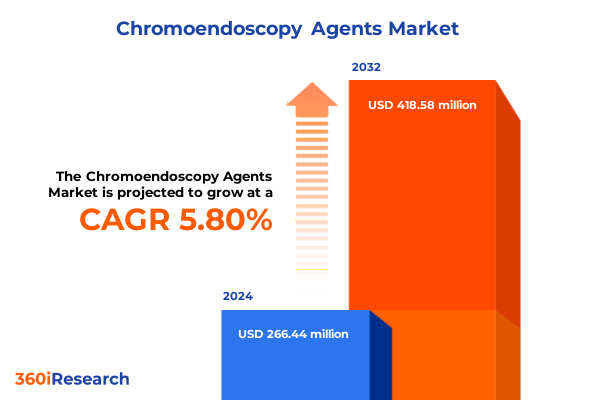

The Chromoendoscopy Agents Market size was estimated at USD 232.52 million in 2025 and expected to reach USD 253.16 million in 2026, at a CAGR of 7.01% to reach USD 373.72 million by 2032.

Uncovering the Evolution and Critical Relevance of Chromoendoscopy Agents in Modern Gastrointestinal Diagnostic Practices and Procedural Enhancements

Chromoendoscopy agents have emerged as pivotal tools in enhancing the visualization of mucosal patterns and vascular structures during endoscopic procedures. By applying specialized dyes or leveraging advanced virtual imaging techniques, clinicians can detect subtle lesions and differentiate neoplastic from non-neoplastic tissue with greater precision. Over time, the integration of these agents into diagnostic workflows has shifted the threshold for early cancer detection, enabling more accurate and timely interventions. This shift underscores the critical relevance of chromoendoscopy agents as both diagnostic enhancers and patient outcome optimizers.

As the clinical community increasingly prioritizes minimally invasive methodologies, the demand for refined imaging solutions continues to grow. Chromoendoscopy agents now serve as foundational components in an array of gastrointestinal diagnostic protocols, supporting the detection of colorectal, esophageal, gastric cancers, and inflammatory bowel disease surveillance. Consequently, the industry has seen a surge in product innovation and regulatory approvals, reflecting a broader trend toward enhanced endoscopic precision and patient-centric care.

In this landscape of rapid technological advancements and evolving clinical standards, understanding the evolution and multifaceted applications of chromoendoscopy agents is indispensable. The subsequent sections of this executive summary will explore transformative shifts, tariff influences, segmentation dynamics, regional insights, competitive positioning, and strategic recommendations, all designed to guide decision-makers through this complex and burgeoning field.

Examining Paradigm Defining Technological and Clinical Shifts Reshaping Chromoendoscopy Applications Across Healthcare Settings

The chromoendoscopy market has undergone paradigm-defining shifts as new technologies and clinical practices converge to reshape diagnostic standards. Initially reliant on traditional dye-based techniques, the field has progressively embraced virtual enhancement methods such as Flexible Spectral Imaging Color Enhancement, I-Scan, and Narrow Band Imaging. These virtual platforms reduce preparation time, minimize dye-related side effects, and offer real-time image processing, thereby elevating overall procedural efficiency and diagnostic yield.

Simultaneously, integration with artificial intelligence and machine learning algorithms has intensified the drive toward automated lesion detection. By training models on large image datasets, developers are forging tools capable of identifying suspicious regions with high sensitivity, streamlining workflow, and reducing inter-operator variability. Furthermore, updated clinical guidelines now explicitly recommend chromoendoscopic evaluation for high-risk patient cohorts, reinforcing its role in comprehensive surveillance programs.

Regulatory frameworks have also evolved, with accelerated review pathways for imaging technologies that demonstrate clear patient benefit. As a result, manufacturers are aligning their research and development pipelines to meet stringent quality benchmarks and secure expedited market entry. Collectively, these technological, clinical, and regulatory shifts coalesce to form a dynamic landscape where innovation is both the driver and the outcome of progress in chromoendoscopy applications.

Analyzing the Far Reaching Effects of Newly Implemented United States Tariffs on Chromoendoscopy Agent Supply Chains and Pricing Structures

In 2025, the introduction of new United States tariffs on key raw materials and import components has exerted a cumulative impact on the chromoendoscopy agent supply chain. Tariffs targeting chemical precursors used in dye-based formulations led to incremental cost pressures for Cresyl Violet, Indigo Carmine, and Methylene Blue, while levies on optical filter modules and imaging processors affected virtual enhancement systems. These headwinds have prompted manufacturers to reassess their procurement strategies and reevaluate pricing structures in order to maintain profitability.

To navigate these cost fluctuations, industry participants are diversifying their supplier base, with some investing in domestic production capabilities to mitigate reliance on imported goods. Concurrently, collaborative agreements between diagnostic companies and chemical manufacturers have emerged to negotiate volume-based contracts that offset tariff expenses. Despite these efforts, downstream buyers-including hospitals, ambulatory surgery centers, and clinics-are encountering higher acquisition costs, influencing purchasing cycles and contract negotiations.

Looking ahead, stakeholders must anticipate potential policy revisions and explore tariff pass-through mechanisms that balance affordability with innovation incentives. Effective engagement with regulatory bodies and proactive supply chain risk assessments will be instrumental in maintaining market stability and protecting patient access to essential diagnostic agents.

Deriving Profound Insights from Multidimensional Segmentation Reflecting Diverse Agent Types Indications and End User Dynamics

An in-depth examination of segmentation reveals critical insights into how chromoendoscopy agents perform across diverse applications and clinical environments. By agent type, the market bifurcates into Dye Based options-encompassing Cresyl Violet, Indigo Carmine, and Methylene Blue-and Virtual platforms such as Flexible Spectral Imaging Color Enhancement, I-Scan, and Narrow Band Imaging. Dye based formulations continue to be valued for their cost-effectiveness and familiarity among practitioners, whereas virtual techniques are gaining traction for their operational convenience and minimal patient preparation requirements.

When viewed through the lens of clinical indication, these agents demonstrate differentiated efficacy profiles. Colorectal cancer detection remains the foremost application, owing to the high prevalence and established screening protocols. Esophageal cancer detection follows, with chromoendoscopic methods enhancing Barrett’s esophagus surveillance, while gastric cancer diagnosis benefits from both targeted dye staining and contrast-enhanced imaging. Inflammatory bowel disease surveillance also employs these technologies to identify dysplastic changes, underscoring their versatility across multiple gastrointestinal conditions.

Evaluating end user categories further highlights adoption patterns. Ambulatory surgery centers and clinics typically prefer virtual systems for their streamlined workflows, while hospitals allocate resources for both dye and virtual solutions to address a broader patient mix. Distribution channels play a complementary role, with hospital pharmacies serving as the primary procurement hub, while online and retail pharmacies enable direct access for outpatient settings. This multidimensional segmentation framework illuminates the nuanced drivers of adoption, informing tailored strategies for product development and commercialization.

This comprehensive research report categorizes the Chromoendoscopy Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Staining Agent

- Indication

- Formulation Type

- Patient Demographics

- Delivery Method

- Application Area

- End User

Illuminating Regional Disparities and Synergies in Chromoendoscopy Adoption Across the Americas Europe Middle East and Africa and Asia Pacific

Regional dynamics exert a significant influence on the adoption and utilization of chromoendoscopy agents, reflecting local healthcare infrastructures, regulatory policies, and epidemiological trends. In the Americas, robust reimbursement frameworks and widespread screening initiatives have fostered high penetration rates of both dye based and virtual technologies. Leading healthcare institutions in North America are conducting clinical trials and publishing evidence that further validate the diagnostic superiority of enhanced imaging modalities.

Across Europe Middle East and Africa, market development is more heterogeneous, shaped by disparate regulatory regimes and variable healthcare spending capacities. In Western Europe, centralized healthcare systems facilitate standardized procurement processes, while market entry pathways in Middle Eastern and African countries often necessitate localized clinical validation studies. This diversity creates opportunities for strategic partnerships with regional distributors and clinical research organizations to navigate complex approval timelines and procurement mechanisms.

Asia Pacific represents an emerging growth frontier, driven by escalating gastrointestinal cancer incidence rates and expanding endoscopic capabilities in countries such as China, India, and Australia. Government-led cancer control programs are expanding screening coverage, and investments in training initiatives are equipping gastroenterologists with proficiency in advanced imaging techniques. By understanding these region specific factors, stakeholders can optimize market entry strategies and align resource allocations with local demand drivers.

This comprehensive research report examines key regions that drive the evolution of the Chromoendoscopy Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Strategic Positioning and Innovation Trajectories of Leading Players Driving Chromoendoscopy Agent Market Evolution

Leading providers have been instrumental in shaping the chromoendoscopy agent landscape through strategic innovations and partnerships. Manufacturers of dye based agents continue to invest in formulation enhancements that improve stain retention and reduce mucosal irritation, while developers of virtual systems are focusing on next-generation imaging algorithms and integrated artificial intelligence modules. These combined efforts are elevating the overall diagnostic accuracy and expanding clinical applications beyond traditional indications.

Strategic alliances between equipment manufacturers and chemical suppliers have also intensified, yielding co branded solutions that integrate proprietary dyes with optimized endoscope configurations. In parallel, some market entrants are pursuing targeted acquisitions of niche imaging technology firms to bolster their virtual enhancement portfolios. This consolidation trend underscores the growing importance of end-to-end solutions that marry optical hardware with advanced software analytics.

Moreover, collaborative research partnerships with leading academic centers are advancing the evidence base for chromoendoscopy applications, particularly in pre cancerous lesion detection and surveillance protocols. Through joint publications and clinical trial sponsorships, these key players are solidifying their reputations as thought leaders and driving the adoption curve. As competition evolves, differentiation through innovation and clinical validation will remain essential for those seeking to capture leadership positions in this dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chromoendoscopy Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Laboratories

- American Regent, Inc.

- Carmonja GmbH

- Cosmo Pharmaceuticals NV.

- Hikma Pharmaceuticals PLC

- Long Grove Pharmaceuticals, LLC by Capstone Development Services Company, LLC

- Macsen Labs

- Merck KGaA

- Provepharm Life solutions SA

- Renylab Quimica E Farmaceutica Ltda.

- Thermo Fisher Scientific Inc.

Crafting Actionable Strategic Recommendations Empowering Industry Leaders to Navigate and Capitalize on Chromoendoscopy Market Complexities

Industry leaders must adopt targeted strategies to navigate the complexities of the chromoendoscopy agent environment and secure sustainable market advantage. Prioritizing investment in virtual imaging platforms, with integrated artificial intelligence support, will offer competitive differentiation by streamlining workflows and enhancing diagnostic confidence. Equally important is the reinforcement of domestic manufacturing capabilities or collaborative supply partnerships to mitigate the effects of international tariffs and ensure consistent product availability.

Clinician engagement remains a cornerstone of successful market penetration. Organizing hands on training workshops, sponsoring key opinion leader forums, and disseminating real world evidence through peer reviewed channels will foster broader acceptance and standardization of enhanced imaging protocols. In parallel, active collaboration with payers and regulatory bodies to establish favorable reimbursement codes and streamlined approval pathways will underpin longterm commercial viability.

Finally, tailoring value propositions to distinct end user segments-highlighting cost efficiencies for ambulatory surgery centers and enhanced diagnostic throughput for hospitals-will strengthen market positioning. By aligning product development with evolving clinical guidelines and patient care objectives, organizations can convert emerging trends into tangible growth opportunities.

Detailing a Rigorous Multiphase Research Methodology Anchoring the Chromoendoscopy Agent Market Analysis on Robust Data Foundations

The research methodology underpinning this analysis adheres to a robust, multistage process designed to ensure data integrity and actionable insights. Initially, comprehensive secondary research was conducted, reviewing peer reviewed literature, regulatory filings, and clinical guideline updates to map the technological and application landscape of chromoendoscopy agents. These insights were synthesized to develop a preliminary market framework and identify key variables.

Subsequently, primary research was undertaken through structured interviews with gastroenterologists, hospital procurement officers, distributor executives, and regulatory experts. These discussions provided qualitative validation of emerging trends, pricing pressures, and adoption barriers, and informed the weighting of segmentation variables. Quantitative data points, such as tariff schedules and end user procurement volumes, were triangulated with public financial disclosures and specialty pharmacy reports.

Finally, the collected information underwent rigorous validation through cross functional workshops involving clinical advisors, data scientists, and market strategists. This iterative process refined the analytical models, tested market assumptions, and ensured alignment with real world scenarios. The result is a comprehensive, evidence based perspective that equips stakeholders with the insights required to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chromoendoscopy Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chromoendoscopy Agents Market, by Staining Agent

- Chromoendoscopy Agents Market, by Indication

- Chromoendoscopy Agents Market, by Formulation Type

- Chromoendoscopy Agents Market, by Patient Demographics

- Chromoendoscopy Agents Market, by Delivery Method

- Chromoendoscopy Agents Market, by Application Area

- Chromoendoscopy Agents Market, by End User

- Chromoendoscopy Agents Market, by Region

- Chromoendoscopy Agents Market, by Group

- Chromoendoscopy Agents Market, by Country

- United States Chromoendoscopy Agents Market

- China Chromoendoscopy Agents Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives to Consolidate Understanding of the Chromoendoscopy Agent Landscape and Future Directions

This executive summary has elucidated the dynamic evolution of chromoendoscopy agents from foundational dye based techniques to highly sophisticated virtual imaging solutions. A confluence of technological innovation, shifting clinical guidelines, and regulatory incentives has propelled the sector forward, while recent United States tariffs have introduced new imperatives for supply chain resilience. Segmentation analysis highlighted the distinct drivers across dye and virtual platforms as well as the influence of clinical indications, end user environments, and distribution channels on adoption patterns.

Regional insights underscored the mature, reimbursement driven markets of the Americas, the heterogeneous regulatory landscape of Europe Middle East and Africa, and the rapidly expanding opportunities within Asia Pacific. The competitive arena remains vibrant, with leading players forging strategic alliances, advancing product integrations, and amplifying clinical evidence. To thrive in this complex terrain, organizations must act on the strategic recommendations outlined-investing in innovation, strengthening supply chain agility, and deepening clinician partnerships.

Collectively, these findings and strategic imperatives form a cohesive blueprint for navigating the chromoendoscopy agent market. By synthesizing data driven insights with pragmatic recommendations, stakeholders can confidently align their initiatives with emerging trends and secure a sustainable competitive edge.

Engaging with Ketan Rohom to Secure Comprehensive Chromoendoscopy Market Intelligence and Propel Strategic Decision Making

To delve deeper into the comprehensive findings and equip your organization with the strategic intelligence necessary to stay at the forefront of the chromoendoscopy landscape, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. His extensive experience in guiding healthcare stakeholders through complex diagnostic technology markets will ensure you receive tailored insights that align with your objectives and challenges.

By engaging with Ketan Rohom, you will gain access to a full suite of proprietary data, in-depth competitive benchmarking, and actionable roadmaps that extend beyond the scope of this summary. Whether you aim to refine your product portfolio, optimize procurement strategies, or enhance clinical adoption, his expertise will accelerate your decision-making process and unlock new growth avenues.

Contacting Ketan Rohom will also provide you with a detailed briefing on emerging opportunities arising from technological advances, regulatory shifts, and evolving patient needs. Secure your copy of the full market research report today to transform these insights into measurable outcomes, and take the next decisive step in capitalizing on the chromoendoscopy agent market.

- How big is the Chromoendoscopy Agents Market?

- What is the Chromoendoscopy Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?