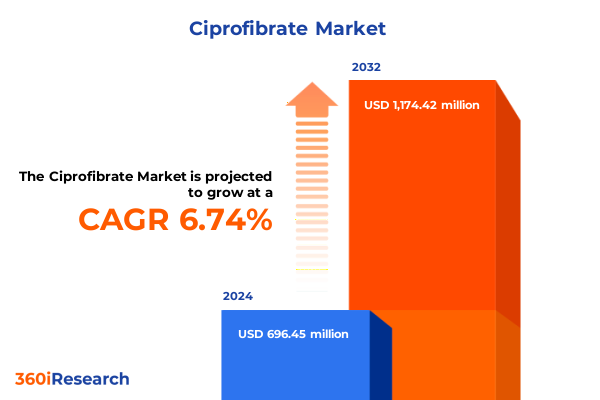

The Ciprofibrate Market size was estimated at USD 736.08 million in 2025 and expected to reach USD 780.01 million in 2026, at a CAGR of 6.90% to reach USD 1,174.41 million by 2032.

Unveiling the Evolving Role of Ciprofibrate in Modern Lipid Management Amid Shifting Healthcare Dynamics and Personalized Treatment Paradigms

Ciprofibrate has emerged as a cornerstone in the management of dyslipidemia, building upon decades of clinical evidence that highlight its efficacy in lowering triglyceride levels and improving overall cardiovascular risk profiles. Since its introduction, the molecule has been steadily integrated into therapeutic regimens alongside statins, offering an alternative mechanism of action through peroxisome proliferator-activated receptor alpha (PPARα) activation. As healthcare professionals increasingly prioritize personalized treatment plans, ciprofibrate’s well-characterized safety profile and favorable pharmacokinetics position it as a compelling option for patients who present with isolated hypertriglyceridemia or statin intolerance. Moreover, the drug’s ability to modulate lipid parameters beyond low-density lipoprotein cholesterol underscores its relevance in a landscape that values multifaceted cardiovascular risk reduction.

How Emerging Healthcare Innovations and Regulatory Changes Are Reshaping the Ciprofibrate Therapeutic Paradigm amid Digital Transformation Initiatives

The landscape for lipid-lowering therapies is being reshaped by advances in digital health solutions, evolving regulatory frameworks, and a growing emphasis on value-based care models. Telemedicine platforms now facilitate remote lipid monitoring and adherence support, enabling clinicians to track patient response to ciprofibrate regimens more closely and adjust dosages in real time. Concurrently, health authorities in major markets are streamlining approval pathways for follow-on medications, expediting the entry of generics and biosimilar fibrate formulations. This regulatory momentum is complemented by payer-driven initiatives that prioritize treatments demonstrating robust real-world outcomes, pushing manufacturers to invest in post-launch evidence generation. In addition, the rise of patient support programs underscores the shift toward holistic care, ensuring that individuals prescribed ciprofibrate receive educational resources and adherence incentives that optimize clinical results.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Ciprofibrate Supply Chains and Pricing Structures

The introduction of tightened tariff measures on active pharmaceutical ingredients (APIs) and finished dosages in 2025 has resulted in pronounced shifts across the supply chain for ciprofibrate. Import duties on raw materials sourced primarily from established manufacturing hubs have increased input costs, driving manufacturers to reassess sourcing strategies and optimize inventory frameworks. These levies have not only contributed to higher unit expenses but have also accelerated conversations around supply chain resilience, particularly for companies reliant on single-origin suppliers. As a direct consequence, some firms have begun restructuring their procurement models to include dual-sourcing arrangements and increased domestic API production, mitigating exposure to international duties while ensuring continuity of supply.

Unpacking Comprehensive Segmentation Insights to Illuminate Patient Profiles Distribution Channels Dosage Strengths and Product Forms for Ciprofibrate

Analyzing the market through the lens of product nature reveals a bifurcation between branded and generic offerings, each commanding distinct positioning strategies. Within the generic segment, products are further delineated into branded generics, which leverage established brand recognition, and unbranded formulations that compete predominantly on price. The latter is subdivided into multisource generics, where multiple manufacturers vie for formulary inclusion, and single-source generics distinguished by exclusive manufacturing rights. This stratification illustrates the competitive intensity at each tier and underscores the importance of differentiation tactics.

When observing distribution channels, hospital pharmacies remain critical for acute care settings, while retail pharmacy networks provide broad patient access. The e-commerce subset, encompassing direct-to-consumer manufacturer websites and third-party marketplaces, has grown rapidly, propelled by consumer preference for home delivery and digital ordering. This diversification in distribution underscores the necessity for omnichannel strategies that ensure product availability across traditional and online touchpoints.

Segmentation by dosage strength, end user, and product form further highlights patient-centric variation. Dosage strengths include 50 mg, 100 mg, and 200 mg formulations, with the 100 mg dose available in blister packs and bottle packs, both in glass and plastic formats. End-user classifications span clinical practices, hospitals, and home healthcare settings, the latter featuring both self-administration and nursing services provided by agency-based and independent practitioners. Finally, the full spectrum of product forms encompasses capsules-hard capsules and soft capsules-oral suspensions, and tablets available in film-coated and uncoated varieties, reflecting a market that demands flexibility to meet diverse therapeutic preferences.

This comprehensive research report categorizes the Ciprofibrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Nature

- Dosage Form

- Distribution Channel

Exploring Regional Market Dynamics and Access Patterns Shaping Ciprofibrate Adoption Across the Americas Europe Middle East Africa and Asia-Pacific

Across the Americas, progressive reimbursement models and well-established distribution infrastructures have supported broad access to ciprofibrate, particularly in countries with mature generic markets where pricing competition drives affordability. North American clinicians benefit from streamlined approval processes and payer incentives that reinforce evidence-based prescribing, while Latin American initiatives focus on expanding access through national health programs.

In Europe, Middle East, and Africa, regulatory harmonization via regional authorities has facilitated cross-border approvals, but reimbursement disparities persist. Western European nations emphasize cost-effectiveness evaluations that occasionally delay formulary additions, whereas emerging markets in Eastern Europe and the Middle East prioritize local manufacturing partnerships to secure supply. African markets are gradually integrating ciprofibrate into essential medicines lists, promoting wider availability amid infrastructure challenges.

Within Asia-Pacific, the dynamic interplay between rapidly growing healthcare spending and significant generic manufacturing capacity positions the region as both a production hub and a key consumption market. Regulatory liberalization in Southeast Asian economies, coupled with government-led public health campaigns addressing cardiovascular disease prevalence, has elevated the role of lipid-lowering agents. Simultaneously, the robust pharmaceutical export sectors in India and China continue to influence global API supply dynamics, underscoring Asia-Pacific’s dual importance as a source and end-user of ciprofibrate products.

This comprehensive research report examines key regions that drive the evolution of the Ciprofibrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Strategic Initiatives Collaborations and Portfolio Developments Among Leading Companies in the Ciprofibrate Arena

Key players in the ciprofibrate landscape demonstrate diverse strategies, ranging from deepening generic portfolios to exploring novel combination therapies. Major generic pharmaceutical companies leverage economies of scale, expansive manufacturing footprints, and established distribution networks to secure formulary placement and drive volume growth. Meanwhile, specialized firms focus on differentiated delivery formats-such as extended-release capsules or combination packs-to carve out niche segments.

Innovative biopharma organizations have also initiated licensing agreements that co-develop ciprofibrate with complementary lipid-modulating compounds, aiming to enhance therapeutic outcomes while extending patent life cycles. Collaborations between API manufacturers and finished dosage producers have increased, underscoring the value of integrated supply chains that reduce cost volatility and bolster quality control. Additionally, several companies are investing in targeted patient support initiatives to improve adherence metrics, reflecting a broader shift toward value-based contracting where reimbursement aligns with clinical performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ciprofibrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agnitio Pharma

- Anax Laboratories

- Biosynth Ltd.

- Cayman Chemical

- Chemicea Limited

- Enzo Life Sciences, Inc.

- LGC Limited

- LKT Laboratories, Inc.

- Lupin Limited

- Manus Aktteva Biopharma LLP

- Merck KGaA

- Sanofi SA

- Teva Pharmaceutical Industries Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry

- VWR International, LLC

Crafting Actionable Strategic Recommendations to Empower Industry Leaders Driving Growth Efficiency and Patient Outcomes in the Ciprofibrate Sector

To navigate the evolving tariff environment and capitalize on shifting patient needs, industry leaders should diversify API sourcing by establishing regional production partnerships that mitigate import duty exposure while enhancing supply security. Complementing this approach, organizations must harness digital tools for direct patient engagement, deploying telehealth platforms and mobile adherence applications that support dosage adjustments and monitor safety in real time. Integrating these technologies will not only improve patient outcomes but also generate rich real-world evidence to satisfy payer requirements and underpin favorable reimbursement terms.

Furthermore, forging strategic alliances with contract manufacturing organizations and logistics providers can yield operational efficiencies, enabling scalable production and streamlined distribution across omnichannel networks. Companies should also prioritize patient support programs tailored to various care settings, from hospital administration to home healthcare, ensuring that nursing services and self-administration pathways are effectively supported. Finally, aligning portfolio roadmaps with evolving value-based care models-by developing novel formulations or fixed-dose combinations that address unmet clinical needs-will position organizations for sustainable growth as market dynamics continue to evolve.

Detailing a Rigorous Research Methodology Incorporating Multi-Source Data Collection Validation Processes and Analytic Rigor

This research integrates a robust, multi-pronged methodology to ensure comprehensive and reliable insights. Initially, exhaustive secondary research was conducted, leveraging peer-reviewed scientific literature, regulatory filings, clinical trial registries, and public health databases to map historical and current market trajectories. Patent databases and intellectual property filings were examined to identify emerging formulation technologies and novel combination therapies.

Complementing secondary sources, primary qualitative research involved in-depth interviews with key opinion leaders, including cardiologists, endocrinologists, pharmacists, and payers across North America, Europe, and Asia-Pacific, providing firsthand perspectives on prescribing behaviors and reimbursement considerations. Data triangulation techniques were employed to reconcile findings, ensuring consistency and validity. Analytical frameworks such as PESTEL analysis, Porter’s five forces, and SWOT assessments underpinned strategic evaluation, while an iterative internal review process updated insights in response to the evolving landscape. The methodology’s transparent documentation supports reproducibility and rigor, offering stakeholders confidence in the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ciprofibrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ciprofibrate Market, by Product Nature

- Ciprofibrate Market, by Dosage Form

- Ciprofibrate Market, by Distribution Channel

- Ciprofibrate Market, by Region

- Ciprofibrate Market, by Group

- Ciprofibrate Market, by Country

- United States Ciprofibrate Market

- China Ciprofibrate Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways and Forward-Looking Perspectives to Conclude Insights on Ciprofibrate Market Evolution and Strategic Implications

Drawing together the critical themes, the analysis underscores ciprofibrate’s sustained relevance in lipid management through its complementary mechanism to statins and strong safety record. Segmentation insights reveal granular opportunities across branded and generic tiers, varied distribution channels from traditional pharmacies to digital platforms, and a spectrum of dosage strengths and product forms tailored to patient needs. Regional perspectives highlight differentiated access models driven by reimbursement frameworks, regulatory harmonization, and manufacturing footprints.

Corporate intelligence shows that strategic collaborations, portfolio diversification, and patient support initiatives are central to competitive differentiation. The proposed strategic recommendations offer a clear roadmap for navigating tariff pressures, embracing digital engagement, and aligning with value-based care imperatives. As the healthcare environment continues to evolve, stakeholders equipped with these insights will be well-positioned to capture growth opportunities and optimize patient outcomes in the ciprofibrate market. The comprehensive nature of this report ensures that decision-makers can confidently refine strategies in response to emerging trends and market shifts.

Drive Informed Investments and Partnerships by Accessing Comprehensive Ciprofibrate Market Intelligence Through Expert Engagement with Ketan Rohom

To gain exclusive, in-depth perspectives on Ciprofibrate market dynamics and actionable intelligence that can drive your strategic initiatives forward, connect directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan can guide you through the comprehensive report’s structure, answer your specific questions about segmentation, regional trends, tariff impacts, and company strategies, and provide tailored recommendations to suit your organization’s unique needs. By partnering with him, you secure access to meticulously gathered research, enabling you to optimize decision-making, identify high-value opportunities, and stay ahead of competitors. Reach out today to unlock the full potential of this critical market intelligence and empower your team to make data-driven investments in Ciprofibrate with confidence.

- How big is the Ciprofibrate Market?

- What is the Ciprofibrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?