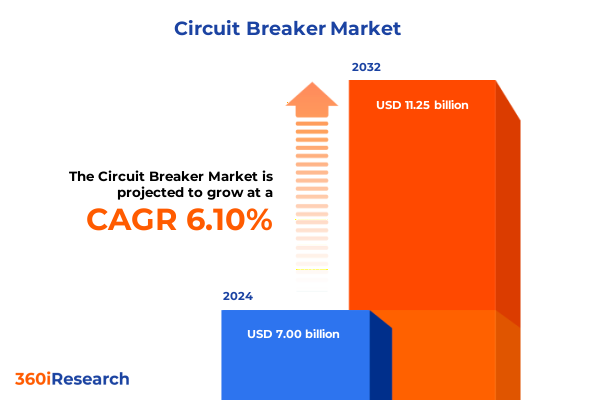

The Circuit Breaker Market size was estimated at USD 7.42 billion in 2025 and expected to reach USD 7.83 billion in 2026, at a CAGR of 6.12% to reach USD 11.25 billion by 2032.

Understanding Evolving Circuit Breaker Dynamics and Rising Demand for Safety Solutions in an Accelerating Global Infrastructure Environment

Electrical infrastructure resilience hinges on reliable circuit breaker technology. These critical components protect electrical systems from overload, fault conditions, and short circuits by interrupting current flow quickly and safely. Growing urbanization, renewable energy integration, and industry 4.0 trends have amplified the need for advanced safety solutions capable of handling complex power distribution networks. As digitalization and smart grid implementations accelerate, stakeholders across verticals prioritize devices that combine rugged performance with intelligent diagnostics to maximize uptime and operational efficiency.

This executive summary distills key insights for decision makers evaluating the dynamic circuit breaker ecosystem. It begins by exploring transformative market shifts driven by technological innovation and regulatory change. It then examines the cumulative impact of recent United States tariff measures on supply chains and cost structures. Subsequent sections shed light on critical segmentation dimensions, regional market nuances, and competitive landscapes. The analysis concludes with actionable recommendations for industry leaders and an overview of the research methodology employed to ensure robust, validated conclusions.

Recognizing Major Technological, Regulatory, and Market Forces That Are Reshaping Circuit Breaker Industry Fundamentals and Driving Innovation

Rapid advancements in digital connectivity and automation have ushered in a new era for circuit breaker solutions. Smart sensors embedded within modern circuit breakers now continuously monitor current, temperature, and mechanical integrity, enabling predictive maintenance and reducing unexpected downtime. Integration with cloud-based platforms allows real-time diagnostics and remote configuration, which in turn empowers maintenance teams to address potential faults before they escalate. Furthermore, the adoption of advanced materials, such as thermosetting composites and 3D-printed insulating components, has enhanced reliability while enabling more compact, lightweight designs that adapt to space-constrained applications.

Simultaneously, cybersecurity considerations are shaping product roadmaps as electrical networks become increasingly networked. Regulatory bodies are updating standards to address both physical safety and digital resilience, requiring manufacturers to demonstrate robust protection against unauthorized access and manipulation. In parallel, environmental and sustainability mandates are driving a shift toward more energy-efficient operation modes and lower global warming potential in insulating gases. Collectively, these technological and regulatory forces are recalibrating expectations for performance, safety, and environmental impact, prompting suppliers and end-users to reassess their procurement criteria and long-term investment strategies.

Examining the Comprehensive Consequences of Recent United States Tariff Policies on Circuit Breaker Supply Chains, Costs, and Competitive Positioning

Recent adjustments to United States tariff schedules have imposed additional duties on imported electrical components and raw materials, placing renewed emphasis on cost management across the circuit breaker value chain. Manufacturers sourcing specialized alloys, copper conductors, and electronic modules have encountered elevated input costs, compelling procurement teams to explore alternative suppliers or negotiate revised agreements. In response, several producers have accelerated local content strategies and sought partnerships with domestic fabricators to mitigate exposure to cross-border duties and maintain stable lead times.

These tariff-driven dynamics have also influenced competitive positioning, as larger incumbents leverage scale advantages to absorb incremental costs, while smaller players reevaluate their business models. Downstream, system integrators and large end-users confront potential project delays and margin compression unless they proactively secure long-term supply arrangements. To navigate this landscape, market participants are adopting flexible sourcing frameworks, optimizing inventory planning, and enhancing price transparency with end-users. As a result, the industry is witnessing a recalibration of supplier portfolios and a renewed focus on operational agility to address the cumulative impact of these trade policy changes.

Unveiling Critical Market Segmentation Insights by Breaker Type, Voltage Level, End Users, Mounting Methods, and Operation Modes for Strategic Clarity

Analyzing market segmentation provides clarity on demand drivers and growth opportunities across diverse breaker configurations. When considering breaker type, the market encompasses robust air circuit breakers that serve high-capacity applications, compact miniature devices for residential safety, specialized earth leakage breakers that enhance fault protection, and molded case solutions that balance performance with modularity. This diversity of form factors underscores the importance of tailored design approaches that address unique voltage, current, and environmental requirements. At the same time, voltage level segmentation highlights the divergent needs of high voltage installations found in heavy industries and power utilities, medium voltage systems utilized in commercial complexes and industrial plants, and low voltage applications predominant in residential and light commercial settings.

Examining end use reveals further nuance, as commercial environments such as hospitality venues, office buildings, and retail facilities prioritize energy efficiency and aesthetic integration, whereas industrial sectors spanning manufacturing plants, mining operations, and oil and gas facilities demand ruggedized breakers capable of withstanding rigorous operational cycles. In residential installations, distinctions between single-family dwellings and multi-family complexes affect device selection based on load diversity and space constraints. Utility segments focused on power generation and transmission and distribution require high-performance breakers with advanced monitoring capabilities to protect critical infrastructure. Mounting preferences range from DIN rail models that simplify installation in control panels to floor-mounted units for heavy-duty switchgear assemblies, while operation mode segmentation differentiates between electronic trip units offering precise digital control, purely magnetic mechanisms optimized for rapid fault interruption, and thermal magnetic designs that combine overload and short-circuit protection. Together, these segmentation insights equip stakeholders with a nuanced understanding of end-user requirements, design trade-offs, and service expectations.

This comprehensive research report categorizes the Circuit Breaker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Breaker Type

- Voltage Level

- Mounting

- Operation Mode

- End Use

Mapping Regional Market Variations and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Circuit Breaker Sectors

Regional market dynamics reveal contrasting growth drivers and challenges across the Americas, Europe Middle East Africa, and Asia Pacific regions. In the Americas, infrastructure modernization projects and increased investment in data centers and renewable integration have heightened demand for advanced protection devices. End-users in North America emphasize compliance with stringent safety standards and seek smart circuit breakers that integrate seamlessly with building management systems, while Latin American markets present opportunities tied to grid expansion and rural electrification initiatives.

Shifting eastward, the Europe Middle East Africa region experiences regulatory harmonization under evolving continental directives, prompting manufacturers to adopt unified design standards and environmental benchmarks. In Europe, energy efficiency targets and carbon neutrality goals encourage utilities and industrial clients to upgrade legacy switchgear with intelligent breakers. Middle Eastern oil-focused economies invest in resilient power distribution networks to support energy export and diversification strategies, while African nations pursue electrification drives that require cost-effective yet reliable circuit protection.

Meanwhile, Asia Pacific stands at the forefront of industrial automation and smart city development. Rapid expansion of manufacturing clusters in Southeast Asia, large-scale metro rail projects, and widespread deployment of distributed energy resources underscore the need for high-performance breakers with integrated diagnostics. As local content requirements evolve, international and domestic suppliers collaborate to deliver scalable solutions that address both urban megaprojects and emerging rural infrastructure demands.

This comprehensive research report examines key regions that drive the evolution of the Circuit Breaker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators, Strategic Partnerships, and Competitive Differentiators Shaping Excellence within the Global Circuit Breaker Business Ecosystem

Leading global players have demonstrated distinct strategic approaches that underscore the competitive dynamics within the circuit breaker landscape. Some innovators prioritize digital transformation by embedding advanced microprocessor-based trip units and IoT connectivity into their product lines, thereby offering end-to-end solutions that include cloud-based asset management and condition monitoring services. Others focus on materials science breakthroughs, leveraging proprietary composites and novel insulating technologies to enhance dielectric performance while reducing lifecycle maintenance requirements. Strategic alliances and co-development programs further accelerate innovation cycles, enabling consortiums of suppliers and system integrators to co-create next-generation switchgear that addresses complex energy transition challenges.

In parallel, a wave of targeted acquisitions has reshaped the competitive environment, as companies seek to broaden their portfolios across voltage classes, geographic reach, and end-use segments. Mergers with regional specialists have facilitated access to emerging markets in Southeast Asia and Latin America, while partnerships with technology firms have bolstered cybersecurity and digital service offerings. Sustainability commitments also feature prominently, with several firms pledging to achieve carbon neutrality across manufacturing operations and to incorporate environmentally benign insulating mediums. Collectively, these strategic moves illustrate how top-tier companies balance core competencies with growth initiatives, reinforcing their leadership and setting new industry benchmarks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Circuit Breaker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Analog Devices, Inc.

- Bel Fuse Inc.

- E-T-A Elektrotechnische Apparate GmbH

- Eaton Corporation PLC

- General Electric Company

- Honeywell International Inc.

- Itron, Inc.

- Legrand SA

- Littelfuse, Inc.

- Mersen Corporate Services SAS

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd.

- NXP Semiconductors N.V.

- PHOENIX CONTACT India Pvt. Ltd.

- PKC Group Ltd. by Motherson Sumi Systems Ltd.

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schurter Holding AG

- Sensata Technologies, Inc.

- Siemens AG

- STMicroelectronics N.V.

- Texas Instruments Incorporated

Strategizing Actionable Recommendations to Empower Industry Leadership in Enhancing Efficiency, Sustainability, and Resilience of Circuit Breaker Operations

Industry leaders can capitalize on emerging trends by integrating advanced digital capabilities into their core offerings. Prioritizing investment in research and development of next-generation trip units, sensor networks, and cloud analytics will not only enhance real-time diagnostics but also enable predictive maintenance that minimizes unplanned outages. At the same time, adopting sustainable design principles-such as the use of eco-friendly insulating materials and energy-efficient actuation mechanisms-aligns product roadmaps with tightening environmental regulations and customer demands for lower lifecycle carbon footprints.

In parallel, organizations should cultivate collaborative ecosystems that span suppliers, system integrators, and end-users. Establishing co-innovation platforms allows for rapid validation of novel technologies in operational settings, while strategic procurement partnerships and flexible sourcing agreements bolster supply chain resilience in the face of geopolitical disruptions. Investing in workforce development and cross-functional training empowers technical teams to harness data-driven insights, fostering a culture of continuous improvement. By pursuing these actionable steps, companies will strengthen their competitive edge, accelerate time-to-market for differentiated solutions, and navigate the evolving landscape of circuit breaker applications more effectively.

Detailing Robust Research Methodology with Rigorous Data Collection, Analysis Techniques, and Validation Protocols Ensuring Integrity and Practical Insight

The research methodology underpinning this analysis combines robust primary and secondary approaches to ensure comprehensive coverage and validity. Primary research encompassed structured interviews with senior executives, engineering leads, and procurement specialists across a cross-section of utilities, industrial operators, and original equipment manufacturers. These discussions provided qualitative insights into evolving performance requirements, supply chain challenges, and adoption barriers for digital and eco-friendly breaker technologies. Concurrently, site visits to manufacturing facilities and testing laboratories offered firsthand perspectives on production processes, quality control protocols, and emerging material innovations.

Secondary research involved the systematic review of technical papers, regulatory publications, and industry association standards, augmented by data from publicly available government trade records and corporate disclosures. Through iterative cross-referencing and data triangulation, the analysis reconciled divergent viewpoints and addressed information gaps. Validation protocols included peer reviews by subject matter experts in electrical engineering and market analysis, ensuring that conclusions reflect real-world conditions and align with the latest regulatory frameworks. This multi-layered approach guarantees that the insights and recommendations presented herein rest on a foundation of rigorous evidence and professional scrutiny.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Circuit Breaker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Circuit Breaker Market, by Breaker Type

- Circuit Breaker Market, by Voltage Level

- Circuit Breaker Market, by Mounting

- Circuit Breaker Market, by Operation Mode

- Circuit Breaker Market, by End Use

- Circuit Breaker Market, by Region

- Circuit Breaker Market, by Group

- Circuit Breaker Market, by Country

- United States Circuit Breaker Market

- China Circuit Breaker Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Provide Clarity on Future Pathways and Competitive Advantage in the Circuit Breaker Domain

This executive summary has synthesized critical insights spanning technological innovation, regulatory evolution, tariff impacts, market segmentation, regional dynamics, and competitive strategies. By examining how digitalization, advanced materials, and cybersecurity requirements converge with shifting trade policies, the analysis underscores the multifaceted nature of modern circuit breaker markets. Segmentation perspectives highlight the importance of tailoring solutions to distinct operational contexts, while regional insights reveal varied investment drivers and adoption timelines across key geographies.

Collectively, these findings emphasize that success in the circuit breaker domain hinges on agility, collaboration, and strategic foresight. Companies that integrate intelligent diagnostics, embrace sustainable design, and diversify supply chains will be best positioned to meet the demands of a power ecosystem defined by decentralization and decarbonization. As stakeholders navigate this complex landscape, the actionable recommendations outlined herein provide a clear roadmap for enhancing resilience, accelerating innovation, and securing competitive advantage in the years ahead.

Engaging Invitation to Connect with Associate Director of Sales and Marketing for Expert Guidance on the Comprehensive Circuit Breaker Market Research Report

Industry stakeholders seeking in-depth guidance on optimizing their circuit breaker strategies are invited to connect with our Associate Director of Sales and Marketing, Ketan Rohom. As a seasoned professional specializing in translating technical insights into strategic decisions, he can provide personalized recommendations aligned with your organization’s objectives. By engaging directly, you’ll gain clarity on how to navigate emerging market dynamics, leverage advanced technologies, and mitigate supply chain disruptions. Whether you represent a global manufacturer, system integrator, or end-user, this consultation offers a unique opportunity to access the full spectrum of strategic, segmentation, and regional insights detailed in our comprehensive circuit breaker market research report. Reach out today to elevate your competitive positioning and drive sustainable growth.

- How big is the Circuit Breaker Market?

- What is the Circuit Breaker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?