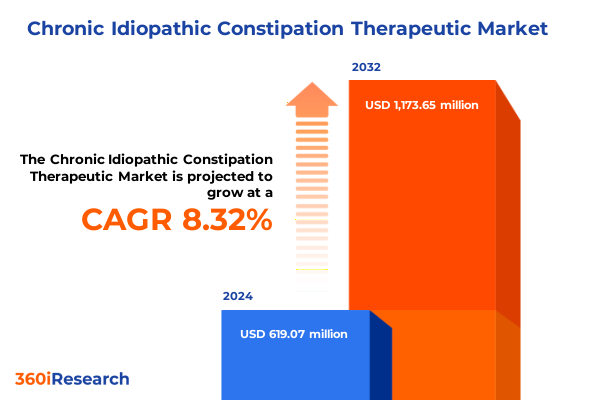

The Chronic Idiopathic Constipation Therapeutic Market size was estimated at USD 1.37 billion in 2025 and expected to reach USD 1.48 billion in 2026, at a CAGR of 7.93% to reach USD 2.35 billion by 2032.

Exploring the Emerging Paradigms in Chronic Idiopathic Constipation Treatment to Address Unmet Patient Needs and Enhance Clinical Outcomes

In recent years, chronic idiopathic constipation has evolved from a common gastrointestinal complaint into a focal point for therapeutic innovation driven by burgeoning clinical research and shifting patient expectations. As the prevalence of this condition continues to rise among diverse demographic groups, healthcare stakeholders are compelled to reassess existing management protocols and explore novel interventions that address both symptom burden and quality of life. This introduction provides an essential overview of the clinical challenges, patient journey complexities, and emerging treatment paradigms that define the current therapeutic landscape.

Against the backdrop of an aging population and growing awareness of gut health, practitioners are increasingly attentive to the chronic and often multidimensional nature of idiopathic constipation. Patients frequently navigate a maze of dietary modifications, lifestyle adjustments, and pharmacological attempts before achieving meaningful relief. As such, the imperative to deliver more effective, well-tolerated treatments has never been more pronounced. This section establishes the foundational context for understanding how historical approaches have shaped present-day strategies and why a cohesive review of therapeutic options remains essential for guiding future decision making.

Unraveling the Transformative Shifts Redefining the Chronic Idiopathic Constipation Therapeutic Landscape Through Innovation and Patient-Centric Strategies

The therapeutic landscape for chronic idiopathic constipation is undergoing rapid transformation, propelled by advancements in pharmacology, digital health integration, and patient-centric care models. Novel drug candidates targeting distinct physiological pathways are reshaping treatment algorithms, transcending the traditional reliance on osmotic and stimulant laxatives. In parallel, digital platforms offer real-time symptom tracking and personalized feedback, enabling clinicians to refine interventions and improve adherence through data-driven insights.

Moreover, the patient’s voice has emerged as a critical driver of innovation, with real-world evidence initiatives capturing the nuanced impact of treatments on day-to-day functioning. This shift towards holistic outcome measures underscores the importance of understanding both physiological efficacy and broader quality-of-life metrics. As a result, pharmaceutical developers and healthcare providers are collaborating more closely to ensure that novel therapies align with patient preferences, address underlying pathophysiology, and ultimately deliver durable relief.

The convergence of these developments signals a new era in which therapeutic strategies for chronic idiopathic constipation will no longer be confined to symptom management alone; instead, they will integrate behavioral, technological, and molecular approaches to create sustained patient benefits.

Analyzing the Cumulative Influences of 2025 United States Tariffs on Supply Chains Pricing and Access Dynamics in Chronic Idiopathic Constipation Therapies

Throughout 2025, United States tariff adjustments have introduced new complexities into the supply chains underpinning chronic idiopathic constipation therapies. By imposing higher duties on key active pharmaceutical ingredients and excipients imported from major manufacturing hubs, these tariffs have exerted upward pressure on production costs. Consequently, manufacturers have encountered the dual challenge of managing margin compression while maintaining competitive pricing in an environment where patients and payers demand cost-effective solutions.

Deciphering Segmentation Insights Across Drug Class Route of Administration Prescription Status Treatment Modality and Distribution Channels

Distinct patient needs and provider preferences drive variation across several therapeutic categories in chronic idiopathic constipation management. Treatments targeting 5-HT4 receptor pathways often appeal to patients seeking prokinetic solutions, whereas chloride channel activators have demonstrated robust efficacy in improving stool consistency and frequency. Guanylate cyclase-C agonists, in turn, provide mechanisms that address gut secretions with minimal systemic absorption, offering a favorable safety profile. Meanwhile, traditional osmotic and stimulant laxatives continue to retain relevance for acute relief, and stool softeners serve as foundational adjuncts for individuals requiring gentle regimen intensification.

Route of administration further differentiates patient experiences, as oral therapies dominate general practice due to ease of use, whereas rectal options offer rapid onset in refractory cases. The balance between over-the-counter accessibility and prescription-only status influences not only patient convenience but also the role of physician oversight in ensuring appropriate utilization. Moreover, treatment modalities extend beyond pharmacological agents, with non-pharmacological and adjunctive measures such as dietary fiber enhancement, biofeedback, and pelvic floor rehabilitation gaining acceptance alongside drug-based therapies. Finally, the channel through which therapies reach patients-whether hospital pharmacies equipped for acute inpatient care, online pharmacies offering home delivery, or retail pharmacies serving outpatient communities-shapes access, adherence, and overall patient satisfaction.

This comprehensive research report categorizes the Chronic Idiopathic Constipation Therapeutic market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Modality

- Drug Class

- Formulation Type

- Route Of Administration

- Prescription Status

- End User

- Distribution Channel

- Age Group

Mapping Regional Dynamics of Chronic Idiopathic Constipation Therapeutics Across Americas Europe Middle East and Africa Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping therapeutic adoption and development for chronic idiopathic constipation. In the Americas, robust clinical trial activity, coupled with favorable reimbursement frameworks, has catalyzed rapid uptake of novel agents, particularly in the United States and Canada. Latin American markets, though more price-sensitive, are witnessing growing demand for affordable formulations and patient support programs that ease treatment initiation.

Europe, the Middle East, and Africa present a mosaic of regulatory environments and healthcare infrastructures. Western Europe benefits from centralized approval processes and well-established gastroenterology guidelines, driving consistent prescribing patterns for advanced therapies. In contrast, Middle Eastern nations are gradually expanding specialty care access, while many African markets continue to prioritize basic laxative options and generics, reflecting resource constraints and evolving health priorities.

Within the Asia-Pacific region, diverse economic profiles influence market evolution. High-income markets such as Japan and Australia exhibit strong preference for innovative, targeted treatments, underpinned by national reimbursement schemes. Emerging economies including India and Southeast Asian nations balance growing prevalence with cost considerations, leading to hybrid models where branded and generic options coexist. Collectively, these regional distinctions underscore the necessity for tailored strategies that align product positioning with local clinical, regulatory, and economic realities.

This comprehensive research report examines key regions that drive the evolution of the Chronic Idiopathic Constipation Therapeutic market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Shaping the Chronic Idiopathic Constipation Therapeutic Arena with Innovative Strategies and Competitive Differentiators

A competitive array of pharmaceutical innovators and established generics manufacturers drives progress in chronic idiopathic constipation therapies. Leading multinational companies have expanded their portfolios through strategic collaborations, in-licensing agreements, and targeted acquisitions aimed at bolstering pipeline diversity. These alliances have accelerated development timelines for first-in-class and best-in-class candidates that harness novel mechanisms of action, from selective receptor modulators to combination therapies that address interconnected gastrointestinal pathways.

Meanwhile, specialty biotechs are carving out niches by focusing on advanced drug delivery systems, leveraging technologies such as sustained-release matrices and mucoadhesive formulations to optimize local drug concentration and minimize systemic side effects. At the same time, generic producers have capitalized on patent expirations by offering cost-effective versions of staple therapies, prompting branded manufacturers to invest in value-added extensions and patient support initiatives that preserve market share.

The interplay between these stakeholder groups fosters a dynamic competitive environment in which differentiation through clinical data, real-world evidence, and patient-centric services becomes paramount. As industry leaders refine their strategic roadmaps, the emphasis on speed to market, regulatory agility, and robust post-launch support continues to intensify.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chronic Idiopathic Constipation Therapeutic market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Albireo Pharma, Inc. by Ipsen S.A.

- ANI Pharmaceuticals, Inc.

- Ardelyx Inc.

- Bausch Health Companies Inc.

- Bayer AG

- Dr. Reddy’s Laboratories Ltd.

- Eisai Co., Ltd.

- Ferring B.V.

- Ironwood Pharmaceuticals, Inc.

- Lupin Limited

- Mallinckrodt plc

- MSN Laboratories Private Limited

- Norgine B.V.

- Sanofi S.A.

- Shionogi & Co., Ltd.

- Takeda Pharmaceutical Company Limited

- Zydus Cadila Limited

Delivering Strategic Recommendations for Industry Leaders to Navigate Market Complexities Enhance Competitive Advantage and Drive Sustainable Growth

Industry leaders seeking to excel in chronic idiopathic constipation therapeutics should prioritize holistic product portfolios that integrate both established and emerging modalities. By aligning research investments with unmet patient segments-such as those inadequately served by conventional laxatives-organizations can unlock new avenues for differentiation. Simultaneously, forging partnerships with digital health providers can enhance patient engagement through remote monitoring tools and personalized adherence programs, thereby improving clinical outcomes and fostering brand loyalty.

To mitigate supply chain vulnerabilities exacerbated by tariff-induced cost fluctuations, decision makers should diversify sourcing strategies and cultivate relationships with alternate contract manufacturers. This approach reduces reliance on single-origin suppliers and ensures continuity in raw material availability. In parallel, value-based contracting with payers offers a pathway to demonstrate real-world effectiveness and align pricing with patient-centric endpoints.

Finally, tailored market entry strategies must account for regional heterogeneity in regulatory approval timelines, reimbursement pathways, and distribution infrastructures. By adopting agile commercialization frameworks and leveraging local partnerships, organizations can accelerate adoption across both high- and emerging-growth areas.

Outlining Rigorous Research Methodology Employed to Gather and Analyze Primary Secondary and Expert Data for Comprehensive Therapeutic Insights

This research study employed a rigorous methodology that combined primary and secondary data sources to ensure comprehensive coverage of the chronic idiopathic constipation therapeutic landscape. Primary research consisted of structured interviews with key opinion leaders, including gastroenterologists, pharmacologists, and healthcare policy experts, who provided qualitative insights on clinical practice trends, patient experiences, and unmet needs in various care settings.

Secondary research involved an extensive review of peer-reviewed journals, regulatory filings, patent databases, and published clinical trial registries. Publicly available health economics analyses and reimbursement policies were synthesized to contextualize cost and access considerations. Throughout the analysis, data triangulation techniques were used to validate findings across multiple sources, ensuring accuracy and reliability.

Analysts further incorporated real-world evidence from healthcare databases and patient registries, applying statistical techniques to discern patterns in treatment utilization and outcome measures. This blended approach yielded a multidimensional perspective that balances clinical, commercial, and regulatory factors critical for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chronic Idiopathic Constipation Therapeutic market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chronic Idiopathic Constipation Therapeutic Market, by Treatment Modality

- Chronic Idiopathic Constipation Therapeutic Market, by Drug Class

- Chronic Idiopathic Constipation Therapeutic Market, by Formulation Type

- Chronic Idiopathic Constipation Therapeutic Market, by Route Of Administration

- Chronic Idiopathic Constipation Therapeutic Market, by Prescription Status

- Chronic Idiopathic Constipation Therapeutic Market, by End User

- Chronic Idiopathic Constipation Therapeutic Market, by Distribution Channel

- Chronic Idiopathic Constipation Therapeutic Market, by Age Group

- Chronic Idiopathic Constipation Therapeutic Market, by Region

- Chronic Idiopathic Constipation Therapeutic Market, by Group

- Chronic Idiopathic Constipation Therapeutic Market, by Country

- United States Chronic Idiopathic Constipation Therapeutic Market

- China Chronic Idiopathic Constipation Therapeutic Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Synthesizing Critical Insights and Forward-Looking Perspectives to Empower Decision Makers in Advancing Chronic Idiopathic Constipation Therapeutic Solutions

Chronic idiopathic constipation represents a multifaceted therapeutic challenge marked by diverse patient profiles, evolving treatment paradigms, and shifting external pressures such as tariff policies and regional regulatory changes. By mapping the interplay between novel drug classes, distribution channels, and market adoption factors, this executive summary has crystallized the key dynamics shaping the current landscape. Importantly, segmentation insights reveal how variations in administration route, prescription status, treatment modality, and distribution environment inform strategic priorities for both innovators and generic providers.

Regional analysis highlights distinct opportunities and obstacles across the Americas, Europe, Middle East, Africa, and Asia-Pacific, underscoring the value of localized approaches to market entry and expansion. Similarly, profiles of leading companies demonstrate that competition increasingly revolves around clinical differentiation, supply chain resilience, and patient-centric service models. Together, these findings emphasize the critical need for integrated strategies that leverage robust data, agile partnerships, and value-based frameworks.

As the field continues to advance, stakeholders equipped with nuanced insights and actionable recommendations will be best positioned to deliver meaningful improvements in patient outcomes while navigating the complexities of the global therapeutic environment.

Engaging with Ketan Rohom Associate Director Sales Marketing to Secure the Definitive Report and Accelerate Market Understanding for Strategic Success

To unlock comprehensive insights into chronic idiopathic constipation therapeutics and gain a competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your copy of the full market research report. Whether you seek to refine your strategic planning, identify uncharted opportunities, or validate your next investment, Ketan will guide you through the report’s rich findings and ensure you receive the depth of analysis required to propel your organization forward. Engage today to transform data into decisive action and set a new benchmark in therapeutic innovation for chronic idiopathic constipation

- How big is the Chronic Idiopathic Constipation Therapeutic Market?

- What is the Chronic Idiopathic Constipation Therapeutic Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?