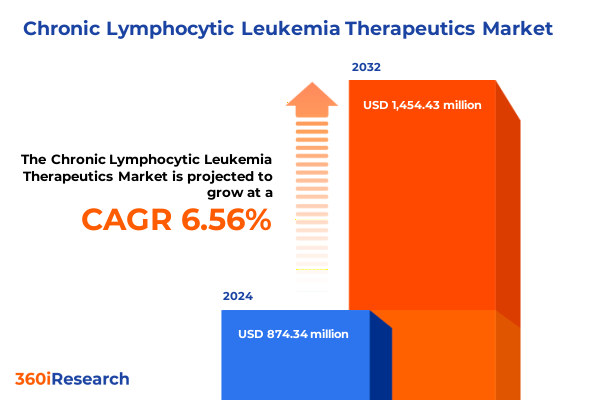

The Chronic Lymphocytic Leukemia Therapeutics Market size was estimated at USD 925.45 million in 2025 and expected to reach USD 980.89 million in 2026, at a CAGR of 6.67% to reach USD 1,454.43 million by 2032.

Setting the Stage for Innovative Chronic Lymphocytic Leukemia Therapeutic Strategies by Exploring Disease Burden and Emerging Patient Needs

Chronic lymphocytic leukemia (CLL) remains one of the most prevalent forms of adult leukemia worldwide, presenting unique clinical challenges and a persistent need for novel therapeutic solutions. Patients and clinicians alike are navigating a rapidly evolving treatment environment where safety, long-term efficacy, and quality of life considerations are paramount. This executive summary offers a concise yet thorough overview of the key drivers shaping the CLL therapeutics landscape, from groundbreaking scientific advances to evolving regulatory and policy dynamics.

At the heart of this landscape lies an urgent imperative to translate molecular insights into effective, patient-centric therapies. Biopharmaceutical innovators are racing to develop targeted agents that address fundamental disease biology, while simultaneously optimizing combination regimens to overcome treatment resistance. Moreover, the integration of real-world evidence into clinical decision making has become increasingly critical, enabling stakeholders to evaluate therapeutic performance beyond the controlled confines of clinical trials.

This introduction sets the stage for an in-depth analysis of the transformative shifts occurring across the CLL market, the tangible effects of newly implemented United States tariff policies in 2025, and the nuanced segmentation and regional dynamics that influence access and adoption. By illuminating the strategies of leading companies and offering actionable recommendations, this summary equips decision-makers with the insights necessary to prioritize investment, advance clinical development, and ultimately improve patient outcomes.

Uncovering the Paradigm-Shifting Advances Transforming the Chronic Lymphocytic Leukemia Treatment Landscape with Next-Generation Modalities

The chronic lymphocytic leukemia landscape is undergoing a profound transformation driven by converging scientific and technological innovations. Most notably, targeted therapies have shifted from broad cytotoxic agents toward precision-guided inhibitors that selectively disrupt key signaling pathways, fundamentally altering the therapeutic paradigm. Concurrently, the emergence of immunotherapeutic modalities has expanded treatment horizons, leveraging engineered T-cell technologies and immune checkpoint modulation to achieve deeper, more durable remissions.

Equally pivotal is the rise of combination regimens that synergize targeted and immune-based approaches, enabling clinicians to tailor treatment algorithms that address the disease’s heterogeneity and evolving resistance mechanisms. Advanced genomic profiling coupled with digital health tools has further enhanced patient stratification, ensuring that therapies are aligned with individual disease biology and minimizing exposure to ineffective interventions.

Real-world data registries and digital monitoring platforms are now integral to capturing longitudinal patient outcomes, feeding back into adaptive clinical trial designs that accelerate the pace of innovation. As a result, the pipeline for next-generation CLL therapies has grown more robust, reflecting a strategic shift toward multi-modal treatment strategies, predictive biomarker development, and a heightened focus on improving quality of life metrics alongside traditional efficacy endpoints.

Examining the Aggregate Effects of 2025 United States Tariff Policies on Chronic Lymphocytic Leukemia Therapeutics Supply Chains and Pricing Dynamics

In 2025, newly enacted United States tariff policies have introduced additional layers of complexity to the chronic lymphocytic leukemia supply chain. By imposing levies on key imported active pharmaceutical ingredients and biologic components, these tariffs have incrementally increased manufacturing costs for both generic chemotherapy agents and advanced immunotherapies. The immediate impact has been a recalibration of pricing strategies across the value chain, as manufacturers seek to absorb or pass through tariff-induced cost pressures.

Over time, these policy changes have prompted a strategic realignment among stakeholders. Several contract development and manufacturing organizations have localized production of critical reagents to mitigate import dependencies, while some biopharma firms have reevaluated their supplier networks to optimize resilience against future trade disruptions. From a market access perspective, payers and providers are closely monitoring how these incremental costs affect formulary negotiations and reimbursement models, with an emphasis on total cost of care rather than unit price.

Looking ahead, the knock-on effects of tariffs will likely drive increased interest in onshore manufacturing partnerships, co-development agreements that share risk across stakeholders, and the adoption of risk-sharing contracts. Proactive engagement with policy-makers and trade associations will be essential for industry leaders seeking to influence nuanced tariff adjustments and safeguard patient access to high-value CLL therapeutics.

Deriving Actionable Insights from Multi-Dimensional Segmentation of Chronic Lymphocytic Leukemia Therapeutics across Class, Administration, and Distribution

A comprehensive understanding of the chronic lymphocytic leukemia therapeutic landscape necessitates a multi-dimensional segmentation framework that illuminates where innovation and adoption intersect. Analysis based on therapeutic class reveals distinct growth trajectories: legacy chemotherapy agents continue to serve as backbone therapies, whereas combination regimens integrating chemotherapy with targeted inhibitors are driving more nuanced treatment paradigms. Immunotherapies, spanning CAR-T constructs, checkpoint inhibitors, and monoclonal antibodies, stand at the forefront of next-generation approaches, particularly when combined with novel agents to overcome microenvironmental resistance. In parallel, targeted therapies such as BCL-2 inhibitors, BTK inhibitors, and PI3K inhibitors offer high-precision interventions that selectively disrupt survival pathways in leukemic cells.

Mode of administration also provides critical insight into patient experience and market dynamics. Intravenous formulations, while delivering controlled dosing, require significant infusion infrastructure and clinical monitoring, often influencing site-of-care decisions. Conversely, the growing availability of oral formulations enables outpatient management and greater patient convenience, particularly for targeted agents that support chronic, long-term administration.

Distribution channels further shape accessibility and reimbursement. Hospital pharmacies remain pivotal for complex infusion-based regimens, whereas retail pharmacies facilitate broader access to oral therapies. Specialty pharmacies have emerged as key partners in managing high-cost, high-complexity biologics and supporting patient adherence through specialized patient support programs. Understanding the interdependencies across these segmentation dimensions is essential for stakeholders aiming to optimize product launch strategies and maximize therapeutic impact.

This comprehensive research report categorizes the Chronic Lymphocytic Leukemia Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Class

- Mode Of Administration

- Distribution Channel

Analyzing Regional Disparities and Opportunities in Chronic Lymphocytic Leukemia Therapy Adoption across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics play a decisive role in shaping the uptake and diffusion of chronic lymphocytic leukemia therapies. In the Americas, robust healthcare infrastructures and well-established reimbursement frameworks have accelerated access to novel targeted and immunotherapeutic agents. The United States leads in both clinical trial activity and early adoption of high-value therapies, supported by streamlined regulatory pathways and competitive commercial environments. Latin American markets, while advancing steadily, face challenges related to pricing negotiations and variable payer coverage, underscoring the need for tiered pricing models and capacity building among healthcare providers.

In Europe, the Middle East, and Africa, diverse regulatory landscapes and economic heterogeneity shape access pathways. Western European countries typically offer broad coverage for innovative CLL treatments, guided by health technology assessments that emphasize both clinical benefit and cost-effectiveness. In contrast, many Middle Eastern and African regions remain in early stages of adopting next-generation therapies, with market entry often predicated on local partnerships, patient assistance programs, and technology transfers. Stakeholders seeking to expand in EMEA must navigate complex reimbursement processes and establish value propositions aligned with national health priorities.

The Asia-Pacific region presents a mosaic of opportunity and challenge. Japan, South Korea, and Australia have emerged as early adopters of targeted and immuno-oncology platforms, backed by favorable regulatory incentives and strong pharmaceutical innovation ecosystems. Meanwhile, markets in Southeast Asia and Greater China are characterized by rapidly evolving healthcare spending and increasing patient demand for advanced treatments. Tailored market entry strategies that account for local regulatory requirements, cultural preferences, and price sensitivity are critical to unlocking the region’s long-term growth potential.

This comprehensive research report examines key regions that drive the evolution of the Chronic Lymphocytic Leukemia Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Biopharmaceutical Leaders Shaping the Chronic Lymphocytic Leukemia Market through Strategic Alliances and Innovative Pipeline Developments

The competitive landscape for chronic lymphocytic leukemia therapeutics is defined by a handful of biopharmaceutical leaders that have successfully advanced novel agents to late-stage development and obtained regulatory approvals across key markets. Several companies have leveraged pioneering research in apoptosis pathways to bring BCL-2 inhibitors to market, establishing new treatment standards. Collaboration between immuno-oncology innovators and academic institutions has accelerated the translation of CAR-T constructs and checkpoint blockade combinations into the clinic. Moreover, strategic licensing agreements and co-development partnerships have enabled the cross-pollination of early-stage assets, expanding the depth and diversity of pipelines dedicated to overcoming resistance and improving long-term outcomes.

In tandem, the rise of biosimilars and generics providers has introduced competitive dynamics in the small-molecule and monoclonal antibody segments, prompting originator companies to invest in lifecycle management strategies and differentiated formulations. Several leading firms have also formed joint ventures to localize manufacturing in priority regions, mitigating tariff exposure and strengthening supply chain resilience.

As the competitive environment intensifies, key players are doubling down on predictive biomarker research and digital health collaborations, integrating companion diagnostics and remote patient monitoring to demonstrate real-world value. These strategic maneuvers underscore an industry-wide shift toward evidence-driven differentiation and patient-centric commercialization models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chronic Lymphocytic Leukemia Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Astellas Pharma Inc.

- AstraZeneca plc

- Bayer AG

- Bristol Myers Squibb Company

- F. Hoffmann-La Roche Ltd

- Incyte Corporation

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Secura Bio, Inc.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

Crafting Strategic Imperatives for Industry Stakeholders to Accelerate Chronic Lymphocytic Leukemia Therapeutic Innovations and Market Access Pathways

To thrive amidst the evolving chronic lymphocytic leukemia environment, industry stakeholders must adopt a strategic playbook centered on resilience, agility, and value creation. First, diversifying manufacturing footprints by forging partnerships with onshore and nearshore producers can safeguard supply chains against geopolitical and tariff-driven disruptions. This approach not only reduces cost volatility but also positions organizations for accelerated market entry in key jurisdictions.

Second, forging cross-sector collaborations with academic centers, technology firms, and patient advocacy groups can catalyze novel therapeutic discoveries and streamline trial recruitment. Such alliances are particularly valuable for advancing combination regimens that span traditional therapeutic boundaries. Third, embedding digital health tools into development and commercialization plans-from e-consent platforms that expedite trial enrollment to remote monitoring solutions that enhance adherence-can generate robust real-world evidence and support differentiated value propositions during payer negotiations.

Fourth, engaging proactively with regulatory and reimbursement bodies by leveraging health economics and outcomes research helps articulate a clear narrative around long-term cost savings and patient quality of life improvements. Finally, tailoring pricing and access strategies to specific market conditions-whether through risk-sharing agreements in emerging regions or value-based contracts in mature markets-will be instrumental in driving market uptake and ensuring equitable patient access.

Detailing a Robust Mixed-Method Research Framework Underpinning the Credibility and Depth of Chronic Lymphocytic Leukemia Therapeutics Market Insights

The foundation of this executive summary rests upon a rigorous mixed-method research framework designed to ensure both breadth and depth of insight. Primary research comprised in-depth interviews with key opinion leaders spanning hematology-oncology clinical practice, regulatory affairs, and health economics, as well as discussions with commercial and supply chain executives at leading biopharma companies. These interviews provided qualitative perspectives on clinical unmet needs, adoption barriers, and strategic priorities across therapeutic segments and geographies.

Complementing these insights, secondary research involved comprehensive reviews of peer-reviewed literature, clinical trial registries, regulatory approval databases, and corporate disclosures. Data points were triangulated across multiple sources to validate trends and ensure consistency. Quantitative analyses employed publicly available pipeline analytics, reimbursement schedules, and distribution channel metrics to profile segment performance without projecting unit volumes or financial forecasts.

Throughout the process, methodological rigor was maintained via validation workshops with industry experts and iterative feedback loops, strengthening the credibility of conclusions and recommendations. By integrating structured qualitative narratives with robust secondary data, this methodology delivers a holistic and actionable view of the chronic lymphocytic leukemia therapeutics market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chronic Lymphocytic Leukemia Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chronic Lymphocytic Leukemia Therapeutics Market, by Therapeutic Class

- Chronic Lymphocytic Leukemia Therapeutics Market, by Mode Of Administration

- Chronic Lymphocytic Leukemia Therapeutics Market, by Distribution Channel

- Chronic Lymphocytic Leukemia Therapeutics Market, by Region

- Chronic Lymphocytic Leukemia Therapeutics Market, by Group

- Chronic Lymphocytic Leukemia Therapeutics Market, by Country

- United States Chronic Lymphocytic Leukemia Therapeutics Market

- China Chronic Lymphocytic Leukemia Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Summarizing Core Insights and Strategic Takeaways to Navigate the Future of Chronic Lymphocytic Leukemia Treatment Advancements with Confidence

As chronic lymphocytic leukemia treatment paradigms continue to evolve, stakeholders must remain vigilant to the implications of scientific innovation, policy shifts, and market dynamics. The integration of targeted and immunotherapeutic modalities, supported by real-world evidence and digital health platforms, is reshaping clinical outcomes and patient expectations. Meanwhile, tariff policies in 2025 have underscored the importance of supply chain resilience and local manufacturing strategies in safeguarding access and controlling costs.

Multi-dimensional segmentation clarifies the interplay between therapeutic class, administration mode, and distribution channels, guiding tailored launch and commercialization strategies. Regional analyses reveal both mature and emerging markets with distinct regulatory and reimbursement frameworks, demanding nuanced market entry and pricing approaches. Concurrently, leading biopharmaceutical companies are doubling down on strategic collaborations, biomarker-driven development, and innovative partnerships to maintain competitive advantage amid rising biosimilar competition.

By adopting the actionable recommendations outlined-spanning supply chain optimization, collaborative R&D models, digital health integration, and adaptive pricing structures-industry leaders can position themselves to capitalize on growth opportunities while delivering meaningful patient benefit. This summary equips decision-makers with the insights necessary to navigate the future of CLL therapeutics with confidence and precision.

Engaging Directly with Our Associate Director to Secure Comprehensive Chronic Lymphocytic Leukemia Therapeutics Market Research Insights for Your Strategic Initiatives

For a comprehensive exploration of the complex dynamics driving innovation and adoption in the chronic lymphocytic leukemia therapeutics arena, reach out to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through tailored research deliverables, customized data deep-dives, and strategic advisory services that empower your organization to make informed decisions. Whether you seek detailed competitive intelligence, granular segmentation analysis, or proactive risk-mitigation strategies in light of evolving policy and market forces, partnering with Ketan ensures you access actionable insights that align precisely with your business objectives. Secure your market research report today to stay ahead of pivotal trends, optimize your development and launch plans, and confidently navigate the future of CLL therapeutics.

- How big is the Chronic Lymphocytic Leukemia Therapeutics Market?

- What is the Chronic Lymphocytic Leukemia Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?