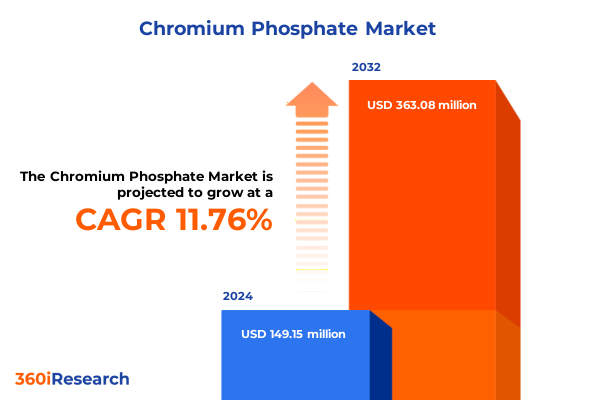

The Chromium Phosphate Market size was estimated at USD 166.91 million in 2025 and expected to reach USD 183.98 million in 2026, at a CAGR of 11.74% to reach USD 363.08 million by 2032.

Unveiling the Unique Chemical and Industrial Significance of Chromium Phosphate and Its Role in Advanced Corrosion Protection and Ceramic Technologies

Chromium phosphate, characterized by its crystalline structure and remarkable chemical stability, plays a pivotal role in high-performance industrial applications. As an insoluble salt of chromium(III) and phosphate ions, it exhibits outstanding thermal stability and resistance to acidic environments, making it an ideal additive in corrosion-resistant coatings and specialty ceramics. Beyond its inherent durability, chromium phosphate’s cation-exchange capacity under specific pH and temperature conditions enables its use in environmental remediation, particularly in reducing heavy metal ion concentrations in wastewater through sorption mechanisms.

In addition to its environmental and corrosion-inhibiting properties, chromium phosphate’s inert, non-toxic profile has contributed to its adoption in consumer and industrial formulations. Innovations in pigment technology have leveraged the compound’s vibrancy and stability, producing colorants that maintain hue integrity even under UV exposure and elevated temperatures. The material’s role in ceramic glazes, where it enhances wear resistance and color consistency, underscores its versatility across sanitary ware and tile sectors, while its emerging applications in battery cathode precursors highlight the evolving potential of this multifaceted inorganic compound.

Charting the Evolution of Chromium Phosphate Through Sustainability, Technological Breakthroughs, and Regulatory Integration

The chromium phosphate landscape is undergoing transformative shifts driven by stringent environmental regulations, advances in sustainable chemistry, and the rise of high-performance materials. Regulatory frameworks such as the EU’s REACH and the U.S. Toxic Substances Control Act have accelerated the phase-out of hexavalent chromium compounds, catalyzing demand for chromium(III) phosphate as a safer alternative in anticorrosive formulations. This pivot toward less hazardous chemistries has sparked innovation in pigment and coating technologies, where iron- and chromium-based phosphates meet both performance and compliance criteria.

Concurrently, sustainability imperatives and carbon footprint considerations are driving research into low-energy synthesis routes and renewable feedstocks. Producers are investing in green manufacturing processes that minimize solvent use and optimize energy consumption, with some companies exploring biomass-derived phosphorus sources. Moreover, the growing electrification trend in the automotive and energy storage sectors has opened new avenues for chromium phosphate as a precursor to lithium iron phosphate cathode materials, further diversifying its industrial relevance and underscoring the material’s adaptability in the era of clean energy.

Examining the Compounded Effects of 2025 United States Tariff Policies on Chromium Phosphate Supply Chains and Cost Structures

The imposition of sweeping U.S. trade tariffs in early 2025 has introduced complex dynamics into the chromium phosphate supply chain, with a baseline 10 percent duty on non-USMCA imports shaping procurement strategies and cost structures. Imports from Canada and Mexico that fail to comply with the United States-Mexico-Canada Agreement face a higher 25 percent levy, creating an uneven tariff landscape that compels manufacturers to reassess sourcing from traditional North American suppliers.

Beyond phosphate rock, the tariffs extend to specialty inorganic additives, magnifying price volatility across coatings and chemical sectors. Agricultural users and industrial feedstock buyers have already reported elevated input costs, with some fertilizer producers warning of up to a 15 percent increase in expenses for phosphate-based compounds used in crop nutrient formulations. These tariff measures have collectively heightened the urgency for supply chain diversification and strategic inventory planning to mitigate the risk of sustained cost inflation and production disruptions.

Delving Into the Critical Segmentation Profiles That Illuminate Demand Drivers and Application Niches in the Chromium Phosphate Sector

Understanding chromium phosphate demand requires an integrated view of how application, grade, product form, end-use industry, and distribution channel intersect to define market dynamics. In tableware and tile finishing applications, the stability and colorfastness of sanitary and tile glazes drive adoption, while corrosion inhibitor uses are primarily anchored in protective coatings for industrial equipment, oil and gas treatments, and water treatment systems. Flame retardant functions in building materials, polymer additives, and textile treatments illustrate chromium phosphate’s versatility across safety-critical applications. Pigment applications leverage the compound’s color retention in ceramic and plastic substrates, and its role in wood preservation for outdoor lumber and plywood underscores the demand for weather-resistant treatments.

Alongside application drivers, the spectrum of grades-from agricultural to pharmaceutical-highlights the compound’s purity requirements tailored to specific regulatory and performance needs. Form factors, whether granular, liquid, or powder, further dictate logistics and processing choices, with subcategories like coarse and fine granules, aqueous suspensions, and varying powder fineness influencing handling and dispersion characteristics. End-use industries span agriculture, automotive, coatings and paints, construction, and electronics, each with downstream segments such as animal feed additives, exterior and interior automotive applications, industrial and wood coatings, cement additives, concrete admixtures, printed circuit board manufacturing, and solder flux. Finally, distribution via direct sales, distributors, or digital channels reflects evolving procurement preferences, with national and regional distributor networks serving bulk industrial clients and e-commerce platforms and manufacturer websites offering more agile supply solutions.

This comprehensive research report categorizes the Chromium Phosphate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Product Form

- End Use Industry

- Distribution Channel

- Application

Highlighting Regional Market Nuances and Growth Dynamics for Chromium Phosphate Across the Americas, EMEA, and the Asia-Pacific Regions

Regional considerations exert a significant influence on chromium phosphate demand, starting with the Americas. North America’s manufacturing resurgence and emphasis on infrastructure refurbishment have kept demand for corrosion-inhibiting and flame-retardant additives robust, even as tariff policies alter traditional trade routes and import patterns. Agricultural usage trends continue to support grade-specific formulations, with domestic fertilizer producers seeking alternatives to imported phosphate compounds amid tariff pressures.

In Europe, the Middle East, and Africa, regulatory alignment with sustainability objectives drives adoption of chromium phosphate in high-value applications such as precision coatings and advanced ceramics. The EU’s REACH framework reinforces preferences for hexavalent-free chemistries, propelling research collaboration between European academic institutions and specialty chemical firms to develop next-generation phosphate materials under stringent environmental criteria.

Asia-Pacific remains the largest production and consumption hub for chromium phosphate, led by vertically integrated manufacturers in China and expanding specialty chemical capacity in India and Japan. Market leaders in Shandong province leverage low-cost raw materials to supply global pigment and corrosion-inhibitor markets, while Japanese firms focus on ultra-high-purity grades for electronics and semiconductor device fabrication. The region’s dynamic growth profile is underpinned by supportive industrial policy, rapid electrification trends, and ongoing investments in infrastructure and green chemistry initiatives.

This comprehensive research report examines key regions that drive the evolution of the Chromium Phosphate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Global Producers Driving Innovation and Competitive Advantage in the Chromium Phosphate Landscape

Hebang Chemical, headquartered in Shandong, China, stands as the largest integrated producer of chromium phosphate, boasting world-class capacity and an expansive distribution network. Its cost leadership is fortified by upstream phosphate rock integration and a vertically consolidated value chain that spans mining, processing, and specialty formulation.

LANXESS AG, based in Cologne, Germany, differentiates through sustainability-driven production and extensive technical support services. The company’s long-standing pigment expertise and commitment to environmental compliance have positioned its products favorably in high-temperature ceramic, refractory, and polymer additive applications.

Nippon Chemical Industrial of Tokyo, Japan, leads the high-purity segment, supplying nanostructured chromium phosphate grades for electronics, precision coatings, and advanced manufacturing processes. Its dedicated R&D infrastructure and focus on ultra-fine crystalline materials underscore a technology-driven competitive edge.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chromium Phosphate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AD International BV

- American Elements

- BASF SE

- Brenntag SE

- Chemetall GmbH

- Covestro AG

- GFS Chemicals Inc

- Hangzhou Weck Chemical Industry Co Ltd

- Hubei Jusheng Technology Co Ltd

- Incheon Chemical Co Ltd

- Lanxess AG

- Merck KGaA

- Nanochemazone

- Nippon Chemical Industrial Co Ltd

- Otto Chemie Pvt Ltd

- Oxkem Limited

- Service Chemical Industries

- Shaanxi Shangnan Dongzheng Chemical Co Ltd

- Solvay SA

- The Shepherd Chemical Company

- Thermo Fisher Scientific, Inc.

- Wuhan Youngde Chemical Co Ltd

- Zhengzhou Acme Chemical Co Ltd

Outlining Strategic Initiatives for Industry Stakeholders to Mitigate Risk, Enhance Innovation, and Strengthen Supply Chains in Chromium Phosphate

To navigate today’s volatile trade environment and evolving regulatory requirements, stakeholders should prioritize supplier diversification, balancing North American, European, and Asia-Pacific sources to mitigate tariff-driven disruptions. Establishing strategic partnerships with regional producers and leveraging bonded-warehouse arrangements can reduce exposure to sudden duty impositions. Simultaneously, accelerated investment in green synthesis pathways-such as energy-efficient sol–gel processes and biomass-based phosphorus feedstocks-will align operations with global sustainability mandates while potentially unlocking incentive programs and carbon credit opportunities.

Companies are also advised to enhance end-to-end supply chain transparency through digital platform integration, ensuring real-time tracking of inventory, tariffs, and compliance status. Co-development agreements with downstream technology leaders in ceramics, coatings, and battery cathodes can foster tailored solutions that differentiate offerings and build long-term customer loyalty. Finally, maintaining active engagement with industry associations and trade policy forums will enable early visibility into legislative shifts, allowing preemptive adaptation to tariff schedules and regulatory updates.

Detailing the Rigorous Multi-Method Research Approach Employed to Ensure Comprehensive and Credible Insights into Chromium Phosphate Markets

This analysis is grounded in a robust multi-method approach combining extensive secondary research with primary insights. Secondary research encompassed peer-reviewed scientific literature, patent filings, regulatory databases, and authoritative industry news sources to capture the latest advances in chromium phosphate synthesis, applications, and trade policies. Primary research involved structured interviews with chemical engineers, procurement executives, and regulatory experts to validate findings and gather forward-looking perspectives.

Quantitative data were triangulated through cross-referencing global trade statistics, customs records, and company financial disclosures, ensuring both accuracy and comprehensiveness. Market segmentation modeling employed a use-case-driven framework, integrating application, grade, form factor, end-use industry, and distribution channel metrics. This methodology provides a clear linkage between market drivers and strategic imperatives, enabling stakeholders to make informed decisions underpinned by transparent research protocols.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chromium Phosphate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chromium Phosphate Market, by Grade

- Chromium Phosphate Market, by Product Form

- Chromium Phosphate Market, by End Use Industry

- Chromium Phosphate Market, by Distribution Channel

- Chromium Phosphate Market, by Application

- Chromium Phosphate Market, by Region

- Chromium Phosphate Market, by Group

- Chromium Phosphate Market, by Country

- United States Chromium Phosphate Market

- China Chromium Phosphate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Summarizing Key Findings and Strategic Imperatives to Navigate Complexities in the Global Chromium Phosphate Landscape

The evolving landscape of chromium phosphate is defined by converging forces: regulatory imperatives favoring hexavalent-free chemistries, sustainability mandates reshaping production methods, and trade policies introducing new cost dynamics. Stakeholders who embrace diversification in sourcing, invest in green manufacturing, and leverage digital supply chain tools are poised to capitalize on the compound’s expanding role in corrosion protection, advanced ceramics, and emerging battery technologies.

As market leaders continue to innovate and regulatory landscapes evolve, ongoing collaboration across the value chain will be critical to maintaining resilience and unlocking new growth pathways. By aligning strategic priorities with environmental, social, and governance objectives, industry participants can not only mitigate current challenges but also position themselves at the forefront of next-generation applications for chromium phosphate.

Engage With Ketan Rohom to Secure the Comprehensive Chromium Phosphate Report and Drive Strategic Growth Initiatives

Unlock unparalleled insights and actionable data by connecting with Ketan Rohom, whose expertise will guide you through the specialized nuances of the chromium phosphate landscape and help you acquire the full comprehensive market research report to inform your procurement strategies, drive innovation initiatives, and gain a competitive edge in this dynamic sector

- How big is the Chromium Phosphate Market?

- What is the Chromium Phosphate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?