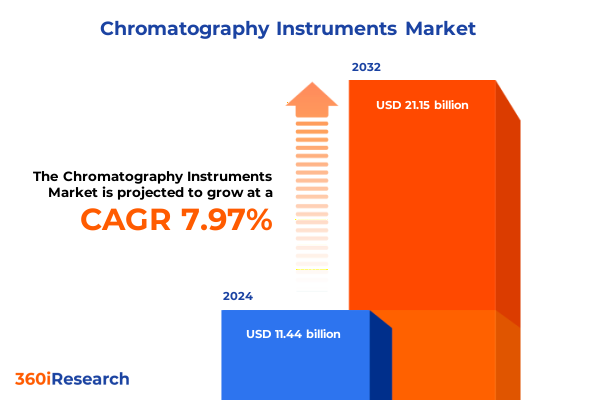

The Chromatography Instruments Market size was estimated at USD 12.17 billion in 2025 and expected to reach USD 12.94 billion in 2026, at a CAGR of 8.21% to reach USD 21.15 billion by 2032.

Exploring the Foundations and Emerging Drivers Shaping the Chromatography Instruments Industry in Today’s Analytical Landscape

Chromatography instruments form the analytical backbone of countless scientific and industrial processes, delivering the resolution and sensitivity required for complex separations. From academic laboratories uncovering new biomolecular interactions to pharmaceutical manufacturers ensuring drug purity, these systems drive critical insights across sectors. As innovations in detector technology and sample preparation expand analytical capabilities, decision-makers are increasingly relying on chromatography platforms to solve pressing challenges in quality control, environmental monitoring, and clinical diagnostics.

Against this backdrop, several key factors are shaping the current landscape. Rapid advances in automation and digital integration are reducing per-sample costs and accelerating throughput, while stringent regulatory frameworks are heightening demand for trace-level precision. Moreover, the convergence of artificial intelligence with data acquisition software is unlocking new possibilities for predictive maintenance and real-time method optimization. Consequently, stakeholders must navigate a rapidly evolving environment where both incremental improvements and disruptive breakthroughs can redefine competitive boundaries.

Uncovering the Pivotal Technological and Market Shifts Propelling Chromatography Instrumentation toward Next-Generation Applications

Recent years have witnessed fundamental shifts that are redefining the market for chromatography instruments. One of the most significant transformations involves the adoption of modular, software-driven architectures that integrate seamlessly with laboratory information management systems. This digital pivot is enabling end users to automate complex workflows, reduce manual intervention, and glean deeper insights from multi-dimensional datasets. Simultaneously, miniaturized and portable platforms are extending analytical capabilities beyond centralized laboratories, opening new opportunities for field-based environmental analysis and on-site process monitoring.

Furthermore, sustainability considerations are accelerating the development of green chromatography techniques, such as supercritical fluid chromatography. These methods minimize solvent usage and waste generation, aligning with corporate responsibility objectives and regulatory pressures to reduce environmental footprints. As a result, vendors are channeling R&D investments into energy-efficient pumps, recyclable column materials, and solvent recycling modules. Together, these technological and ecological imperatives are converging to push the industry toward a more agile, connected, and sustainable future.

Assessing the Ripple Effects of Recent 2025 United States Tariff Measures on Chromatography Instrumentation Supply Chains

The United States’ imposition of new tariff measures in 2025 has introduced fresh complexities into global chromatography supply chains. Increased duties on key instrument components and raw materials have elevated landed costs, prompting vendors and end users to reassess procurement strategies. In particular, customs duties on specialized columns and detectors have driven a renewed emphasis on local sourcing and regional manufacturing partnerships. Consequently, laboratories and production facilities are exploring inventory buffering and multi-vendor agreements to mitigate potential disruptions.

Delving into Critical Instrument Type, Technique, End User, Application, Detector, and Component Segments Guiding Market Dynamics

A nuanced understanding of market segmentation illuminates how diverse needs are shaping product development and commercial strategies. When examining instrument types, benchtop systems continue to anchor central laboratories, while portable platforms gain traction for on-site environmental and food safety testing. In terms of analytical techniques, affinity chromatography addresses biospecific separation challenges, whereas gas chromatography-with headspace sampling, split injection, and splitless injection variants-remains indispensable for volatile compound analysis. Ion chromatography excels in ion-exchange applications, and liquid chromatography offers a spectrum of configurations, from high-performance to ultra-high-performance modes, to accommodate varying resolution and throughput requirements. Meanwhile, supercritical fluid chromatography is emerging as a greener alternative for nonpolar analytes.

End-user dynamics further shape market trajectories. Academic research establishments leverage versatile configurations for method development, while clinical diagnostics laboratories demand rapid turnaround times and robust quality controls. Environmental agencies increasingly rely on compact field instruments to monitor pollutants, whereas food and beverage processors implement chromatographic assays to ensure product safety. Pharmaceutical and biotech companies integrate chromatography across developmental pipelines, from discovery to quality assurance. Complementing these segments, applications span clinical diagnostics, environmental testing, food safety, petrochemical analysis, and pharmaceutical analysis, each requiring tailored performance metrics.

Detector selection and component customization underpin platform versatility. Flame ionization and thermal conductivity detectors offer cost-effective options for routine applications, while refractive index and ultraviolet-visible detectors deliver broad applicability. Mass spectrometry coupling provides unparalleled specificity for trace-level analyses. Core components such as automated samplers, precision-engineered columns, sensitive detectors, reliable injectors, and constant-pressure pumps are being optimized to enhance uptime and reproducibility across diverse workflows.

This comprehensive research report categorizes the Chromatography Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Technique

- Detector Type

- Component

- End User

- Application

Mapping Chromatography Instrumentation Growth Patterns and Nuanced Regional Trends across the Americas, EMEA, and Asia-Pacific

Regional variations reveal distinctive patterns of investment, regulatory focus, and adoption pace. In the Americas, North American centers of excellence maintain robust R&D ecosystems and benefit from favorable funding frameworks that support advanced method development. Latin American laboratories are increasingly upgrading legacy systems to address environmental monitoring needs and bolster domestic pharmaceutical manufacturing capabilities.

Europe, Middle East & Africa present a heterogeneous landscape in which stringent European Union chemical regulations drive demand for high-resolution systems, and Middle Eastern research initiatives are accelerating through government-led innovation programs. Meanwhile, select African markets prioritize portable instrumentation to tackle field-based agrochemical and water quality assessments.

Asia-Pacific stands out as a high-growth region, characterized by rapid industrialization and strong public-sector investments in health and environmental infrastructure. China’s expanding network of contract research organizations and India’s burgeoning pharmaceutical sector are fueling demand for both benchtop and high-throughput platforms. Japan and Australia continue to lead in advanced method development, while Southeast Asian economies adopt cost-effective configurations to balance performance with budgetary constraints.

This comprehensive research report examines key regions that drive the evolution of the Chromatography Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Chromatography Instruments Sector

Leading companies are differentiating through strategic investments, collaborative partnerships, and service expansions. Agilent Technologies has fortified its presence with comprehensive service networks and integrated software suites that enhance uptime and facilitate predictive maintenance. Thermo Fisher Scientific accelerates innovation via acquisitions of specialized detector and column manufacturers, enabling rapid deployment of bundled solutions tailored to key verticals.

Shimadzu Corporation emphasizes product reliability and user-friendly interfaces, while Waters Corporation doubles down on ultra-high performance liquid chromatography systems coupled with mass spectrometry for cutting-edge research applications. PerkinElmer reinforces its market position through co-development projects with academic institutions, driving novel assay development for emerging contaminants. Collectively, these players are channeling resources into artificial intelligence integration, sustainable materials, and modular architectures to maintain competitive advantage in a dynamic environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chromatography Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Bruker Corporation

- Danaher Corporation

- Danaher Corporation

- Gilson, Inc.

- GL Sciences, Inc.

- JASCO Corporation

- Knauer Wissenschaftliche Geräte GmbH

- KNAUER Wissenschaftliche Geräte GmbH

- LECO Corporation

- Metrohm AG

- Novasep Holding S.A.S.

- Pall Corporation

- PerkinElmer, Inc.

- Phenomenex, Inc.

- Restek Corporation

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Trajan Scientific & Medical Pty Ltd

- Waters Corporation

- YMC Co., Ltd.

Charting Strategic Pathways for Industry Leaders to Capitalize on Technological Advances and Evolving Market Demands

Industry leaders should prioritize flexible, software-enabled platforms that accommodate evolving application requirements and regulatory changes. By investing in scalable architectures, companies can future-proof their portfolios and respond nimbly to customer demands. Furthermore, establishing localized production and distribution channels can mitigate tariff-related disruptions and reduce lead times in key markets.

Strategic collaborations with academic and research institutions can accelerate method validation and foster co-innovation, while partnerships with environmental agencies and regulatory bodies help shape standards that align with product roadmaps. Additionally, embedding sustainability across the value chain-from recyclable column materials to energy-efficient components-can enhance brand reputation and meet growing corporate and governmental environmental mandates. Finally, cultivating talent with interdisciplinary expertise in analytical chemistry, data science, and regulatory compliance will be essential for translating technical innovation into commercial success.

Detailing the Rigorous Research Framework and Multidimensional Data Collection Approaches Underpinning Our Analytical Insights

Our research methodology combines in-depth secondary research with targeted primary engagements to ensure comprehensive and reliable insights. Initially, industry publications, patent databases, and regulatory filings were analyzed to map technological evolution and competitive positioning. This desk research was complemented by expert interviews with senior executives, quality managers, and procurement specialists across major end-user segments, providing nuanced perspectives on operational challenges and adoption drivers.

Data triangulation techniques were employed to validate findings, cross-referencing quantitative inputs with qualitative feedback. Additionally, case studies highlighting deployment scenarios in pharmaceuticals, environmental monitoring, and food safety were reviewed to ground-truth strategic considerations. A governance framework ensured consistency in data collection, while rigorous peer review and editorial processes safeguarded analytical integrity. Together, these approaches underpin a robust framework for strategic decision-making in chromatography instrumentation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chromatography Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chromatography Instruments Market, by Instrument Type

- Chromatography Instruments Market, by Technique

- Chromatography Instruments Market, by Detector Type

- Chromatography Instruments Market, by Component

- Chromatography Instruments Market, by End User

- Chromatography Instruments Market, by Application

- Chromatography Instruments Market, by Region

- Chromatography Instruments Market, by Group

- Chromatography Instruments Market, by Country

- United States Chromatography Instruments Market

- China Chromatography Instruments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Critical Insights and Strategic Imperatives for Stakeholders in the Chromatography Instruments Market

Collectively, these findings underscore a dynamic industry characterized by rapid technological progress, evolving regulatory landscapes, and shifting supply chain paradigms. Stakeholders who integrate modular, software-driven systems and embrace sustainability practices will be well positioned to capture emerging opportunities. Moreover, organizations that adapt to tariff challenges through regional diversification and local partnerships can maintain supply chain resilience.

By aligning product development with end-user requirements-whether in academic research, clinical diagnostics, environmental testing, food safety, or petrochemical analysis-companies can deliver tailored value propositions. Ultimately, success in the chromatography instruments market will hinge on a balanced strategy that leverages innovation, operational agility, and deep market understanding to navigate an increasingly complex global environment.

Connect with Ketan Rohom to Unlock In-Depth Chromatography Instruments Market Research and Propel Strategic Decision-Making

Don’t let the complexities of chromatography instrument selection and market dynamics slow your strategic initiatives. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive market intelligence that powers confident decision-making. With expert guidance and tailored insights, you can align your growth strategies with the latest technological trends, navigate evolving tariff environments, and capitalize on emerging regional opportunities. Contact Ketan Rohom today to unlock the full potential of your investments in chromatography instrumentation and drive measurable business outcomes.

- How big is the Chromatography Instruments Market?

- What is the Chromatography Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?