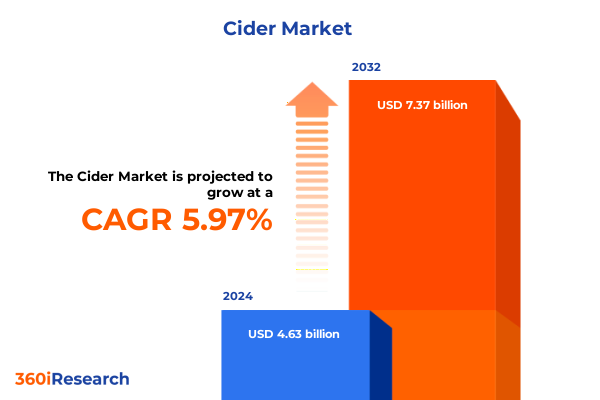

The Cider Market size was estimated at USD 4.90 billion in 2025 and expected to reach USD 5.13 billion in 2026, at a CAGR of 5.98% to reach USD 7.37 billion by 2032.

Exploring contemporary shifts in palate preferences premium craftsmanship and experiential consumption driving the modern resurgence of the cider market

The cider market has undergone a remarkable transformation in recent years, driven by a confluence of evolving consumer tastes and a renewed appreciation for artisanal beverage craftsmanship. Once relegated to niche English and French heritage segments, modern cider has emerged as a versatile and innovative category that appeals to a broad demographic spectrum. Today’s consumers seek more than a simple alcoholic offering; they pursue authenticity, natural ingredients, and engaging brand narratives. This trend has spurred both established beverage conglomerates and nimble craft producers to expand their portfolios, experimenting with novel flavor profiles and premium packaging formats.

Heightened interest in health and wellness has further propelled cider’s renaissance. Consumers frequently associate cider with fruit-forward naturalness, viewing it as a lighter alternative to many traditional beers and sweetened alcoholic beverages. As a result, brands have pivoted to emphasize low-calorie formulations, gluten-free options, and organic certifications, aligning with the broader lifestyle aspirations of contemporary drinkers. In parallel, the premiumization phenomenon has taken hold, with consumers willing to pay a premium for small-batch limited editions and innovative barrel-aging techniques that elevate cider’s sensory complexity.

Moreover, the digital revolution has reshaped how cider reaches its audience. Direct-to-consumer channels and e-commerce platforms facilitate personalized marketing campaigns and subscription offerings, enabling brands to cultivate intimate relationships with end buyers. Social media engagement and influencer collaborations amplify brand stories, while data-driven loyalty programs optimize retention. As this dynamic landscape continues to expand, stakeholders must stay attuned to rapid changes in consumer expectations, distribution models, and brand positioning. These foundational shifts set the stage for the transformative developments explored in the following section.

Uncovering transformative industry catalysts technological sustainability and flavor innovation that are revolutionizing production distribution and consumption patterns in cider

The cider industry is experiencing a wave of transformative catalysts that are redefining every stage of production, distribution, and consumption. Technological innovation stands at the forefront, with advancements in orchard management and fermentation control enabling producers to deliver consistent quality while experimenting with unique varietals and yeast strains. Automated sorting and pressing equipment ensure optimal juice extraction, while precision fermentation tanks allow for fine-tuning sugar levels, acidity, and mouthfeel. Such capabilities have unlocked a realm of flavor possibilities, from delicately balanced apple-only expressions to bold fruit blend fusions and experimental barrel-aged variants.

Simultaneously, sustainability has emerged as a core strategic pillar for cider makers. Producers are investing in eco-friendly agricultural practices, from integrated pest management to water-conserving irrigation systems, while exploring circular packaging solutions such as lightweight glass, recycled aluminum cans, and reusable stainless-steel kegs. These green initiatives resonate strongly with environmentally conscious consumers, who increasingly demand transparency around a brand’s ecological footprint. As a result, certifications related to organic farming and carbon neutrality have become powerful differentiators in a crowded market.

Flavor innovation continues to drive category expansion, with industry leaders and craft artisans alike pushing boundaries through the incorporation of unconventional fruits, botanicals, and spices. Botanical-infused ciders featuring hibiscus, ginger, or elderflower appeal to adventurous palates seeking novel taste experiences, while limited-edition seasonal releases tap into consumer desire for exclusivity. On the distribution front, digital marketplaces and omnichannel retail partnerships ensure broad accessibility without sacrificing brand storytelling. Growing collaboration between producers and on-premise venues, including bars and restaurants, further enhances experiential engagement, as curated cider flights and food pairing menus introduce the category to new audiences. This convergence of technology, sustainability, and flavor creativity signals a bold new era for cider.

Examining the cumulative effects of the 2025 United States tariff regime on imported cider supply chain economics pricing strategies and market competitiveness

In 2025, the United States implemented targeted tariffs on a range of European agricultural imports, including select cider products, as part of broader trade negotiations. These measures have had a cumulative ripple effect across import volumes, pricing structures, and competitive positioning within the domestic market. Importers initially faced higher landed costs, prompting many to reevaluate supply contracts and logistics strategies. Consequently, some retailers and distributors passed incremental cost burdens onto consumers, leading to modest price increases at the retail level and influencing purchasing decisions among price-sensitive segments.

Domestic producers have responded by scaling up apple cultivation and fermentation capacity to capture incremental market share. Investments in expanded orchard acreage, alongside partnerships with contract growers, have reinforced supply chain resilience and reduced reliance on foreign sources. At the same time, tariff pressures have catalyzed a renewed emphasis on operational efficiency and cost optimization. Producers have streamlined production workflows, negotiated volume discounts with component suppliers, and adopted lean inventory practices to mitigate margin erosion.

On the consumer front, the tariff-induced pricing dynamic has inadvertently stimulated demand for niche, small-batch offerings that deliver perceived value beyond unit cost. Premium cider subcategories-such as ice cider and barrel-aged limited editions- have seen a relative uplift as enthusiasts prioritize quality and authenticity over price considerations. Meanwhile, some large-scale brands have adjusted formulation and packaging strategies to offer entry-level price points that balance affordability with brand recognition. As the long-term effects of the 2025 tariff framework continue to crystallize, industry actors must navigate a recalibrated competitive landscape, balancing cost pressures with innovation and differentiation.

Delving into multifaceted segmentation insights across product type packaging flavor organic credentials and distribution channels shaping consumer choice in cider

Understanding consumer choice in the cider category requires a nuanced exploration of how product type, packaging, flavor profile, organic certification, and distribution channels intersect to shape buying behavior. From a product perspective, the dichotomy between hard cider and ice cider defines two distinct experiences: hard cider appeals through its refreshing simplicity and lower price entry, while ice cider commands attention with intensified sweetness, complexity, and niche positioning. Producers are leveraging both variants to cater to casual drinkers and connoisseurs alike, often innovating hybrid expressions that blend the two styles.

Packaging plays an equally pivotal role in consumer perception and purchase triggers. Bottles crafted from glass or lightweight plastic convey premium or convenience-focused signals respectively, while aluminum cans have surged in popularity for their portability, recyclability, and on-the-go appeal. Meanwhile, stainless-steel kegs remain integral to on-premise draft offerings in bars, pubs, and restaurants, where tap presentations accentuate freshness and facilitate experiential sampling. Within each container type, visual design and closure technology further differentiate products on crowded shelf spaces.

Flavor diversity remains a cornerstone of cider’s attraction, spanning core apple-centric renditions to inventive fruit blends and single-varietal pear bottlings. Each profile resonates with distinct occasions and palates: apple remains the familiar touchpoint for traditionalists, fruit blends entice younger demographics seeking bold new combinations, and pear ciders serve an emerging niche that values crispness and subtle sweetness. Organic status overlays the profile question, as conventional and certified organic labels drive purchase decisions among health- and environmentally minded consumers seeking chemical-free production methods.

The distribution landscape further dictates accessibility and brand experience. E-commerce platforms offer direct-to-consumer convenience and subscription models that guarantee timely replenishment, while third-party online retailers aggregate diverse offerings. Off-trade channels-encompassing grocery stores, hypermarkets, supermarkets, and specialty stores-remain critical for broad market penetration and impulse purchases. On-premise outlets such as bars, pubs, and restaurants provide immersive tastings and curated cider pairings, cultivating brand loyalty through sensory experiences. By decoding the interplay among these segmentation dimensions, industry stakeholders can tailor product development, packaging investments, and channel strategies to maximize resonance with target audiences.

This comprehensive research report categorizes the Cider market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging

- Flavor

- Organic Status

- Distribution Channel

Analyzing regional dynamics in the Americas EMEA and Asia Pacific to reveal distinct consumption behaviors regulatory environments and growth opportunities in cider

Regional dynamics exert a profound influence on cider consumption patterns and industry development, with distinct attributes emerging across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, long-standing markets such as the United States and Canada exhibit mature retail infrastructures, robust direct-to-consumer ecosystems, and a proliferation of craft producers. Consumer interest in locally sourced fruit, small-batch releases, and cross-category collaborations continues to gain momentum, bolstered by cider-focused festivals and taproom experiences.

By contrast, the Europe Middle East & Africa region draws deeply from cider’s historical roots in Western Europe. Traditional cider belts in the United Kingdom, France, and Spain remain strongholds for heritage brands and age-old production methods emphasizing single-varietal ciders and artisanal techniques. Meanwhile, emerging markets in the Middle East and Africa are characterized by rapid urbanization and an expanding hospitality sector that has introduced curated beverage menus featuring cider flights alongside local fruit wine traditions. Regulatory frameworks and trade agreements in this region have also influenced cross-border cider flows and collaborative ventures among producers.

In the Asia Pacific arena, cider finds itself at an earlier stage of category development, with growth driven by rising consumer awareness of Western lifestyle imports and premium alcoholic options. Markets such as Australia and New Zealand, with their own apple-growing heritage, have quickly embraced craft cider movements that emphasize terroir-driven expressions and sustainable farming. In East Asia, particularly Japan and South Korea, cider is gaining traction through limited-edition seasonal releases and collaborations with local fruit growers, appealing to a demographic that values novelty and quality. Across the region, distribution partnerships with upscale on-trade venues and e-commerce platforms facilitate rapid exposure, positioning cider as a sophisticated alternative to beer and sake.

This comprehensive research report examines key regions that drive the evolution of the Cider market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic movements of leading cider producers through innovation collaboration and sustainable practices that define competitive advantage in the industry

The competitive landscape in the cider industry is marked by strategic maneuvers from established beverage conglomerates and agile craft innovators alike. Leading multinational brewers leverage their expansive distribution networks and marketing budgets to sustain flagship cider brands while experimenting with new sub-brands that tap into emerging consumer segments. These incumbents often pursue joint ventures and acquisitions to quickly integrate local craft operations, gaining immediate access to specialized production know-how and brand equity.

Simultaneously, pure-play cider houses have honed their competitive advantage through vertical integration and terroir-driven storytelling. By controlling orchard management, pressing, and fermentation in-house, these players ensure traceability and consistency from tree to bottle. Sustainability initiatives, such as regenerative agriculture practices and closed-loop water systems, further differentiate their premium offerings amid rising environmental scrutiny. Strategic collaborations with chefs, mixologists, and lifestyle influencers amplify brand visibility and reinforce cider’s versatility in culinary and cocktail contexts.

Partnerships between cider producers and digital retail platforms have also become instrumental. By leveraging data analytics from e-commerce channels and DTC subscription services, companies refine flavor development roadmaps and fine-tune pricing tiers to match evolving demand. Off-trade and on-trade alliances-ranging from grocery chain promotions to exclusive bar takeovers-allow brands to orchestrate targeted campaigns and seasonal launches. These collaborative efforts underscore the importance of an omnichannel approach, wherein each touchpoint delivers a cohesive narrative around product provenance, flavor innovation, and sustainable ethos.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cider market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpenfire Cider

- Anheuser-Busch InBev

- Aspall Cyder Limited

- C&C Group PLC

- Carlsberg A/S

- Fish Brewing Company

- H. Weston & Sons Limited

- H.P. Bulmer Limited

- Heineken N.V.

- Kelly's Cider Company

- Matilda Bay Brewing Company

- Matthew Clark plc

- Minhas Brewery d/b/a The Ace Cider Company

- Molson Coors Beverage Company

- Pipsqueak Cider Company

- Puddicombe Estate Winery & Cidery

- Red Branch Cider Company

- Roquette Frères

- Thatchers Cider Ltd

- The Boston Beer Company, Inc.

- The Crispin Cider Company

- Vermont Hard Cider Company

- Åbro Bryggeri AB

Outlining actionable strategies for industry leaders to navigate tariffs optimize segmentation and leverage emerging trends in product innovation and distribution for cider

Industry leaders can proactively navigate the evolving cider landscape by adopting a suite of targeted strategies that optimize resilience and market relevance. First, investing in premium and craft-focused product lines aligns with consumer willingness to explore unique flavor innovations and small-batch limited editions. By accentuating provenance and artisanal methodologies, brands cultivate emotional connections that justify higher price points and foster brand loyalty.

Second, enhancing supply chain diversification mitigates the impact of trade policy shifts such as tariffs. Establishing partnerships with domestic growers and exploring contract cultivation agreements in underutilized apple-growing regions reduces reliance on imports. Simultaneously, adopting agile inventory management and dynamic pricing tools allows for rapid cost-pass-through adjustments, preserving margins without alienating value-seeking consumers.

Third, packaging innovation remains crucial. Brands should consider lightweight glass alternatives and sustainable aluminum can formats that resonate with eco-conscious audiences, while maintaining premium aesthetics. Leveraging reusable stainless-steel kegs for on-premise accounts can further minimize waste and streamline draft operations. Fourth, deepening digital engagement through immersive content, virtual tasting events, and subscription-based e-commerce platforms enhances customer lifetime value and provides actionable data on consumer preferences.

Finally, embedding robust sustainability credentials-from organic orchard certifications to carbon-neutral pledges-addresses growing environmental concerns and differentiates brands in a crowded field. Pursuing third-party certifications and transparently reporting progress fosters consumer trust and aligns with broader corporate responsibility commitments. By holistically integrating these strategic levers, cider producers and distributors can anticipate market shifts, capitalize on emerging opportunities, and sustain competitive advantage.

Detailing the rigorous mixed methodology combining primary interviews secondary analysis and data triangulation employed to ensure validity and depth in cider market research

To ensure comprehensive and robust insights into the cider market, a mixed methodology framework has underpinned this research, combining quantitative analysis with qualitative validation. Initially, secondary research involved systematic gathering of publicly available information, including trade publications, academic studies on fruit fermentation, industry white papers, and news releases from leading beverage associations. This phase established foundational context around production technologies, regulatory environments, and consumer trends.

Subsequently, rigorous primary research was conducted through in-depth interviews with senior executives across major cider-producing companies, orchard operators, and distribution specialists. These conversations explored strategic priorities, operational challenges, and anticipated market shifts, yielding nuanced perspectives that complement secondary data. In parallel, online surveys targeting end consumers across multiple regions captured attitudinal and behavioral insights, revealing drivers of purchase decisions and emerging flavor preferences.

To validate findings and ensure consistency, data triangulation techniques were employed, cross-referencing quantitative shipment statistics with consumption estimates derived from retail audit databases and digital sales platforms. Geographic information system mapping provided spatial analysis of key orchard regions and distribution footprints. Additionally, expert workshops convened agronomists, fermentation scientists, and brand strategists to critique preliminary conclusions and refine strategic recommendations. This iterative approach guaranteed that insights reflect both empirical evidence and real-world industry practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cider market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cider Market, by Product Type

- Cider Market, by Packaging

- Cider Market, by Flavor

- Cider Market, by Organic Status

- Cider Market, by Distribution Channel

- Cider Market, by Region

- Cider Market, by Group

- Cider Market, by Country

- United States Cider Market

- China Cider Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing key findings on market drivers consumer preferences and structural challenges to reinforce strategic imperatives for stakeholders in the cider sector

The analysis reveals a cider industry in the midst of dynamic evolution, shaped by shifting consumer values, technological advancements, and complex trade environments. Premiumization and flavor innovation have emerged as central growth engines, with producers capitalizing on artisanal techniques and sustainability credentials to differentiate in a competitive marketplace. At the same time, the 2025 tariff interventions have underscored the importance of supply chain agility and domestic sourcing strategies to mitigate pricing volatility.

Segmentation insights illustrate the multifaceted nature of consumer choice, spanning product types such as hard cider and ice cider, diverse packaging formats, flavor profiles ranging from classic apple to avant-garde fruit blends, and channels that include both e-commerce and experiential on-premise venues. Regional analysis demonstrates that while mature markets continue to deepen penetration and segmentation, emerging regions are rapidly adopting cider as a sophisticated alcoholic alternative, driven by premiumization trends and urbanization.

Companies that succeed will be those that integrate these strategic imperatives-innovating across product and packaging, diversifying supply chains, and forging omnichannel distribution partnerships-while maintaining authentic connections through storytelling and transparent sustainability practices. As the landscape continues to shift, stakeholders who harness data-driven decision making and adapt proactively will secure leadership positions in the next phase of the cider market’s growth trajectory.

Inviting engagement with Associate Director of Sales & Marketing Ketan Rohom to secure comprehensive market intelligence and elevate strategic decision making in cider

For tailored insights that delve deeply into evolving consumer behaviors tariff impacts and segmentation strategies within the cider market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise in translating complex industry dynamics into actionable intelligence will guide your organization through competitive and regulatory challenges. Reach out to secure your copy of the comprehensive market research report and position your business at the forefront of innovation, growth, and strategic decision making in the cider sector.

- How big is the Cider Market?

- What is the Cider Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?