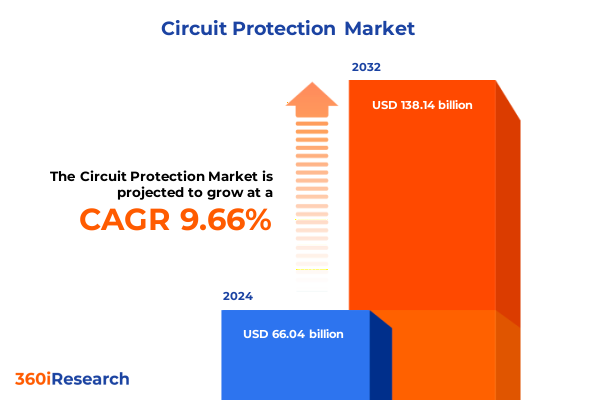

The Circuit Protection Market size was estimated at USD 72.17 billion in 2025 and expected to reach USD 78.88 billion in 2026, at a CAGR of 9.71% to reach USD 138.14 billion by 2032.

Powering the Future of Infrastructure with Advanced Circuit Protection Solutions Amid Growing Electrification Demands Worldwide

Global electricity consumption has entered a phase of unprecedented growth, driven by surging demand across multiple sectors. Recent analysis reveals that global power demand rose by 4.3% in 2024 and is expected to sustain near-4% annual growth through 2027. This acceleration marks one of the fastest expansions in decades, demanding significant upgrades to transmission, distribution, and safety infrastructure.

This wave of electrification is being propelled by several converging factors: the rapid deployment of electric vehicles requiring robust charging networks, the proliferation of data centers and digital services that demand uninterrupted power supply, and the push for energy efficiency in residential and commercial buildings. As a result, the need for reliable circuit protection solutions that safeguard against overloads, short circuits, and transient disturbances has never been more critical.

Simultaneously, the global shift toward renewable energy has reached a pivotal tipping point. Wind and solar power additions accounted for more than 74% of new electrical capacity in 2024, with costs for solar declining by 41% and wind by 53% year-over-year, further accelerating clean energy deployment. Integrating these intermittent resources into the grid introduces new reliability challenges, heightening the importance of advanced surge protective devices and adaptive breakers.

Moreover, the rise of distributed energy resources, microgrids, and prosumer models is reshaping traditional power system architectures. This decentralization amplifies the complexity of fault detection and isolation, necessitating next-generation circuit breakers, fuses, and protective technologies that can respond instantly and intelligently to dynamic load conditions.

Unleashing Digital and Technological Transformations Redefining Circuit Protection Requirements Across Modern Power Systems

The power industry is undergoing a digital metamorphosis that is redefining how circuit protection is designed, deployed, and managed. In recent years, more than 72% of utility operators have significantly increased investments in digital solutions, leveraging IoT, AI, and advanced analytics to enhance grid reliability and optimize operational efficiency. This transformation was on full display at Distributech 2025, where industry leaders underscored the shift from reactive maintenance to proactive grid management powered by machine learning and real-time data integration.

IoT sensors embedded within breakers and switchgear are now providing granular visibility into equipment health, enabling predictive maintenance strategies that reduce unplanned outages. By 2025, billions of connected devices will be monitoring critical parameters-temperature, current flow, and vibration-enabling utilities and industrial operators to detect anomalies before they escalate into failures. This data-driven approach not only enhances asset longevity but also optimizes operational budgets.

Concurrently, smart circuit breakers are gaining traction as key enablers of modern grid architectures. Over 5,000 industrial facilities worldwide have integrated IoT-enabled breakers, harnessing remote management and instant fault isolation to maintain continuous operations and improve safety protocols. These devices integrate seamlessly into digital platforms, providing customizable trip settings, automated logging, and seamless integration with energy management systems.

In parallel, sustainability considerations are driving innovation toward eco-friendly protection technologies. Leading manufacturers are rapidly commercializing SF₆-free breakers and alternative insulating mediums to meet stringent emissions targets. At the same time, digital twin applications are allowing utilities to simulate fault scenarios and optimize protective settings virtually, accelerating deployment cycles while ensuring compliance with evolving regulations.

Navigating the Layered Impact of Evolving United States Tariffs on Circuit Protection Supply Chains and Cost Structures in 2025

The persistence of Section 301 tariffs on Chinese imports continues to shape cost structures in the circuit protection arena. Tariffs imposed since 2018 remain at 25% for a broad range of electrical equipment, with the USTR extending certain exclusions only through May 31, 2025. As these exclusions expire, many protective devices and components face reinstated duties, prompting manufacturers to reevaluate sourcing strategies.

In parallel, an executive order enacted March 4, 2025, under the International Emergency Economic Powers Act, imposed a 25% tariff on imports from Canada and Mexico while increasing duties on Chinese-origin goods from 10% to 20%. This layer of protectionist measures has amplified cost pressures across cross-border supply chains.

Escalation peaked on April 9, 2025, when reciprocal tariffs on Chinese exports surged to 125%, stacking atop existing Section 301 and IEEPA levies to yield a combined duty of 170% on select products. This sudden spike triggered notable inflationary effects for imported circuit breakers, fuses, and surge protective devices, leading many distributors to pass through increased costs and extend lead times.

A subsequent trade agreement reached in Geneva on May 12, 2025, reduced reciprocal tariffs back to 10%, yet maintained the core Section 301 and other duties. While this provided some relief, the persistent elevated tariff baseline continues to influence capital budgets and sourcing decisions for both end-users and original equipment manufacturers.

Adding to the complexity, recent announcements by the administration elevated tariffs on critical imports-electric vehicle batteries, computer chips, and select medical products-underscoring the broader government push to support domestic manufacturing and safeguard strategic industries. Stakeholders now face a landscape where tariff volatility necessitates agile supply chain models and diversified manufacturing footprints.

Dissecting Critical Segmentation Insights Spanning Product Types End-Use Industries Technologies Voltages Mounting Channels for Circuit Protection Excellence

Insight into product type segmentation reveals that circuit breakers dominate the protection landscape, offering diverse solutions ranging from high-capacity air circuit breakers to sensitive ground fault interrupters. Each variant, whether miniature or molded case, is engineered to address specific fault currents and operational conditions, underscoring the importance of selecting the right breaker for precise applications.

Fuses continue to fill niche roles where compactness and simplicity are paramount. Cartridge, resettable, and thermal fuses cater to low-to-medium current requirements, providing fail-safe protection for control circuits and sensitive electronics. Meanwhile, surge protective devices-classified into Type 1, Type 2, and Type 3 categories-are rapidly gaining adoption to guard against transient voltages generated by lightning, switching events, and grid disturbances.

End-use segmentation highlights unique demand drivers: the automotive sector differentiates between commercial vehicle systems and passenger vehicle applications, while the construction industry prioritizes robust protection for complex building services. The electrical and electronics sector spans consumer, industrial, and telecommunication domains, each with tailored protection needs. In heavy industries such as oil, gas, and petrochemicals, and emerging renewable energy installations, specialized devices must withstand harsh environments and variable load profiles.

Technology segmentation underscores a continued reliance on thermal protection for cost-sensitive deployments, with magnetic trip units delivering precise fault detection in industrial settings. Electronic protection solutions are increasingly valued for programmability and integration capabilities, while solid state technologies promise ultra-fast response times and enhanced longevity in the most demanding scenarios.

Voltage ratings further stratify the market: low-voltage protections remain ubiquitous in residential and commercial spaces, medium-voltage devices serve the backbone of industrial parks and large buildings, and high-voltage solutions are critical for transmission lines and utility substations. Correspondingly, current ratings span from low-current devices designed for control circuits to high-current breakers engineered for data centers, EV charging stations, and heavy manufacturing.

Mounting preferences reflect installation environments: DIN rail and panel-mounted devices are standard in industrial switchgear cabinets, PCB-mounted components integrate into compact electronic assemblies, and wall-mounted units support building management systems. Across distribution channels, some OEMs favor direct sourcing for custom projects, while indirect channels such as distributors and online retail platforms cater to aftermarket replacements and quick-turn requirements.

This comprehensive research report categorizes the Circuit Protection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Protective Technology

- Voltage Rating

- Current Rating

- Mounting Type

- End-Use Industry

- Distribution Channel

Decoding Distinct Regional Dynamics That Are Shaping Circuit Protection Demand Patterns Across Americas Europe Middle East Africa and Asia Pacific

In the Americas, the grid modernization wave is underpinned by strong policy support and significant capital allocation for infrastructure upgrades. In the United States, electricity demand rebounded by 2% in 2024, prompting utilities to invest heavily in protective device retrofits to enhance resilience and accommodate expanding EV charging networks. Canada’s clean energy targets also drive regional manufacturers to scale output of advanced breakers and SPDs.

Across Europe, the Middle East, and Africa, distinctive regional dynamics shape protection requirements. European nations are mandating SF₆-free solutions and higher efficiency standards to meet sustainability goals, while MENA infrastructure projects in oil, gas, and petrochemical sectors demand high-voltage protections engineered for extreme conditions. In Africa, rural electrification and off-grid renewable installations are creating new opportunities for modular, scalable protective devices that can be deployed with minimal logistical overhead.

Asia-Pacific emerges as the fastest-growing region, driven by China’s record renewable capacity additions-198 GW of solar and 46 GW of wind in early 2025-and a 43% surge in new energy vehicle sales in the first half of the year. India’s industrial expansion, Japan’s smart grid rollouts, and Southeast Asia’s infrastructure investments are collectively accelerating demand for both low- and medium-voltage protective solutions.

This comprehensive research report examines key regions that drive the evolution of the Circuit Protection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading and Emerging Circuit Protection Innovators Driving Technological Breakthroughs Sustainability and Global Market Expansion Strategies

Leading the charge in innovation, Schneider Electric leverages its EcoStruxure platform to deliver IoT-enabled circuit breakers that integrate seamlessly into digital ecosystems, enabling remote diagnostics and real-time analytics to optimize protection strategies.

Eaton and Siemens have embraced digital twin methodologies, allowing utilities and industrial operators to simulate fault conditions virtually and refine protective settings before field deployment. These approaches enhance safety and streamline commissioning processes, reducing time-to-live for critical assets.

At recent industry showcases, GE Vernova and Hitachi Energy have demonstrated turnkey solutions tailored to renewable and microgrid projects, offering customized low- and medium-voltage switchgear equipped with advanced protection and control functionalities.

Specialized innovators such as Littelfuse continue to expand manufacturing capacity, exemplified by the opening of a new 106,000-square-foot plant in Piedras Negras, Mexico, which doubles local production of industrial circuit protection components for renewable energy, data centers, and telecommunication sectors.

Meanwhile, niche players are focusing on surge protective devices and custom fuse technologies, collaborating with distribution partners to deliver rapid response and technical support for critical applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Circuit Protection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Limited

- Altech Corporation

- Bel Fuse Inc.

- Eaton Corporation PLC

- General Electric Company

- Grayhill, Inc.

- Hitachi, Ltd.

- Keystone Electronics Corp.

- Larsen & Toubro Limited

- Littelfuse, Inc.

- MERSEN CORPORATE SERVICES SAS

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corp. by Semiconductor Components Industries, LLC

- PHOENIX CONTACT India Pvt. Ltd.

- RAYMING TECHNOLOGY

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schurter Holding AG

- Sensata Technologies, Inc.

- Siemens AG

- TAIFLEX Scientific Co., Ltd.

- TE Connectivity

- Texas Instruments Incorporated

Strategic Action Plans for Industry Leaders to Enhance Resilience Optimize Supply Chains and Accelerate Innovation in Circuit Protection Domain

Industry leaders must prioritize diversification of supply chains to mitigate the effects of tariff volatility and geopolitical uncertainty. By establishing alternative sourcing partnerships and nearshoring critical component production, organizations can reduce lead times and safeguard against future trade disruptions.

Investing in digital protection platforms is no longer optional; integrating smart breakers, IoT sensors, and AI-driven analytics will be essential for real-time visibility and proactive maintenance. Such capabilities not only improve reliability but also enable data-driven decision-making that optimizes asset utilization and lowers total cost of ownership.

Sustainability goals and regulatory mandates necessitate a shift toward eco-friendly insulating mediums and energy-efficient designs. Adopting SF₆-free solutions and aligning product roadmaps with emissions reduction targets will enhance compliance and position companies as responsible innovation partners.

Collaboration with utilities, technology providers, and standards bodies can accelerate the development of interoperable protection systems. Joint pilot projects and industry consortia enable rapid validation of emerging technologies and foster consensus on best practices.

Finally, upskilling the workforce through targeted training programs on digital tools, cybersecurity, and advanced protection schemes will ensure organizations are prepared to deploy and manage next-generation systems effectively.

Comprehensive Research Methodology Detailing Data Collection Analysis and Validation Techniques Underpinning Circuit Protection Market Insights

This research integrates primary and secondary methodologies to deliver robust, validated insights. Primary data was gathered through structured interviews with utility executives, OEM technical leaders, and procurement specialists, providing firsthand perspectives on evolving protection requirements.

Comprehensive secondary research involved analysis of industry publications, government and regulatory announcements-including tariff notices and clean energy policies-as well as data from the International Energy Agency and major technical journals. This ensured a holistic view of market drivers and regulatory landscapes.

Quantitative data points and qualitative trends were triangulated to enhance reliability, with discrepancies addressed through follow-up consultations. The research team also employed thematic analysis to identify emerging patterns in technological adoption and regional demand dynamics.

Expert review panels comprising academic researchers, industry analysts, and field engineers validated the findings, ensuring actionable accuracy. Data integrity protocols were applied throughout, including version control, source traceability, and peer review, to underpin the credibility of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Circuit Protection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Circuit Protection Market, by Product Type

- Circuit Protection Market, by Protective Technology

- Circuit Protection Market, by Voltage Rating

- Circuit Protection Market, by Current Rating

- Circuit Protection Market, by Mounting Type

- Circuit Protection Market, by End-Use Industry

- Circuit Protection Market, by Distribution Channel

- Circuit Protection Market, by Region

- Circuit Protection Market, by Group

- Circuit Protection Market, by Country

- United States Circuit Protection Market

- China Circuit Protection Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Transformative Trajectory of Circuit Protection Industry Amidst Emerging Technologies and Geopolitical Shifts

The circuit protection sector stands at the crossroads of multiple transformative forces, from rapid electrification and renewable integration to digital grid modernization and shifting trade policies. Emerging technologies are reshaping traditional protection paradigms, delivering enhanced safety, efficiency, and sustainability.

While tariff uncertainties present challenges, they also create opportunities for strategic reshoring and supply chain innovation. Companies that embrace digital protection platforms and eco-friendly materials will gain competitive differentiation in a market increasingly driven by performance and compliance imperatives.

Regional dynamics will continue to diversify demand patterns, with the Americas focusing on EV infrastructure, EMEA prioritizing sustainable standards, and APAC leading in renewable and industrial growth. Collaboration among technology providers, utilities, and regulatory bodies will be pivotal in establishing interoperable frameworks that support future grid architectures.

Ultimately, the trajectory of the circuit protection industry hinges on the ability of stakeholders to adapt swiftly, invest in next-generation capabilities, and align with evolving market and policy landscapes. These concluding insights underscore a future defined by resilience, innovation, and strategic partnerships.

Engage with Expert Associate Director to Secure Essential Circuit Protection Market Research Insights and Propel Strategic Decision Making Today

For a comprehensive exploration of the trends, drivers, and strategic imperatives shaping the circuit protection industry, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise and insights will ensure you secure tailored guidance and access to our full market research report. Don’t miss this opportunity to equip your organization with the actionable intelligence needed to stay ahead in an evolving landscape-reach out today to purchase the definitive resource on circuit protection market dynamics and drive your strategic initiatives forward.

- How big is the Circuit Protection Market?

- What is the Circuit Protection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?