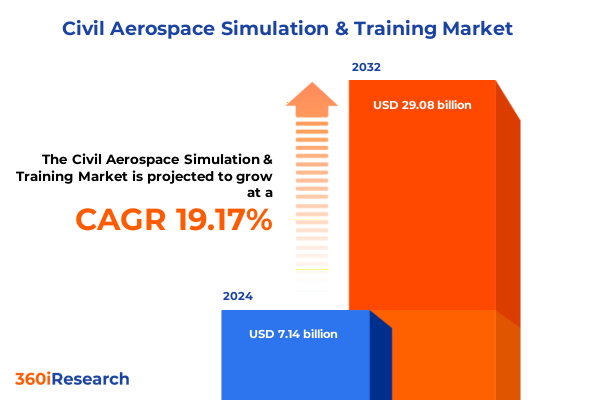

The Civil Aerospace Simulation & Training Market size was estimated at USD 8.49 billion in 2025 and expected to reach USD 10.00 billion in 2026, at a CAGR of 19.21% to reach USD 29.08 billion by 2032.

Groundbreaking Overview of Civil Aerospace Simulation and Training Emerging Trends Shaping Pilot Preparation Strategies and Technological Innovation

The civil aerospace simulation and training landscape has grown increasingly complex as industry stakeholders strive to balance rigorous safety requirements with the pressures of operational efficiency. In the midst of evolving regulatory frameworks and accelerating air traffic volumes, simulation technology serves as a critical enabler for pilot proficiency, system reliability, and cost containment. Leading aviation authorities continue to recognize simulation as a cornerstone of recurrent and type-specific training, underscoring its importance in maintaining the highest standards of airworthiness and crew competency.

Moreover, recent advancements in digital architecture and real‐time analytics have propelled simulation platforms beyond traditional use cases, allowing training providers to adopt more adaptive and data‐driven instructional models. This foundational overview sets the stage for an in‐depth exploration of the transformative forces reshaping pilot preparation, maintenance readiness, and system integration strategies. Through this introduction, readers will gain clarity on the evolving demands, technological catalysts, and strategic imperatives defining the modern civil aerospace simulation and training market.

Unprecedented Advances and Paradigm Shifts Driving the Evolution of Civil Aerospace Simulation and Training Systems Worldwide

The civil aerospace simulation sector is experiencing unprecedented advances that extend well beyond incremental hardware enhancements. Artificial intelligence and machine learning algorithms are now embedded in flight dynamics models, enabling predictive scenario generation and personalized learning pathways. Furthermore, the convergence of virtual reality and augmented reality has given rise to hybrid environments that bridge the gap between physical cockpit replicas and fully immersive digital worlds, thereby enhancing procedural proficiency and situational awareness.

In parallel, regulatory bodies are adopting competency‐based training standards that prioritize outcome metrics over prescriptive flight hours. Consequently, training centers are investing in modular, scalable simulators to support flexible curriculum credentials and distance learning initiatives. Additionally, the trend toward distributed learning networks has accelerated collaboration among airlines, OEMs, and specialized software providers. As a result, the overall training ecosystem has become more interconnected, fostering innovation cycles that respond swiftly to emerging aircraft architectures and mission profiles.

Assessing How Recent Tariff Measures Shape the Supply Chain, Cost Structures, and Innovation Trajectory in Civil Aerospace Simulation and Training

Assessing the cumulative impacts of the latest tariff measures reveals critical challenges across the supply chain and cost structures of simulation equipment and services. Heightened duties on imported hardware subassemblies have introduced material supply bottlenecks, compelling original equipment manufacturers to evaluate domestic sourcing and localized assembly options. Simultaneously, training providers have adjusted their capital expenditure frameworks to mitigate margin erosion caused by elevated acquisition expenses.

Moreover, cost escalation in maintenance and calibration services has spurred a broader adoption of remote diagnostics and software‐centric updates. To counterbalance the financial strain, many stakeholders are renegotiating long‐term vendor contracts and exploring co‐investment models for simulator development. Ultimately, these strategic responses underscore the need for agile procurement practices and diversified supplier portfolios, ensuring resilience in a landscape shaped by evolving trade policies and geopolitical considerations.

Deep Dive into Product, Platform, End User, Training Type, and Technology Segmentation Revealing Critical Nuances in Civil Aerospace Simulation Landscape

A granular examination of product segmentation underscores the diverse requirements across flight training devices, full flight simulators, part task trainers, simulation software, and training services. Flight training devices span foundational FNPT I configurations, multi‐crew coordination FNPT I MCC variants, and advanced FNPT II platforms, catering to both initial and recurrent pilot skill development. Full flight simulators range from entry‐level Level A installations to the most sophisticated Level D envelopes, each calibrated for specific procedural fidelity and visual system performance. Similarly, simulation software encompasses flight dynamics engines, instructor operating station modules, and virtual cockpit interfaces, enabling an integrated training workflow from briefing to debriefing. Training services further augment these hardware and software elements through consulting engagements, managed services agreements, and comprehensive support and maintenance programs.

In terms of platform segmentation, the market accommodates fixed wing, rotary wing, and unmanned aerial vehicle training requirements, each driven by distinct aerodynamic modeling and mission scenarios. End user segmentation captures airlines focused on operational readiness, military operators enhancing mission effectiveness, original equipment manufacturers supporting type certification, and independent training centers delivering a blend of services to a diverse customer base. Training type segmentation includes crew resource management drills, emergency procedure simulations, and maintenance instruction subdivided into avionics maintenance and engine maintenance curricula. Pilot training pathways span initial qualification modules, recurrent evaluation sessions, type conversion courses, and type rating endorsements. Technology segmentation highlights augmented reality solutions-both marker‐based and markerless-alongside hardware simulator rigs, PC‐based training suites, and virtual reality systems offered in fully immersive and semi‐immersive configurations. This multi‐dimensional framework illuminates the nuanced demand drivers and investment priorities shaping strategic planning across the industry.

This comprehensive research report categorizes the Civil Aerospace Simulation & Training market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Platform

- Training Type

- Technology

Uncovering Diverse Regional Dynamics Impacting Civil Aerospace Simulation and Training Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics exert a profound influence on simulation and training strategies, with each geographic cluster typified by unique regulatory regimes, infrastructure maturity, and investment appetites. In the Americas, robust airline networks and a concentration of maintenance, repair, and overhaul organizations drive demand for high‐fidelity simulators and managed service contracts. Commercial carriers and defense operators alike harness these capabilities to optimize pilot throughput and maximize fleet utilization.

Across Europe, the Middle East, and Africa, cross‐border collaboration frameworks and harmonized aviation directives facilitate multi‐national training initiatives. This region also serves as a critical testing ground for next‐generation training standards, as stakeholders leverage centralized aviation hubs to pilot advanced procedural curricula. Meanwhile, the Asia Pacific corridor continues to record some of the fastest growth trajectories, propelled by surging pilot recruitment programs, government‐backed training academies, and expanding low‐cost carrier footprints. Consequently, providers are prioritizing scalable installation designs and remote connectivity features to serve geographically dispersed training networks.

This comprehensive research report examines key regions that drive the evolution of the Civil Aerospace Simulation & Training market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Benchmarking of Leading Solution Providers Showcases Competitive Strategies and Innovation Pathways in the Civil Aerospace Training Ecosystem

Leading solution providers exhibit distinct strategic postures that reflect their core competencies and market aspirations. One prominent simulator manufacturer has integrated cloud‐native data analytics into its service offerings, enabling continuous performance monitoring and predictive maintenance scheduling. Another major vendor has forged partnerships with avionics suppliers to co‐develop full flight simulators that replicate next‐generation cockpit avionics suites. Additionally, select providers are investing heavily in virtual reality ecosystems, collaborating with game engine developers to accelerate immersive content creation.

Meanwhile, aircraft OEMs are expanding their training portfolios by bundling simulators with aftermarket services, positioning themselves as end‐to‐end solution partners. Defense‐oriented firms leverage proprietary hardware and secure communications protocols to address classified mission training use cases. Across these varied approaches, strategic alliances and technology licensing deals have emerged as key levers for sustaining innovation and achieving global market reach.

This comprehensive research report delivers an in-depth overview of the principal market players in the Civil Aerospace Simulation & Training market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SE

- ALSIM Simulateurs

- AXIS Flight Training Systems GmbH

- BAE Systems plc

- CAE Inc

- Collins Aerospace

- ECA SA

- ELITE Simulation Solutions AG

- FlightSafety International

- Frasca International Inc

- General Dynamics Corporation

- HAVELSAN AS

- Honeywell International Inc

- Indra Sistemas SA

- Kongsberg Gruppen ASA

- L3Harris Technologies Inc

- Leonardo SpA

- Lockheed Martin Corporation

- Moog Inc

- Multi Pilot Simulations BV

- Rheinmetall AG

- Siemens AG

- Thales Group

- The Boeing Company

- TRU Simulation

Practical Guidance and Strategic Imperatives for Industry Leaders to Enhance Competitive Advantage and Operational Excellence in Simulation and Training

To secure a competitive edge, industry leaders should prioritize the development of modular simulation architectures that support rapid reconfiguration for multiple aircraft types. Engaging early with augmented and virtual reality technology specialists will accelerate the creation of immersive training experiences, while joint pilots with software vendors can optimize instructor operating station workflows. Moreover, investing in secure, high‐bandwidth connectivity solutions will unlock remote training models that reduce the physical footprint and enable distributed learning across disparate locations.

Furthermore, proactive regulatory engagement is essential for shaping competency‐based training guidelines and ensuring simulator qualifications align with emerging certification standards. Diversifying the supplier base through regional partnerships can mitigate exposure to trade policy fluctuations, while co‐investment in localized assembly facilities enhances supply chain resilience. Lastly, tailoring service bundles to address distinct regional requirements and end user priorities will drive recurring revenue streams and foster long‐term customer loyalty.

Rigorous Mixed Methodology Combining Primary Engagement and Secondary Data Triangulation to Ensure Robust Civil Aerospace Simulation Market Insights

Our research team employed a rigorous mixed methodology that combined secondary data analysis with direct stakeholder engagement. Secondary research encompassed a review of aviation authority publications, technical standard documents, regional regulatory filings, industry conference proceedings, and publicly available financial disclosures. This foundational layer provided a macroeconomic and regulatory context against which market dynamics were calibrated.

Primary research comprised in‐depth interviews and structured surveys with senior executives from airlines, defense organizations, OEMs, and independent training centers. The team also conducted on‐site facility visits to observe simulator operations, training curricula, and lifecycle management protocols. Through a systematic process of data triangulation and validation, qualitative insights were corroborated with quantitative metrics, ensuring a robust and actionable set of findings that reflect the current state of civil aerospace simulation and training.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Civil Aerospace Simulation & Training market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Civil Aerospace Simulation & Training Market, by Product

- Civil Aerospace Simulation & Training Market, by Platform

- Civil Aerospace Simulation & Training Market, by Training Type

- Civil Aerospace Simulation & Training Market, by Technology

- Civil Aerospace Simulation & Training Market, by Region

- Civil Aerospace Simulation & Training Market, by Group

- Civil Aerospace Simulation & Training Market, by Country

- United States Civil Aerospace Simulation & Training Market

- China Civil Aerospace Simulation & Training Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesis of Discoveries Reinforcing the Strategic Importance of Advanced Simulation and Training in a Rapidly Evolving Civil Aerospace Environment

This executive synthesis validates the strategic importance of advanced simulation and training as a foundational pillar for civil aerospace safety, efficiency, and innovation. Emerging technologies, from AI‐driven flight models to immersive reality environments, are reshaping how pilots acquire and maintain critical competencies. At the same time, evolving trade policies and tariff regimes underscore the need for agile procurement and supply chain strategies.

By examining granular segmentation patterns and regional dynamics, organizations can better align their product roadmaps, service offerings, and investment priorities with evolving end user needs. As the industry navigates regulatory shifts and competitive pressures, holistic insights and forward‐looking recommendations will prove indispensable for maintaining operational readiness and realizing growth aspirations.

Engage with Ketan Rohom to Secure Comprehensive Civil Aerospace Simulation and Training Insights Tailored for Strategic Competitive Advantage

Our comprehensive market research report offers unparalleled depth and actionable intelligence tailored to drive strategic decisions and competitive positioning within the civil aerospace simulation and training sector. By partnering directly with Associate Director of Sales & Marketing Ketan Rohom, you will access an expertly curated analysis that aligns with your organizational priorities and growth objectives. Engage in a personalized consultation to uncover bespoke insights, validate critical hypotheses, and refine your operational roadmap for maximum impact.

Seize the opportunity to transform uncertainty into strategic clarity by securing your copy of this definitive industry resource. Whether you seek to benchmark performance, evaluate emerging technologies, or anticipate shifts in regulatory frameworks, our tailored approach ensures you receive only the most relevant and timely findings. Reach out to Ketan Rohom today to initiate a collaborative engagement and empower your leadership team with the intelligence needed to excel in a rapidly evolving marketplace.

- How big is the Civil Aerospace Simulation & Training Market?

- What is the Civil Aerospace Simulation & Training Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?