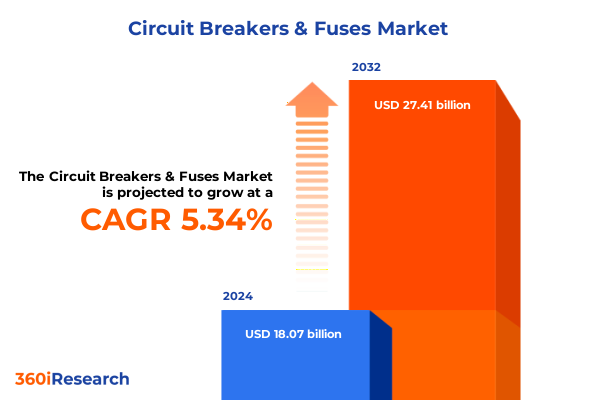

The Circuit Breakers & Fuses Market size was estimated at USD 19.04 billion in 2025 and expected to reach USD 19.97 billion in 2026, at a CAGR of 5.33% to reach USD 27.41 billion by 2032.

Exploring the critical role of circuit breakers and fuses in safeguarding electrical systems and driving operational resilience across diverse industries

The global evolution of electrical power systems has underscored the indispensable role of circuit breakers and fuses as foundational elements in safeguarding infrastructure and enabling operational continuity. Historically, rudimentary fuses offered basic overcurrent protection in early electrical networks, but the increasing complexity of modern installations has demanded advanced circuit interruption technologies capable of instantaneous response and selective coordination. Today, circuit breakers and fuses function not only as protective barriers but also as critical enablers of system reliability, safety, and efficiency across industrial, commercial, residential, and utility contexts.

Growing electrification trends combined with stringent regulatory mandates around safety and grid resilience have driven manufacturers to innovate features such as arc flash mitigation, digital trip units, and integrated communication protocols. These enhancements allow real-time monitoring of health metrics, predictive maintenance alerts, and seamless integration with energy management systems, thereby transforming protective devices into intelligent nodes of the modern grid. As energy portfolios shift toward distributed generation and intermittent renewables, the necessity for adaptive coordination among protective devices intensifies, making circuit breakers and fuses central to achieving both operational flexibility and risk mitigation.

This introduction aims to contextualize subsequent analysis by highlighting how foundational protection devices have evolved into strategic assets. By examining the interplay between regulatory frameworks, technological advancements, and emerging application domains, stakeholders can appreciate the critical dynamics shaping both short-term project requirements and long-term infrastructure investments underpinned by robust electrical protection.

Identifying the major technological innovations and market disruptions reshaping the circuit breaker and fuse landscape toward smarter and safer electrical infrastructure

Over the past decade, the landscape of circuit breaker and fuse technologies has been transformed by a convergence of digitalization, material science breakthroughs, and heightened safety imperatives. One of the most significant shifts has been the migration from analog trip mechanisms to microprocessor-based trip units, which afford precise fault analysis, customizable protection curves, and data logs that feed into overarching asset management platforms. This digitization not only enhances operational transparency but also reduces downtime through predictive maintenance practices that preemptively address degradation before failures occur.

Simultaneously, the development of compact, high-interrupting-capacity devices has enabled designers to accommodate denser electrical panels and equipment racks, optimizing floor space in complex facilities such as data centers and manufacturing plants. Innovations in composite insulating materials and advanced electromagnetics have also driven down device footprints while improving dielectric performance under elevated temperatures and harsh environmental conditions. This miniaturization aligns with global trends toward modular, prefabricated electrical solutions that accelerate installation timelines and support agile retrofit strategies.

In parallel, safety standards such as NFPA 70E and IEC 61439 have been periodically updated to mandate enhanced arc flash containment, temperature logging, and touch-safe enclosures. Manufacturers have responded by integrating features like arc-resistant compartments, infrared window access points, and reinforced barriers that mitigate risk to personnel during maintenance. Additionally, the rise of renewable energy integration, electric vehicle charging infrastructure, and microgrid architectures has spurred demand for bi-directional protection devices capable of handling reverse currents and renewable intermittency. These diverse dynamics collectively represent the transformative shifts currently defining protection device markets and set the stage for future product roadmaps and business models.

Analyzing how recent United States tariff measures introduced in 2025 have affected supply chain costs sourcing strategies and pricing structures across the market

In 2025, the United States implemented a series of tariff measures targeting imported electrical protection equipment, including circuit breakers and fuses, aimed at bolstering domestic manufacturing competitiveness and addressing perceived trade imbalances. The immediate effect was an uptick in landed costs for products sourced from key manufacturing hubs in Asia, notably China and Southeast Asia, leading many end users to reassess their supply strategies. This shift prompted an accelerated pivot toward regional sourcing, with procurement teams increasingly favoring North American and European suppliers to maintain budget predictability and avoid volatility associated with tariff adjustments.

The cumulative impact of these tariffs has manifested in a dual-layered cost challenge: first, the direct increase in unit pricing due to import duties; and second, the indirect pressure on global supply chains, as manufacturers pass through increased financing and compliance costs. To offset these effects, several major producers have announced localized assembly facilities within the U.S., thereby mitigating tariff exposure and reducing lead times. This localization strategy, while effective in curtailing import duties, entails significant capital investment and operational ramp-up phases, which in turn influences pricing strategies and long-term partnership structures.

On the demand side, traditionally price-sensitive segments such as residential and small commercial projects have felt the greatest strain, leading to extended procurement cycles and a resurgence of interest in alternative protection solutions like thermal fuses and low-cost cartridge options. Conversely, large industrial and utility end users have leveraged strategic volume agreements and long-term contracts to stabilize pricing, ensuring continuity of service for critical infrastructure. Overall, the 2025 tariff landscape has catalyzed both supply chain diversification and strategic realignment in sourcing policies, compelling stakeholders to balance immediate cost management with sustained investment in domestic production capabilities.

Unveiling the comprehensive segmentation of circuit breaker and fuse markets through product type voltage rating distribution channel and end user industry dynamics

An in-depth segmentation analysis reveals the varied dynamics governing product portfolios, voltage classifications, distribution frameworks, and end user verticals within the circuit breaker and fuse market. The product type categorization spans high-capacity systems such as air circuit breakers and molded case circuit breakers alongside more specialized devices including earth leakage circuit breakers and miniature circuit breakers, with the fuse link segment further dissected into cartridge, striker, and thermal variants reflecting distinct protection and response characteristics. Voltage-based segmentation underscores the divergent needs across low-voltage applications under one kilovolt, medium-voltage installations ranging from one to thirty-five kilovolts, and high-voltage networks exceeding thirty-five kilovolts, each necessitating tailored design, testing, and certification protocols.

Distribution channels bifurcate into offline networks-anchored by authorized dealers, electrical wholesalers, and independent distributors-and online platforms that encompass distributor portals, ecommerce marketplaces, and manufacturer websites. The offline sector prioritizes hands-on technical support and relationship-driven sales, whereas the online domain leverages digital configurators, rapid quoting engines, and just-in-time delivery models. End user industry segmentation highlights the commercial sector’s demand for flexibly scalable solutions, the industrial domain’s emphasis on rugged performance and continuity, the residential segment’s focus on safety and aesthetic integration, and the utilities field’s stringent reliability and regulatory compliance needs.

These segmentation layers interact to create a mosaic of market opportunities and challenges. For instance, medium-voltage molded case breakers find strong traction among utilities planning grid modernization, while cartridge fuse links remain cost-effective choices for contractors seeking rapid replacement cycles in residential applications. The convergence of digital sales channels with specialized offline expertise further shapes distribution strategies, suggesting that hybrid engagement models will define competitive advantage in the coming years.

This comprehensive research report categorizes the Circuit Breakers & Fuses market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Voltage Rating

- Distribution Channel

- End User Industry

Assessing regional dynamics across Americas Europe Middle East Africa and Asia Pacific to reveal growth drivers and investment hotspots in electrical protection devices

Regional analysis indicates distinct growth trajectories and investment priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, infrastructure renewal initiatives and government-backed grid resilience projects have driven demand for next-generation protection devices, particularly those compatible with smart grid architectures and renewable integration. North American utilities and large industrial users increasingly prioritize arc flash mitigation and digital fault diagnostics, prompting manufacturers to expand local service capabilities and training programs. Latin America, while more price-sensitive, is exhibiting gradual uptake of medium-voltage breakers and fuse links as distribution networks modernize.

Within the Europe Middle East & Africa region, regulatory harmonization under frameworks like the European Union’s Low Voltage Directive and various MENA electrical codes fosters a steady replacement cycle of legacy protection equipment. Demand is bolstered by trends in data center expansion in the Gulf Cooperation Council states and renewable-driven grid enhancements in Southern Europe. Manufacturers active in this territory often emphasize modular panel designs and cross-certified solutions to navigate diverse national standards and accelerate project delivery.

Asia-Pacific remains a dynamic landscape, with emerging economies in Southeast Asia and India investing heavily in electrification and industrial capacity-building. Here, low-voltage miniature circuit breakers see significant adoption, while high-voltage air circuit breakers are in demand for large-scale power generation and transmission projects. China’s mature manufacturing base and government incentives for domestic production continue to influence regional pricing and supply, even as other markets seek to diversify sourcing and cultivate local assembly partnerships.

This comprehensive research report examines key regions that drive the evolution of the Circuit Breakers & Fuses market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive strategies technology leadership and partnership approaches of leading manufacturers driving innovation and market penetration in circuit breakers and fuses

Industry leadership in the circuit breaker and fuse market is characterized by a blend of technological depth, global footprint, and strategic alliances. Leading multinational manufacturers have invested heavily in R&D centers focused on power electronics, materials engineering, and digital integration, resulting in portfolio expansions that cover both conventional mechanical devices and emerging solid-state protection systems. Collaborative partnerships with software vendors and system integrators further enable the delivery of turnkey solutions, encompassing protective hardware, monitoring platforms, and consulting services addressing arc flash studies and coordination analysis.

Several companies have distinguished themselves through vertically integrated supply chains, securing raw materials for contact alloys and insulating substrates to maintain cost stability amidst commodity fluctuations. Others have prioritized geographic expansion, establishing localized assembly lines in critical markets such as North America and the Middle East to meet region-specific regulatory requirements and compressed lead time expectations. Acquisition strategies remain prevalent, with major players selectively acquiring niche specialists in areas like thermal fuse technology or digital trip electronics to accelerate innovation cycles and cross-sell complementary product families.

In parallel, the rise of private equity-backed entrants has injected competitive pressure around pricing and service offerings, particularly in aftermarket segments that include testing, maintenance, and certification. These new market participants often leverage digital platforms to streamline order-to-delivery processes and offer subscription-based maintenance packages, challenging traditional OEM models. The interplay between established manufacturers and agile disruptors is redefining buyer expectations, driving continuous improvement in device performance, digital usability, and total cost of ownership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Circuit Breakers & Fuses market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Alstom SA

- Bel Fuse Inc

- Carling Technologies

- CHINT Group Corporation

- Eaton Corporation plc

- Fuji Electric Co Ltd

- G&W Electric Company

- General Electric Company

- Hager Group

- Hitachi Ltd

- Larsen & Toubro Limited

- Legrand S.A.

- Littelfuse Inc

- Mersen S.A.

- Mitsubishi Electric Corporation

- Phoenix Contact

- Powell Industries Inc

- Rockwell Automation Inc

- Schneider Electric SE

- SCHURTER Holding AG

- Sensata Technologies Inc

- Siemens AG

- TE Connectivity Ltd

- Toshiba Corporation

Presenting strategic priorities and operational steps for industry leaders to optimize resilience innovation and market responsiveness in evolving electrical protection markets

Industry leaders should prioritize the integration of digital trip units with advanced analytics capabilities to enable predictive maintenance workflows and reduce unplanned downtime. By deploying data-driven monitoring solutions, organizations can transition from reactive service calls to condition-based interventions that optimize asset lifecycles and minimize operational disruptions. Simultaneously, investment in training programs for field technicians and end users will ensure that sophisticated protective features are correctly configured, commissioned, and maintained throughout the asset lifecycle.

Supply chain resilience must also be addressed through diversified sourcing strategies and strategic stock positioning. Organizations can mitigate the impact of import tariffs and logistics constraints by cultivating partnerships with regional assembly hubs and dual-sourcing critical components. Collaborative agreements with distributors and integrators to maintain safety stock for high-priority segments can further safeguard against market volatility and project delays.

On the product development front, manufacturers and end users alike should collaborate in co-innovation programs to tailor protection devices for emerging use cases such as electric vehicle charging networks, microgrid deployments, and hydrogen production facilities. These initiatives will accelerate the validation of bi-directional protection schemes, enabling grid-edge assets to operate safely within complex power flow scenarios. Finally, adopting sustainability criteria-such as recyclable materials and energy-efficient manufacturing processes-can enhance corporate responsibility profiles and align product portfolios with evolving regulatory expectations and customer values.

Outlining the rigorous research framework data collection and analytical techniques employed to deliver reliable insights into the circuit breaker and fuse market landscape

The research underpinning this analysis was conducted through a multi-tiered approach combining primary interviews, secondary literature review, and rigorous data triangulation. Expert consultations with product managers, design engineers, and procurement leads across utilities, industrial firms, and commercial real estate developers provided qualitative insights into evolving technology adoption patterns, regulatory impacts, and strategic decision-making drivers.

Secondary data sources included publicly available technical standards, industry white papers, financial disclosures from leading manufacturers, and academic publications on protective device performance. These materials were systematically analyzed to validate emerging trends in digitalization, material innovation, and thermal-fluid dynamics. To ensure the reliability of cost and supply chain observations, tariff schedules and trade data were cross-referenced against company disclosures and customs records.

Quantitative findings were corroborated through cross-tabulation of device shipments, patent filings, and distribution channel growth indicators to identify consistent patterns. Regional performance metrics were benchmarked using investment announcements, grid modernization funding allocations, and electrification indices maintained by international agencies. Throughout the process, methodological rigor was upheld by adhering to standardized research protocols, ensuring transparency, replicability, and defensibility of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Circuit Breakers & Fuses market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Circuit Breakers & Fuses Market, by Product Type

- Circuit Breakers & Fuses Market, by Voltage Rating

- Circuit Breakers & Fuses Market, by Distribution Channel

- Circuit Breakers & Fuses Market, by End User Industry

- Circuit Breakers & Fuses Market, by Region

- Circuit Breakers & Fuses Market, by Group

- Circuit Breakers & Fuses Market, by Country

- United States Circuit Breakers & Fuses Market

- China Circuit Breakers & Fuses Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing critical findings to underscore the strategic implications and future considerations for stakeholders navigating the evolving circuit breaker and fuse ecosystem

The analysis presented highlights a market in transition, propelled by digitalization, regulatory evolution, and shifting supply chain paradigms. Circuit breakers and fuses, once viewed solely as passive safety devices, are now integral components of intelligent power ecosystems, contributing to real-time fault management and system optimization. As tariff measures influence sourcing decisions and regional production footprints, agility in procurement and strategic localization emerge as critical competitive differentiators.

Segmentation dynamics underscore the need for tailored approaches across product types, voltage classes, distribution channels, and end user industries, while regional insights reveal distinct drivers and constraints that shape investment priorities. Leading manufacturers must balance innovation with operational excellence and consider partnership-driven models to respond effectively to emerging applications such as renewable integration, electrified transport, and microgrid solutions. The path forward demands coordinated efforts among OEMs, distributors, end users, and regulatory bodies to harmonize technical standards, digital protocols, and sustainability objectives.

In synthesizing these findings, stakeholders are equipped with a clearer understanding of the strategic levers available to navigate complexity, manage risk, and unlock new growth avenues. Whether through targeted digital upgrades, supply chain diversification, or co-innovation ventures, the recommendations herein offer a roadmap for capitalizing on the evolving circuit breaker and fuse landscape.

Engaging with Ketan Rohom to secure comprehensive market intelligence that empowers informed decisions and drives competitive advantage in electrical protection solutions

For organizations seeking to navigate the evolving complexities of the circuit breaker and fuse market, engaging directly with Ketan Rohom as Associate Director of Sales & Marketing provides unparalleled access to customized insights and tailored collaboration opportunities. By connecting with Ketan, decision-makers can explore bespoke data packages, receive targeted advisory support, and secure early intelligence on emerging trends and regulatory shifts. This proactive engagement ensures executives have the guidance required to accelerate strategic initiatives, optimize procurement frameworks, and strengthen competitive positioning across global power protection landscapes. Reach out today to transform market intelligence into actionable advantage and drive sustainable growth in your electrical protection portfolio

- How big is the Circuit Breakers & Fuses Market?

- What is the Circuit Breakers & Fuses Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?