific metrics. Geographical insights were generated by benchmarking healthcare infrastructure indices, reimbursement schedules, and regional screening initiatives. Finally, strategic partner evaluations incorporated a competitive landscape assessment framework to identify key strengths, weaknesses, opportunities, and threats for major industry participants.

Throughout the research process, quality control measures-such as data verification protocols and expert panel reviews-were implemented to maintain methodological integrity. This comprehensive approach underpins the reliability of the segmentation insights, regional analyses, and strategic recommendations outlined in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cholesterol Testing Products & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cholesterol Testing Products & Services Market, by Product Type

- Cholesterol Testing Products & Services Market, by Testing Method

- Cholesterol Testing Products & Services Market, by Service Model

- Cholesterol Testing Products & Services Market, by End User

- Cholesterol Testing Products & Services Market, by Distribution Channel

- Cholesterol Testing Products & Services Market, by Region

- Cholesterol Testing Products & Services Market, by Group

- Cholesterol Testing Products & Services Market, by Country

- United States Cholesterol Testing Products & Services Market

- China Cholesterol Testing Products & Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Concluding Perspectives on Emerging Opportunities, Challenges, and Strategic Imperatives in the Evolving Cholesterol Testing Landscape

The evolving cholesterol testing ecosystem presents a compelling tapestry of innovation, regulatory shifts, and market realignments. As patient expectations gravitate toward personalized care pathways and digital engagement, diagnostic platforms must adapt by blending laboratory-grade performance with user-centric designs. Tariff recalibrations in 2025 have injected a renewed focus on supply chain resilience and cost optimization, compelling industry players to refine strategic partnerships and service offerings.

Key segmentation insights illuminate how demand varies across software services, consumable strips, and diverse testing devices, highlighting the imperative for portfolio breadth and interoperability. Regional analyses further underscore the importance of aligning market entry strategies with local infrastructure capabilities and healthcare policy frameworks. Collectively, these insights point to an era where integrated digital diagnostics, flexible service models, and collaborative ecosystems will define competitive leadership.

Moving forward, stakeholders who embrace data-driven decision-making, agile supply chain strategies, and patient-centric innovations will be best positioned to harness the full potential of the cholesterol testing market. The convergence of technological advances and evolving care paradigms offers a unique opportunity to enhance population health outcomes while driving sustainable growth.

Get Expert Guidance and Advanced Market Insights Directly from Ketan Rohom to Propel Your Cholesterol Testing Strategic Decisions Today

To access in-depth market intelligence and customized strategic guidance from Ketan Rohom, Associate Director of Sales & Marketing, you can secure a comprehensive report that supports critical decision-making. Engagement with this report empowers leaders to align product roadmaps with emerging demands, navigate tariff fluctuations, and identify high-impact partnership opportunities.

By partnering with Ketan Rohom, you gain direct insight into nuanced regional trends, advanced segmentation analyses, and actionable recommendations fine-tuned for your organization. This call to action invites you to leverage expertise that transforms raw data into competitive advantage, catalyzing growth in the rapidly evolving cholesterol testing field.

Reach out today to initiate a tailored consultation, ensure your strategies stay ahead of regulatory and technological shifts, and maximize your market positioning with premium research insights.

- How big is the Cholesterol Testing Products & Services Market?

- What is the Cholesterol Testing Products & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?