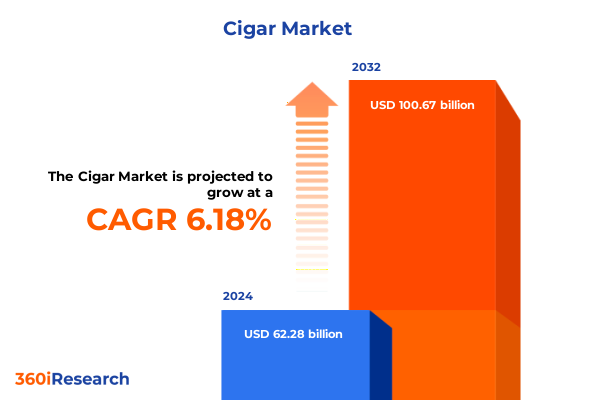

The Cigar Market size was estimated at USD 66.06 billion in 2025 and expected to reach USD 70.09 billion in 2026, at a CAGR of 6.20% to reach USD 100.67 billion by 2032.

Comprehensive Overview of the Evolving Cigar Industry Dynamics and Emerging Market Forces

The global cigar industry has undergone significant evolution, driven by changing consumer preferences, shifting regulatory landscapes, and fluctuating international trade dynamics. As demand diversifies across luxury connoisseurs and value-oriented smokers alike, industry stakeholders face both fresh opportunities and complex challenges. This executive summary offers a concise yet thorough exploration of the current cigar market environment, highlighting the pivotal factors that will shape growth trajectories through 2025 and beyond.

Within this introduction, we set the stage for an in-depth analysis by outlining the broader context in which cigar producers, distributors, and retailers operate today. Key drivers such as premiumization trends, demographic shifts, and the impact of digital commerce are briefly introduced to orient the reader. Ultimately, the insights provided here lay the groundwork for understanding how strategic decisions must adapt in an era of rapid change and intensifying competition.

How Sustainability Trends, Regulatory Changes, and Omnichannel Distribution Have Reshaped Cigar Market Competition

Over the past several years, the cigar landscape has witnessed transformational shifts as consumer expectations have expanded beyond traditional taste profiles to include sustainability, provenance, and experiential purchasing. Premium hand-rolled offerings have gained prominence, fueled by aficionados seeking authentic craftsmanship and differentiated flavor profiles. Simultaneously, machine-made cigars have leveraged technological advancements in production to deliver consistency and affordability, capturing new segments of price-sensitive consumers.

Regulatory actions and health-conscious campaigns have reshaped the competitive environment, prompting companies to innovate in areas such as natural wrappers and organic tobacco blends. This movement toward cleaner labeling and transparent sourcing has resonated with a growing audience that values environmental stewardship. As convenience stores and online retail platforms increasingly dominate distribution channels, manufacturers must pivot to omnichannel strategies that capitalize on digital discovery without sacrificing the sensory experiences central to cigar appreciation.

Quantifying the Strategic Consequences of Elevated U.S. Tariffs on Cigar Sourcing Supply Chains and Retail Pricing

The imposition of higher U.S. tariffs in 2025 has exerted significant pressure on import-dependent segments of the cigar supply chain. Tariffs across premium hand-rolled categories disrupted traditional sourcing from established tobacco regions, leading to cost escalations that reverberated through pricing and margin structures. Brands heavily reliant on wrappers from key producing countries faced the challenge of absorbing duty increases or passing costs to consumers, potentially dampening demand among price-sensitive cohorts.

In response, several manufacturers diversified procurement, forging partnerships with emerging leaf-growing regions to mitigate risk. Retailers adjusted assortment strategies to feature more domestically produced alternatives and value-tier machine-made lines that could better withstand tariff-induced price adjustments. While these adaptive measures have provided some relief, the cumulative impact of U.S. tariffs continues to shape portfolio optimization, with long-term implications for supply chain resilience and competitive positioning.

Deep Dive into How Product Type Combinations Shape Consumer Preferences and Distribution Advantages in the Cigar Market

Analysis of the cigar market by product type underscores distinct growth pathways for hand-rolled versus machine-made offerings. Hand-rolled cigars, segmented by filler and wrapper type, reveal nuanced consumer prioritization of flavor complexity and leaf origin. Enthusiasts of long-filler blends, particularly those wrapped in Connecticut Shade or Maduro, demonstrate willingness to pay premiums for artisanal quality. Conversely, short-filler hand-rolled products, available in Cameroon and Natural wrappers, appeal to consumers seeking mid-tier indulgence with accessible price points.

Machine-made cigars, featuring only short filler, have capitalized on stable production costs and consistent flavor profiles to maintain broad appeal across convenience stores and supermarkets. Distribution channel insights show strong performance both in brick-and-mortar convenience outlets and expanding online retail platforms. Price range segmentation highlights that the premium tier drives brand prestige, while mid-range offerings command the largest volume. Flavor segmentation further delineates consumer tastes, with aromatic variants such as cherry and vanilla attracting novice users and non-aromatic lines favored by purists. Demographic analysis by age group indicates robust adoption among 25-to-34-year-olds seeking premium experiences and resilient loyalty among the 45-and-above cohort who prioritize legacy brand authenticity.

This comprehensive research report categorizes the Cigar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Range

- Flavor

- Distribution Channel

- End User Age Group

Examining Regional Contrasts and Growth Drivers across the Americas, EMEA, and Asia-Pacific Cigar Markets

In the Americas, the market remains anchored by long-standing production hubs and robust consumer culture, where premium hand-rolled cigars account for a substantial share of consumption. The region’s mature regulatory frameworks and strong retail networks facilitate diverse product portfolios, though tariff headwinds have spurred renewed focus on domestic leaf production.

Across Europe, Middle East, and Africa, rising disposable incomes and a growing expatriate population underpin demand for both aromatic and non-aromatic cigars. Regulatory heterogeneity across countries drives market fragmentation, yet lucrative opportunities emerge in duty-free channels and specialty tobacconists in key tourism centers.

Asia-Pacific exhibits the fastest expansion, fueled by an emerging middle class with growing interest in premium lifestyle products. Urbanization and increasing acceptance of luxury tobacco goods have elevated machine-made cigar volumes initially, while hand-rolled segments gain traction among discerning consumers in metropolitan hubs. Cross-border e-commerce further accelerates accessibility, signaling a promising outlook for producers targeting this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Cigar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into How Industry Leaders Leverage Vertical Integration and Branding Innovations to Sustain Competitive Advantages

Major companies dominate through integrated value chains that span tobacco cultivation to retail partnerships. Leading hand-rolled specialists leverage proprietary seed varieties and legacy craftsmanship to reinforce brand exclusivity, while global consumer goods conglomerates deploy scale economies in machine-made lines to optimize cost efficiencies. Joint ventures between growers and premium cigar makers have emerged, aiming to secure high-quality leaf supply and stabilize raw material costs.

Competitive differentiation also arises from marketing innovations, as companies invest in digital storytelling, limited-edition releases, and lifestyle collaborations to deepen consumer engagement. Strategic acquisitions of boutique brands allow large players to broaden their portfolios without diluting artisanal heritage. Additionally, adherence to stringent quality controls and sustainable farming certifications serves as a battleground for companies striving to meet evolving regulatory and ethical standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cigar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Imperial Brands PLC

- J.C. Newman Cigar Co., Inc.

- John Middleton Co., Inc.

- Oettinger Davidoff Holding AG

- Plasencia Cigars S.A.

- Rocky Patel Premium Cigars, LLC

- Scandinavian Tobacco Group A/S

- Swedish Match AB

- Swisher International, Inc.

- Villiger Söhne GmbH & Co. KG

Actionable Strategies to Enhance Supply Chain Resilience, Brand Premiumization, and Omnichannel Engagement in Cigar Markets

Industry executives must prioritize supply chain agility to respond swiftly to trade policy fluctuations. Establishing alternative sourcing partnerships in underutilized growing regions will mitigate tariff risks and ensure continuity of high-quality leaf supply. Concurrently, building flexible production capabilities that can shift between hand-rolled and machine-made lines allows firms to align output with evolving demand patterns.

To capture premiumization trends, companies should invest in limited-edition and heritage-inspired product lines that resonate with connoisseurs. Enhanced transparency in sourcing, through blockchain tracking or certification programs, will further bolster brand credibility. On the distribution front, optimizing omnichannel strategies by integrating digital platforms with in-store experiences will maintain relevance among both traditional and emerging consumer segments. Lastly, targeted marketing campaigns tailored to distinct age demographics and flavor preferences can deepen brand loyalty and foster incremental revenue streams.

Comprehensive Primary and Secondary Research Framework Reinforced by Statistical Modeling and Industry Benchmarking

The research methodology underpinning this report integrates primary and secondary data collection alongside rigorous qualitative and quantitative analyses. Primary insights were obtained through interviews with key manufacturers, distributors, and retail executives, complemented by surveys of end consumers across major markets. Secondary sources included regulatory filings, industry publications, and customs data to capture trade dynamics and price movements.

Statistical modeling was employed to identify correlations between pricing tiers, flavor preferences, and demographic profiles, ensuring robust segmentation insights. Peer benchmarking against industry best practices provided context for evaluating competitive strategies and supply chain structures. Data triangulation across multiple sources underpinned the validity of findings, while continuous market monitoring allowed for the incorporation of the latest tariff developments and distribution channel shifts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cigar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cigar Market, by Product Type

- Cigar Market, by Price Range

- Cigar Market, by Flavor

- Cigar Market, by Distribution Channel

- Cigar Market, by End User Age Group

- Cigar Market, by Region

- Cigar Market, by Group

- Cigar Market, by Country

- United States Cigar Market

- China Cigar Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summative Insights Highlighting the Essential Pathways to Growth Amidst Regulatory and Consumer Evolution in Cigar Markets

The cigar market stands at an inflection point where consumer desires for authenticity, premiumization, and affordability collide with regulatory pressures and shifting trade policies. Navigating this complex environment requires a nuanced understanding of segmentation, regional variations, and competitive tactics. Stakeholders must balance tradition with innovation, leveraging artisanal heritage while embracing technological advancements and omnichannel distribution.

Ultimately, success will hinge on strategic supply chain diversification, targeted brand positioning, and adaptive marketing approaches that resonate with diverse consumer cohorts. By synthesizing the insights detailed throughout this summary, industry participants can confidently chart growth trajectories that capitalize on emerging trends and mitigate external uncertainties. The detailed analysis and recommendations offered herein serve as a practical roadmap for achieving sustained leadership in the evolving cigar landscape.

Secure Personalized Expert Consultation and the Definitive Cigar Market Report to Accelerate Your Trademarked Business Growth

For personalized guidance on leveraging the insights presented in this report for strategic growth, reach out to Ketan Rohom. As the Associate Director of Sales & Marketing, he offers expert consultations designed to align research findings with your unique business objectives. Engaging with Ketan ensures you receive tailored recommendations and actionable plans that bridge industry trends to real-world implementation, accelerating your path to competitive advantage. Contact him today to secure your copy of the comprehensive market research report and unlock the data-driven intelligence you need to thrive in the evolving cigar market

- How big is the Cigar Market?

- What is the Cigar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?