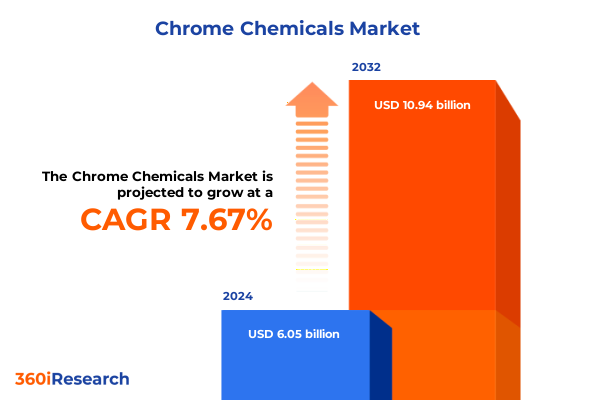

The Chrome Chemicals Market size was estimated at USD 6.49 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 7.73% to reach USD 10.94 billion by 2032.

Discover the Foundational Context and Strategic Importance of Chrome Chemicals in Modern Industrial Applications and Supply Chain Dynamics

Chrome chemicals encompass a diverse array of compounds derived from chromium, notably hexavalent and trivalent forms, which play pivotal roles in a myriad of industrial applications. Their unique properties, including exceptional corrosion resistance, catalytic activity, and vibrant pigmentation, underpin critical processes in industries ranging from leather tanning to advanced coatings. As global industries seek to enhance performance characteristics and extend product lifecycles, the reliance on chromium-based solutions continues to grow, driving manufacturers to optimize production methods and regulatory compliance frameworks. In this context, understanding the nuanced behavior of these compounds under varying operational conditions becomes essential for stakeholders aiming to maintain competitiveness and adhere to evolving environmental standards.

In the wake of mounting regulatory pressures and heightened emphasis on sustainable manufacturing, stakeholders across the value chain are re-evaluating traditional sourcing and application models for chrome chemicals. Downstream industries, including automotive, construction, and water treatment, are increasingly demanding formulations that balance performance with environmental and safety mandates. Consequently, industry participants are investing in research to develop lower-toxicity alternatives, enhance recycling protocols, and implement real-time process monitoring. This executive summary synthesizes the critical context driving market dynamics, providing a strategic lens through which decision-makers can navigate technological advancements, compliance challenges, and supply chain complexities inherent to the chrome chemicals sector.

Uncover the Key Transformative Shifts Shaping the Global Chrome Chemicals Sector Amid Regulatory Evolution and Technological Innovation Over Recent Years

Recent years have seen the chrome chemicals landscape fundamentally altered by increasingly stringent environmental regulations and elevated safety protocols. North American and European authorities have tightened exposure limits for hexavalent chromium, necessitating advanced treatment and containment solutions. Simultaneously, Asia-Pacific regions are moving toward harmonized standards, leveling the global operating field. In consequence, research and development initiatives are prioritizing alternative chemistries and closed-loop recovery systems that reduce environmental impact and meet corporate sustainability commitments.

Concurrently, technological advancements have redefined production and application methodologies across the sector. Emerging electroplating platforms integrate IoT-enabled monitoring, ensuring precise control over bath chemistry and reducing waste. Catalyst innovation has accelerated, with refined polymerization and petrochemical catalysts delivering superior activity and selectivity. These developments not only enhance process efficiency but also enable predictive maintenance through data analytics. Such digital integration empowers stakeholders to optimize resource utilization while maintaining stringent quality and performance standards.

Meanwhile, supply chain evolution is reshaping competitive dynamics. Geopolitical uncertainties and trade policy changes are driving companies toward supply diversification and strategic partnerships. Concurrently, downstream industries are emphasizing circular economy principles, incentivizing recycling and reclamation of chrome-rich byproducts. This convergence of factors underscores the need for agility, as market players must navigate regulatory complexity, leverage technological innovation, and fortify supply continuity to stay ahead in an increasingly competitive environment.

Examine the Comprehensive Effects of the 2025 United States Tariffs on Chrome Chemicals Including Supply Chain, Pricing, and Competitive Landscape Dynamics

In 2025, the introduction of targeted tariffs on imported chrome chemicals by the United States has exerted notable influence across the supply chain. Rooted in trade policy objectives aimed at bolstering domestic production, these levies have been applied primarily to hexavalent chromium compounds sourced from key overseas producers. The measure reflects broader geopolitical considerations and an emphasis on safeguarding critical industrial inputs. Consequently, both importers and domestic manufacturers are reevaluating sourcing strategies and cost structures in light of the updated tariff framework.

From a cost perspective, the applied duties have increased landed prices for imported chromium reagents, creating immediate margin pressures for downstream users. Industrial processors in metal treatment and coatings sectors are absorbing higher raw material costs or passing incremental expenses to customers, thereby affecting profit margins and competitive positioning. On the other hand, domestic producers have experienced a relative price advantage, prompting capacity expansions and investment in production infrastructure. However, maintaining operational efficiency remains crucial as global competitors adjust their market penetration strategies in response to shifting price dynamics.

In response to these tariff-driven shifts, industry participants have adopted a range of adaptive strategies. Some organizations have pursued alternative low-cost suppliers in tariff-exempt jurisdictions, while others have accelerated initiatives to develop trivalent chromium alternatives that fall outside the levy’s scope. Collaborative procurement agreements and joint ventures are emerging as vehicles to mitigate supply risk and share raw material access. Furthermore, there is an increasing focus on vertical integration, enabling major players to internalize production of critical intermediates and shield end-use operations from external cost volatility.

Gain In-Depth Segmentation Insights Across Product Type, Application, End Use Industry, Form, Grade, and Distribution Channels for Chrome Chemicals

Segmenting the market by product type reveals distinct dynamics between hexavalent and trivalent chromium. Hexavalent chromium remains widely utilized due to its high oxidative potential and pigment versatility, whereas trivalent chromium is increasingly favored for its lower toxicity profile and regulatory compliance advantages. Understanding the performance trade-offs between these two chemistries is essential for product development teams seeking to balance functionality with environmental and safety considerations.

Application-based segmentation highlights a spectrum of use cases that drive demand patterns. In catalyst applications, petrochemical and polymerization catalysts benefit from tailored surface interactions and active site distributions. Corrosion inhibitors provide extended protection in harsh environments, while electroplating processes leverage chromium compounds for wear resistance and aesthetic finishes. Pigment applications bifurcate into inorganic and organic pigments, each offering unique color fastness and chemical stability. Additionally, tanning applications continue to rely on established chromate protocols for leather processing efficiency.

Further segmentation by end use industry underscores diverse market drivers. The leather sector demands consistency in tanning efficiency and environmental discharge control. Metal treatment industries prioritize decorative coating uniformity and substrate adhesion. Paints and coatings applications require pigment dispersion stability and corrosion resistance. Meanwhile, water treatment processes utilize chrome-based inhibitors for scale control and microbial suppression. These differentiated requirements shape product formulation and distribution strategies across the supply chain.

Classification by form and grade provides additional granularity. Chrome chemicals are available in flakes, granules, liquid, and powder forms, each facilitating specific handling, solubility, and application protocols. Industrial grade materials cater to bulk manufacturing needs, whereas pharmaceutical grade products adhere to stringent purity benchmarks. Technical grade compounds support specialized niche applications. Distribution channels include direct sales for high-volume customers and distributor sales for more flexible, market-responsive delivery models, ensuring broad accessibility and logistical efficiency.

This comprehensive research report categorizes the Chrome Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Oxidation State

- Form

- Grade

- Production Process

- Purity Level

- Distribution Channel

- Application

- End Use Industry

Reveal Critical Regional Insights for Chrome Chemicals Market Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific Growth Drivers

In the Americas, market dynamics are shaped by robust industrial activity and evolving regulatory landscapes. The United States continues to balance environmental compliance with support for domestic production through incentive programs and tariff measures. In Canada, stringent worker safety standards are driving adoption of trivalent chromium for corrosion and plating applications. Meanwhile, growing infrastructure investments in Latin America are boosting demand for chrome-based pigments and corrosion inhibitors in construction and automotive sectors.

Europe, the Middle East, and Africa region presents a mosaic of regulatory regimes and growth trajectories. In Western Europe, rigorous environmental directives under REACH and local emission controls necessitate advanced effluent treatment and alternative chemistries. Gulf Cooperation Council countries are expanding their petrochemical capacities, creating demand for specialized catalysts. In Africa, nascent manufacturing sectors and infrastructure development are driving incremental use of chrome chemicals, although market penetration remains constrained by logistical challenges and local regulatory frameworks.

Asia-Pacific dominates global consumption driven by large-scale manufacturing hubs and competitive cost structures. China and India lead in electroplating and pigment production, supported by extensive chemical infrastructure and low-cost feedstock availability. Japan and South Korea focus on high-purity technical and pharmaceutical grade formulations for advanced electronics and specialty applications. Southeast Asian economies are increasingly integrating circular economy principles, creating opportunities for recycling initiatives and reclaimed chrome recovery programs to address environmental concerns.

This comprehensive research report examines key regions that drive the evolution of the Chrome Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze the Strategic Positioning, Innovation Trajectories, and Competitive Strengths of Key Players Driving the Chrome Chemicals Industry Forward

Key industry participants have pursued diverse strategies to strengthen market position and capitalize on emerging trends. Major chemical conglomerates have invested in capacity expansions and modernization of manufacturing assets to meet growing demand for trivalent formulations. Several leading firms are leveraging proprietary process technologies to optimize yield and reduce waste. Meanwhile, specialty chemical companies are focusing on niche segments, offering value-added pigment and catalyst solutions tailored to specific customer requirements.

Collaborative ventures and strategic partnerships are reshaping competitive dynamics. Joint research initiatives between chemical producers and end-use manufacturers are accelerating innovation in corrosion inhibitor and plating technologies. Alliances with technology providers have enabled the deployment of digital process management platforms, enhancing quality control and operational transparency. Additionally, mergers and acquisitions are streamlining portfolios, allowing major players to integrate backward into raw material sourcing and strengthen supply chain resilience.

Sustainability commitments and regulatory compliance remain central to corporate agendas. Leading firms are implementing closed-loop water and waste treatment systems to reduce environmental footprint. Investments in advanced emissions control and alternative chromium chemistries reflect a proactive stance toward evolving regulatory regimes. Concurrently, several companies are establishing specialized centers of excellence to drive continuous improvement and support customer education on safe handling and application best practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chrome Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AD International B.V.

- Aldon Corporation

- Bannari Amman Group

- BASF SE

- BlueStar Yabang Chemical Co., Ltd.

- Brother Enterprises Holding Co., Ltd.

- Cathay Industries

- Chongqing Minfeng Chemical Co.,Ltd.

- Chrome Star Chemical Works

- DIC Group

- Hebei Chromate Chemical Co., Ltd.

- Hunter Chemical LLC

- Hwatsi Chemical Pvt. Ltd.

- Korean Chemical Co., Ltd.

- Luoyang Zhengjie New Material Technology Co., Ltd.

- McGean

- Merck KGaA

- Muby Chemicals

- Nilkanth Organics

- Nippon Chemical Industrial Co., Ltd.

- Noah Chemicals, INC

- Polyplast Group

- ProChem, Inc.

- Rishabh Intermediates

- Sam Industries

- Sichuan Yinhe Chemical Co., Ltd.

- Sun Industries

- Suvchem

- Vishnu Chemials Limited

- YILDIRIM Group

- Şişecam

Discover Actionable Strategic Recommendations to Enhance Operational Efficiency, Resiliency, and Sustainable Growth in the Evolving Chrome Chemicals Sector

Industry leaders should prioritize the development and scaling of sustainable production processes that minimize environmental impact without compromising performance. This entails increasing R&D investment in lower-toxicity trivalent chromium alternatives and advanced effluent treatment technologies. By adopting closed-loop recycling systems for chrome-bearing waste streams, companies can reduce raw material dependency and align with circular economy principles. Continuous engagement with regulatory bodies will facilitate proactive adaptation to emerging requirements and foster a competitive advantage in green credentials.

Strengthening supply chain resilience is imperative to mitigate the effects of trade policy fluctuations and raw material volatility. Organizations are advised to diversify sourcing across multiple geographies, including tariff-exempt jurisdictions, and establish collaborative procurement frameworks with key suppliers. The integration of digital supply chain platforms can enhance inventory visibility, optimize logistics, and enable proactive risk management. By leveraging predictive analytics, decision-makers can anticipate disruptions and implement contingency plans, ensuring uninterrupted operations.

Fostering strategic partnerships and alliances will accelerate innovation and market penetration. Chemical producers should collaborate with catalyst end-users to co-develop tailored solutions that address specific performance criteria. Partnerships with technology firms can facilitate the adoption of Industry 4.0 capabilities, such as real-time process monitoring and automated quality control systems. In parallel, engaging in targeted academic and industrial research networks can yield breakthroughs in material science, positioning organizations at the forefront of emerging applications in sectors like water treatment and advanced coatings.

Understand the Rigorous Research Methodology Employed to Ensure Data Reliability, Analytical Rigor, and Comprehensive Coverage for the Chrome Chemicals Study

The analysis underpinning this report draws on a blend of primary and secondary research methodologies. Primary insights were obtained through in-depth interviews with industry stakeholders, including chemical manufacturers, end-users, and regulatory experts. Supplementing these perspectives, secondary research encompassed the review of academic publications, white papers, and publicly available regulatory filings. This dual approach ensures that the synthesized findings reflect both frontline industry experience and authoritative documentary evidence.

Segmentation analysis followed a structured framework across product type, application, end use industry, form, grade, and distribution channel. Data points were categorized according to these dimensions to reveal consumption patterns, performance characteristics, and value chain configurations. Geographical breakdowns were applied to elucidate regional demand drivers and regulatory influences. Consistency checks were conducted to maintain uniformity of classification, enabling comparability across segments and facilitating nuanced insights into market dynamics.

Rigorous data validation and quality control procedures were implemented throughout the research process. Triangulation techniques cross-referenced information from multiple independent sources to resolve discrepancies. A panel of industry advisors provided review and feedback, ensuring analytical rigor and relevance to stakeholder needs. Statistical credibility was further bolstered through trend analysis and scenario assessments, granting decision-makers confidence in the report’s conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chrome Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chrome Chemicals Market, by Product Type

- Chrome Chemicals Market, by Oxidation State

- Chrome Chemicals Market, by Form

- Chrome Chemicals Market, by Grade

- Chrome Chemicals Market, by Production Process

- Chrome Chemicals Market, by Purity Level

- Chrome Chemicals Market, by Distribution Channel

- Chrome Chemicals Market, by Application

- Chrome Chemicals Market, by End Use Industry

- Chrome Chemicals Market, by Region

- Chrome Chemicals Market, by Group

- Chrome Chemicals Market, by Country

- United States Chrome Chemicals Market

- China Chrome Chemicals Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2544 ]

Synthesize the Core Findings and Strategic Implications to Conclude the Executive Summary for the Chrome Chemicals Market Overview

The overview of the chrome chemicals landscape reveals a sector at the intersection of regulatory transformation, technological innovation, and dynamic supply chain realignment. Stringent environmental and safety regulations are accelerating the shift from hexavalent to trivalent chromium solutions, while advancements in electroplating and catalyst technologies are unlocking new performance thresholds. Concurrently, trade policy interventions, such as the 2025 US tariffs, underscore the necessity for diversification and adaptive sourcing strategies. Together, these forces are reshaping competitive dynamics and challenging industry participants to evolve their product portfolios and operational models.

In light of these converging trends, stakeholders must adopt a proactive approach that balances sustainability imperatives with commercial objectives. Detailed segmentation analysis highlights opportunities in high-purity and specialty applications, while regional insights underscore the importance of tailored strategies in the Americas, EMEA, and Asia-Pacific. Collaborative innovation, digital integration, and supply chain resilience emerge as critical pillars for market leadership. By embracing these strategic imperatives, organizations can not only navigate current challenges but also position themselves to capitalize on long-term growth prospects in the chrome chemicals domain.

Engage with Ketan Rohom Associate Director Sales Marketing to Secure Your Comprehensive Chrome Chemicals Market Research Report Today

For organizations seeking comprehensive guidance on navigating the evolving chrome chemicals landscape, securing the full market research report is essential. To explore detailed data, in-depth analyses, and tailored strategic recommendations, please reach out to Ketan Rohom, Associate Director Sales & Marketing at 360iResearch. His expertise and insights will assist you in selecting the optimal package to support your decision-making processes and drive competitive advantage.

Engaging with this report will equip your team with actionable intelligence on regulatory trends, segmentation breakdowns, regional dynamics, and leadership strategies. Contact Ketan to schedule a personalized consultation or to request sample excerpts. By partnering with a dedicated industry specialist, you will gain the clarity and foresight needed to achieve operational excellence and sustainable growth in the chrome chemicals sector.

- How big is the Chrome Chemicals Market?

- What is the Chrome Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?