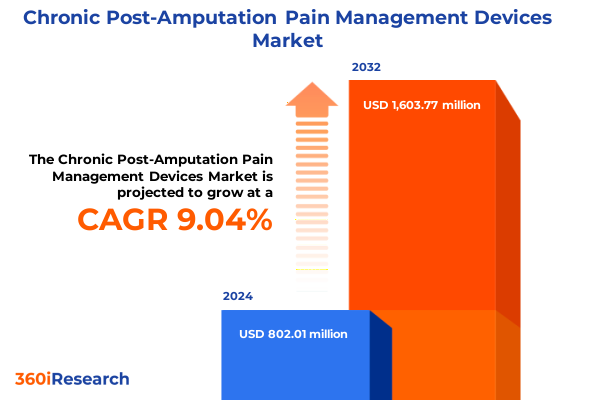

The Chronic Post-Amputation Pain Management Devices Market size was estimated at USD 802.01 million in 2024 and expected to reach USD 871.47 million in 2025, at a CAGR of 9.04% to reach USD 1,603.77 million by 2032.

Exploring the Vital Importance and Evolving Significance of Sevoflurane Inhalation Within Contemporary Anesthesia and Healthcare Environments

Sevoflurane has emerged as a cornerstone inhalational anesthetic, prized for its rapid induction, consistent recovery profile, and minimal systemic metabolism. Clinicians increasingly rely on its favorable pharmacokinetic properties to manage both routine and complex surgical procedures. As the global healthcare community strives to enhance patient safety and operational efficiency, sevoflurane’s low blood–gas partition coefficient facilitates a smooth transition into postoperative care, reducing turnover times and improving patient throughput in high-volume settings.

Concurrent technological advancements in anesthesia delivery systems have amplified sevoflurane’s impact on perioperative workflows. Integration with closed-circuit anesthesia machines and digital monitoring platforms allows practitioners to tailor dosing protocols, optimize gas consumption, and ensure real-time physiological oversight. In turn, healthcare institutions can augment resource utilization while maintaining safety margins, aligning with broader efforts to streamline clinical pathways and contain operating room expenditures.

Looking ahead, the inhalation anesthetic segment is poised to continue its evolution, driven by patient-centric considerations and sustainability imperatives. The need for low-emission agents and carbon footprint reduction is catalyzing research into environmentally benign formulations, where sevoflurane’s existing profile sets a benchmark. With regulatory agencies advocating greener practices, sevoflurane is well positioned to remain at the forefront of inhalation anesthetic therapy, addressing both clinical performance and ecological responsibility.

Navigating the Recent Milestones and Groundbreaking Innovations That Are Reshaping the Global Sevoflurane Inhalation Market Landscape

Over the past decade, the sevoflurane inhalation domain has undergone a profound transformation, driven by technological breakthroughs, regulatory shifts, and changing clinical expectations. Advances in vaporizer design and precision delivery have enhanced dose control and minimized agent loss, enabling anesthesia providers to achieve optimal concentrations with greater consistency. Digital integration and closed-loop control systems further reinforce this trend, allowing anesthesiologists to monitor end-tidal concentrations automatically and adjust administration parameters in real time.

Another pivotal shift stems from sustainability and emissions reduction. Healthcare systems worldwide are under mounting pressure to lower greenhouse gas emissions, prompting a reassessment of anesthetic gas selection. Sevoflurane’s relatively lower global warming potential compared to legacy agents has accelerated its adoption, even as novel low-impact compounds emerge. In response, manufacturers are investing in capture and recycling technologies, advancing efforts to recuperate exhaled anesthetic and curtail environmental release.

Furthermore, evolving anesthesia protocols have positioned sevoflurane as a linchpin for enhanced recovery after surgery programs. Its rapid uptake and washout characteristics support same-day discharge models and ambulatory surgical workflows, reshaping perioperative efficiency. As procedural volumes grow in hospitals, clinics, and ambulatory surgical centers, sevoflurane’s profile aligns with institutional goals of reducing length of stay and optimizing patient turnover, marking a decisive shift in clinical practice dynamics.

Assessing the Broad Effects of Newly Implemented United States Tariffs on Sevoflurane Manufacturing Supply Chains and Distribution Dynamics

In 2025, the introduction of new United States tariffs on pharmaceutical intermediates and active agents has reverberated through the sevoflurane supply chain. Tariff adjustments on precursor chemicals have increased input costs for manufacturers, prompting many to reconfigure procurement strategies. Companies previously reliant on international sourcing have begun a cautious pivot toward domestic production and backward integration, seeking to mitigate exposure to trade policy fluctuations.

This realignment has also prompted organizations to intensify collaboration with regional contract manufacturing partners. By localizing synthesis and formulation steps, businesses aim to stabilize cost structures and ensure continuity of supply. However, these adjustments require capital investments in facility upgrades and regulatory approvals, lengthening time to market for new production lines.

Concurrently, distributors and direct sales teams are recalibrating pricing frameworks to reflect evolving cost bases. While end users face incrementally higher unit prices, many institutions have negotiated longer-term agreements to secure volume discounts and predictable supply. Moreover, e-commerce platforms have emerged as alternative channels for smaller buyers seeking greater transparency and competitive pricing, compelling traditional national and regional distributors to innovate their service offerings.

Delving Into Critical Segmentation Perspectives That Define End Users, Product Variants, Clinical Applications, and Distribution Pathways

Sevoflurane demand exhibits distinct characteristics when viewed through end-user lenses encompassing ambulatory surgical centers, clinics, hospitals, and research institutions. Ambulatory surgical centers prioritize agents that facilitate rapid discharge, whereas hospitals-encompassing private, public, and teaching facilities-balance cost management with complex caseloads and diverse patient acuity levels. Clinics typically value cost-effective solutions and reliable supply, and research institutions require high-purity grades to support investigational protocols.

From a product standpoint, the branded segment thrives on established legacy suppliers offering validated formulations and integrated service support for anesthesia equipment calibration. Meanwhile, the generic segment competes on price, leveraging streamlined registration pathways and leaner overheads to supply both hospital systems and community-based providers.

Clinically, sevoflurane’s applications split between induction and maintenance phases. During induction, its rapid onset and minimal airway irritation favor pediatric and outpatient procedures. In maintenance, its consistent pharmacokinetic profile supports stable hemodynamics over prolonged surgeries, satisfying the needs of complex and lengthy interventions.

Distribution routes further delineate market behavior. Direct sales channels are predominant in large hospital systems seeking tailored logistics and technical training. Distributors-both national and regional-cater to smaller networks and independent clinics, bundling anesthesia agents with ancillary supplies. E-commerce platforms, although nascent, are emerging as viable alternatives for cost-sensitive buyers and research laboratories requiring small-volume orders, reflecting an evolving distribution ecosystem.

This comprehensive research report categorizes the Chronic Post-Amputation Pain Management Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Technology

- Pain Type

- End User

- Application Setting

- Distribution Channel

Uncovering Distinct Regional Patterns and Market Drivers Across the Americas, Europe Middle East and Africa, and Asia Pacific Regions

The Americas region underpins global sevoflurane demand, driven by advanced healthcare infrastructure, high procedural volumes, and robust reimbursement frameworks. In North America, hospitals and ambulatory centers spearhead uptake of high-performance anesthetics, supported by stringent regulatory approvals and established supply networks. Latin American markets, while more price sensitive, are experiencing gradual expansion as mid-tier hospitals invest in upgrading anesthetic capabilities.

In Europe, the Middle East, and Africa, market dynamics vary notably. Western Europe emphasizes sustainability and stringent pharmacovigilance, compelling suppliers to demonstrate low environmental impact and robust safety data. Public hospitals in the region negotiate large-scale procurement contracts, while teaching hospitals prioritize access to the latest anesthetic formulations for academic and training purposes. In the Middle East, government-led infrastructure projects and healthcare modernization drive demand, whereas African markets remain in early developmental stages, constrained by limited distribution channels and budgetary pressures.

Asia Pacific presents a mosaic of emerging and mature markets. Japan and Australia reflect advanced protocols and consistent sevoflurane utilization in tertiary hospitals. In China and Southeast Asia, hospital expansions and investments in ambulatory surgical centers are fueling incremental adoption. Meanwhile, robust clinical research activity in India and South Korea underpins demand for high-purity grades in investigational contexts. Across the region, government initiatives to enhance surgical care accessibility and localize pharmaceutical manufacturing are accelerating market growth.

This comprehensive research report examines key regions that drive the evolution of the Chronic Post-Amputation Pain Management Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Prominent Industry Players’ Strategic Approaches, Collaborative Initiatives, and Innovations Shaping the Sevoflurane Market Environment

The sevoflurane inhalation sector features a competitive landscape shaped by global pharmaceutical manufacturers, specialized anesthetic solution providers, and contract formulators. Leading suppliers stand out through integrated value propositions that combine high-purity agent supply with training services, equipment calibration support, and sustainability initiatives.

Some organizations have pursued strategic partnerships with instrument manufacturers to bundle anesthetic agents with next-generation vaporizers, thereby streamlining procurement and maintenance processes for hospitals and surgical centers. Others are expanding production capacities through greenfield investments or acquisitions of regional players, enabling more agile responses to local regulatory requirements and tariff-driven cost pressures.

Generics specialists have intensified efforts to broaden their geographic footprint, leveraging cost-efficient synthesis platforms to penetrate price-sensitive segments. At the same time, incumbent branded suppliers bolster their market positioning by committing to research collaborations aimed at developing lower-emission formulations and exploring novel inhalational compounds.

Smaller innovators and research-focused enterprises complement the landscape by delivering ultra-high-purity grades and customized formulations for preclinical and clinical trial applications. Their agility in navigating regulatory pathways has fostered closer engagement with academic centers and governmental agencies, reinforcing a diversified competitive tapestry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Chronic Post-Amputation Pain Management Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AtriCure, Inc.

- Beijing Pins Medical Co., Ltd.

- Bioventus Inc.

- Boston Scientific Corporation

- Curonix LLC

- HMS Medical Systems

- Medtronic plc

- NeuroMetrix, Inc. by electroCore, Inc.

- Neuros Medical, Inc.

- Nevro Corp.

- OMRON Healthcare, Inc.

- Saluda Medical Pty Ltd.

- SensTrain

- SPR Therapeutics

- Stryker Corporation

- Zynex Inc.

Providing Concrete Strategic Directions and Practical Action Points to Strengthen Competitive Positioning in the Sevoflurane Inhalation Sector

To thrive in the evolving sevoflurane landscape, industry leaders should first fortify supply chain resilience by diversifying sourcing across domestic and international synthesis facilities. Strategic alliances with regional contract manufacturers can mitigate exposure to tariff volatility and enhance responsiveness to local regulatory shifts. Concurrently, investing in vapor capture and recycling technologies will not only address sustainability mandates but also reduce net anesthetic costs over time.

Next, organizations must cultivate differentiated service models. Bundling agent supply with digital monitoring tools, real-time analytics, and remote training platforms enhances value propositions for hospital systems and ambulatory centers alike. Emphasizing low-emission credentials in marketing communications can further resonate with sustainability-focused procurement teams and policy makers.

Companies should also explore tiered portfolio strategies, balancing premium branded formulations with competitively priced generics. Such an approach allows penetration of diverse end-user segments while safeguarding margins in mature, high-volume markets. Furthermore, establishing dedicated e-commerce channels for smaller-volume buyers and research institutions will unlock incremental opportunities and provide valuable data on customer purchasing patterns.

Finally, fostering collaborative research initiatives with academic centers and regulatory agencies can accelerate the development of next-generation inhalation agents. By co-investing in clinical studies and environmental impact assessments, firms can shape future regulatory frameworks and solidify their position as industry innovators.

Outlining a Comprehensive, Rigorous Research Framework Incorporating Qualitative and Quantitative Methods for Robust Market Intelligence

The underpinning research framework combines comprehensive secondary research with rigorous primary investigation to ensure a multidimensional understanding of the sevoflurane inhalation space. Initial phases entailed systematic reviews of peer-reviewed journals, regulatory filings, and technical white papers to map historical trends and technological milestones. Concurrently, patent analyses and environmental impact assessments furnished insights into sustainability trajectories and formulation innovations.

Subsequent primary research involved structured interviews with key opinion leaders, including anesthesiology professionals, hospital procurement officers, and regulatory experts. These dialogues provided firsthand perspectives on adoption barriers, operational preferences, and emerging clinical protocols. Additionally, a series of focus group sessions with biomedical engineers and supply chain specialists illuminated the practical implications of tariff changes and equipment integration challenges.

Quantitative validation was achieved through a detailed survey of institutional buyers across major geographic regions. Responses were calibrated against secondary data to triangulate adoption rates, procurement cycles, and distribution model performance. Data integrity checks and cross-validation protocols ensured consistency between independently sourced information and stakeholder feedback.

Throughout the research process, the methodology adhered to stringent data governance practices, maintaining confidentiality of proprietary insights and aligning with global ethical standards. This robust framework yields a balanced, objective portrayal of the competitive landscape, segmentation dynamics, and regional nuances driving the sevoflurane inhalation market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Chronic Post-Amputation Pain Management Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Chronic Post-Amputation Pain Management Devices Market, by Device Type

- Chronic Post-Amputation Pain Management Devices Market, by Technology

- Chronic Post-Amputation Pain Management Devices Market, by Pain Type

- Chronic Post-Amputation Pain Management Devices Market, by End User

- Chronic Post-Amputation Pain Management Devices Market, by Application Setting

- Chronic Post-Amputation Pain Management Devices Market, by Distribution Channel

- Chronic Post-Amputation Pain Management Devices Market, by Region

- Chronic Post-Amputation Pain Management Devices Market, by Group

- Chronic Post-Amputation Pain Management Devices Market, by Country

- United States Chronic Post-Amputation Pain Management Devices Market

- China Chronic Post-Amputation Pain Management Devices Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Strategic Imperatives to Inform Decision Making in the Dynamic Sevoflurane Inhalation Market Context

This analysis underscores sevoflurane inhalation’s pivotal role in modern anesthetic practice, shaped by rapid induction capabilities, environmental considerations, and diverse end-user requirements. Technological advancements in delivery systems, combined with growing sustainability mandates, have driven transformative shifts in both clinical protocols and supply chain configurations.

The imposition of United States tariffs in 2025 has acted as a catalyst for strategic realignment, prompting greater emphasis on domestic production, regional partnerships, and distribution innovation. Segmentation insights reveal nuanced demand patterns across ambulatory centers, hospitals, clinics, and research institutions, while product, application, and channel variations underscore the need for portfolio agility.

Regional analyses highlight the Americas as a mature market with established infrastructure, EMEA’s focus on regulatory rigor and environmental impact, and Asia Pacific’s heterogeneous growth profile tied to healthcare investments and manufacturing localization efforts. Competitive intelligence points to a dynamic mix of legacy suppliers, generics competitors, and niche innovators, each deploying unique value propositions to capture share and drive adoption.

As industry stakeholders navigate these complexities, the convergence of sustainability, digitalization, and strategic diversification emerges as the defining narrative for sevoflurane’s future trajectory. In this context, informed decision making and proactive strategy execution will determine market leaders of tomorrow.

Engaging Stakeholders to Acquire In-Depth Market Intelligence and Secure Competitive Advantage Through Direct Consultation with Ketan Rohom

To gain unparalleled insights into the evolving sevoflurane inhalation market landscape and to empower your organization with evidence-based strategies, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. His expertise ensures you receive personalized guidance on report offerings tailored to your unique operational needs and strategic priorities. Engage with an industry specialist who can clarify any queries, highlight specific areas of interest such as supply chain resilience or regional adoption dynamics, and facilitate rapid access to comprehensive analysis.

By collaborating with Ketan Rohom, you will unlock the full potential of the latest research findings, benefit from dedicated support in interpreting complex data, and secure a competitive edge through timely, actionable intelligence. Contact him today to explore flexible licensing models, enterprise solutions, and customized deliverables that align with your decision-making frameworks. Elevate your organizational planning and investment strategies by investing in a resource that translates market complexities into clear, strategic direction. Let Ketan guide you toward informed, confident actions in the sevoflurane inhalation domain.

- How big is the Chronic Post-Amputation Pain Management Devices Market?

- What is the Chronic Post-Amputation Pain Management Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?