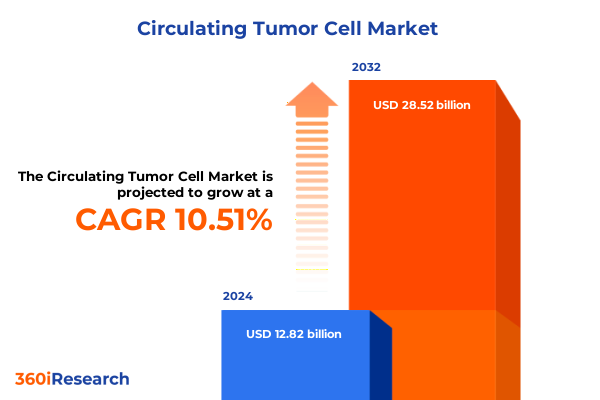

The Circulating Tumor Cell Market size was estimated at USD 14.10 billion in 2025 and expected to reach USD 15.52 billion in 2026, at a CAGR of 10.58% to reach USD 28.52 billion by 2032.

Revolutionizing Cancer Management with Advanced Circulating Tumor Cell Technologies Driving Precision Medicine and Early Diagnostic Capabilities

The landscape of oncology diagnostics has witnessed a profound shift with the emergence of circulating tumor cell technologies as pivotal tools in the quest for precision medicine. Circulating tumor cells, which detach from primary or metastatic lesions and enter the bloodstream, serve as liquid biopsy indicators that offer real-time insights into tumor heterogeneity and treatment response. This paradigm enables clinicians and researchers to monitor disease progression via minimally invasive approaches, reducing the reliance on surgical biopsies and improving patient comfort. By harnessing these cellular biomarkers, healthcare providers can tailor treatment regimens to individual patient profiles, thereby enhancing therapeutic efficacy and minimizing adverse events.

Building upon the foundational science, innovative methodologies for CTC detection and analysis have rapidly evolved. Early-stage techniques relied primarily on immunomagnetic capture methods that target cell surface antigens, while emerging microfluidic-based separation platforms exploit hydrodynamic forces and physical properties to isolate rare tumor cells with heightened sensitivity. These technological advancements have accelerated the integration of CTC assays into clinical workflows, offering streamlined sample processing and multiparametric analyses. As a result, stakeholders across clinical diagnostic settings and research institutions have embraced CTC platforms for their ability to deliver actionable data in both therapeutic decision-making and drug development pipelines.

Transitioning from concept to commercial adoption, the circulating tumor cell ecosystem has matured underpinned by regulatory milestones and growing evidence of clinical utility. Collaboration among instrument manufacturers, reagent developers, and academic consortia has provided the necessary validation to support broader market acceptance. Looking ahead, ongoing research endeavors continue to refine the robustness and reproducibility of CTC assays, cementing their role as indispensable components in the era of personalized oncology management.

Navigating the Paradigm Shifts in Circulating Tumor Cell Detection Fueled by Microfluidics and Immunomagnetic Innovations that Reshape Clinical and Research Applications

The trajectory of circulating tumor cell technologies has been marked by transformative shifts that have redefined both clinical and research paradigms. Initially, immunomagnetic separation represented the cornerstone of CTC isolation, leveraging antigen–antibody interactions to enrich tumor cells from peripheral blood. While effective, these methods faced challenges related to antigen heterogeneity and variable recovery rates. Subsequently, microfluidic-based separation emerged as a game-changing innovation, utilizing finely engineered channels and fluid dynamics to capture cells based on size, deformability, and other biophysical properties. This transition not only improved capture efficiency but also facilitated high-throughput processing, enabling parallel analyses across multiple samples with reduced hands-on time.

Concurrently, advances in single-cell sequencing and downstream molecular characterization have recontextualized circulating tumor cells as more than mere diagnostic markers. Integrated analytical platforms now permit proteomic, genomic, and transcriptomic profiling of isolated cells, yielding comprehensive insights into tumor evolution, drug resistance mechanisms, and metastatic potential. This convergence of separation science and next-generation omics has catalyzed a deeper understanding of cancer biology, empowering precision oncology strategies that adapt dynamically to patient-specific tumor landscapes.

Furthermore, the democratization of CTC platforms has accelerated through collaborative frameworks that unite industry leaders, academic research centers, and clinical consortia. Standardized protocols and quality control benchmarks now underpin interlaboratory studies, fostering reliable comparative analyses and driving regulatory confidence. As a direct consequence, CTC technologies have transcended niche research applications to become integral components of clinical trials and routine diagnostic workflows, reshaping the continuum of cancer care from early detection to treatment monitoring.

Assessing the Cumulative Repercussions of 2025 United States Tariffs on Circulating Tumor Cell Technology Supply Chains and Cost Dynamics

The policy environment in 2025 has introduced a new layer of complexity for organizations sourcing circulating tumor cell technologies, as cumulative United States tariffs have altered the cost dynamics of imported medical devices and reagents. Initially implemented to address broader trade imbalances, these duties now encompass various components critical to CTC systems, including specialty lab consumables, microfluidic cartridges, and advanced instrumentation modules. The imposition of additional duties has prompted supply chain stakeholders to re-examine procurement strategies, emphasizing the need for diversified sourcing and closer collaboration with domestic manufacturers to mitigate fiscal pressures.

In response to these trade measures, manufacturers have accelerated efforts to localize production of high-value components, notably microfabricated chips and proprietary antibodies. This shift has catalyzed investments in domestic research and manufacturing capacity, fostering partnerships with regional biotech incubators and contract development organizations. Consequently, the industry has witnessed a surge in process optimization initiatives aimed at reducing dependency on tariff-affected imports while maintaining stringent quality and performance standards.

Despite the inherent challenges posed by elevated input costs, the tariff landscape has also spurred innovation and strategic realignment. Companies have initiated value engineering programs to streamline component designs, consolidate supplier networks, and reconfigure logistical pathways. These adaptive strategies have proven vital for preserving operational resilience and ensuring uninterrupted access to critical technologies amidst evolving trade policies. Looking forward, continued dialogue between industry stakeholders and regulatory bodies will play a pivotal role in shaping a balanced environment that supports both innovation and economic sustainability.

Unveiling Strategic Segmentation Perspectives to Drive Focused Circulating Tumor Cell Solutions Across Technologies Products Applications Cancer Types and End Users

An in-depth segmentation analysis illuminates distinct pathways through which circulating tumor cell technologies address diverse market needs and user profiles. From a technology standpoint, the landscape encompasses CTC analysis platforms and detection & isolation solutions, wherein the latter subdivides into immunomagnetic separation and microfluidic-based separation techniques. This technological bifurcation underscores the critical interplay between capture efficiency and analytical depth, enabling tailored approaches for both high-throughput screening and intricate single-cell investigations.

Turning to product type, the market framework distinguishes between instruments and kits & reagents, reflecting the complementary dynamics of hardware platforms and consumable chemistries. Instruments serve as the operational backbone, delivering the mechanical precision required for consistent cell capture, while kits and reagents supply the biochemical specificity that drives accurate identification and downstream profiling. Together, these categories foster an integrated ecosystem that supports seamless workflows across diagnostic laboratories and research facilities.

When viewed through the lens of application, the dual domains of clinical diagnostics & research and drug development emerge as principal arenas of CTC utilization. In diagnostic settings, CTC assays offer clinicians a minimally invasive window into disease status, facilitating longitudinal monitoring and response assessment. Conversely, pharmaceutical stakeholders harness circulating tumor cells to evaluate therapeutic efficacy, elucidate resistance pathways, and refine candidate compounds during preclinical and clinical development.

Further segmentation by cancer type highlights a focused concentration on breast, colorectal, lung, and prostate malignancies, reflecting epidemiological priorities and established clinical utility. Finally, end-user categories spanning diagnostic centers, hospital & clinic networks, and research & academic institutes delineate the organizational contexts within which CTC platforms deliver value. Collectively, this multifaceted segmentation matrix provides a robust blueprint for stakeholders seeking to navigate product development, market entry, and adoption strategies with precision.

This comprehensive research report categorizes the Circulating Tumor Cell market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Product Type

- Application

- Cancer Type

- End Users

Deciphering Regional Growth Drivers and Challenges for Circulating Tumor Cell Markets Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics significantly influence the uptake and integration of circulating tumor cell technologies, as each geographic market exhibits unique drivers and barriers to adoption. In the Americas, a well-established healthcare infrastructure and strong reimbursement frameworks have accelerated the deployment of CTC assays in both clinical trials and specialty diagnostic centers. Regulatory clarity and proactive government initiatives aimed at advancing precision oncology have further catalyzed market maturation, positioning the region at the forefront of innovative liquid biopsy applications.

In Europe, Middle East and Africa, stakeholders navigate a heterogeneous regulatory landscape marked by diverse approval pathways and varying reimbursement models. While Western European markets benefit from consolidated health technology assessment mechanisms, emerging economies within the region are witnessing growing investment in cancer diagnostics infrastructure. Collaborative public-private initiatives and pan-regional consortia have played instrumental roles in standardizing protocols and facilitating knowledge sharing, thereby expanding access to cutting-edge CTC platforms across medical research hubs and academic centers.

The Asia Pacific region presents a dynamic environment shaped by rapid expansion of oncology care networks and increased R&D spending. Countries with robust biotechnology ecosystems are well positioned to adopt advanced CTC technologies, leveraging government funding and academic partnerships to drive localized innovation. Meanwhile, high-growth markets are fostering talent development and infrastructure upgrades to meet the rising demand for early-detection diagnostics. As a result, strategic alliances between global technology providers and regional distributors have become essential to ensure efficient market penetration and support local customization of CTC workflows.

This comprehensive research report examines key regions that drive the evolution of the Circulating Tumor Cell market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Innovators and Emerging Pioneers Shaping the Future of Circulating Tumor Cell Technology Landscape with Strategic Alliances and Acquisitions

The competitive landscape for circulating tumor cell technologies is characterized by a blend of established leaders and agile emerging players, each contributing unique strengths to the evolving ecosystem. Pioneer instrument manufacturers have leveraged decades of expertise in diagnostic device development to design robust platforms that integrate seamlessly into clinical laboratories, while specialized reagent suppliers focus on enhancing capture specificity and compatibility with high-throughput workflows.

Moreover, strategic collaborations and licensing agreements have become increasingly prevalent as companies seek to expand their technological capabilities and accelerate time to market. Partnerships between microfluidics innovators and life science firms have given rise to hybrid solutions that combine physical cell separation with molecular profiling, offering comprehensive end-to-end workflows. At the same time, nimble startups are introducing disruptive approaches, such as label-free detection and automated single-cell sequencing interfaces, challenging incumbents to continuously optimize performance and user experience.

Across the value chain, merger and acquisition activity underscores the drive toward portfolio diversification and global expansion. By integrating complementary assets-ranging from advanced imaging modules to proprietary antibody libraries-industry participants are fortifying their competitive positioning and catalyzing synergies between manufacturing scale and specialized research capabilities. This dynamic interplay of innovation, collaboration, and consolidation defines the current state of the market and sets the stage for ongoing technological breakthroughs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Circulating Tumor Cell market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Cell Diagnostics, Inc.

- Bio-Techne Corporation

- BioFluidica

- Biolidics Limited

- Creatv MicroTech, Inc.

- Epic Sciences

- Fluxion Biosciences, Inc. by Cell Microsystems

- Greiner Bio-One International GmbH

- Ikonisys, Inc.

- LungLife AI, Inc.

- Menarini Silicon Biosystems

- Miltenyi Biotec GmbH

- Precision Medicine Group, LLC

- QIAGEN N.V.

- Rarecells Diagnostics

- ScreenCell

- SRI International

- STEMCELL Technologies, Inc.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Empowering Industry Leaders with Actionable Strategies to Enhance Circulating Tumor Cell Adoption Innovation Partnerships and Clinical Integration

To maintain competitive momentum and foster sustainable growth, industry leaders must adopt a set of actionable strategies that capitalize on technological advances and address evolving market demands. First, investing in modular platform architectures will allow organizations to rapidly incorporate emerging capture and analysis modalities, thereby extending the utility of existing instrument bases and maximizing return on infrastructure investments. By prioritizing interoperability and upgrade pathways, companies can reduce entry barriers for end users and facilitate seamless technology adoption.

Second, building robust partnerships with academic institutions and clinical centers will expedite the validation of novel biomarkers and assay formats. Collaborative research agreements and co-development programs can accelerate data generation, enhance regulatory submissions, and provide critical real-world evidence to support reimbursement discussions. Such cooperative frameworks also strengthen relationships across the healthcare ecosystem, driving broader acceptance of CTC applications in routine care.

Third, expanding domestic manufacturing capabilities in response to trade policy fluctuations will safeguard supply chain continuity and protect against tariff-induced cost escalations. By establishing regional production hubs for microfluidic cartridges, specialty reagents, and quality control materials, companies can localize critical processes, foster resilience, and reduce lead times. This strategic localization not only mitigates external risks but also aligns with evolving regulatory preferences for domestic sourcing.

Finally, enhancing customer-centric support models through comprehensive training, digital diagnostics platforms, and remote monitoring services will improve end-user engagement and boost assay reliability. By integrating artificial intelligence–driven analytics and virtual troubleshooting tools, providers can deliver proactive performance insights and optimize operational workflows, ultimately improving clinical decision-making and patient outcomes.

Illuminating Rigorous Research Frameworks Underpinning the Comprehensive Assessment of Circulating Tumor Cell Technologies and Market Dynamics

The insights presented in this report are grounded in a robust research methodology designed to capture a comprehensive view of circulating tumor cell technologies and market dynamics. Primary research constituted in-depth interviews with key opinion leaders, laboratory directors, and executive stakeholders across diagnostic centers, hospital networks, and academic institutions. These qualitative interactions provided nuanced perspectives on technology adoption decisions, product performance benchmarks, and evolving clinical use cases.

Complementing primary inputs, secondary research encompassed extensive review of peer-reviewed journals, regulatory filings, and technical whitepapers to ensure factual accuracy and contextual depth. Proprietary patent analysis highlighted innovation trajectories in microfluidic design, immunocapture reagents, and single-cell sequencing integrations. Additionally, trade association reports and government policy documentation informed the assessment of tariff impacts, reimbursement trends, and regional regulatory frameworks.

Data triangulation methods were applied to reconcile divergent viewpoints and validate emerging patterns. Statistical tools facilitated cross-geography comparisons of technology readiness levels, while gap analysis pinpointed unmet needs in diagnostic workflows. This multifaceted approach ensures that the report delivers actionable intelligence underpinned by rigorous evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Circulating Tumor Cell market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Circulating Tumor Cell Market, by Technology Type

- Circulating Tumor Cell Market, by Product Type

- Circulating Tumor Cell Market, by Application

- Circulating Tumor Cell Market, by Cancer Type

- Circulating Tumor Cell Market, by End Users

- Circulating Tumor Cell Market, by Region

- Circulating Tumor Cell Market, by Group

- Circulating Tumor Cell Market, by Country

- United States Circulating Tumor Cell Market

- China Circulating Tumor Cell Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Future Imperatives Guiding the Advancement of Circulating Tumor Cell Solutions in Precision Oncology

The landscape of circulating tumor cell technologies stands at the nexus of innovation and clinical utility, driven by advances in separation science, molecular characterization, and data analytics. Segmented by technology, product type, application, cancer subtype, and end-user context, the ecosystem reveals myriad opportunities for targeted growth and enhanced patient impact. Regional analyses further underscore the importance of adapting strategies to localized regulatory environments and infrastructure maturity levels.

Trade policy developments have prompted companies to reimagine supply chain models, cultivating domestic capacities and agile sourcing strategies that bolster resilience against external shocks. Concurrently, the proliferation of strategic partnerships and consolidation activities has enriched the competitive environment, incubating novel platforms that integrate seamlessly into established laboratory workflows. Such collaboration not only accelerates innovation but also streamlines the path from discovery to clinical adoption.

Actionable recommendations stress the imperative of modular design, collaborative validation, localized manufacturing, and enhanced service offerings as cornerstones of future success. Collectively, these elements form a comprehensive blueprint for stakeholders aiming to navigate the complexities of precision oncology diagnostics and maximize the clinical value of circulating tumor cell assays. As the field continues to evolve, sustained focus on interoperability, quality assurance, and end-user training will be critical in translating technological breakthroughs into tangible patient outcomes.

Seize Cutting-Edge Insights on Circulating Tumor Cell Markets by Connecting with an Associate Director for Exclusive Market Research Access

Unlock the full potential of your strategic planning by acquiring a comprehensive market research report on circulating tumor cell technologies. To gain immediate access to detailed insights on industry trends, segmentation analysis, and regional dynamics, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate a tailored consultation and guide you through the value propositions of this indispensable resource. Partnering with an experienced liaison will ensure that your organization leverages cutting-edge data to drive innovation, strengthen competitive positioning, and capitalize on emerging opportunities across precision oncology applications.

- How big is the Circulating Tumor Cell Market?

- What is the Circulating Tumor Cell Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?