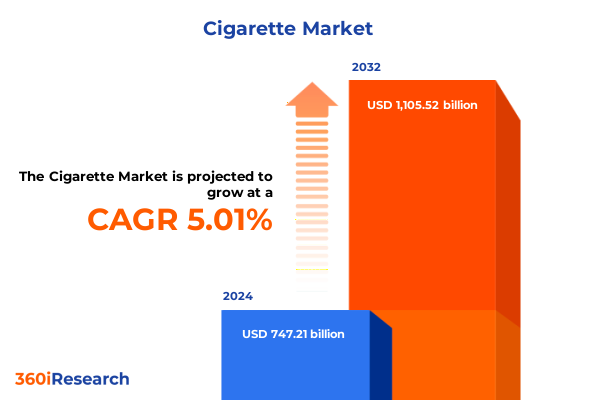

The Cigarette Market size was estimated at USD 783.40 billion in 2025 and expected to reach USD 821.31 billion in 2026, at a CAGR of 4.90% to reach USD 1,095.51 billion by 2032.

Setting the Stage for an In-Depth Analysis of Key Growth Drivers, Regulatory Challenges, and Consumer Behaviors Shaping the United States Cigarette Market

In recent years, the United States cigarette market has undergone notable transitions driven by a complex interplay of regulatory frameworks, shifting consumer preferences, and technological advancements. While traditional smoking products continue to maintain a core base, alternative offerings and heated tobacco devices have emerged to capture the attention of health-aware consumers seeking reduced-risk options. The convergence of heightened scrutiny from public health authorities, evolving societal attitudes, and rapid innovation in nicotine delivery methods establishes a multifaceted backdrop for stakeholders aiming to navigate this competitive environment.

Moreover, economic variables such as import tariffs, supply chain disruptions, and fluctuating input costs have added further complexity to operational decision-making. Amid these pressures, market participants are compelled to prioritize agility and resilience in their business strategies-whether by diversifying product portfolios, strengthening downstream partnerships, or leveraging digital platforms to engage with emerging audience segments. As the industry braces for incremental policy changes and consumer-driven transformations, this report offers an essential introduction to the critical forces shaping the United States cigarette sector today.

Examining the Paradigm Shifts Redefining Competitive Landscapes, Technological Innovations, and Consumer Preferences in the Modern Cigarette Industry

Over the last decade, the cigarette industry has witnessed transformative shifts that extend beyond simple product substitutions. Technological innovation has redefined the concept of nicotine delivery, with electronic nicotine delivery systems and heated tobacco products complementing, and in some cases challenging, the dominance of conventional cigarettes. This evolution has been further accelerated by the proliferation of digital marketing strategies, enabling manufacturers to build direct-to-consumer relationships and gather real-time data to inform product innovation.

Concurrently, public health campaigns and regulatory milestones have driven a deeper awareness of health risks, prompting consumers to explore reduced-harm alternatives. The adoption of flavor restrictions and packaging guidelines in various states has compelled brands to revisit their flavor portfolios, refine ingredient transparency, and invest in scientifically validated harm reduction research. Sustainability considerations have also emerged as a potent force, influencing packaging design and raw material sourcing decisions. Together, these paradigm shifts redefine competitive structures, compelling incumbents to adapt swiftly and challenger brands to seize emerging opportunities.

Uncovering the Compound Effects of 2025 Federal Tariffs on Import Operations, Price Structures, and Supply Chain Resilience in the United States Cigarette Trade

In 2025, a series of federal tariff adjustments targeting tobacco imports significantly impacted cost structures across the cigarette supply chain. Import duties on raw tobacco leaf and finished cigarette products increased incrementally, resulting in elevated landed costs for manufacturers reliant on international sourcing. These adjustments prompted key players to reassess supplier agreements, diversify procurement channels, and explore domestic cultivation partnerships to mitigate margin erosion.

Meanwhile, wholesale distributors and retail partners confronted higher acquisition costs, which in turn influenced their retail pricing strategies and promotional frameworks. Certain manufacturers absorbed portions of the tariff burden to preserve shelf price competitiveness, while others passed costs onto end consumers, leading to observed fluctuations in volume trends. The cumulative effect of these measures underscores the importance of proactive tariff risk management and supply chain resilience planning, as stakeholders align their operational models to navigate an environment characterized by policy-driven cost volatility.

Illuminating Critical Consumer and Market Segmentation Dimensions That Drive Product Development, Targeting Strategies, and Channel Optimization Across the Cigarette Landscape

A granular evaluation of the cigarette sector reveals distinct dynamics across multiple dimensions of consumer and product segmentation. Based on Type, the market is studied across Conventional Cigarette and E-Cigarettes, illuminating divergent growth trajectories and innovation cycles. When segmenting Based on Flavor, insights into Flavored and Non-Flavored offerings gain further depth by examining subcategories within Flavored, including Fruit, Mint, and Spice profiles and their resonance with shifting taste preferences.

Ingredient-level analysis dissects the market Based on Ingredient by separating Additives from Tobacco to uncover variations in consumer health perceptions and regulatory exposure. Distribution patterns are clarified when observed Based on Distribution Channel, where Offline and Online Retail play complementary roles, and Offline is further studied across Convenience Stores and Supermarkets & Hypermarkets to understand pivot points in consumer purchasing journeys. Finally, segmentations Based on Age Group and Based on Gender, which cover cohorts spanning 18-24 Years, 25-44 Years, 45-64 Years, and 65 Years & Above alongside Female and Male consumers, collectively inform targeted marketing and product development strategies that align with demographic shifts and loyalty drivers.

This comprehensive research report categorizes the Cigarette market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Flavor Profile

- Ingredient

- Age Group

- Distribution Channel

- Gender

Exploring Distinctive Regional Trends, Distribution Models, and Regulatory Environments Across the Americas, Europe Middle East & Africa, and Asia-Pacific Cigarette Markets

Regional developments shape the United States cigarette market through a tapestry of regulatory innovations, cultural shifts, and distribution infrastructures. In the Americas, domestic policies on flavor bans and age-of-sale regulations coexist with cross-border dynamics affecting supply chains and illicit trade flows. This region’s retail environment is characterized by a dense network of convenience outlets and evolving e-commerce penetration, demanding agile channel strategies from suppliers.

In Europe, Middle East & Africa, regulatory models ranging from stringent packaging directives to progressive harm reduction frameworks offer a palette of policy case studies for U.S. stakeholders. Certain EMEA markets lead in adopting e-liquid standards, providing benchmarks for labeling and safety protocols. Meanwhile, Asia-Pacific experiences rapid urbanization and burgeoning demand for reduced-risk products, fueled by a young adult demographic and supportive retail ecosystems. These divergent regional landscapes collectively inform risk mitigation, innovation roadmaps, and international collaboration opportunities for market participants seeking comparative insights.

This comprehensive research report examines key regions that drive the evolution of the Cigarette market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders in the Cigarette Industry and Evaluating Their Strategic Positioning, Competitive Advantages, and Collaborative Ventures

A closer look at leading market players underscores a spectrum of strategic postures, from legacy tobacco giants to nimble disruptors. Certain incumbents leverage extensive global supply chains and deep regulatory lobbying expertise to maintain scaled efficiencies and secure shelf presence. In contrast, emerging organizations focus on building differentiated portfolios by investing heavily in research collaborations, harm reduction evidence, and nicotine alternative technologies.

Joint ventures and strategic partnerships have become instrumental in achieving rapid market entry and technology transfer. Cross-sector alliances with consumer goods conglomerates and pharmaceutical innovators further enrich value propositions. As intellectual property considerations and merger approvals evolve, companies that align their R&D investments with shifting regulatory priorities and consumer health concerns are likely to establish sustainable competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cigarette market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 22nd Century Group Inc

- ALD Group Limited

- Altria Group Inc.

- British America Tobacco PLC

- Cheyenne International, LLC

- China Tobacco International (HK) Company Limited

- Eastern Company S.A.E

- Godfrey Phillips India Ltd.

- Golden Tobacco Limited

- Imperial Brands PLC

- ITC Limited

- JT International SA

- Korea Tobacco & Ginseng Corporation

- NTC INDUSTRIES LTD.

- Philip Morris International Inc.

- PT Djarum

- PT Nojorono Tobacco International

- PT Wismilak Inti Makmur Tbk

- PT. Gudang Garam Tbk

- RLX Technology Inc.

- Scandinavian Tobacco Group A/S

- Shenzhen Innokin Technology Co., Ltd.

- Sichuan Tobacco Industry Co., Ltd.

- Sinnar Bidi Udyog Ltd.

- U.S. Flue-Cured Tobacco Growers, Inc

- Vietnam National Tobacco Corp.

- Xcaliber International LTD., LLC

Strategic Action Blueprint for Industry Stakeholders to Navigate Regulatory Headwinds, Drive Innovation, and Cultivate Sustainable Growth in the Cigarette Sector

Industry leaders should prioritize proactive engagement with policymakers and public health advocates to shape balanced regulations that foster both innovation and consumer protection. Companies can optimize their product pipelines by integrating modular design approaches that allow swift reformulation in response to flavor restrictions or updated safety standards. Simultaneously, expanding digital touchpoints-such as direct fulfillment platforms and predictive analytics-enables more personalized consumer experiences and loyalty-building initiatives.

To mitigate policy-driven cost fluctuations, organizations are encouraged to develop diversified sourcing strategies and invest in regional supply bases that reduce exposure to import tariff volatility. Environmental sustainability must also be elevated from tactical initiatives to strategic pillars, guiding packaging redesign, waste reduction targets, and transparency in ingredient sourcing. By aligning these imperatives with corporate purpose and investor expectations, industry participants can cultivate resilience and reinforce brand credibility across stakeholder groups.

Outlining Rigorous Research Frameworks, Data Collection Protocols, and Analytical Techniques Employed to Ensure Accuracy and Credibility in Market Insights

This report synthesizes insights derived from a dual-pronged research approach that combines comprehensive secondary data analysis with targeted primary interviews. The secondary phase involved systematic review of publicly available regulatory filings, trade publications, and industry white papers to map policy trajectories and historical consumption trends. In parallel, primary research comprised in-depth discussions with executives, supply chain managers, regulators, and retail channel leaders to validate market assumptions and capture forward-looking perspectives.

Subsequent data triangulation and thematic coding processes ensured robust cross-verification of findings. Advanced analytics tools facilitated pattern recognition across segmentation variables, while qualitative synthesis distilled strategic implications. The rigorous methodology underscores the credibility and actionable nature of the findings, ensuring that decision-makers can rely on this analysis to inform high-stakes strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cigarette market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cigarette Market, by Product Type

- Cigarette Market, by Flavor Profile

- Cigarette Market, by Ingredient

- Cigarette Market, by Age Group

- Cigarette Market, by Distribution Channel

- Cigarette Market, by Gender

- Cigarette Market, by Region

- Cigarette Market, by Group

- Cigarette Market, by Country

- United States Cigarette Market

- China Cigarette Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Consolidating Core Findings, Strategic Imperatives, and Future Outlooks to Provide a Holistic Perspective on the Evolving Cigarette Industry Landscape

The findings presented herein illustrate a market at the crossroads of heritage and innovation, where established tobacco products coexist with emerging alternatives shaped by health, regulatory, and technological influences. While conventional cigarettes continue to anchor revenue streams, e-cigarettes and heated tobacco items are redefining consumer engagement and growth potential. Regional contrasts offer valuable lessons on policy impact and consumer adoption, and segmentation insights highlight the necessity of tailored offerings to resonate with diverse demographic cohorts.

Looking ahead, market participants that embed agility into their operating models-by anticipating regulatory shifts, adopting sustainable practices, and harnessing data-driven consumer intelligence-will be best positioned to thrive. The imperative for collaborative innovation, proactive stakeholder engagement, and resilient supply chain planning provides a clear strategic mandate. This holistic perspective equips decision-makers to formulate dynamic strategies that sustain profitability while advancing public health objectives in an increasingly complex marketplace.

Engagement Invitation to Connect with Ketan Rohom for Custom Insights and Acquisition of the Comprehensive United States Cigarette Market Research Report

For personalized guidance and to secure your copy of the comprehensive United States cigarette market research report, we invite you to reach out directly to Ketan Rohom, who brings extensive expertise in translating complex market dynamics into strategic growth opportunities. Ketan is available to discuss how the insights can be tailored to your organization’s objectives, whether that involves optimizing product portfolios, navigating regulatory changes, or expanding into high-potential segments. Simply connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore bespoke solutions, receive a detailed briefing, and finalize your purchase.

Don’t miss this opportunity to leverage deep-dive analysis and actionable intelligence crafted to elevate your strategic roadmap. Contact Ketan today for an exclusive consultation and begin unlocking the full potential of the United States cigarette market through data-driven decisions.

- How big is the Cigarette Market?

- What is the Cigarette Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?